Wiinii

Member

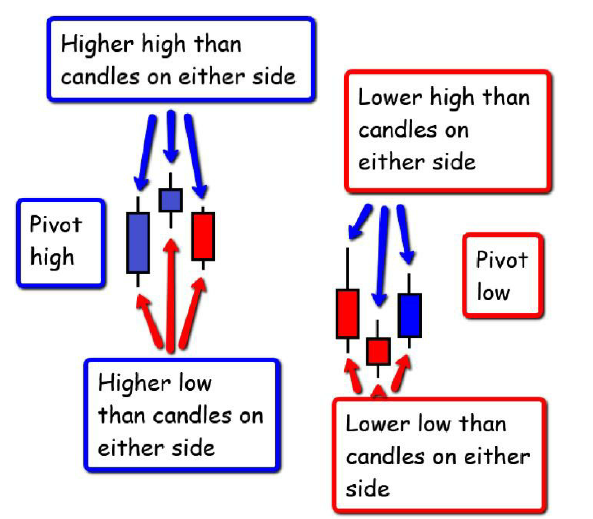

Identifies Isolated Pivot patterns on your chart as described in A Complete Guide to Volume Price Analysis by Anna Coulling.

Shared Link: http://tos.mx/3URlRUV (or use code below). Click here for --> Easiest way to load shared links

Shared Link: http://tos.mx/3URlRUV (or use code below). Click here for --> Easiest way to load shared links

Code:

# Isolated Pivots by Wiinii

# Version 1.0

#https://usethinkscript.com/threads/isolated-pivots-pattern-detector-for-thinkorswim.14447/

#hint: Detects Isolated Pivots and flags them on your chart. \n big_body_size tells how much taller than average the first tall candle has to be. \n little_body_size tells how many x smaller the middle little candle has to be compared to the intitial tall one.

# Isolated Pivots by Wiinii

# Version 1.0

#https://usethinkscript.com/threads/isolated-pivots-pattern-detector-for-thinkorswim.14447/

#hint: Detects Isolated Pivots and flags them on your chart. \n big_body_size tells how much taller than average the first tall candle has to be. \n little_body_size tells how many x smaller the middle little candle has to be compared to the intitial tall one.

input CandleAverage = 10;

input big_body_size = 1.2;

input little_body_size = 3.0;

def IsUp = close > open;

def IsDown = close < open;

def avgRange = 0.05 * Average(high - low, 20);

def AvgCandleBody = Average(BodyHeight(), CandleAverage);

def AvgCandle = SimpleMovingAvg(price = (high[1] - low[1]), length = CandleAverage);

def CurrentCandle = high - low;

def BigUp = IsUp and ((BodyHeight() > (AvgCandleBody * big_body_size)));

def BigDown = IsDown and ((BodyHeight() > (AvgCandleBody * big_body_size)));

def LittleUp = IsUp and BodyHeight() < BodyHeight()[1] * little_body_size;

def LittleDown = IsDown and BodyHeight() < BodyHeight()[1] * little_body_size;

plot IsoPivUp =

BigUp[2] and

(LittleUp[1] or LittleDown[1]) and

BigDown[0] and (BodyHeight() > BodyHeight()[1] * little_body_size) and

open[1] > close[0] and

open[2] < open[1] and

close[2] <= high[1] and

open[2] < low[1] and

low[1] > close[0] and

high[1] >= open[0] and

high[1] is equal to Highest(high[1], 2);

IsoPivUp.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

IsoPivUp.SetDefaultColor(GetColor(1));

IsoPivUp.SetLineWeight(5);

plot IsoPivDn =

BigDown[2] and

(LittleUp[1] or LittleDown[1]) and

BigUp[0] and (BodyHeight() > BodyHeight()[1] * little_body_size) and

open[2] > open[1] and

open[2] > high[1] and

low[1] < open[0] and

open[1] < close[0] and

close[2] > low[1] and

high[1] < close[0] and

low[1] is equal to Lowest(low[1], 2);

IsoPivDn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

IsoPivDn.SetDefaultColor(GetColor(1));

IsoPivDn.SetLineWeight(5);

Last edited: