Most of 'Chop, Sideways, Consolidation, Contraction, Congestion' indicators display similar data: the zones where price lacks trend, momentum, volume, and direction; basically just lying there like a dead fish, not going anywhere  .

.

What you use depends on what works best with your strategy, how much lower chart real estate you have available versus how cluttered you like your upper chart, and so on and so on.

Which indicator appearance appeals to you most? And whether the additional data provided besides the chop points is of interest to you.

Here are the forum indicators written specifically to identify Chop / Sideways action:

https://usethinkscript.com/search/816383/?q=chop*&t=post&c[child_nodes]=1&c[nodes][0]=3&c[title_only]=1&o=replies

https://usethinkscript.com/threads/indicator-to-identify-a-sideways-market.10878/

https://usethinkscript.com/threads/finding-stocks-on-sideways-trend.3878/

https://usethinkscript.com/threads/redk-chop-breakout-scout-v2-0-for-thinkorswim.12359/

https://usethinkscript.com/threads/chop-zone-with-moving-average-for-thinkorswim.13369/

Looking for Consolidation is the most common way members identify chop on the forum:

https://usethinkscript.com/threads/...ipts-to-detect-periods-of-consolidation.1159/

https://usethinkscript.com/threads/john-carters-squeeze-pro-indicator-for-thinkorswim-free.4021/

https://usethinkscript.com/threads/eci-gaussian-indicator-for-thinkorswim.1160/

https://usethinkscript.com/threads/...kout-breakdown-indicator-for-thinkorswim.103/

https://usethinkscript.com/threads/...n-lack-of-directional-momentum-indicator.404/

https://usethinkscript.com/threads/macd-label-count-consecutive-histogram-bars.8265/#post-77970

https://usethinkscript.com/threads/bull-bear-absolute-strength-indicator-for-thinkorswim.11160/

https://usethinkscript.com/threads/congestion-zone.10503/

https://usethinkscript.com/threads/gaussian-rainbow-ma-indicator-for-thinkorswim.279/

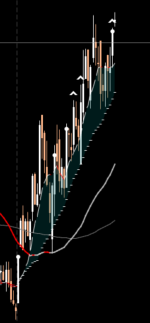

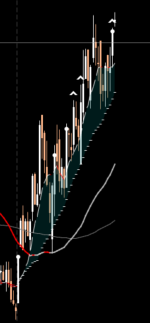

Contraction / Squeeze

https://usethinkscript.com/threads/...m-no-trend-signal-e-g-in-adx.8132/#post-77140

These Squeeze Indicators use the narrowing of bands to determine that a price is in chop. You can start with plugging and playing the ToS TTM Squeeze:

https://usethinkscript.com/threads/ttm-squeeze-format-scan-watchlist-label-for-thinkorswim.2751/

If you find it of value and want to see more, here are the most popular Custom Squeeze studies:

https://usethinkscript.com/threads/how-to-anticipate-an-all-day-squeeze.6579/

https://usethinkscript.com/search/8...1&c[nodes][0]=3&c[title_only]=1&o=replies&g=1

What you use depends on what works best with your strategy, how much lower chart real estate you have available versus how cluttered you like your upper chart, and so on and so on.

Which indicator appearance appeals to you most? And whether the additional data provided besides the chop points is of interest to you.

Here are the forum indicators written specifically to identify Chop / Sideways action:

https://usethinkscript.com/search/816383/?q=chop*&t=post&c[child_nodes]=1&c[nodes][0]=3&c[title_only]=1&o=replies

https://usethinkscript.com/threads/indicator-to-identify-a-sideways-market.10878/

https://usethinkscript.com/threads/finding-stocks-on-sideways-trend.3878/

https://usethinkscript.com/threads/redk-chop-breakout-scout-v2-0-for-thinkorswim.12359/

https://usethinkscript.com/threads/chop-zone-with-moving-average-for-thinkorswim.13369/

Looking for Consolidation is the most common way members identify chop on the forum:

https://usethinkscript.com/threads/...ipts-to-detect-periods-of-consolidation.1159/

https://usethinkscript.com/threads/john-carters-squeeze-pro-indicator-for-thinkorswim-free.4021/

https://usethinkscript.com/threads/eci-gaussian-indicator-for-thinkorswim.1160/

https://usethinkscript.com/threads/...kout-breakdown-indicator-for-thinkorswim.103/

https://usethinkscript.com/threads/...n-lack-of-directional-momentum-indicator.404/

https://usethinkscript.com/threads/macd-label-count-consecutive-histogram-bars.8265/#post-77970

https://usethinkscript.com/threads/bull-bear-absolute-strength-indicator-for-thinkorswim.11160/

https://usethinkscript.com/threads/congestion-zone.10503/

https://usethinkscript.com/threads/gaussian-rainbow-ma-indicator-for-thinkorswim.279/

Contraction / Squeeze

https://usethinkscript.com/threads/...m-no-trend-signal-e-g-in-adx.8132/#post-77140

These Squeeze Indicators use the narrowing of bands to determine that a price is in chop. You can start with plugging and playing the ToS TTM Squeeze:

https://usethinkscript.com/threads/ttm-squeeze-format-scan-watchlist-label-for-thinkorswim.2751/

If you find it of value and want to see more, here are the most popular Custom Squeeze studies:

https://usethinkscript.com/threads/how-to-anticipate-an-all-day-squeeze.6579/

https://usethinkscript.com/search/8...1&c[nodes][0]=3&c[title_only]=1&o=replies&g=1

Last edited: