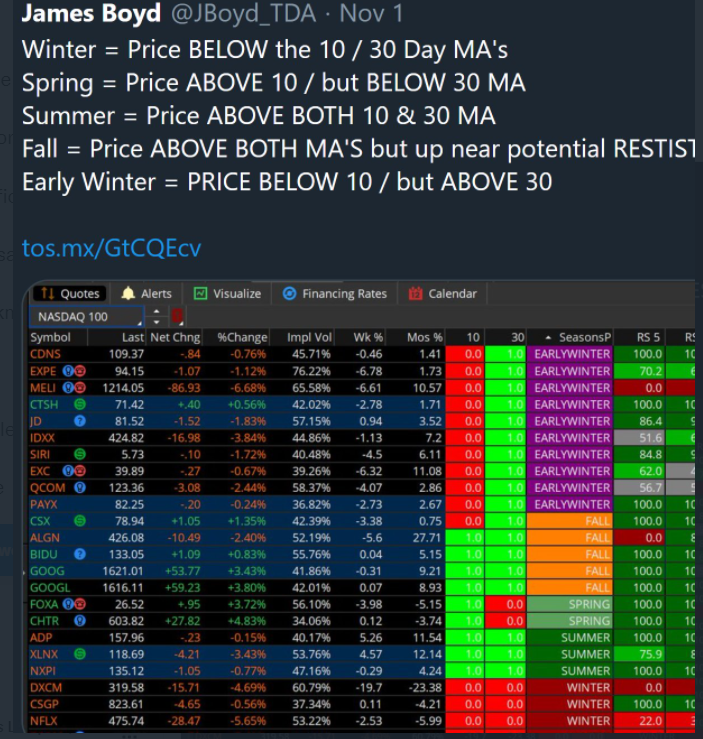

JBoyd_TDA Seasons Column For ThinkOrSwim

Explanation from James Boyd_TDA:

Original link:

ThinkorSwim Shortcut: https://tos.mx/GtCQEcv

code below, if you don't like dealing with the shortcuts.

Explanation from James Boyd_TDA:

Original link:

ThinkorSwim Shortcut: https://tos.mx/GtCQEcv

code below, if you don't like dealing with the shortcuts.

Code:

# Knowing the Mkt Phases can really help to understand stock trend. This

# script breaks out the five market phases as identified by James Boyd.

# The definitions for each market phase are documented in the code. In

# addition to idenfifying the specific market conditions associated with each

# market phase, each phase is color-coded to help the eye evaluate other

# indictors in the watch list.

########################################################################

########################################################################

########################## Phase 1 #####################################

# Market Phase 1 - In phase 1 the stock is trading below the 10-day EMA and

# the 30-day SMA. The stock has no doubt broken horizontal support and

# we are waiting for it to find support and enter into a trend reversal

# pattern and start heading up again. Here are the Phase1 1 market conditions:

#

# 1. Close is less than 10 day EMA

# 2. Close is less than 30 day SMA

#

# Stocks in Phase 1 will have a Dark Red background

#

################# Moving Averages ###########################

def MA10 = movingaverage(averageType.EXPONENTIAL,close,10);

def MA30 = movingaverage(averageType.SIMPLE,close,30);

def closeBelow10 = if close < MA10 then 1 else 0;

def closeBelowMA30 = if close < MA30 then 1 else 0;

def phase1 = if closeBelow10 AND closeBelowMA30 then 1 else 0;

########################################################################

########################## Phase 2 #####################################

# Market Phase 2 - This code is meant to signal stocks breaking upward

# through diagnoal resistance, leaving Phase 1. This is the first step

# to changing from a down-trend to an up-trend. Stocks in Phase 2 will

# be closing above the 10-day EMA, but still lower than the 30-day SMA.

#

# Here are the Phase 2 market conditions:

#

# 1. Close above the 10 day EMA

# 2. Close lower than 30 day SMA

#

# Stocks in Phase 2 will have a Light Green background

#

def closeAbove10 = if close > MA10 then 1 else 0;

def closeBelow30 = if close < MA30 then 1 else 0;

def Phase2 = if closeAbove10 and closeBelow30 then 1 else 0;

########################################################################

########################## Phase 3 #####################################

# Market Phase 3 - Phase 3 represents a strong trending

# stock. We are looking for the stock price to be higher than both the

# 30-day SMA and the 10-day EMA. If the stock remains strong, the 10 day EMA

# will ultimately cross above the 30 day SMA. Market Phase 3 is the

# sweet spot for trading bull flags and horizontal break outs.

# Here are the Phase 3 market conditions:

#

# 1. Price is closing higher than 30 day SMA

# 2. Price is closing higher than 10 day EMA

#

# Stocks in Phase 3 can have two possile background colors:

# a. If the 10-day EMA is below the 30-day SMA, the background color will be Pale Green

# b. If the 10-day EMA is above the 30-day SMA, the background color will be Dark Green

#

def closeAbove30 = if close > MA30 then 1 else 0;

def phase3 = if closeAbove30 and closeAbove10 then 1 else 0;

########################################################################

########################## Phase 4 #####################################

# Market Phase 4 - Technically speaking, the stock is still in Phase 3 but it is

# up against resistance and is showing some signs of weakness. In a strong

# trending stock, this can happen multiple times and often it will bounce off the

# 10-day EMA or the 30-day SMA. However, know that the stock will eventually break

# to the down side from Phase 4. Consider Phase 4 as a warning sign, or another

# opportunity to enter a bullish position on the stock. Use other technical indicators

# to help determine the trading posture.

# Here are the Phase 4 market conditions:

#

# a. Stock in Phase 3

# b. 10-day EMA is greater than 30-day SMA

# c. 10-day Hull MA is falling

#

# Stocks in Phase 4 will have an orange background color

#

# 10 day EMA greater than 30 day SMA

def MA10gtMA30 = if MA10 > MA30 then 1 else 0;

# Hull Moving Average

def hull = HullMovingAvg(price = close, length = 10);

def fallingHull = if hull <= hull[1] then 1 else 0;

def phase4 = if Phase3 AND MA10gtMA30 AND fallingHull then 1 else 0;

########################################################################

########################## Phase 5 #####################################

# Market Phase 5 - Phase 5 represents a strong trending stock that is

# having a brief pull back. If the stock price falls below

# the 10 day EMA, but is still higher than the 30 day SMA it is

# considered to be in Phase 5. For a really strong trending stock,

# it is possible that the will bounce off the 30 day SMA, but if it doesn't

# we should be prepared for it to fall through horizontal support (most

# likely near the 30-day SMA) and keep going.

# Here are the Phase 5 market conditions:

#

# 1. Close is less than 10 day EMA

# 2. Close is greater than 30 day SMA

#

# Stocks in Phase 5 will have a Plum backround color

#

def phase5 = if closeBelow10 AND closeAbove30 then 1 else 0;

###################################################################

# Test for P4 up front, because it is a subset of P3

addlabel (yes, if phase4 then "FALL" else

if phase1 then "WINTER" else

if phase2 then "SPRING" else

if phase3 then "SUMMER" else

if phase5 then "EARLYWINTER" else " ");

assignbackgroundcolor (if phase4 then color.dark_orange else # dark orange

if phase1 then CreateColor(150, 0,0) else # dark red

if phase2 then CreateColor(91, 160, 91) else # light green

if phase3 and MA10gtMA30 then color.dark_green else # dark green

if Phase3 and !MA10gtMA30 then color.dark_green else # dark green

if phase5 then color.plum else # plum

color.WHITE);

Last edited by a moderator: