mod note:

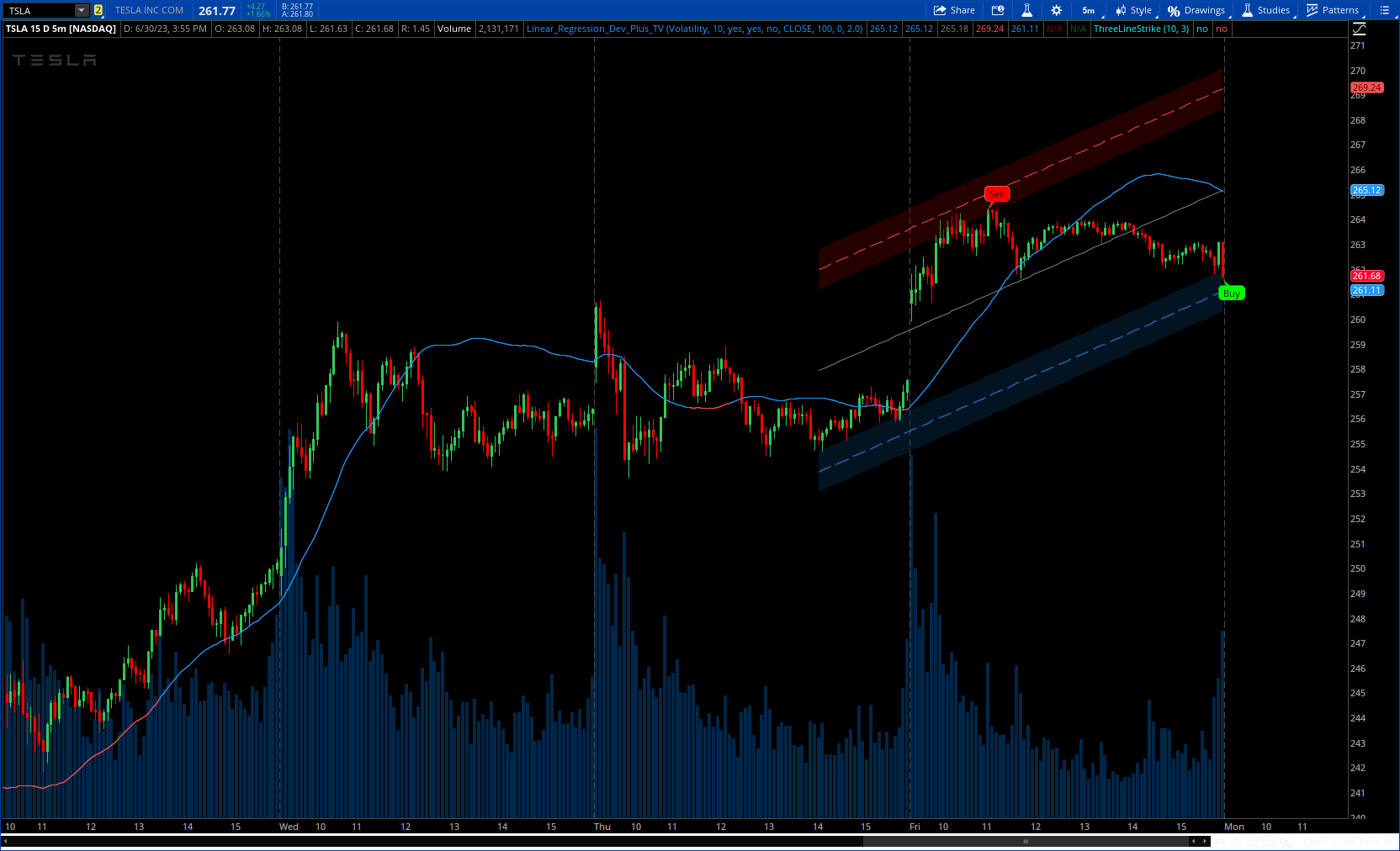

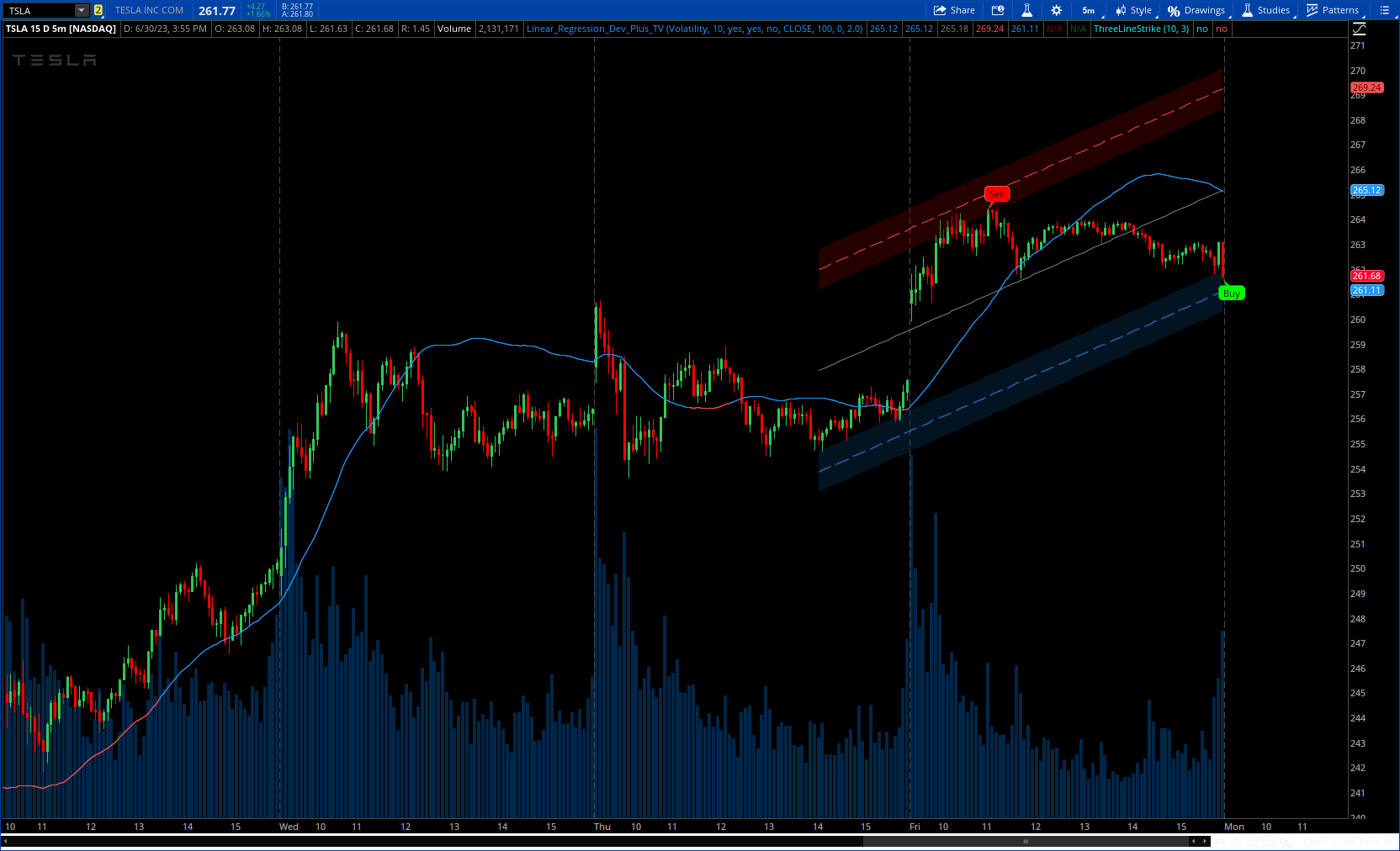

Like all trendlines, swing high / lows, pivots, etc... Regression channels repaint. The use of standard lengths of 155 have been found to help minimize the repainting effect due having more stabilizing data points

I didn't test it in live session. pls do.

the alert shouldn't repaint.

I added option for filter and atr range. Enjoy!

https://www.tradingview.com/script/HaVyhZnP-Linear-Regression/

CODE:

Like all trendlines, swing high / lows, pivots, etc... Regression channels repaint. The use of standard lengths of 155 have been found to help minimize the repainting effect due having more stabilizing data points

I didn't test it in live session. pls do.

the alert shouldn't repaint.

I added option for filter and atr range. Enjoy!

https://www.tradingview.com/script/HaVyhZnP-Linear-Regression/

CODE:

CSS:

#https://www.tradingview.com/v/V7OVP5LE/

#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © DevLucem @LucemAnb

#study("Linear Regression Dev ++", "Lin Reg Dev ++", overlay=true)

# Converted by Sam4Cok@Samer800 - 07/2023

input FilterSignals = {default "Volatility", "Volume","ADX", "Regime", "All", "None"};# 'Filter Signals by'

input filterLength = 10;

input showSignals = yes;

input showLinearRegCloud = yes;

input ShowLinearRegressionBand = no;

input source = close;

input length = 100;

input offset = 0;

input DeviationMulti = 2.0; # "Deviation"

def na = Double.NaN;

def len = length;

# @regime_filter

def value1 = CompoundValue(1, 0.2 * (source - source[1]) + 0.8 * value1[1], 0.2 * (source - source[1]));

def value2 = CompoundValue(1, 0.1 * (high - low) + 0.8 * value2[1], 0.1 * (high - low));

def omega = AbsValue(value1 / value2);

def alpha = (-power(omega,2) + sqrt(power(omega, 4) + 16 * power(omega,2))) / 8;

def klmf = alpha * source + (1 - alpha) * (klmf[1]);

def absCurveSlope = AbsValue(klmf - klmf[1]);

def exponentialAverageAbsCurveSlope = 1.0 * ExpAverage(absCurveSlope, 200);

def normalized_slope_decline = (absCurveSlope - exponentialAverageAbsCurveSlope) / exponentialAverageAbsCurveSlope;

def regime = normalized_slope_decline >= - 0.5;

#volumeBreak(thres) =>

def rsivol = RSI(Price = volume, Length = filterLength);

def osc = HullMovingAvg(rsivol, 10);

def volumeBreak = osc > 49;

#volatilityBreak(volmin, volmax)

def volmin = ATR(LENGTH=1);

def volmax = ATR(LENGTH= filterLength);

def volatilityBreak = volmin > volmax;

def adx = ADX(LENGTH = filterLength);

def adx_vwma = WMA(adx, filterLength);

def nAdx = adx > adx_vwma;

def filter;

switch (FilterSignals) {

case "Volatility" :

filter = volatilityBreak;

case "Volume" :

filter = volumeBreak;

case "ADX" :

filter = nAdx;

case "Regime" :

filter = regime;

case "All" :

filter = (volatilityBreak and volumeBreak and nAdx and regime);

case "None" :

filter = yes;

}

#---Color

DefineGlobalColor("up" , CreateColor(33,150,243));

DefineGlobalColor("dup" , CreateColor(6,66,113));

DefineGlobalColor("dn" , CreateColor(255,82,82));

DefineGlobalColor("ddn" , CreateColor(121, 0, 0));

#// Main Function

#// Tradingview Function

#pine_linreg(src, len, offset=0) =>

Script linreg {

input src = close;

input len = 20;

input offset = 0;

def bar_index = AbsValue(CompoundValue(1, BarNumber(), 0));

def x_sum = if bar_index == 0 then

fold i = 0 to len with p do

p + i else x_sum[1];

def xx_sum = if bar_index == 0 then

fold ii = 0 to len with pp do

pp + ii * ii else xx_sum[1];

def y_sum = sum(src, len);

def xy_sum = fold j = 0 to len with q do

q + j * GetValue(src,len - 1 - j);

def slope = (len * xy_sum - x_sum * y_sum) / (len * xx_sum - x_sum * x_sum);

def intercept = (y_sum - slope * x_sum) / len;

def linreg = intercept + slope * (len - 1 - offset);

plot out = linreg;

}

def linreg = linreg(source, len, offset);

def linreg_p = linreg(source, len, offset + 1);

def lin1 = inertia(source, len);

def midReg = InertiaAll(source, len + 1);

plot LinRegLine = linreg; # "Default Calculation Formula"

plot linreg1 = lin1; # "Manual Calculation Formula"

LinRegLine.AssignValueColor(if linreg>linreg_p then GlobalColor("up") else

if linreg<linreg_p then GlobalColor("dn") else Color.CYAN);

linreg1.AssignValueColor(if linreg>linreg_p then GlobalColor("up") else

if linreg<linreg_p then GlobalColor("dn") else Color.CYAN);

#// Calculating The Range Lines And Drawing Them

def x = highestAll(AbsValue(CompoundValue(1, BarNumber(), 0)));

def slope = linreg - linreg_p;

def intercept = linreg - (x * slope);

def deviationSum = fold i=0 to len -1 with p do

p + power(source[i] -(slope * (x-i) + intercept), 2);

def deviation = sqrt(deviationSum/(len));

def dev = deviation * DeviationMulti;

def stdv = highestAll(inertiaAll(dev,2));

plot b = midReg;

plot dp = midReg + stdv;

plot dm = midReg - stdv;

b.SetDefaultColor(Color.GRAY);

dp.SetDefaultColor(GlobalColor("dn"));

dm.SetDefaultColor(GlobalColor("up"));

dp.SetStyle(Curve.MEDIUM_DASH);

dm.SetStyle(Curve.MEDIUM_DASH);

#// Posting Alerts

def dm_current = linreg - deviation * DeviationMulti;

def dp_current = linreg + deviation * DeviationMulti;

plot bandUp = if !ShowLinearRegressionBand then na else dp_current;

plot bandDn = if !ShowLinearRegressionBand then na else dm_current;

bandUp.SetDefaultColor(Color.DARK_RED);

bandDn.SetDefaultColor(Color.DARK_GREEN);

def atrdev = highestAll(inertiaAll(atr(Length=length), 2));

def atrBand = if showlinearRegCloud then atrdev else na;

AddCloud(dp + atrBand, dp - atrBand, GlobalColor("ddn"), GlobalColor("ddn"));

AddCloud(dm + atrBand, dm - atrBand, GlobalColor("dup"), GlobalColor("dup"));

#// Debugging Alert Sample

def sigUP = if source > dm - atrdev/2 and source < dm + atrdev then sigUP[1] + 1 else 0;

def sigDn = if source < dp + atrdev/2 and source > dp - atrdev then sigDn[1] + 1 else 0;

def buy = sigUP==1 and filter;

def sell = sigDn==1 and filter;

AddChartBubble(showSignals and buy , low, "Buy", Color.GREEN, no);

AddChartBubble(showSignals and sell, high, "Sell", Color.RED, yes);

#-- END of CODE

Last edited by a moderator: