Market Sentiment is a new tool we just released to our community. Its purpose is to indicate whether the market is at an extreme level. You can use the rating we provided to gauge for the next reversal point.

If you didn't get a chance to try it out yet, do so here.

This tutorial will walk you through the basic features of the Market Sentiment tool.

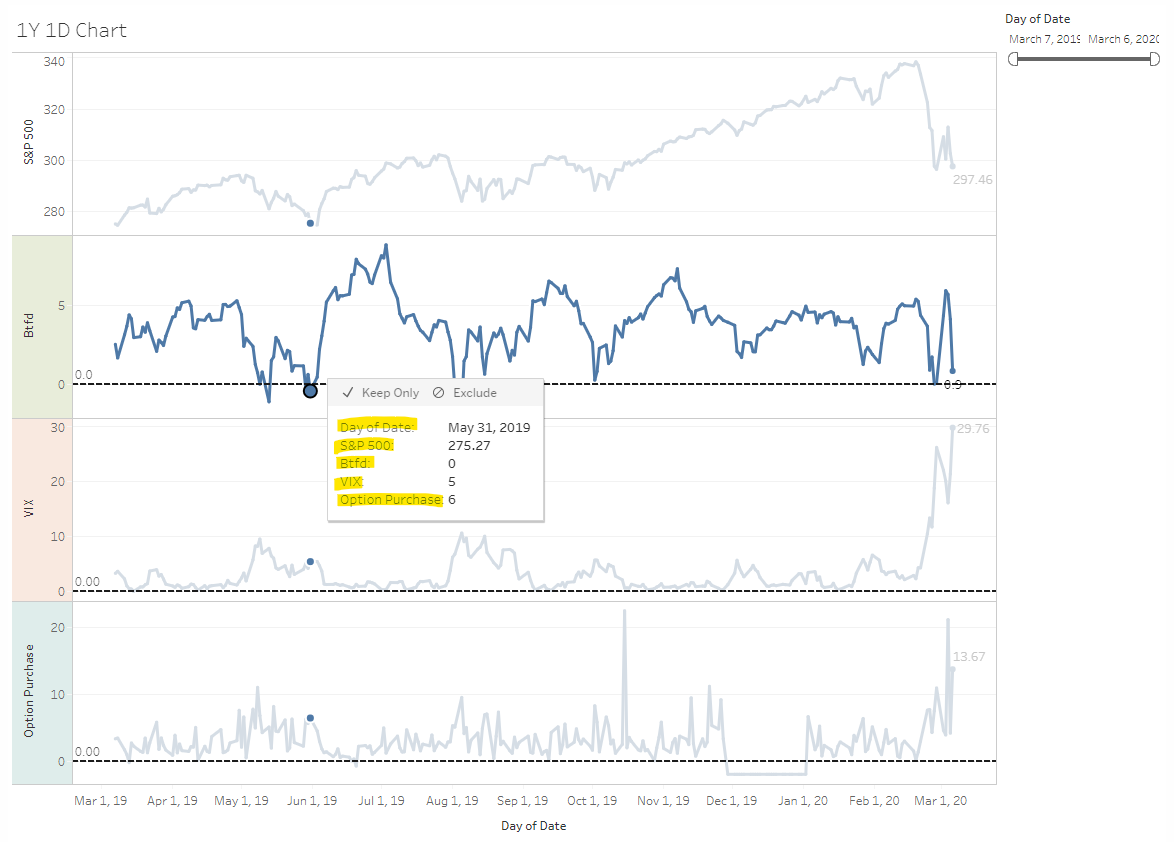

If you hover your mouse on the line chart, it should display the date, S&P closing price, BTFD value, VIX value, and OP value correlate to that specific date. If you click on it, it will highlight the correlation.

