armybender

Active member

Hi,

I've tried my hand at creating something to do this, but can't seem to get it quite right. I'm wondering if someone can help. The idea is that congestion is building, so I want to know when both sides (buyers and sellers) have entered expecting a breakout.

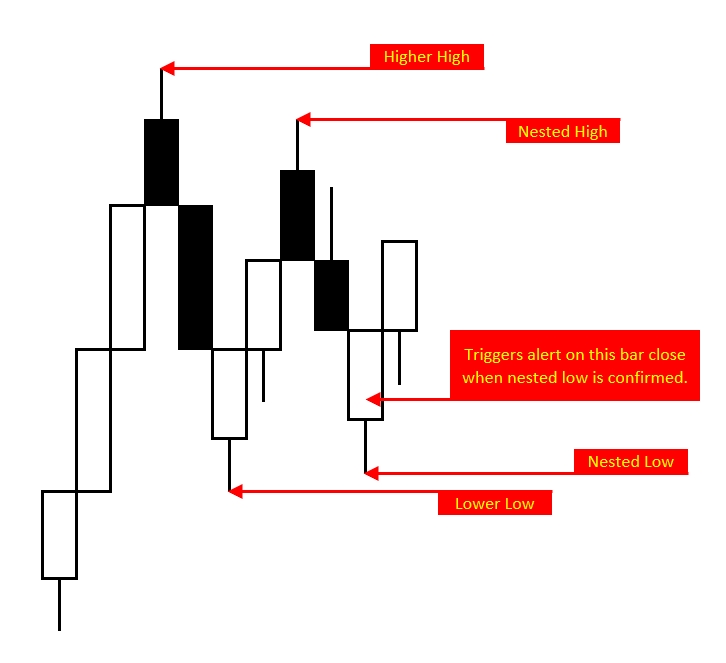

I'm hoping to create an indicator that will put either a down arrow or up arrow above or below a bar when a triangle (nested set of highs or lows) forms and is triggered by the nested high or low being confirmed on the close of a bar.

I've included a picture below, but here are the rules that need to be coded. I'll use the rules that match the picture, but the opposite direction also needs to be considered (i.e. a triangle that is triggered by a bear bar following a set of nested highs / lows).

Here's a picture of how it would work. Any help is appreciated!!!

I've tried my hand at creating something to do this, but can't seem to get it quite right. I'm wondering if someone can help. The idea is that congestion is building, so I want to know when both sides (buyers and sellers) have entered expecting a breakout.

I'm hoping to create an indicator that will put either a down arrow or up arrow above or below a bar when a triangle (nested set of highs or lows) forms and is triggered by the nested high or low being confirmed on the close of a bar.

I've included a picture below, but here are the rules that need to be coded. I'll use the rules that match the picture, but the opposite direction also needs to be considered (i.e. a triangle that is triggered by a bear bar following a set of nested highs / lows).

- There must first be a high - it can be a single bar, and does not need to be considered a swing (i.e. doesn't need to be a specific distance from anything)

- There must then be a low - same rules about not needing to be a swing.

- Next, a subsequent lower high and higher low must form.

- When the higher low is "locked in" by the closing of the bar and the price ticking at least one tick above, there is a triangle formed and it would trigger an alert or draw an arrow underneath the nested low.

Here's a picture of how it would work. Any help is appreciated!!!