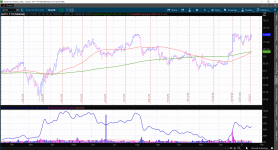

Below is the chart setup for ThinkorSwim inspired by IBD (Investor's Business Daily) stocks chart. Also, a watchlist column and the Relative Strength (RS) indicator.

Here's the Code to put in a Custom Watch List Column:

Shared Watch List Link: http://tos.mx/9VSRMyw

Click here for --> Easiest way to load shared links

Use whichever you would like!

Below is a scan that I came across that will pull the top 20% of Relative Strength stocks in a Scan of the S&P 500. After loading the scanned list, most were above the 75% line for the above chart's RS line. I also changed the inputs to 0 & 20 and the RS line on this chart was down on all on the list. I suggest scanning in S&P 100 or 500 to keep your list manageable. My thanks to Chris Baker.

Grid chart: https://tos.mx/hfEeqh

Here's the Code to put in a Custom Watch List Column:

Ruby:

#uTS Watchlist Code for %52WkRng

#Mobius© WLC Percent Inside 52 Week Range

def h = highest(high, 252);

def l = lowest(low, 252);

def x = (close - l) / (h - l);

plot r = round(x * 100, 0);

AssignBackgroundColor( if rs > 80 then color.dark_green else

if rs > 60 then createcolor(0,175,0) else

if rs > 40 then color.gray else

if rs > 20 then CreateColor(220, 0,0) else

if rs <= 20 then CreateColor(150, 0,0) else

color.white );Click here for --> Easiest way to load shared links

Use whichever you would like!

Below is a scan that I came across that will pull the top 20% of Relative Strength stocks in a Scan of the S&P 500. After loading the scanned list, most were above the 75% line for the above chart's RS line. I also changed the inputs to 0 & 20 and the RS line on this chart was down on all on the list. I suggest scanning in S&P 100 or 500 to keep your list manageable. My thanks to Chris Baker.

Code:

# Scan - Price Rank in Range 80-100

# Edited by Markos to prove out scan for Relative Strength - Use is set for 1Yr-1Day Chart

# This Scan Tab study finds stocks whose price is in the given Price Rank (Price Percentile)

# in the given number of bars.

# By Chris Baker <[email protected]> @ChrisBaker97

# Latest version maintained at: https://bitbucket.org/ChrisBaker97/thinkscript/src/

# This thinkScript is designed for use in the Scan tab. Detailed

# instructions may be found at: https://bitbucket.org/ChrisBaker97/thinkscript/

#

# This work is licensed under the Creative Commons Attribution-ShareAlike

# 3.0 Unported License. To view a copy of this license, visit:

# http://creativecommons.org/licenses/by-sa/3.0/deed.en_US

#Start Code

input period = 252;

input prLo = 80;

input prHi = 100;

def hi = highest(high,period);

def lo = lowest(low,period);

def range = hi - lo;

def priceRank = 100 * (open - lo) / range;

plot inRange = prLo <= priceRank and priceRank <= prHi;

#End CodeGrid chart: https://tos.mx/hfEeqh

Relative Strength (RS) Line

Code:

# Plot the Relative Strength Line in ThinkorSwim

# Written by: @Diamond_Stocks @RayTL_ - TLScripts

# Site: https://www.traderlion.com/ https://www.traderlion.com/tl-scripts/

# V1

# Declare Lower Places a study on the lower subgraph. This declaration is used when your study uses values that are considerably lower or higher than price history or volume values.

declare lower;

# User Inputs

input show_RSNHBP = yes;

input show_RSNH = yes;

#Relative Strength Type - Candlestick to be added later.

input graphStyle = {default "Line"};

#3 Month, 6 Month, 1 Year RS

input TimeFrame = {default "Three_Months", "Six_Months", "1_Year"};

#Index SymbolRelation

input CorrelationWithSecurity = "SPX";

#Calculation TimeFrame

def aggregationperiod = AggregationPeriod.DAY;

#Chart Normalized Relative Strength Rating on Last Bar

def isLastBar = BarNumber() == HighestAll(if !IsNaN(close) then BarNumber() else Double.NaN);

#Turn on or off Alerts when cycling charts

input Alerts_On = yes;

#Add Chart Bubbble to Graph

input RS_Rating_ChartBubble = yes;

#Establish look back length:

def Length = if TimeFrame == TimeFrame.Three_Months then 63 else if TimeFrame == TimeFrame.Six_Months then 126 else 252;

#Get Index Close/Open/High/Low - Prep for Candlestick RS.

def indexopen = open(CorrelationWithSecurity, aggregationperiod);

def indexhigh = high(CorrelationWithSecurity, aggregationperiod);

def indexlow = low(CorrelationWithSecurity, aggregationperiod);

def indexclose = close(CorrelationWithSecurity, aggregationperiod);

#Get Relative Strength - Prep for Candlestick RS.

def RSopen = open / indexopen;

def RShigh = high / indexhigh;

def RSlow = low / indexlow;

def RSclose = close / indexclose;

def barCount = IF !IsNaN(close) THEN IF IsNaN(barCount[1]) THEN 1 ELSE barCount[1] + 1 ELSE barCount[1];

#Normalize Relative Strength

def newRngMax = 99; #Maximum normalized value

def newRngMin = 1; #Minimum normalized value

def HHDataclose = HighestAll(RSclose);

def LLDataclose = LowestAll(RSclose);

def HHDataopen = HighestAll(RSopen);

def LLDataopen = LowestAll(RSopen);

def HHDatalow = HighestAll(RSlow);

def LLDatalow = LowestAll(RSlow);

def HHDatahigh = HighestAll(RShigh);

def LLDatahigh = LowestAll(RShigh);

def normalizeRSclose = ((( newRngMax - newRngMin ) * ( RSclose - LLDataclose )) / ( HHDataclose - LLDataclose )) + newRngMin;

def normalizeRSopen = ((( newRngMax - newRngMin ) * ( RSopen - LLDataopen )) / ( HHDataopen - LLDataopen )) + newRngMin;

def normalizeRShigh = ((( newRngMax - newRngMin ) * ( RShigh - LLDatahigh )) / ( HHDatahigh - LLDatahigh )) + newRngMin;

def normalizeRSlow = ((( newRngMax - newRngMin ) * ( RSlow - LLDatalow )) / ( HHDatalow - LLDatalow )) + newRngMin;

#Chart RS Line and set appearence:

plot RSLine = RSclose;

RSLine.DefineColor("Positive", Color.UPTICK);

RSLine.DefineColor("Negative", Color.DOWNTICK);

RSLine.SetLineWeight(1);

RSLine.AssignValueColor(if RSLine[0] > RSLine[1] then CreateColor(43, 152, 242) else CreateColor(227, 88, 251));

#Get Highest RS Value

def highestRS = Highest(RSclose, Length);

#RSNHBPCondition

def RSNHBPcondition = if RSclose >= highestRS and close < Highest(close, Length) then highestRS else no;

#Plot RSNHBP Condition

plot RSNHBP = if show_RSNHBP and RSNHBPcondition == highestRS then highestRS else Double.NaN;

#Plot RSNH Condition

plot RSNH = if show_RSNH and RSNHBPcondition == no and RSclose == highestRS and isLastBar then highestRS else Double.NaN;

#Appearance Settings

RSNHBP.SetPaintingStrategy(PaintingStrategy.POINTS);

RSNHBP.SetLineWeight(2);

RSNHBP.SetDefaultColor(CreateColor(196, 94, 225));

RSNHBP.HideBubble();

RSNH.SetPaintingStrategy(PaintingStrategy.POINTS);

RSNH.SetDefaultColor(Color.GREEN);

RSNH.SetLineWeight(2);

RSNH.HideBubble();

#Add Chart Bubble for RS Rating

AddChartBubble(RS_Rating_ChartBubble and isLastBar, RSclose, "RS: " + Round(normalizeRSclose, 0), Color.WHITE, no);

#Add Label

AddLabel(yes, Concat("Relative Strength: ", Round(normalizeRSclose, 0)), CreateColor(43, 152, 242));

#Alert Capability

Alert( if Alerts_On and RSNHBP then yes else no, "Relative Strength Line New Highs Before Price", Alert.BAR, Sound.Ding);

Alert(if Alerts_On and RSNH then yes else no, "Relative Strength Line New Highs", Alert.BAR, Sound.Chimes);Attachments

Last edited by a moderator: