Author Message:

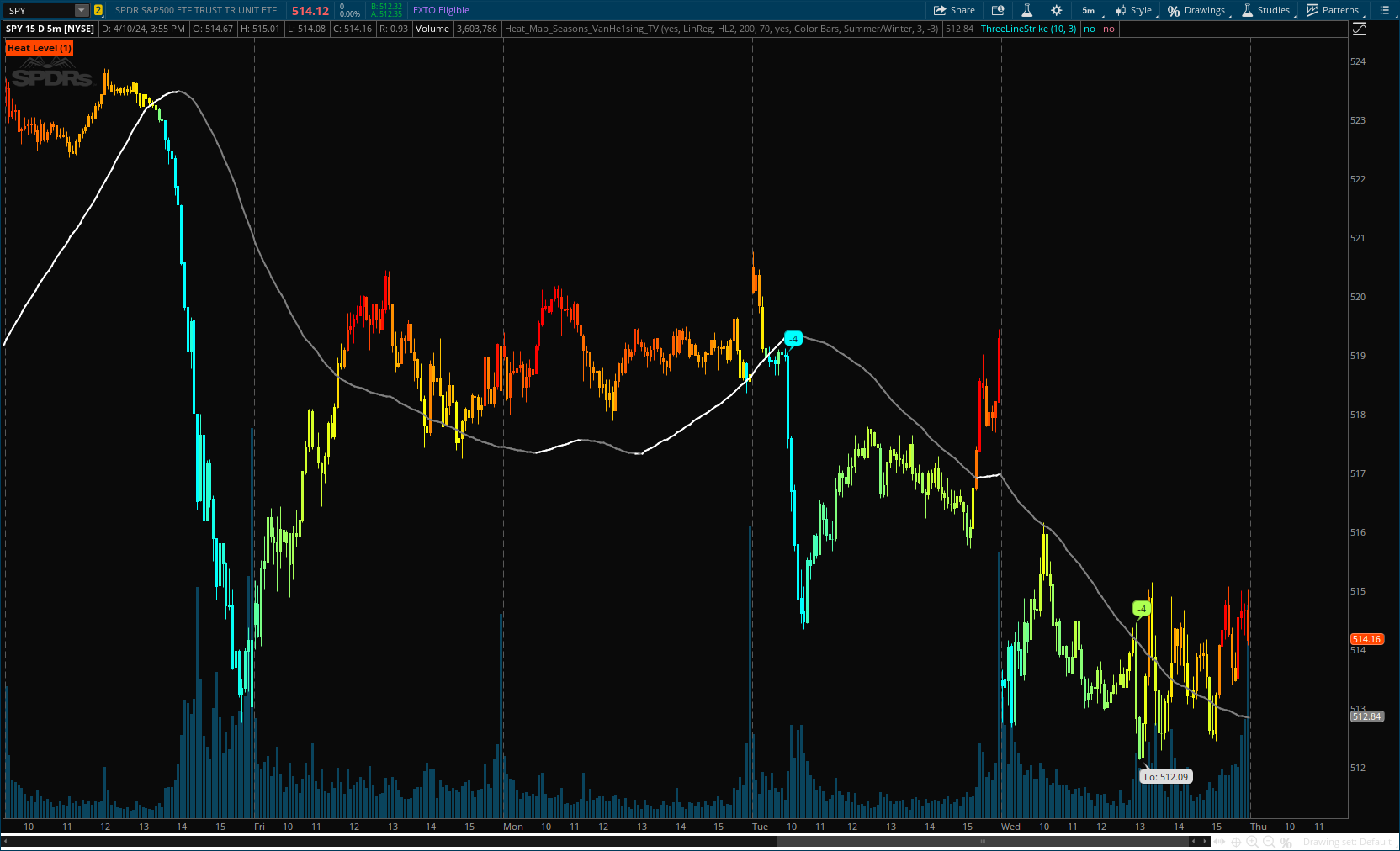

Indicator offers traders a unique perspective on market dynamics by visualizing seasonal trends and deviations from typical price behavior. By blending Mov Avg analysis with a color-coded heat map, this indicator highlights periods of heightened volatility and helps identify potential shifts in market sentiment.

More Details : https://www.tradingview.com/v/zuS134uh/

Code:

CSS:

#// This is a ToS indicator

#// © VanHe1sing

#indicator("Heat Map Seasons", shorttitle = "HeatMapS", overlay = true)

# Converted and mod by Sam4Cok@Samer800 - 04/2024

input showHeatLevelLabel = yes;

input MovAvgType = {default LinReg, SMA, EMA, WMA, TMA, VAR, WWMA, ZLEMA, TSF}; # 'Moving Average Type'

input src = hl2;

input Length = 200; #, "Length")

input HeatSensitivity = 70; #, "Heat Sensitivity", step = 10)

input show_line = yes; # "Show Regression Line?")

input Colors = {Default "Color Bars", "Color Line", "Color Bars & Lines", "Don't Color"};

input signals = {"Summer", "Winter",Default "Summer/Winter", "Don't Show"};

input SummerTemperature = 3;

input WinterTemperature = -3;

def summer = Min(14, Max(SummerTemperature, 0));

def winter = Max(-14, Min(WinterTemperature,0));

def sigUp = signals == signals."Summer" or signals == signals."Summer/Winter";

def sigDn = signals == signals."Winter" or signals == signals."Summer/Winter";

def na = Double.NaN;

def bar; def line;

Switch (Colors) {

Case "Color Line" :

bar = no;

line = yes;

Case "Color Bars & Lines" :

bar = yes;

line = yes;

Case "Don't Color" :

bar = no;

line = no;

Default :

bar = yes;

line = no;

}

#// ————— Normalization Function

Script normalization {

input src = close;

input mean = close;

def norm = (src - mean) / stdev(src, 200);

def nor = if norm > 5 then 5 else if norm < -5 then -5 else norm;

plot out = nor;

}

#// ————— Rescale Function (when range is known).

Script rescale {

input _src = close;

input _oldMin = -100;

input _oldMax = 100;

input _newMin = -1;

input _newMax = 1;

def neg = Double.NEGATIVE_INFINITY;

def mmax = max(_oldMax - _oldMin, neg);

def rescale = _newMin + (_newMax - _newMin) * (_src - _oldMin) / mmax;

plot out = rescale;

}

#pine_linreg(src, len, offset=0) =>

script linreg {

input src = close;

input len = 100;

input offset = 0;

def na = Double.NaN;

def bar_index = IsNaN(close);

def x_sum = if bar_index then na else

fold i = 0 to len with p do

p + i;

def xx_sum = if bar_index then na else

fold ii = 0 to len with pp do

pp + ii * ii;

def y_sum = Sum(src, len);

def xy_sum = fold j = 0 to len with q do

q + j * GetValue(src, len - j - 1);

def slope = (len * xy_sum - x_sum * y_sum) / (len * xx_sum - x_sum * x_sum);

def intercept = (y_sum - slope * x_sum) / len;

def linreg = intercept + slope * (len - offset - 1);

plot out = linreg;

}

script f_var {

input data = close;

input length = 20;

def change = AbsValue(data - data[1]);

def a = Average(data, length);

def b = AbsValue(data - data[9]);

def c = Sum(change, 9);

def d = if c != 0 then b / c else 0;

def e = 2 / (length + 1);

def r = if length == 1 then a else

CompoundValue(1, if !r[1] then a else d * e * (data - r[1]) + r[1], a);

plot out = r;

}

#Wwma_Func(src, length) =>

script Wwma_Func {

input src = close;

input length = 2;

def wwalpha = 1 / length;

def WWMA = CompoundValue(1, wwalpha * src + (1 - wwalpha) * WWMA[1], src);

plot return = WWMA;

}

#Zlema_Func(src, length) =>

script Zlema_Func {

input src = close;

input length = 2;

def zxLag = if length / 2 == Round(length / 2, 0) then length / 2 else (length - 1) / 2;

def zxEMAData = src + src - src[zxLag];

def ZLEMA = ExpAverage(zxEMAData, length);

plot return = ZLEMA;

}

#Tsf_Func(src, length) =>

script Tsf_Func {

input src = close;

input length = 2;

def lrc = Inertia(src, length);

def lrc1 = linreg(src, length, 1);

def lrs = lrc - lrc1;

def TSF = Inertia(src, length) + lrs;

plot retur = TSF;

}

#ma(src, length, type) =>

script ma {

input src = close;

input length = 80;

input type = "SMA";

def ma =

if type == "SMA" then Average(src, length) else

if type == "EMA" then ExpAverage(src, length) else

if type == "WMA" then WMA(src, length) else

if type == "DEMA" then DEMA(src, length) else

if type == "TMA" then MovAvgTriangular(src, length) else

if type == "VAR" then f_var(src, length) else

if type == "WWMA" then WWMA_Func(src, length) else

if type == "ZLEMA" then Zlema_Func(src, length) else

if type == "TSF" then Tsf_Func(src, length) else

if type == "HULL" then HullMovingAvg(src, length) else Inertia(src, length);

plot result = ma;

}

def Regression_Line = ma(src, Length, MovAvgType);

#// ————— Heat Map Color Bars

def color_level = normalization(close - Regression_Line, 0);

def lvlHi = highest(color_level, HeatSensitivity);

def lvlLo = lowest(color_level, HeatSensitivity);

def scaleHi = if color_level > 0 then rescale(color_level, 0, lvlHi, 0, 100) else 0;

def scaleLo = if color_level > 0 then 0 else rescale(color_level, lvlLo, 0, 0, 100);

def colHi = if isNaN(scaleHi) then 0 else if scaleHi > 100 then 100 else if scaleHi < 0 then 0 else scaleHi *2.55;

def colLo = if isNaN(scaleLo) then 0 else if scaleLo > 100 then 100 else if scaleLo < 0 then 0 else scaleLo *2.55;

#// Plot of Regression_Line

plot RegLine = if show_line then Regression_Line else na;

RegLine.AssignValueColor(if !line then if Regression_Line>Regression_Line[1] then Color.WHITE else Color.GRAY else

if color_level > 0 then CreateColor(255,255- colHi, 0) else

CreateColor(colLo, 255 ,255- colLo));

RegLine.SetLineWeight(2);

AssignPriceColor(if !bar then Color.CURRENT else

if color_level > 0 then CreateColor(255,255- colHi, 0) else

CreateColor(colLo, 255 ,255- colLo));

#// Gauge point

def Gauge = rescale(color_level, -4, 5, 0, 30);

def g_p = Round(if Gauge < 0 then 0 else Gauge, 0) - 15;

def conHi = g_p[1] == summer - 1 and (g_p Crosses Above summer);

def conLo = g_p[1] == winter + 1 and (g_p Crosses Below Winter);

AddChartBubble(SigUp and conHi, low, g_p, CreateColor(255,255- colHi, 0), no);

AddChartBubble(SigDn and conLo, high, g_p, CreateColor(colLo, 255 ,255- colLo));

AddLabel(showHeatLevelLabel,"Heat Level (" + g_p + ")", if color_level > 0 then CreateColor(255,255- colHi, 0) else

CreateColor(colLo, 255 ,255- colLo));

#-- END of CODE

Last edited by a moderator: