I created this new MACD indicator yesterday, so I can't vouch for it yet. I'd love to see people's thoughts and possible tweaks to improve it if it seems interesting to anyone.

I am not a coder, but I'm good with AI. The indicator I'm going to show was created by me working with AI to get a good swing trading indicator (not a standalone indicator to make trading decisions).

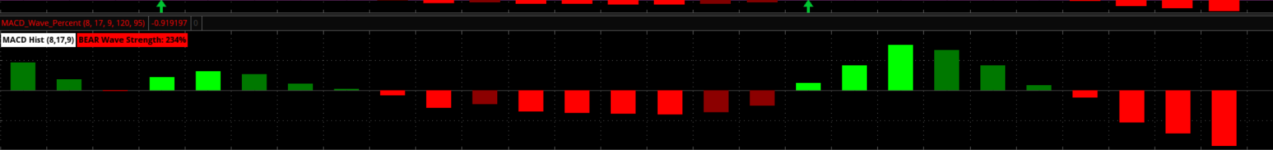

When I use MACD, I change the settings to 8/17/9 instead of the default settings. I've back tested my settings versus the standard ones and have seen better results. I also subscribe to VectorVest that allows quick proprietary back testing, and my settings also show better results than the standard ones. I asked AI if my settings make sense, and it said they do (keep in mind that AI tends to be very complimentary, so take its answers to my questions with that in mind).

The other way I use MACD is to compare the size of the histograms to the size of a prior histograms during moves. I asked AI if that's a good way to use MACD, and it responded that it's the best way to use it.

When I started asking AI to create a workable code for ThinkScript, the first attempts contained multiple errors that I eventually got corrected. The more I threw at AI, the more complex the indicator became.

The "final" version does not repaint though the current one-hour bar will repaint until the bar closes.

This indicator is non-repainting (closed bars do not change) and is intended as a momentum quality filter, not a standalone buy/sell signal. It works best when combined with trend and location tools such as EMAs and VWAP to help avoid low-quality breakouts and manage continuation trades."

I haven't used VWAP, so I need to look into that as an indicator to use with the new MACD I'm about to post. With the new MACD, I mentioned I also use three EMAs (5, 8, and 21); AI said those are great indicators to use as complementary, confirming indicators.

See the next post for updated code.

I am not a coder, but I'm good with AI. The indicator I'm going to show was created by me working with AI to get a good swing trading indicator (not a standalone indicator to make trading decisions).

When I use MACD, I change the settings to 8/17/9 instead of the default settings. I've back tested my settings versus the standard ones and have seen better results. I also subscribe to VectorVest that allows quick proprietary back testing, and my settings also show better results than the standard ones. I asked AI if my settings make sense, and it said they do (keep in mind that AI tends to be very complimentary, so take its answers to my questions with that in mind).

The other way I use MACD is to compare the size of the histograms to the size of a prior histograms during moves. I asked AI if that's a good way to use MACD, and it responded that it's the best way to use it.

When I started asking AI to create a workable code for ThinkScript, the first attempts contained multiple errors that I eventually got corrected. The more I threw at AI, the more complex the indicator became.

The "final" version does not repaint though the current one-hour bar will repaint until the bar closes.

This indicator is non-repainting (closed bars do not change) and is intended as a momentum quality filter, not a standalone buy/sell signal. It works best when combined with trend and location tools such as EMAs and VWAP to help avoid low-quality breakouts and manage continuation trades."

I haven't used VWAP, so I need to look into that as an indicator to use with the new MACD I'm about to post. With the new MACD, I mentioned I also use three EMAs (5, 8, and 21); AI said those are great indicators to use as complementary, confirming indicators.

See the next post for updated code.

Attachments

Last edited by a moderator: