Mr_Wheeler

Active member

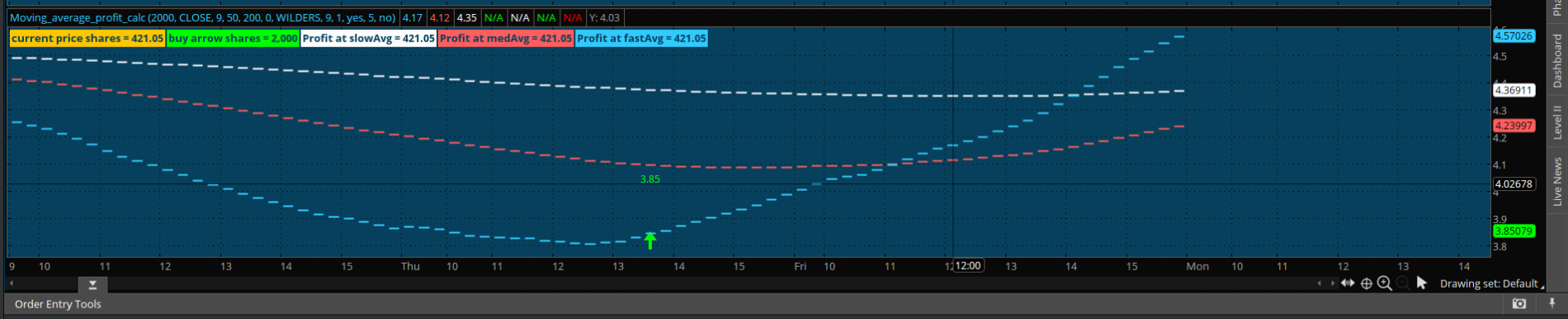

I'm trying to obtain the value, in this case it would be $3.85

http://tos.mx/x6JtfmA

http://tos.mx/x6JtfmA

Code:

input Budget = 2000;

def current_price = close;

def Share_Quantity_purchase_limit = Budget / current_price;

########### Moving Average Lines ###########

input price = close;

input fastLength = 9;

input medLength = 50;

input slowLength = 200;

input displace = 0;

input averageType = AverageType.wilders;

plot fastAvg = MovingAverage(averageType, price[-displace], fastLength);

plot medAvg = MovingAverage(averageType, price[-displace], medLength);

plot slowAvg = MovingAverage(averageType, price[-displace], slowLength);

fastAvg.SetDefaultColor(CreateColor(51, 204, 255));

medAvg.SetDefaultColor(CreateColor(255, 95, 95));

slowAvg.SetDefaultColor(Color.WHITE);

fastAvg.SetLineWeight(2);

medAvg.SetLineWeight(2);

slowAvg.SetLineWeight(2);

fastAvg.SetPaintingStrategy(PaintingStrategy.DASHES);

medAvg.SetPaintingStrategy(PaintingStrategy.DASHES);

slowAvg.SetPaintingStrategy(PaintingStrategy.DASHES);

#####################################################

# Follow Line Indicator

# Coverted to ToS from TV by bigboss. Original © Dreadblitz

#https://usethinkscript.com/threads/follow-line-indicator.9789/

input BbPeriod = 9;

input BbDeviations = 1;

input UseAtrFilter = yes;

input AtrPeriod = 5;

input HideArrows = no;

def BBUpper=SimpleMovingAvg(close,BBperiod)+stdev(close, BBperiod)*BBdeviations;

def BBLower=SimpleMovingAvg(close,BBperiod)-stdev(close, BBperiod)*BBdeviations;

def BBSignal = if close>BBUpper then 1 else if close<BBLower then -1 else 0;

def TrendLine =

if BBSignal == 1 and UseATRfilter == 1 then

max(low-atr(ATRperiod),TrendLine[1])

else if BBSignal == -1 and UseATRfilter == 1 then

min(high+atr(ATRperiod),TrendLine[1])

else if BBSignal == 0 and UseATRfilter == 1 then

TrendLine[1]

else if BBSignal == 1 and UseATRfilter == 0 then

max(low,TrendLine[1])

else if BBSignal == -1 and UseATRfilter == 0 then

min(high,TrendLine[1])

else if BBSignal == 0 and UseATRfilter == 0 then

TrendLine[1]

else TrendLine[1];

def iTrend = if TrendLine>TrendLine[1] then 1 else if TrendLine < TrendLine[1] then -1 else iTrend[1];

plot buy_price = if iTrend[1]==-1 and iTrend==1 and !HideArrows then TrendLine else Double.NaN;

buy_price.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

buy_price.SetDefaultColor(Color.green);

buy_price.SetLineWeight(3);

plot sell_price = if iTrend[1]==1 and iTrend==-1 and !HideArrows then TrendLine else Double.NaN;

sell_price.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

sell_price.SetDefaultColor(Color.white);

sell_price.SetLineWeight(3);

plot buy_arrow = if iTrend[1]==-1 and iTrend==1 and !HideArrows then TrendLine else Double.NaN;

buy_arrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

buy_arrow.SetDefaultColor(Color.green);

buy_arrow.SetLineWeight(5);

plot sell_arrow = if iTrend[1]==1 and iTrend==-1 and !HideArrows then TrendLine else Double.NaN;

sell_arrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

sell_arrow.SetDefaultColor(Color.RED);

sell_arrow.SetLineWeight(5);

###### Math stuff for moving average profit labels ####

def arrow_purchase_price = budget / itrend ;

def profit_at_slowAvg = Share_Quantity_purchase_limit * slowAvg;

#def profit at medAvg

#def profit at fastAvg

############labels###########

AddLabel(yes, Concat("current price shares = ", Round(Share_Quantity_purchase_limit)), Color.orange);

AddLabel(yes, Concat("buy arrow shares = ", Round(arrow_purchase_price)), Color.green);

AddLabel(yes, Concat("Profit at slowAvg = ", Round ( Share_Quantity_purchase_limit * slowAvg)), Color.white);

AddLabel(yes, Concat("Profit at medAvg = ",Round( budget * medAvg)),(CreateColor(255,95,95)));

AddLabel(yes, Concat("Profit at fastAvg = ", Round(budget * fastAvg)),(CreateColor(51, 204, 255)));

########### Alerts########################

Alert(buy_arrow, "Time to buy!", Alert.Bar, Sound.Chimes);

Alert(sell_arrow, "Time to sell!", Alert.Bar, Sound.Bell);

def fastAvg_Alert = MovingAverage(averageType, price[-displace], fastLength) crosses MovingAverage(averageType, price[-displace], medLength);

Alert(fastAvg_Alert, "~~~~~fastAvg / medAvg cross over~~~~~", Alert.BAR, Sound.Chimes);