# ------------------------START BELOW THIS LINE--------------------------

#

# tastytrade/dough Research Team

# Michael Rechenthin, Ph.D.

# Follow me on twitter: @mrechenthin

#

# IV Rank is a description of where the current IV lies in comparison

# to its yearly high and low IV

#

# IV Percentile gives the percentage of days over the last year, that

# were below the current IV. If the IV Rank is above 50%, then

# the script will highlight it green; otherwise red.

#

# For information on the two, see Skinny on Options Data Science,

# titled "IV Rank and IV Percentile (w/ thinkscript)" on Nov 12, 2015

# http://ontt.tv/1Nt4fcS

#

# version 3.2.7

# updated by WhitePath from www.OptionMarketMentor.com (6/25/2024)

# - Fixed IV Percentile always 0 and calculate correct Percentile

# - Added Average IV range with different COLOR

# - Added optional plot for IV Rank and Percentile and IV Cloud

# - Added optional level line for IV at low and average

# - Commented out hide on intraday (should work for any period)

# (does not work for new stocks with less than a year of data)

#

declare lower;

#declare hide_on_intraday; # do not display when using intra-day plots

input IV_Year_Trading_Days = 252; # it is most common to use 1-year (or 252 trading days)

input IV_HalfYear_Trading_Days = 126; # it is most common to use 2-quarter (or 120 trading days)

input IV_Quarter_Trading_Days = 63; # it is most common to use 1-quarter (or 60 trading days)

input IV_Month_Trading_Days = 21; # it is most common to use 1-month (or 20 trading days)

input IV_Threshold_Low = 30; # it is the low threshold on the chart

input IV_Threshold_High = 50; # it is the high threshold on the chart

input IV_Show_High_Area = no;

input IV_Show_All_Labels = yes;

# -----------------------------------

# Limit this to Daily Chart only (Disabled by WhitePath)

# -----------------------------------

#def intraDay;

#if GetAggregationPeriod() < AggregationPeriod.DAY {

#intraDay=1;

#} else {

#intraDay=2;

#}

#AddLabel(yes, "IV Rank for " + GetAggregationPeriod(), COLOR.GRAY);

#AddLabel(yes, if (intraDay==1) then "IV Rank Not available for " + GetAggregationPeriod() else "");

# -----------------------------------

# IV calculations

# -----------------------------------

DefineGlobalColor("IV-COLOR-LOW", COLOR.LIME);

DefineGlobalColor("IV-COLOR-AVG", COLOR.GRAY);

DefineGlobalColor("IV-COLOR-HIGH", COLOR.PINK);

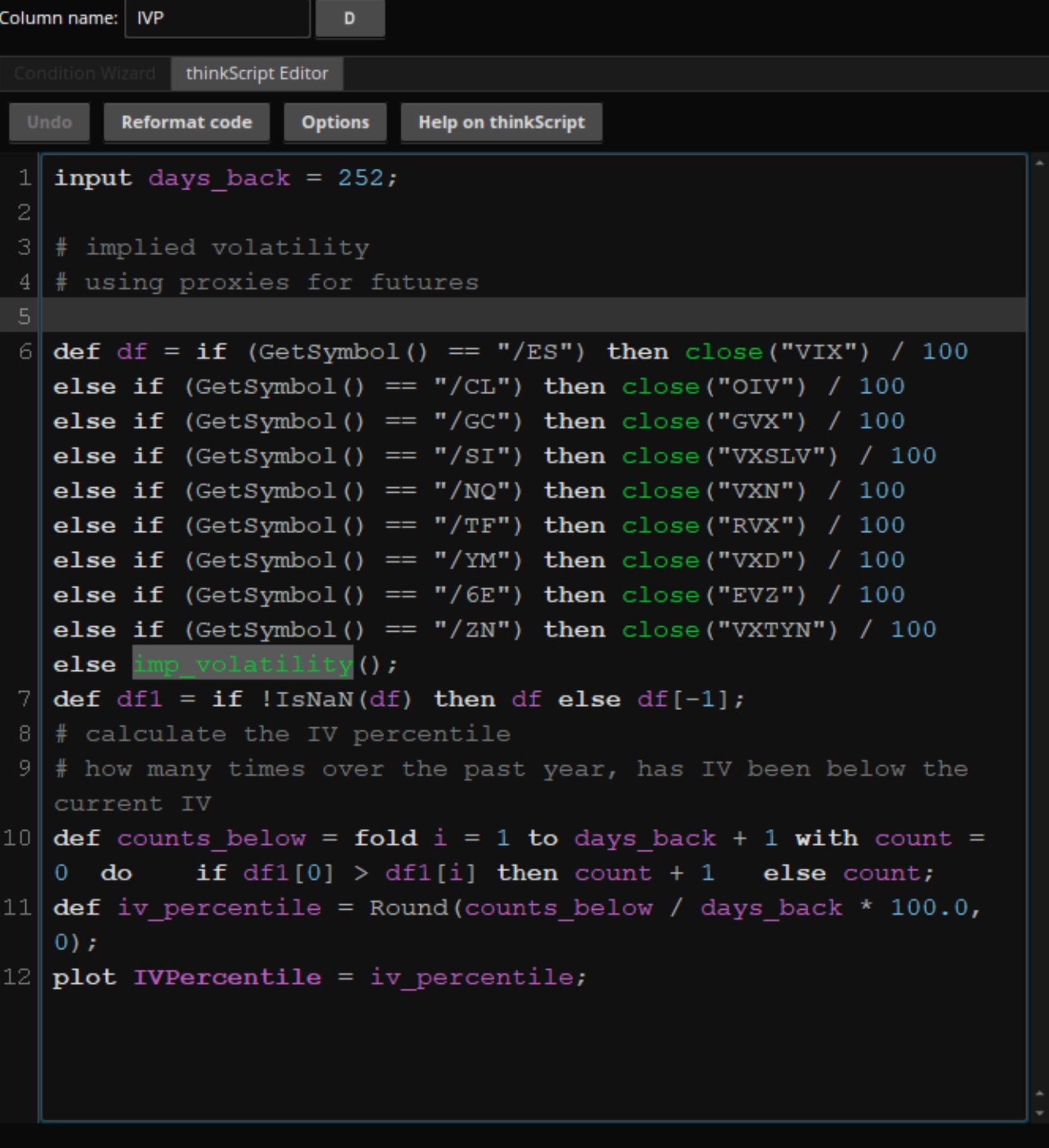

# using proxies for futures

# -----------------------------------

def iv_data = if (GetSymbol() == "/ES") then close("VIX") / 100

else if (GetSymbol() == "/CL") then close("OIV") / 100

else if (GetSymbol() == "/GC") then close("GVX") / 100

else if (GetSymbol() == "/SI") then close("VXSLV") / 100

else if (GetSymbol() == "/NQ") then close("VXN") / 100

else if (GetSymbol() == "/TF") then close("RVX") / 100

else if (GetSymbol() == "/YM") then close("VXD") / 100

else if (GetSymbol() == "/6E") then close("EVZ") / 100

else if (GetSymbol() == "/6J") then close("JYVIX") / 100

else if (GetSymbol() == "/6B") then close("BPVIX") / 100

else if (GetSymbol() == "/ZN") then close("TYVIX") / 100

else if (Getsymbol() == "/ZW") then close("WIV") / 100

else if (Getsymbol() == "/ZB") then imp_volatility("TLT")

else if (Getsymbol() == "/ZC") then imp_volatility("CORN")

else if (Getsymbol() == "/ZS") then imp_volatility("SOYB")

else if (Getsymbol() == "/KC") then imp_volatility("JO")

else if (Getsymbol() == "/NG") then imp_volatility("UNG")

else if (Getsymbol() == "/6S") then imp_volatility("FXF")

else imp_volatility();

# thanks to Kevin Osborn for the following line

# ----------------------------------

AddLabel(yes,

if (GetSymbol() == "/6S"

or GetSymbol() == "/ZB"

or GetSymbol() == "/ZC"

or GetSymbol() == "/NG"

or GetSymbol() == "/ZS"

or GetSymbol() == "/KC")

then "* ETF based"

else ""

, Color.YELLOW);

# display regular implied volatility

# ----------------------------------

#Plot IV

def ivs = Round(iv_data * 100, 2);

plot IV = ivs;

IV.SetLineWeight(1);

IV.SetStyle(Curve.POINTS);

#Plot IV High and Low Threshold

plot IVLow = IV_Threshold_Low;

IVLow.SetLineWeight(1);

IVLow.SetDefaultColor(color = Color.LIGHT_RED);

IVLow.Hide();

Plot IVHigh = IV_Threshold_High;

IVHigh.SetLineWeight(1);

IVHigh.SetDefaultColor(color = Color.LIGHT_GREEN);

IVHigh.Hide();

AddCloud(if IV_Show_High_Area then IVLow else double.nan, IVHigh, Color.GRAY, Color.Light_GREEN);

def low_over_timespan = LowestAll(ivs);

def high_over_timespan = HighestAll(ivs);

AddLabel(IV_Show_All_Labels, "IV MIN: " + Round(low_over_timespan,0) + "%", GlobalColor("IV-Color-LOW"));

#AddLabel(yes, "IV AVG(" + IV_Year_Range + "): " + round(Average(iv_data, IV_Year_Range) * 100,0) + "%", GlobalColor("IV-Color-AVG"));

#AddLabel(yes, "IV AVG(" + IV_2Quarter_Range + "): " + round(Average(iv_data, IV_2Quarter_Range) * 100,0) + "%", GlobalColor("IV-Color-AVG"));

#AddLabel(yes, "IV AVG(" + IV_Quarter_Range + "): " + round(Average(iv_data, IV_Quarter_Range) * 100,0) + "%", GlobalColor("IV-Color-AVG"));

#AddLabel(yes, "IV AVG(" + IV_Month_Range + "): " + round(Average(iv_data, IV_Month_Range) * 100,0) + "%", GlobalColor("IV-Color-AVG"));

AddLabel(IV_Show_All_Labels, "IV MAX: " + Round(high_over_timespan,0) + "%", GlobalColor("IV-Color-HIGH"));

AddLabel(yes, "IV: " + Round(ivs,0) + "%", if ivs > IV_Threshold_High then GlobalColor("IV-Color-HIGH") else (if ivs < IV_Threshold_Low then GlobalColor("IV-Color-LOW") else (if IsNaN(ivs) then Color.GRAY else GlobalColor("IV-Color-AVG"))));

# -----------------------------------

# IV Rank

# -----------------------------------

def ivr = Round( (ivs - low_over_timespan) / (high_over_timespan - low_over_timespan) * 100.0, 0);

IV.AssignValueColor(if ivr > IV_Threshold_HIGH then GlobalColor("IV-Color-HIGH") else (if ivr <= IV_Threshold_LOW then GlobalColor("IV-COLOR-LOW") else GlobalColor("IV-COLOR-AVG")));

AddLabel(yes, "IVR: " + ivr + "%", if ivr > IV_Threshold_High then GlobalColor("IV-COLOR-HIGH") else (if ivr < IV_Threshold_Low then GlobalColor("IV-COLOR-LOW") else GlobalColor("IV-COLOR-AVG")));

# -----------------------------------

# IV Percentile over different timeframes

# -----------------------------------

# how many times over the past year, has IV been below the current IV

def counts_below_y = fold py = 1 to IV_Year_Trading_Days + 1 with county = 0

do

if !IsNaN(GetValue(ivs, py)) and GetValue(ivs, py) <= ivs then

county + 1

else

county;

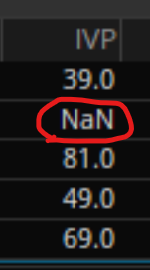

def ivp_year = if !isNaN(counts_below_y) then Round(counts_below_y / IV_Year_Trading_Days * 100.0, 0) else Double.NaN;

AddLabel(!isNaN(counts_below_y), "IVP: " + ivp_year + "%", if ivp_year > IV_Threshold_High then GlobalColor("IV-COLOR-HIGH") else (if ivp_year < IV_Threshold_Low then GlobalColor("IV-COLOR-LOW") else GlobalColor("IV-COLOR-AVG")));

def counts_below_2q = fold p2q = 1 to IV_HalfYear_Trading_Days + 1 with count2q = 0

do

if !IsNaN(GetValue(ivs, p2q)) and GetValue(ivs, p2q) <= ivs then

count2q + 1

else

count2q;

def ivp_2q = if !isNaN(counts_below_2q) then Round(counts_below_2q / IV_HalfYear_Trading_Days * 100.0, 0) else Double.NaN;

AddLabel(!isNaN(counts_below_2q) and IV_Show_All_Labels, "IVP(6M): " + ivp_2q + "%", if ivp_2q > IV_Threshold_High then GlobalColor("IV-COLOR-HIGH") else (if ivp_2q < IV_Threshold_Low then GlobalColor("IV-COLOR-LOW") else GlobalColor("IV-COLOR-AVG")));

def counts_below_q = fold pq = 1 to IV_Quarter_Trading_Days + 1 with countq = 0

do

if !IsNaN(GetValue(ivs, pq)) and GetValue(ivs, pq) <= ivs then

countq + 1

else

countq;

def ivp_q = if !isNaN(counts_below_q) then Round(counts_below_q / IV_Quarter_Trading_Days * 100.0, 0) else Double.NaN;

AddLabel(!isNaN(counts_below_q) and IV_Show_All_Labels, "IVP(3M): " + ivp_q + "%", if ivp_q > IV_Threshold_High then GlobalColor("IV-COLOR-HIGH") else (if ivp_q < IV_Threshold_Low then GlobalColor("IV-COLOR-LOW") else GlobalColor("IV-COLOR-AVG")));

def counts_below_m = fold pm = 1 to IV_Month_Trading_Days + 1 with countm = 0

do

if !IsNaN(GetValue(ivs, pm)) and GetValue(ivs, pm) <= ivs then

countm + 1

else

countm;

def ivp_m = if !isNaN(counts_below_m) then Round(counts_below_m / IV_Month_Trading_Days * 100.0, 0) else Double.NaN;

AddLabel(!isNaN(counts_below_m) and IV_Show_All_Labels, "IVP(M): " + ivp_m + "%", if ivp_m > IV_Threshold_High then GlobalColor("IV-COLOR-HIGH") else (if ivp_m < IV_Threshold_Low then GlobalColor("IV-COLOR-LOW") else GlobalColor("IV-COLOR-AVG")));

# ------------------------END ABOVE THIS LINE--------------------------