#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © LonesomeTheBlue

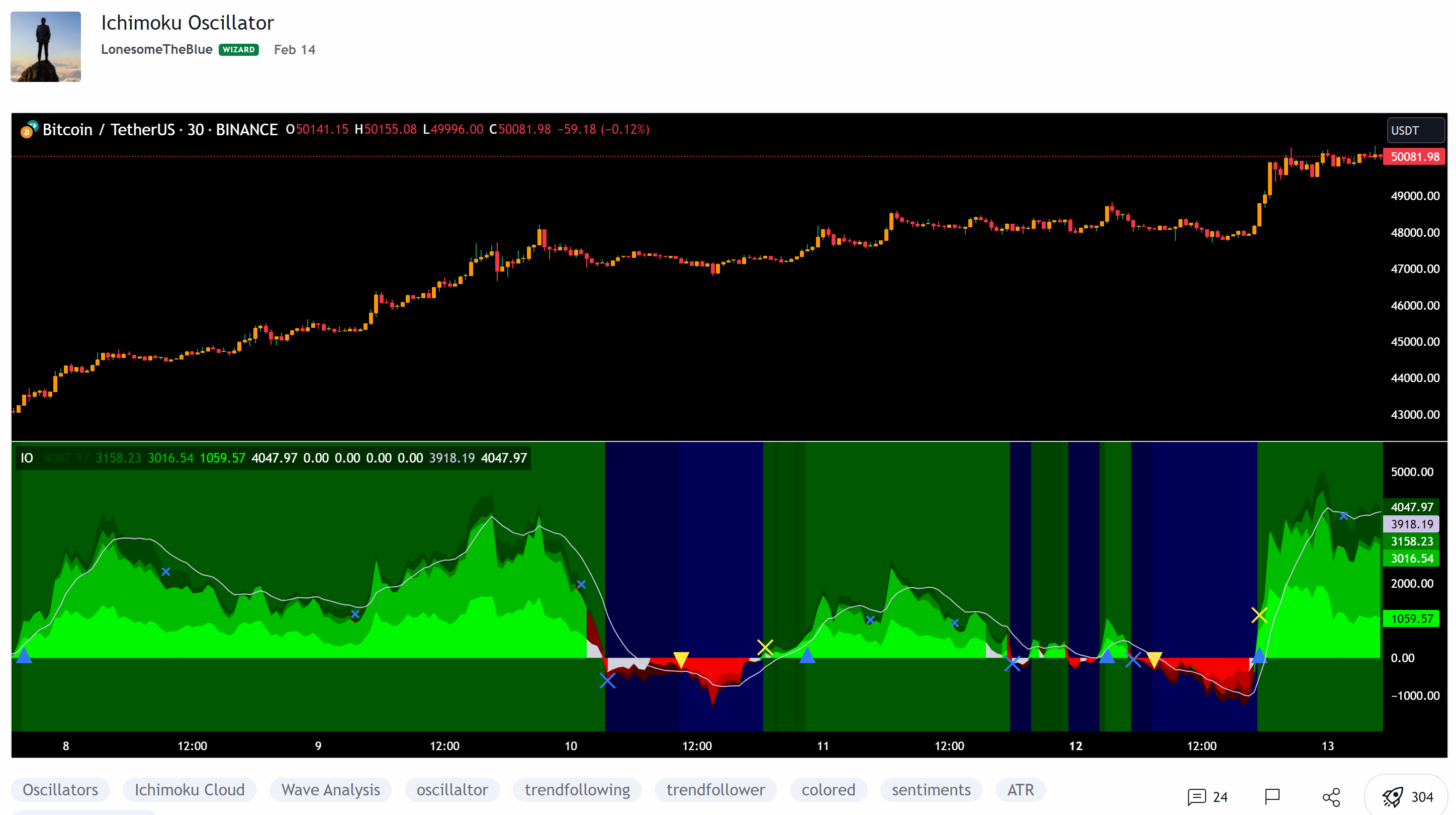

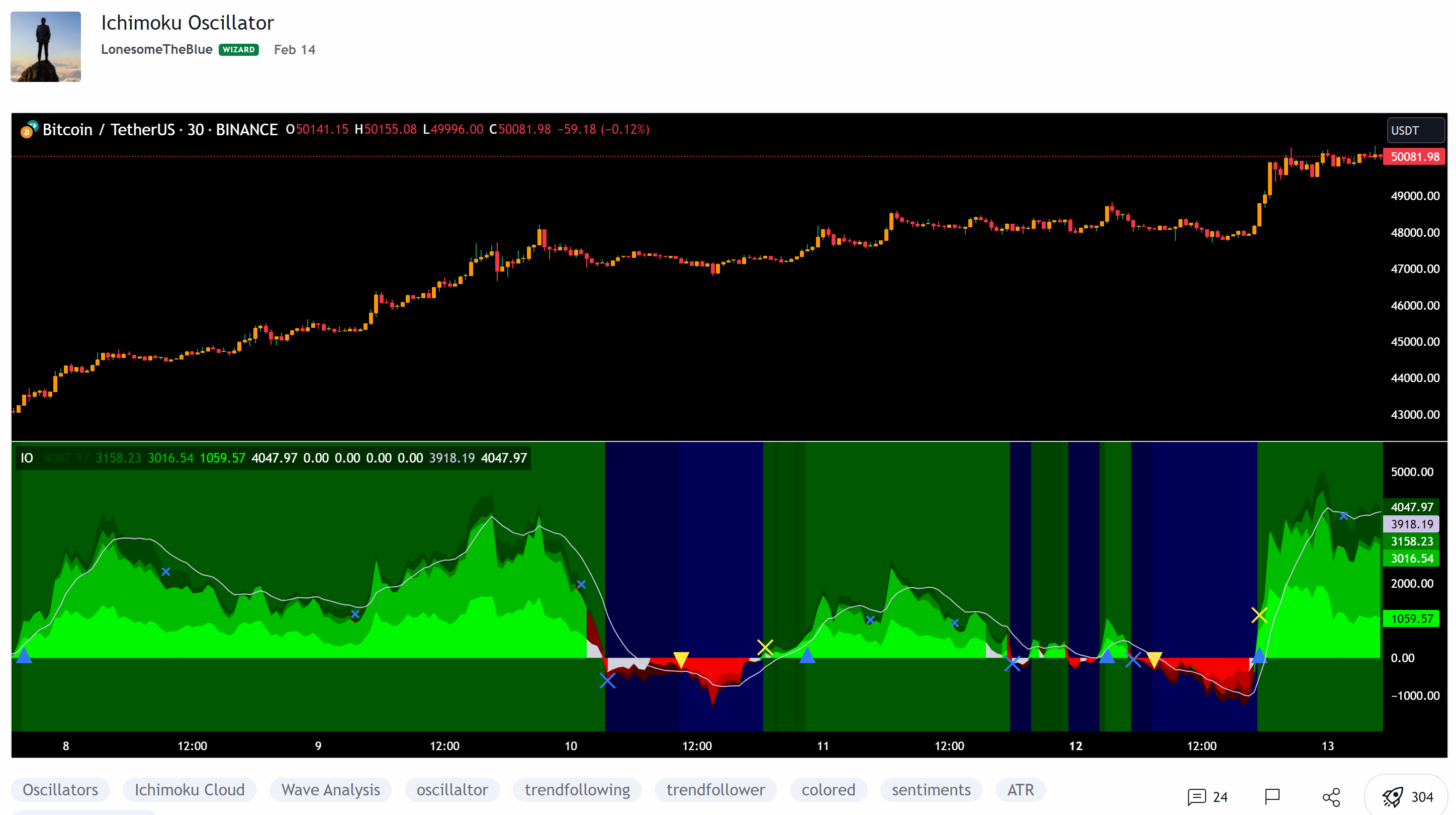

#indicator(title="Ichimoku Oscillator", shorttitle="IO", explicit_plot_zorder = true)

# Converted by Sam4Cok@Samer800 - 02/2024

declare lower;

input conversionPeriods = 8; # "Conversion Line Length"

input basePeriods = 13; # "Base Line Length"

input LeadingSpanBLength = 26; # "Leading Span B Length"

input LaggingSpan = 13; # "Lagging Span"

input useAtr = yes; # "Use ATR", tooltip = "Protection from Whipsaw"

input atrLen = 9; # "?Length"

input atrMul = 2.0; # "?Mult",

input EnableBounceOff = no; # "Bounce Off Support/Resistance"

input useEma = yes; # "Show EMA"

input emaLen = 9; # "?Length"

input TakePartialProfitByEma = yes;

input ColoredBackground = yes; # "Colored Background"

def na = Double.NaN;

def last = isNaN(close);

#-- Colors

DefineGlobalColor("upcol1", CreateColor(0 , 250, 0)); # "Uptrend Colors"

DefineGlobalColor("upcol2", CreateColor(0 , 190, 0));

DefineGlobalColor("upcol3", CreateColor(0 , 130, 0));

DefineGlobalColor("upcol4", CreateColor(0 , 70, 0));

DefineGlobalColor("dbcol1", CreateColor(250, 0, 0)); # "Downtrend Colors"

DefineGlobalColor("dbcol2", CreateColor(190, 0, 0));

DefineGlobalColor("dbcol3", CreateColor(130, 0, 0));

DefineGlobalColor("dbcol4", CreateColor(70, 0, 0));

DefineGlobalColor("inSRcol", CreateColor(209,212,220));

DefineGlobalColor("emacol", CreateColor(209,196,233));

#// ichimoku calculation

script donchian {

input len = 9;

def hh = Highest(high, len);

def ll = Lowest(low, len);

def donchian = (ll + hh) / 2;

plot out = donchian;

}

def conversionLine = donchian(conversionPeriods);

def baseLine = donchian(basePeriods);

def leadLine1 = (conversionLine + baseLine) / 2;

def leadLine2 = donchian(LeadingSpanBLength);

#// Oscillator calculation

def cloudup = leadLine1 >= leadLine2;

def clouddn = leadLine1 <= leadLine2;

def CloudMin = Min(leadLine1[LaggingSpan - 1], leadLine2[LaggingSpan - 1]);

def CloudMax = Max(leadLine1[LaggingSpan - 1], leadLine2[LaggingSpan - 1]);

def inthecloud = close >= CloudMin and close <= CloudMax;

def mtrd = if close > CloudMax then 1 else if close < CloudMin then -1 else mtrd[1];

def mTrend = if isNaN(mtrd) then 0 else mtrd;

#// first layer

def Oscline = if mtrend == 1 then (close - CloudMin) else (close - CloudMax);

#//second layer

def Lagging = Oscline + (if mtrend == 1 then Max(close - CloudMax[LaggingSpan - 1], 0) else

Min(close - CloudMin[LaggingSpan - 1], 0));

#//third layer

def ConvBase = Lagging + (if mtrend == 1 then Max((conversionLine - baseLine), 0) else Min((conversionLine - baseLine), 0));

#// fourth layer

def cloud = ConvBase + (if mtrend == 1 then Max(leadLine1 - leadLine2, 0) else Min(leadLine1 - leadLine2, 0));

def anyofthemrising = (conversionLine - conversionLine[1]) > 0 or (baseLine - baseLine[1]) > 0;

def anyofthemfalling = (conversionLine - conversionLine[1]) < 0 or (baseLine - baseLine[1]) < 0;

def convoverbase = conversionLine >= baseLine;

def baseoverconv = conversionLine <= baseLine;

#// little Protection from whipsaw

def tole = if useatr then ATR(Length = atrlen) * atrmul else 0;

#// calculation of the trend and getting entry level if trend appears

def entrylevel;

def preTrend;

def trend;

if mtrend == 1 {

preTrend = if mtrend[1] == -1 then 0 else trend[1];

if preTrend < 4 and close > CloudMax {

trend = (if Lagging > Oscline then 1 else 0) +

(if convoverbase and anyofthemrising then 1 else 0) +

(if cloudup then 1 else 0) + 1;

entrylevel = if trend == 4 then close else entrylevel[1];

} else {

trend = (if conversionLine < baseLine - tole then 0 else preTrend);

entrylevel = entrylevel[1];

}

} else if mtrend == -1 {

preTrend = if mtrend[1] == 1 then 0 else trend[1];

if preTrend > - 4 and close < CloudMin {

trend = (if Lagging < Oscline then -1 else 0) -

(if baseoverconv and anyofthemfalling then 1 else 0) -

(if clouddn then 1 else 0) - 1;

entrylevel = if trend == -4 then close else entrylevel[1];

} else {

trend = (if conversionLine > baseLine + tole then 0 else preTrend);

entrylevel = entrylevel[1];

}

} else {

preTrend = preTrend[1];

trend = if last then na else preTrend;

entrylevel = entrylevel[1];

}

#// Background coloring if Enabled

def dir = if !isNaN(trend) then trend else 0;

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def uptmult = 159 + power(trend, 3);

def dntmult = 159 - power(trend, 3);

def trendExtUp = (dir > 2) or (dir[1] > 2);

def trendExtDn = (dir <-2) or (dir[1] <-2);

def trendUp = (dir > 0) or (dir[1] > 0);

def trendDn = (dir < 0) or (dir[1] < 0);

AddCloud(if ColoredBackground then if trendExtUp then pos else na else na, neg, Color.DARK_GREEN);

AddCloud(if ColoredBackground then if trendExtDn then pos else na else na, neg, Color.DARK_RED);

AddCloud(if ColoredBackground then if trendUp then pos else na else na, neg, GlobalColor("upcol4"));

AddCloud(if ColoredBackground then if trendDn then pos else na else na, neg, GlobalColor("dbcol4"));

#/ ploting layers

def area = cloud;

def baseArea = ConvBase;

def lagLine = Lagging;

def oscArea = Oscline;

def ConvBaseCol = if conversionLine >= baseLine then 1 else - 1;#? upcol3 : dbcol3

def lagCol = if close > CloudMax then 1 else if close < CloudMin then -1 else 0;

def Osccolor = if inthecloud then 0 else if close > CloudMax then 1 else -1;#? upcol1 : dbcol1

AddCloud(if Osccolor==0 or Osccolor[1] == 0 then oscArea else na, 0, GlobalColor("inSRcol"), GlobalColor("inSRcol"), yes);

AddCloud(if Osccolor > 0 or Osccolor[1] > 0 then oscArea else na, 0, GlobalColor("upcol1"), GlobalColor("upcol1"), yes);

AddCloud(if Osccolor < 0 or Osccolor[1] < 0 then oscArea else na, 0, GlobalColor("dbcol1"), GlobalColor("dbcol1"), yes);

AddCloud(if lagCol > 0 or lagCol[1] > 0 then lagLine else na, 0, GlobalColor("upcol2"), GlobalColor("upcol2"), yes);

AddCloud(if lagCol < 0 or lagCol[1] < 0 then lagLine else na, 0, GlobalColor("dbcol2"), GlobalColor("dbcol2"), yes);

AddCloud(if ConvBaseCol > 0 or ConvBaseCol[1] > 0 then baseArea else na, 0, GlobalColor("upcol3"), GlobalColor("upcol3"), yes);

AddCloud(if ConvBaseCol < 0 or ConvBaseCol[1] < 0 then baseArea else na, 0, GlobalColor("dbcol3"), GlobalColor("dbcol3"), yes);

AddCloud(area, 0, GlobalColor("upcol4"), GlobalColor("dbcol4"));

#// closing main position

def closetrade = (trend-trend[1]) != 0 and AbsValue(trend[1]) == 4;

plot closeShape = if closetrade then cloud else na;

closeShape.SetPaintingStrategy(PaintingStrategy.SQUARES);

closeShape.AssignValueColor(if trend[1] > 0 then Color.WHITE else Color.YELLOW);

#// take long position

def uptrend = trend == 4 and (trend-trend[1]) != 0;

plot LongShape = if uptrend then 0 else na;

LongShape.SetLineWeight(2);

LongShape.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

LongShape.SetDefaultColor(Color.CYAN);

def bouncbackup = EnableBounceOff and trend == 4 and close > CloudMax and inthecloud[1];

plot bounceUp = if bouncbackup then 0 else na;

bounceUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

bounceUp.SetDefaultColor(Color.VIOLET);

#// take short position

def downtrend = trend == -4 and (trend-trend[1]) != 0;

plot shortShape = if downtrend then 0 else na;

shortShape.SetLineWeight(2);

shortShape.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

shortShape.SetDefaultColor(Color.MAGENTA);

def bouncbackdn = EnableBounceOff and trend == -4 and close < CloudMin and inthecloud[1];

plot bounceDn = if bouncbackdn then 0 else na;

bounceDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

bounceDn.SetDefaultColor(Color.PLUM);

#/ plot ema line if enabled

def emaline = ExpAverage(cloud, emalen);

plot ema = if useema then emaline else na;

ema.SetDefaultColor(GlobalColor("emacol"));

#// possible/partially take profit if profitable

def convcrossbase = Crosses(conversionLine, baseLine, CrossingDirection.ABOVE);

def basecrosscons = Crosses(baseLine, conversionLine, CrossingDirection.ABOVE);

def emacrosscloud = Crosses(emaline, cloud, CrossingDirection.ABOVE);

def cloudcrossema = Crosses(cloud, emaline, CrossingDirection.ABOVE);

def profitable = trend == 4 and close > entrylevel or trend == -4 and close < entrylevel;

def posexitcol = if profitable then

if trend == 4 and basecrosscons then 1 else

if trend == 4 and emacrosscloud and TakePartialProfitByEma then 0 else

if trend ==-4 and convcrossbase then -1 else

if trend ==-4 and cloudcrossema and TakePartialProfitByEma then 0 else na else na;

plot profit = posexitcol;

profit.SetPaintingStrategy(PaintingStrategy.POINTS);

profit.AssignValueColor(if posexitcol > 0 then Color.WHITE else

if posexitcol < 0 then Color.YELLOW else GlobalColor("emacol"));

#-- END of CODE