#// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © syntaxgeek

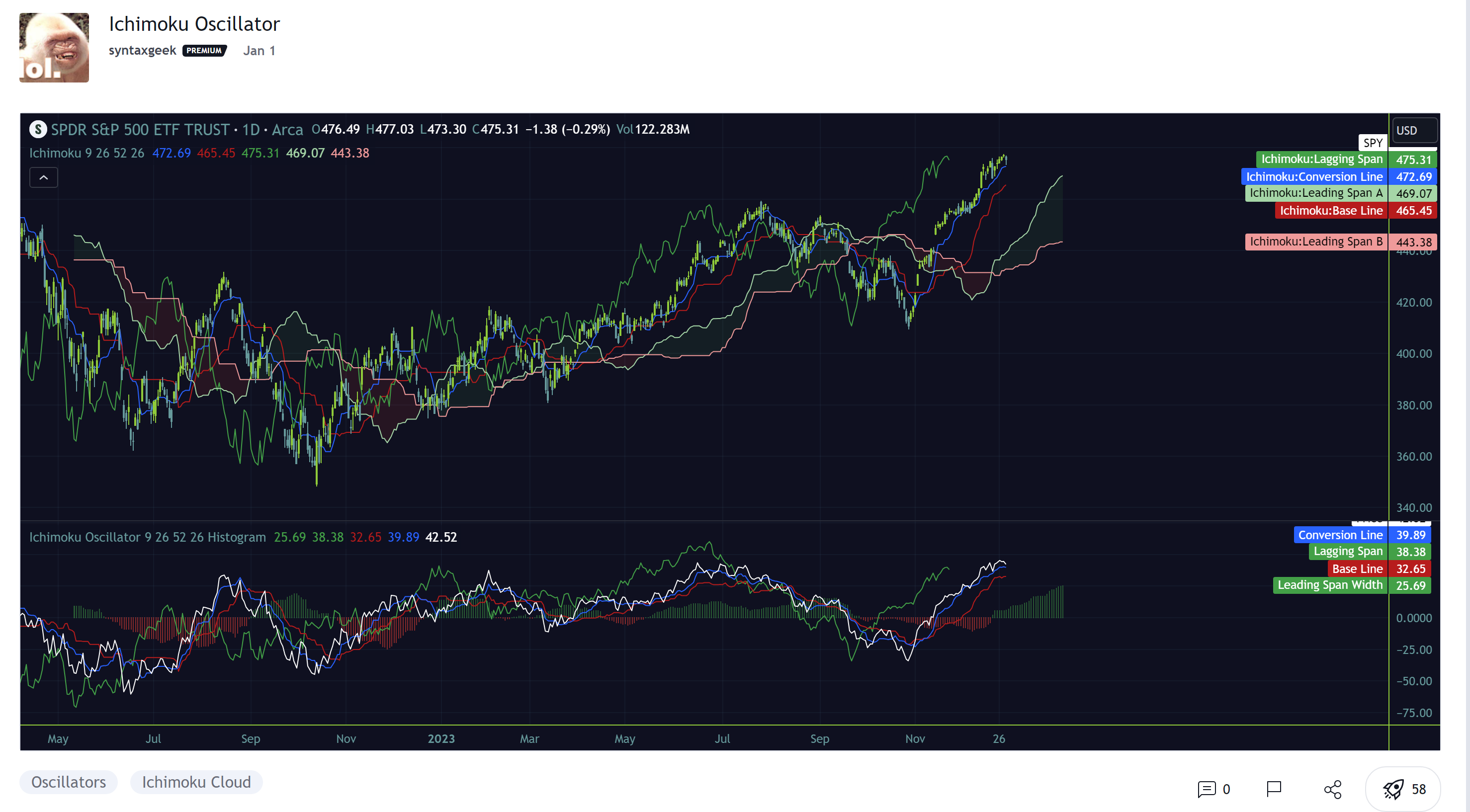

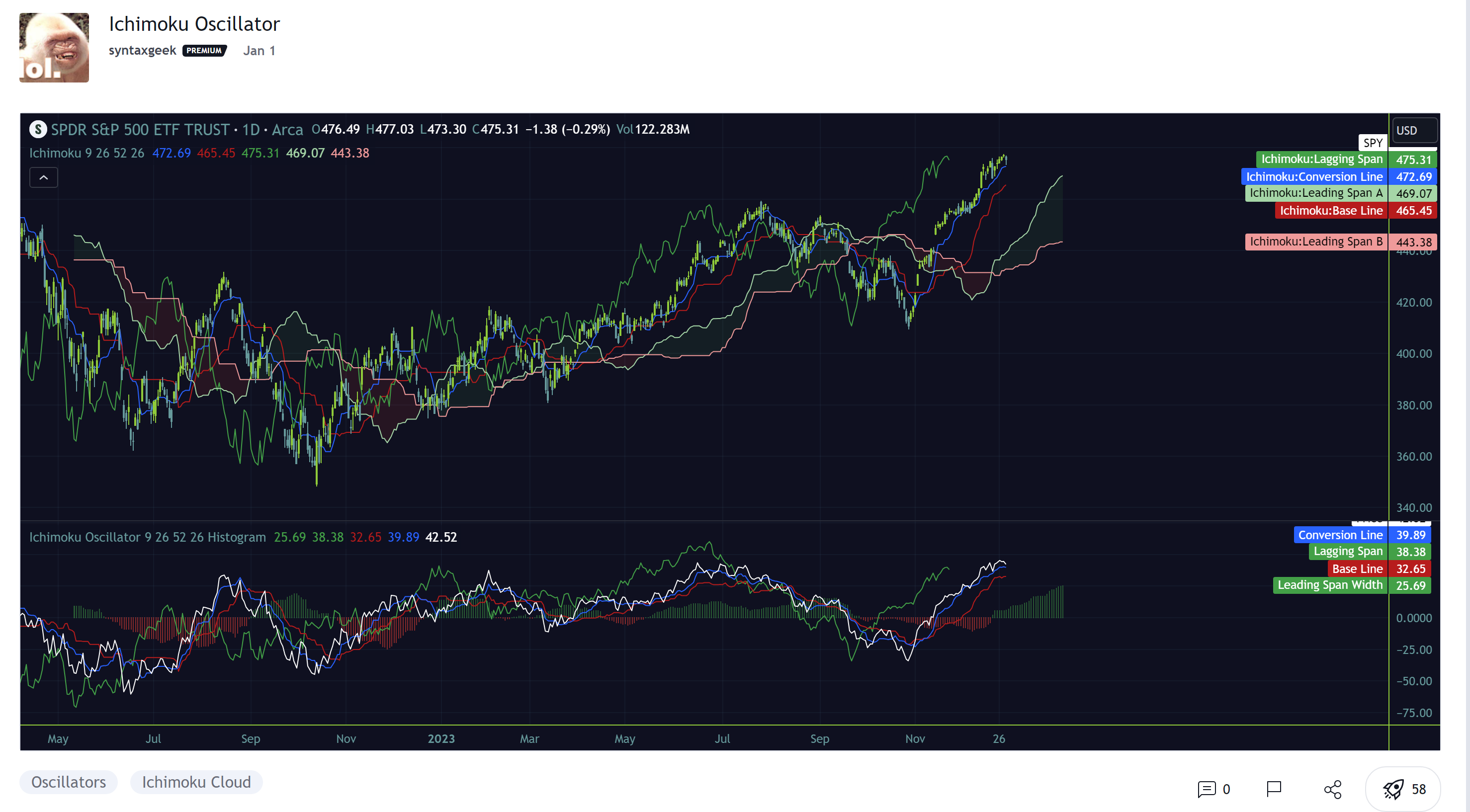

#indicator("Ichimoku Oscillator")

# Converted by Sam4Cok@Samer800 - 01/2024

declare lower;

input ConversionLineLength = 9;#, minval=1, title="Conversion Line Length")

input BaseLineLength = 26;#, minval=1, title="Base Line Length")

input LeadingSpanBLength = 52;#, minval=1, title="Leading Span B Length")

input LaggingSpan = 26;#, minval=1, title="Lagging Span")

input CloudFormat = { default "Histogram", "Filled (Classic)"}; # 'Cloud Format'

def na = Double.NaN;

def v_showHistoPlot = CloudFormat == CloudFormat."Histogram";

def v_showFillPlots = CloudFormat == CloudFormat."Filled (Classic)";

DefineGlobalColor("leadUp", Color.DARK_GREEN);#CreateColor(67, 160, 71));

DefineGlobalColor("leadDn", Color.DARK_RED);#CreateColor(244, 67, 54));

DefineGlobalColor("lag", Color.GREEN);

DefineGlobalColor("base", Color.RED);

DefineGlobalColor("conv", CreateColor(41,98,255));

DefineGlobalColor("price", Color.WHITE);

#// { funcs

script f_donchian {

input len = 9;

def hh = Highest(high, len);

def ll = Lowest(low, len);

def don = (hh + ll) / 2;

plot out = don;

}

#// original ichimoku calculations

def v_conversionLine = f_donchian(ConversionLineLength);

def v_baseLine = f_donchian(BaseLineLength);

def v_leadLine1 = (v_conversionLine + v_baseLine) / 2;

def v_leadLine2 = f_donchian(LeadingSpanBLength);

#// calculate absolute difference between span a and b

def v_leadDiff = AbsValue(v_leadLine1 - v_leadLine2);

#// determine whether difference should be negative or positive depending on span a and b orientation

def v_leadDiffComparison = (if v_leadLine1[LaggingSpan - 1] > v_leadLine2[LaggingSpan - 1]

then v_leadDiff[LaggingSpan - 1] else -v_leadDiff[LaggingSpan - 1]);

#// adjust price line to scale with span difference

def v_close = close - v_leadLine1[LaggingSpan - 1] + v_leadDiffComparison;

#// adjust displaced price lagging line to scale with twice displaced span a and adjust for span twice displaced difference

def v_laggingSpan = close - v_leadLine1[(LaggingSpan * 2) - 1] + v_leadDiffComparison[LaggingSpan - 1];

#// adjust displaced base line to scale with displaced span a and adjust for span difference

def v_baseLineAdjusted = v_baseLine - v_leadLine1[LaggingSpan - 1] + v_leadDiffComparison;

#// adjust displaced conversion line to scale with displaced span a and adjust for span difference

def v_conversionLineAdjusted = v_conversionLine - v_leadLine1[LaggingSpan - 1] + v_leadDiffComparison;

#// } vars

#// { plots

def spanWidth = if v_leadLine1 > v_leadLine2 then v_leadDiff else -v_leadDiff;

def spanA = if !v_showFillPlots then na else if v_leadLine1 > v_leadLine2 then v_leadDiff else 0;

def spanB = if !v_showFillPlots then na else if v_leadLine1 < v_leadLine2 then -v_leadDiff else 0;

plot Lagging = v_laggingSpan[-(LaggingSpan) + 1]; # "Lagging Span"

plot BaseLine = v_baseLineAdjusted; # "Base Line"

plot ConvLine = v_conversionLineAdjusted; # "Conversion Line"

plot price = v_close; # "Price"

Lagging.SetDefaultColor(GlobalColor("lag"));

BaseLine.SetDefaultColor(GlobalColor("base"));

ConvLine.SetDefaultColor(GlobalColor("conv"));

price.SetDefaultColor(GlobalColor("price"));

plot spanHist = if !v_showHistoPlot then na else spanWidth[LaggingSpan - 1]; # 'Leading Span Width'

spanHist.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

spanHist.AssignValueColor(if v_leadLine1[LaggingSpan - 1] > v_leadLine2[LaggingSpan - 1]

then GlobalColor("leadUp") else GlobalColor("leadDn"));

AddCloud(if !v_showFillPlots then na else spanWidth[LaggingSpan - 1], 0, GlobalColor("leadUp"), GlobalColor("leadDn"), yes);

#-- END of CODE