Author Message:

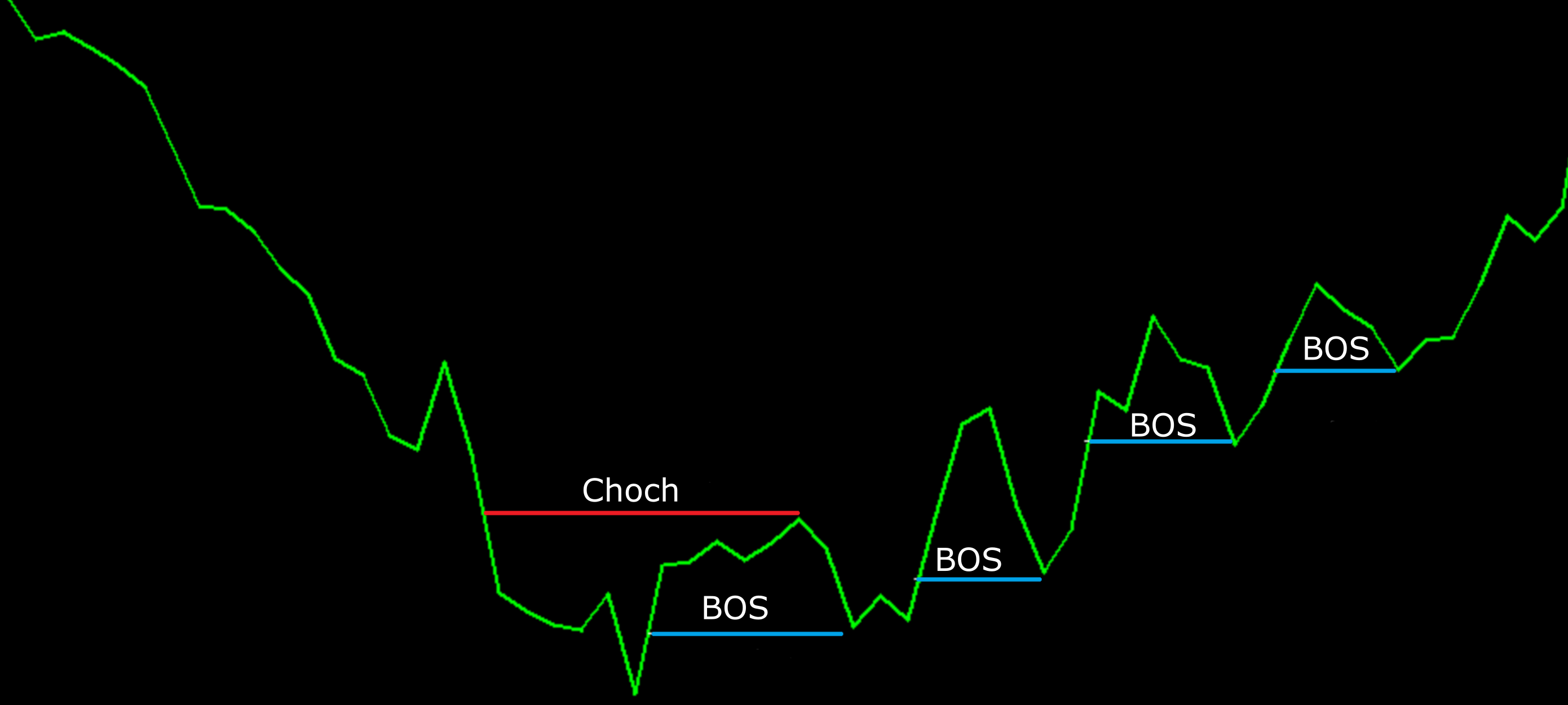

The Liquidity Hunter helps traders identify areas in the market where reversals may occur by analyzing candle formations and structures.

For more Details: https://www.tradingview.com/v/E9z8Isgd/

CODE:

CSS:

#//https://www.tradingview.com/v/E9z8Isgd/

#// This source code is subject to the terms of the Mozilla Public License 2.0

#// © ChartPrime

#indicator("Liquidity Hunter [ChartPrime]",shorttitle = "Liquidity Hunter [ChartPrime]"

# Converted and mod by Sam4Cok@Samer800 - 12/2023

input showInfoLabel = yes;

input colorLiquidityBars = yes;

input useFilter = no;

input filterLength = 14;

input showMarketCharacter = {Default "Lines & Labels", "Lines Only", "Labels Only", "Don't Show"};

input bodyPercentage = 30; # "Body %" tooltip = "Body Value will be lower than this "

input WickPercentage = 60; # "Wick %" tooltip = "Wick Value will be higher than this "

input ShowTargets = yes; # "Show Targets"

input lostSize = 100;

input targetMulti = 1.5; # "Profit Target "

input stopLossMulti = 1.5; # "SL Target "

def na = Double.NaN;

def bar = CompoundValue(1, AbsValue(BarNumber()), 1);

def last = !IsNaN(close);

def bar_index = if last then bar else bar_index[1];

def SMCLine;

def SMCLabel;

Switch (showMarketCharacter) {

Case "Lines Only" :

SMCLine = yes;

SMCLabel = no;

Case "Labels Only" :

SMCLine = no;

SMCLabel = yes;

Case "Don't Show" :

SMCLine = no;

SMCLabel = no;

Default :

SMCLine = yes;

SMCLabel = yes;

}

Script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

def _pivotRange;

##############

_BN = BarNumber();

_nan = Double.NaN;

_pivotRange = lbL + lbL;

_VStop = if !isNaN(dat[_pivotRange]) and lbr > 0 and lbl > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat,-a) else dat < GetValue(dat,-a) else _nan;

if (HL > 0) {

_V = if _BN > lbL and dat == Highest(dat, lbL+1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL and dat == Lowest(dat, lbL+1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

Script get_counts {

input condition = no;

input top = high;

input btm = low;

def count;# = 0

if condition {

count = 0;

} else {

count = count[1] + (if low < top and high > btm then 1 else 0);

}

plot cnt = count;

}

Script _Band {

input len = 5;

def nATR = ATR(LENGTH = len);

def Band = Min(nATR * 0.3, close * (0.3 / 100));

plot _Band = Band[20] / 2;

}

def _Band = _Band(5);

def Zband = _Band(30);

def range = AbsValue(high[1] - low[1]);

def LowerWickRange = Min(open[1], close[1]) - low[1];

def BodyPer = AbsValue(open[1] - close[1]) / range * 100;

def WickPer = (LowerWickRange / range) * 100;

def t = bar_index;

def TIME = if t[5] > 0 then t[5] else 1;

def LTIME = if TIME[1] then TIME[1] else 1;

def Slope = (close[1] - close[2]) / (TIME - LTIME);

def CON = BodyPer <= bodyPercentage and WickPer >= WickPercentage and (Slope * t > 0) and _Band >= _Band[1];

def ph_top;

def ph_btm;

def phtop = if ph_top[1] then ph_top[1] else high + _Band;

def phbtm = if ph_btm[1] then ph_btm[1] else low - _Band;

def pvtH = findpivots(high, 1, filterLength, RoundUp(filterLength/2, 0));

def ph_count = get_counts(!isNaN(pvtH), phtop, phbtm);

ph_top = if !isNaN(pvtH) then high + _Band else phtop;

ph_btm = if !isNaN(pvtH) then low - _Band else phbtm;

def filter = if useFilter then ph_count > 1 else yes;

def long = filter and CON;

def nATR = ATR(Length = 14);

def x2 = low - nATR * stopLossMulti;

def longDiffSL = AbsValue(close - x2);

def TradeisON;

def LongIndex;

def TP;

def CHOCH;

def SL;

def BOS;

def Message;

def top;

def bot;

def ChochisON;

def BOSisON;

def ChoIndex;

def ChoIndex1;

def CHOCHLab;

def Bosindex;

def Bosindex1;

def bosLab;

def entry;

if long and !TradeisON[1] {

entry = ohlc4[-1];

LongIndex = bar_index;

TP = entry + (targetMulti * longDiffSL);

SL = entry - longDiffSL;

CHOCH = close + (targetMulti / 2 * longDiffSL);

BOS = low - (Zband * 15);

top = high + (Zband * 0.5);

bot = low - (Zband * 0.5);

Message = Round(WickPer, 2);

ChoIndex = 0;#ChoIndex[1];

ChoIndex1 = 0;

Bosindex = 0;

Bosindex1 = 0;

CHOCHLab = na;

bosLab = na;

TradeisON = yes;

ChochisON = no;

BOSisON = no;

} else

if TradeisON[1] {

entry = entry[1];

LongIndex = LongIndex[1];

TP = TP[1];

SL = SL[1];

CHOCH = CHOCH[1];

BOS = BOS[1];

Message = no;

top = top[1];

bot = bot[1];

if close >= CHOCH and !ChochisON[1] {

ChoIndex = bar_index;

ChoIndex1 = LongIndex;

CHOCHLab = Floor((ChoIndex1 + ChoIndex) / 2);

ChochisON = yes;

} else {

ChoIndex = 0;

ChoIndex1 = 0;

CHOCHLab = na;

ChochisON = ChochisON[1];

}

if close <= BOS and !BOSisON[1] {

Bosindex = bar_index;

Bosindex1 = LongIndex;

bosLab = Floor((Bosindex1 + Bosindex) / 2);

BOSisON = yes;

} else {

Bosindex = 0;

Bosindex1 = 0;

bosLab = na;

BOSisON = BOSisON[1];

}

TradeisON = if high >= TP then no else

if close <= SL then no else TradeisON[1];

} else {

entry = entry[1];

LongIndex = LongIndex[1];

TP = TP[1];

SL = SL[1];

CHOCH = CHOCH[1];

BOS = BOS[1];

Message = no;

top = top[1];

bot = bot[1];

ChoIndex = 0;#ChoIndex[1];

ChoIndex1 = 0;#ChoIndex1[1];

Bosindex = 0;#Bosindex[1];

Bosindex1 = 0;#Bosindex1[1];

CHOCHLab = na;

bosLab = na;

TradeisON = if high >= TP then no else

if close <= SL then no else TradeisON[1];

ChochisON = if TradeisON then ChochisON[1] else no;

BOSisON = if TradeisON then BOSisON[1] else no;

}

def plotCond = (TradeisON or TradeisON[2]);

def choChCond = TradeisON and bar_index >= HighestAll(ChoIndex1) - 1 and bar_index <= HighestAll(ChoIndex);

def bosCond = TradeisON and bar_index >= HighestAll(Bosindex1) - 1 and bar_index <= HighestAll(Bosindex);

def choChLabCond = bar_index == HighestAll(CHOCHLab);

def bosLabCond = bar_index == HighestAll(bosLab);

def topLine = if TradeisON and top then top else na;

def botLine = if TradeisON and bot then bot else na;

plot TpLine = if ShowTargets and plotCond and TP then TP else na;

plot SlLine = if ShowTargets and plotCond and SL then SL else na;

plot chLine = if SMCLine and choChCond then CHOCH else na;

plot boLine = if SMCLine and bosCond then BOS else na;

chLine.SetStyle(Curve.SHORT_DASH);

chLine.SetDefaultColor(CreateColor(4,123,136));

boLine.SetStyle(Curve.SHORT_DASH);

boLine.SetDefaultColor(Color.DARK_RED);

TpLine.SetDefaultColor(CreateColor(78, 255, 43));

SlLine.SetDefaultColor(Color.MAGENTA);

TpLine.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

SlLine.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

plot wickPerc = if Message then Message else na;

wickPerc.SetDefaultColor(Color.YELLOW);

wickPerc.SetLineWeight(3);

wickPerc.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

def endTrade = !TradeisON and TradeisON[1];

def win = high >= TP;

def los = close <= SL;

plot TradeEnd = if !ShowTargets then na else

if endTrade[2] then

if los[2] then SL[2] else TP[2] else na;

TradeEnd.SetLineWeight(2);

TradeEnd.AssignValueColor(if win[2] then Color.CYAN else Color.MAGENTA);

TradeEnd.SetPaintingStrategy(PaintingStrategy.SQUARES);

#-- Clouds / Bars/ Label

AddCloud(topLine, botLine, Color.DARK_GRAY, Color.DARK_GRAY, yes);

AddChartBubble(SMCLabel and choChLabCond, CHOCH + Zband, "CHoCH", Color.WHITE);

AddChartBubble(SMCLabel and bosLabCond, BOS - Zband, "BOS", Color.WHITE, no);

AssignPriceColor( if colorLiquidityBars and TradeisON then Color.CYAN else Color.CURRENT);

# -- Info Label

def winCnt = if endTrade then if win then winCnt[1] + 1 else winCnt[1] else winCnt[1];

def losCnt = if endTrade then if los then losCnt[1] + 1 else losCnt[1] else losCnt[1];

def PlAmt = if endTrade then if win then PlAmt[1] + (TP - Entry) * lostSize else

if los then PlAmt[1] - (Entry - SL) * lostSize else PlAmt[1] else PlAmt[1];

def totTrade = winCnt + losCnt;

def winRate = winCnt / totTrade;#Round(winCnt / totTrade * 100, 2);

def PL = Round(PlAmt, 2);

AddLabel(showInfoLabel, "Trades("+ totTrade+ ")" , Color.WHITE);

AddLabel(showInfoLabel, "P/L ($" + PL + ")", if PL > 0 then Color.GREEN else

if PL < 0 then Color.RED else Color.GRAY);

AddLabel(showInfoLabel, "WinRate("+ AsPercent(winRate) + ")", if winRate > 0.50 then Color.GREEN else

if winRate < 50 then Color.RED else Color.GRAY);

#-- END of CODE