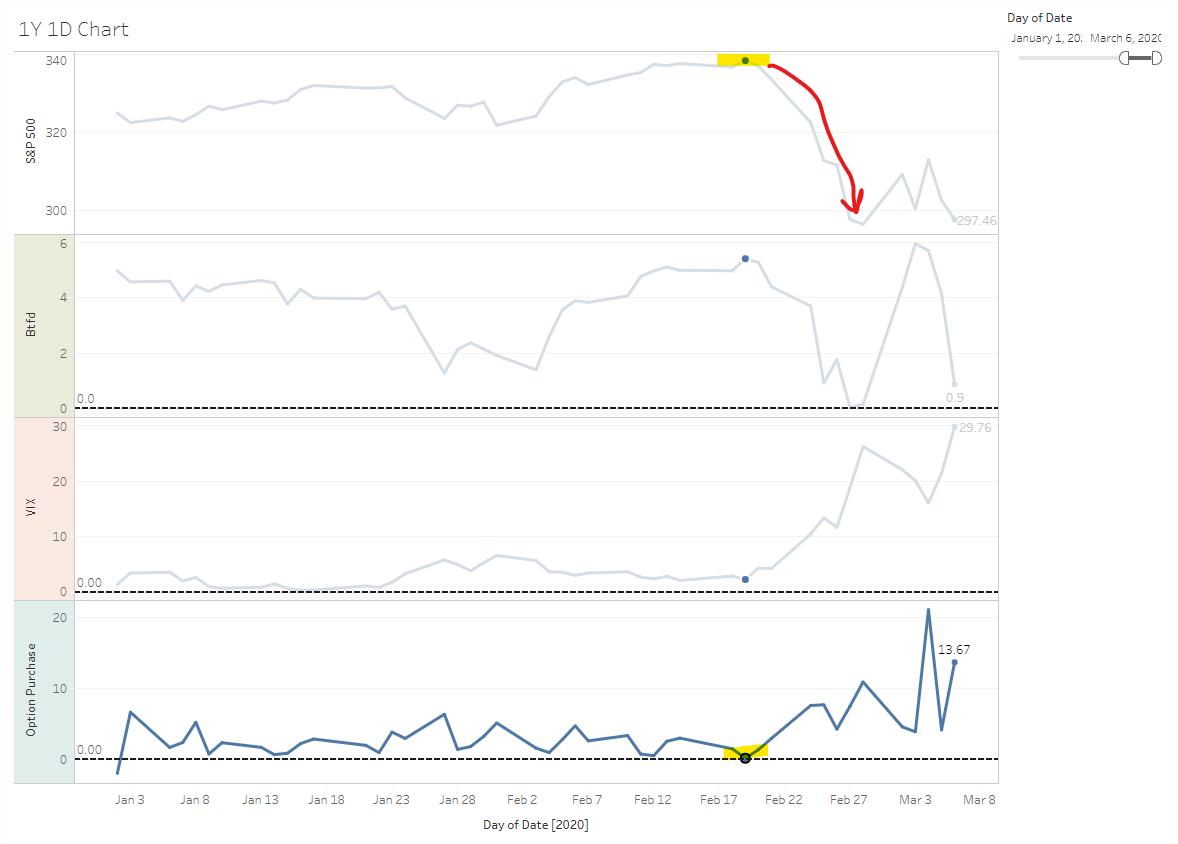

Feb 27th, 2020

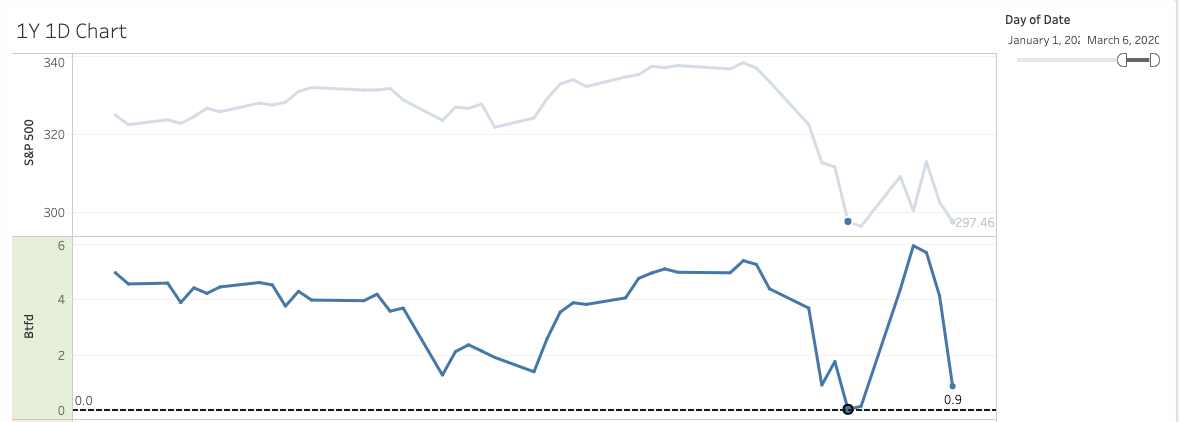

Here is a 3M 1D chart. On February 27th, 2020, the BTFD chart hits 0. The S&P 500 closed at 297.51. What happen after? S&P 500 rebounded to as high as 312.86 within 4 trading sessions.

Feb 12th, 2020

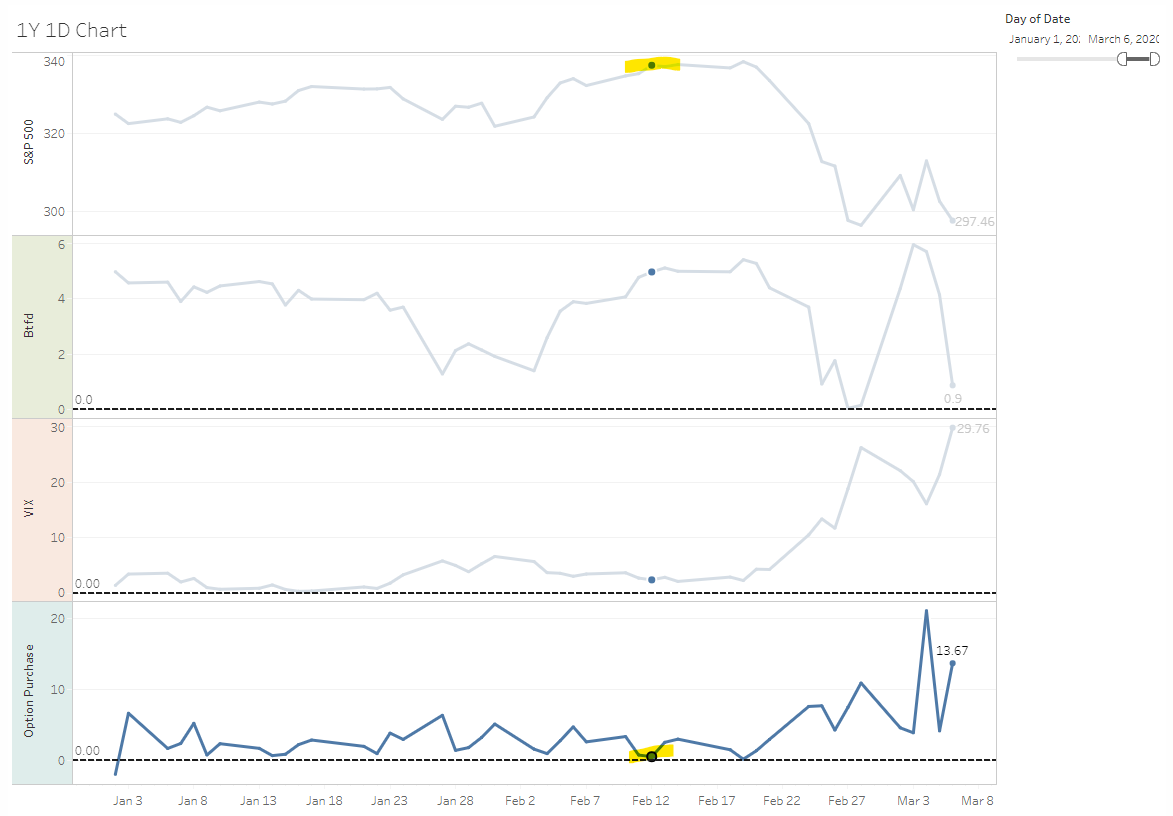

On Feb 12th, 2020, the Option Purchase chart hit 0, and the S&P 500 closed at 337.42 on that day. Following the next few days, the market stalled at 337 price levels.

Then, on Feb 19th, 2020, the Option Purchase chart hit 0 again. That led to a massive pullback on the S&P 500.

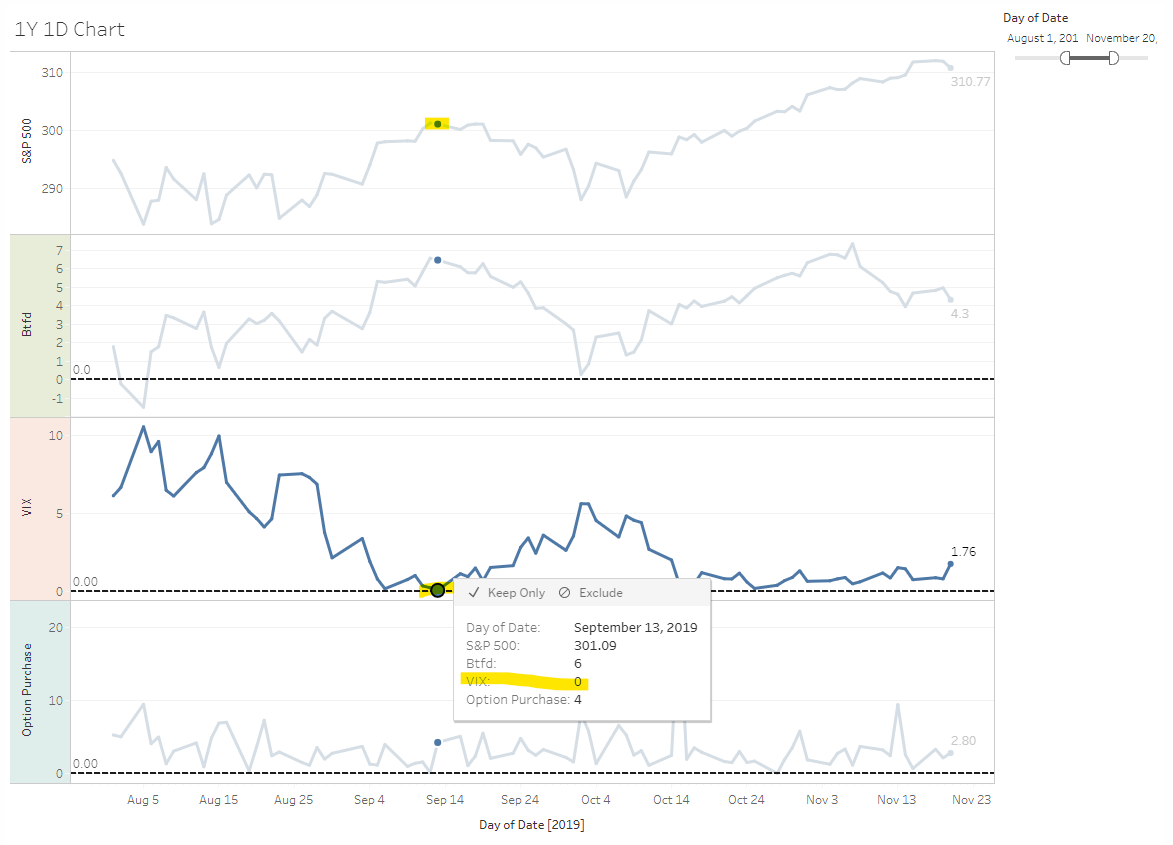

September 13th, 2019

Let's go to September of last year. Specifically on the 13th. We saw the VIX chart hit 0, and the S&P 500 closed at 301.09.

Those are just a few examples of what happens when the BTFD, VIX, or Option Purchase chart hit the 0 line. There are plenty of instances during the past year. You can use the filter on the sidebar to see it for yourself. I hope the tool is helpful for you.

If you didn't get a chance to try it out yet, do so here.

This tutorial will walk you through the basic features of the Market Sentiment tool.

Market Levels

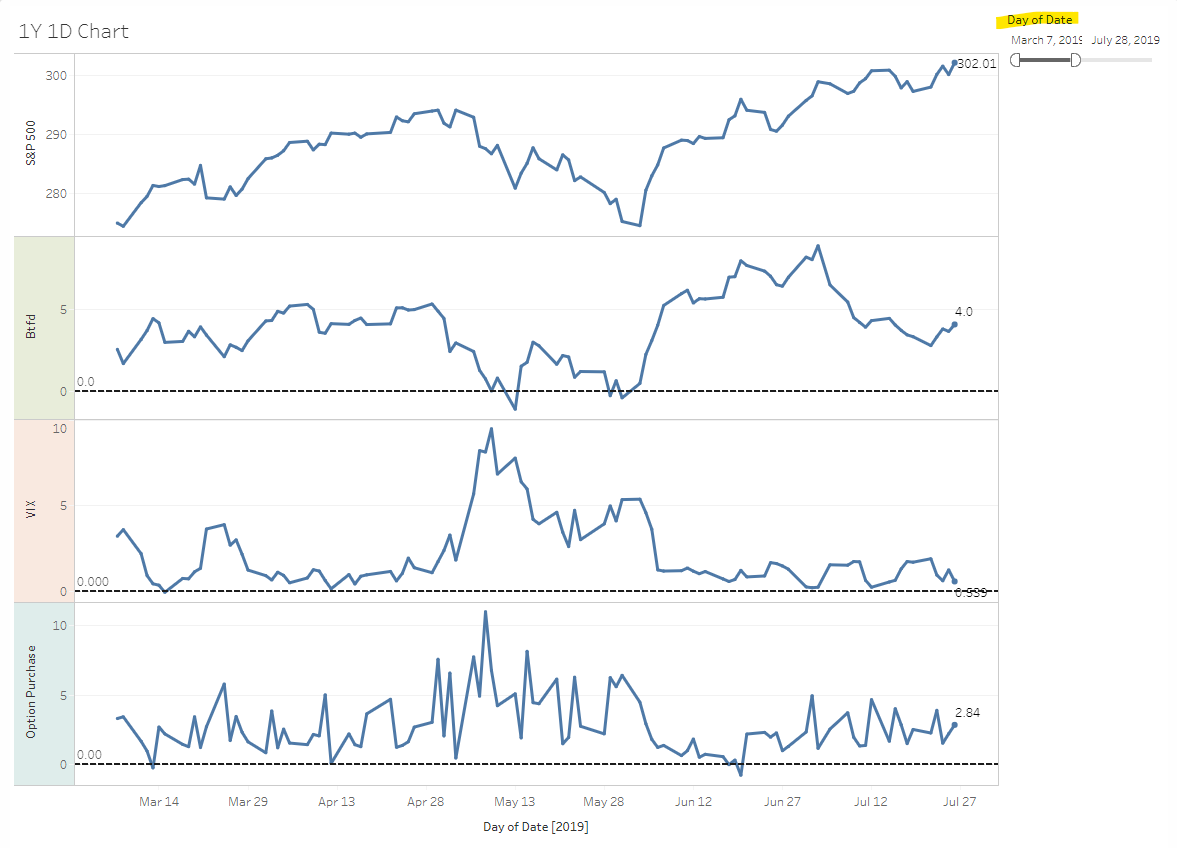

You should pay attention when one of the following happens:- BTFD is at or below 0. This indicates the market is at an extreme level. It's ready for a reversal back to the upside.

- VIX is at or below 0. Again, an extreme level you should pay attention to. The market is ready for a pullback.

- OP (the Put/Call ratio or Option Purchase as we called it) is at or below 0. Similar to the VIX, if this is at or below 0, get ready for a pullback.

Filters and Correlation

On the right side of the chart, there is a slider that you can use. We put it there so you can go back to a specific date in time and get a closer look at the values.If you hover your mouse on the line chart, it should display the date, S&P closing price, BTFD value, VIX value, and OP value correlate to that specific date. If you click on it, it will highlight the correlation.

A few more words

- This tool is still under development. But we hope you enjoy the initial version so far.

- There is a bug on the Option Purchase chart where the value gets below 0 and stays flat for multiple days. That's a bug. So please ignore it.

Observations & Analysis

The Market Sentiment currently provides data for up to one year. But let's see if the tool was able to record any extreme levels during this time. As always, past performance or result of any trading system is not necessarily indicative of future results.Feb 27th, 2020

Here is a 3M 1D chart. On February 27th, 2020, the BTFD chart hits 0. The S&P 500 closed at 297.51. What happen after? S&P 500 rebounded to as high as 312.86 within 4 trading sessions.

Feb 12th, 2020

On Feb 12th, 2020, the Option Purchase chart hit 0, and the S&P 500 closed at 337.42 on that day. Following the next few days, the market stalled at 337 price levels.

Then, on Feb 19th, 2020, the Option Purchase chart hit 0 again. That led to a massive pullback on the S&P 500.

September 13th, 2019

Let's go to September of last year. Specifically on the 13th. We saw the VIX chart hit 0, and the S&P 500 closed at 301.09.

Those are just a few examples of what happens when the BTFD, VIX, or Option Purchase chart hit the 0 line. There are plenty of instances during the past year. You can use the filter on the sidebar to see it for yourself. I hope the tool is helpful for you.

Last edited: