It's gonna get heated up with the Hot Zone indicator! Hope you like it. It is a combination of RSI with IV percentile. The red colored area where IV is greater than RSI is the Hot Zone. Inside the Hot Zone are some colored circles on the midline. A yellow circle is a caution warning. This means it could be a good buy, but be cautious because it is a weak signal. The red circle is the HOT warning. This means it's time to buy or sell put options.

NOTE: there may be a string of red circles, so the first one that appears may not be the best entry because more could follow. You'll want to see the RSI and IV come back together for extra confirmation. Another confirmation is the ZSCORE upper indicator on this forum. Below are a few examples.

This indicator works great with the BTD indicator. Enjoy heating up your account with the Hot Zone!

This is an example of CWH on a daily chart.

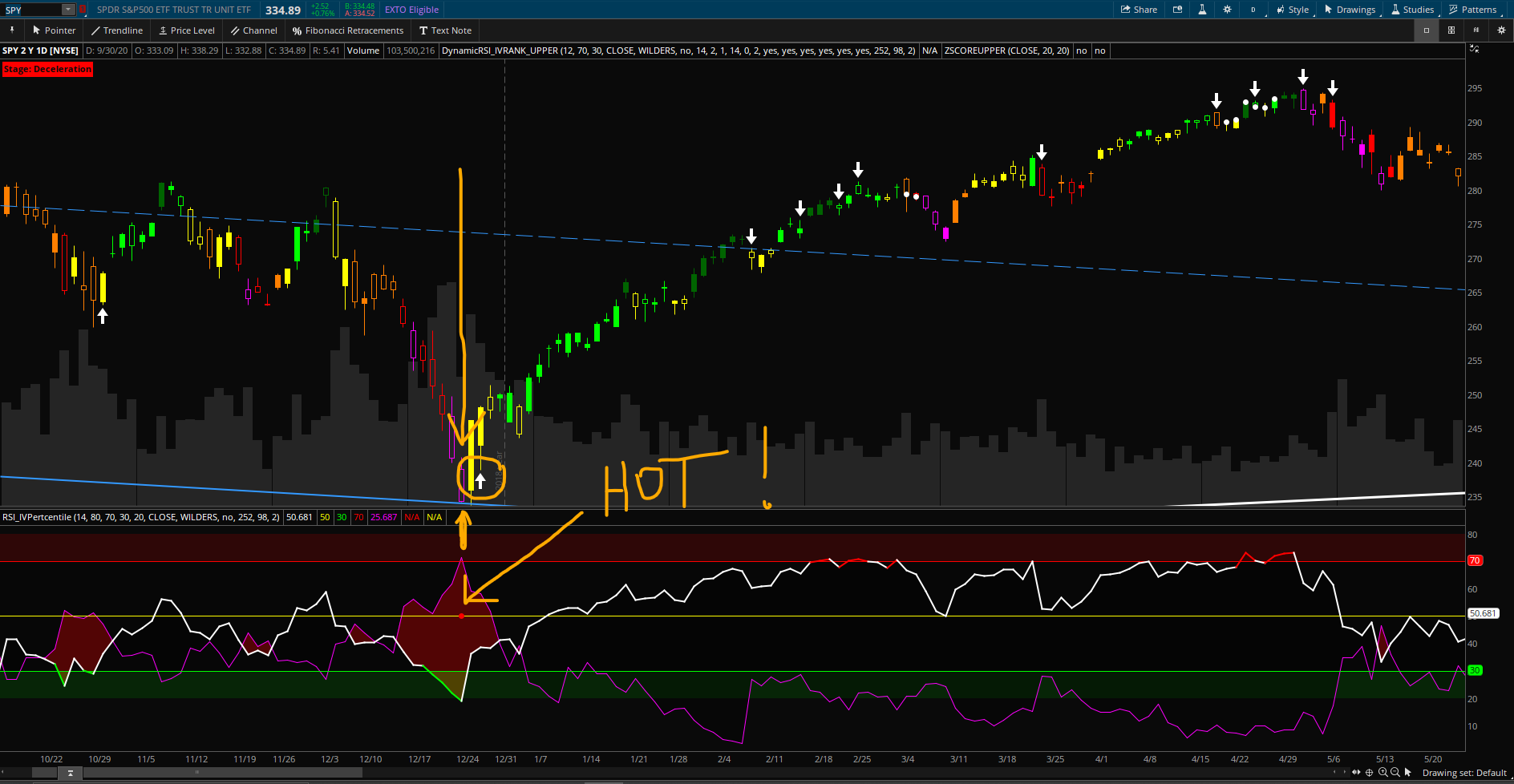

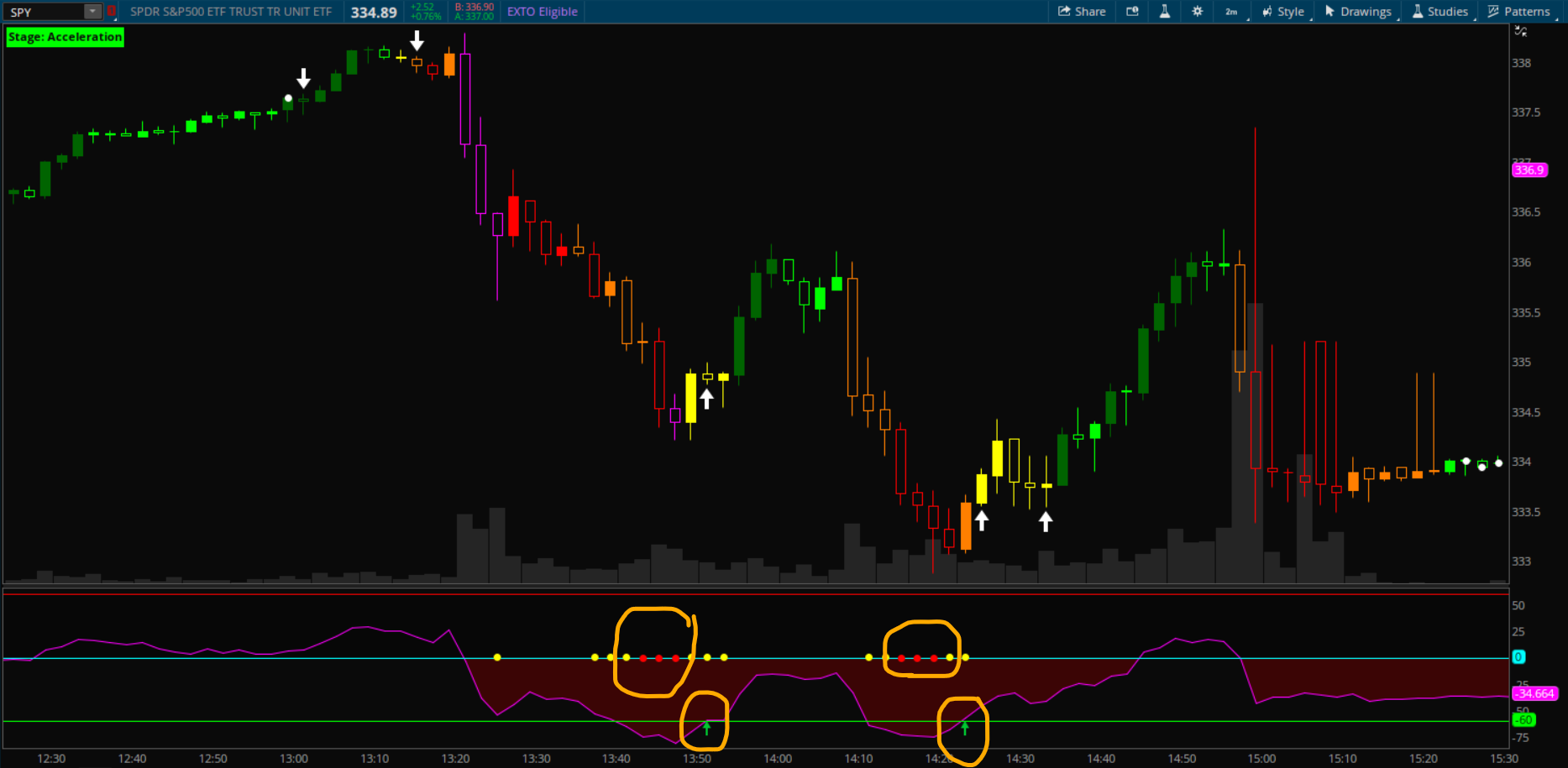

This is an example of SPY on 12/24/2019. It showed the EXACT low! Then it ripped higher for the next 4 months.

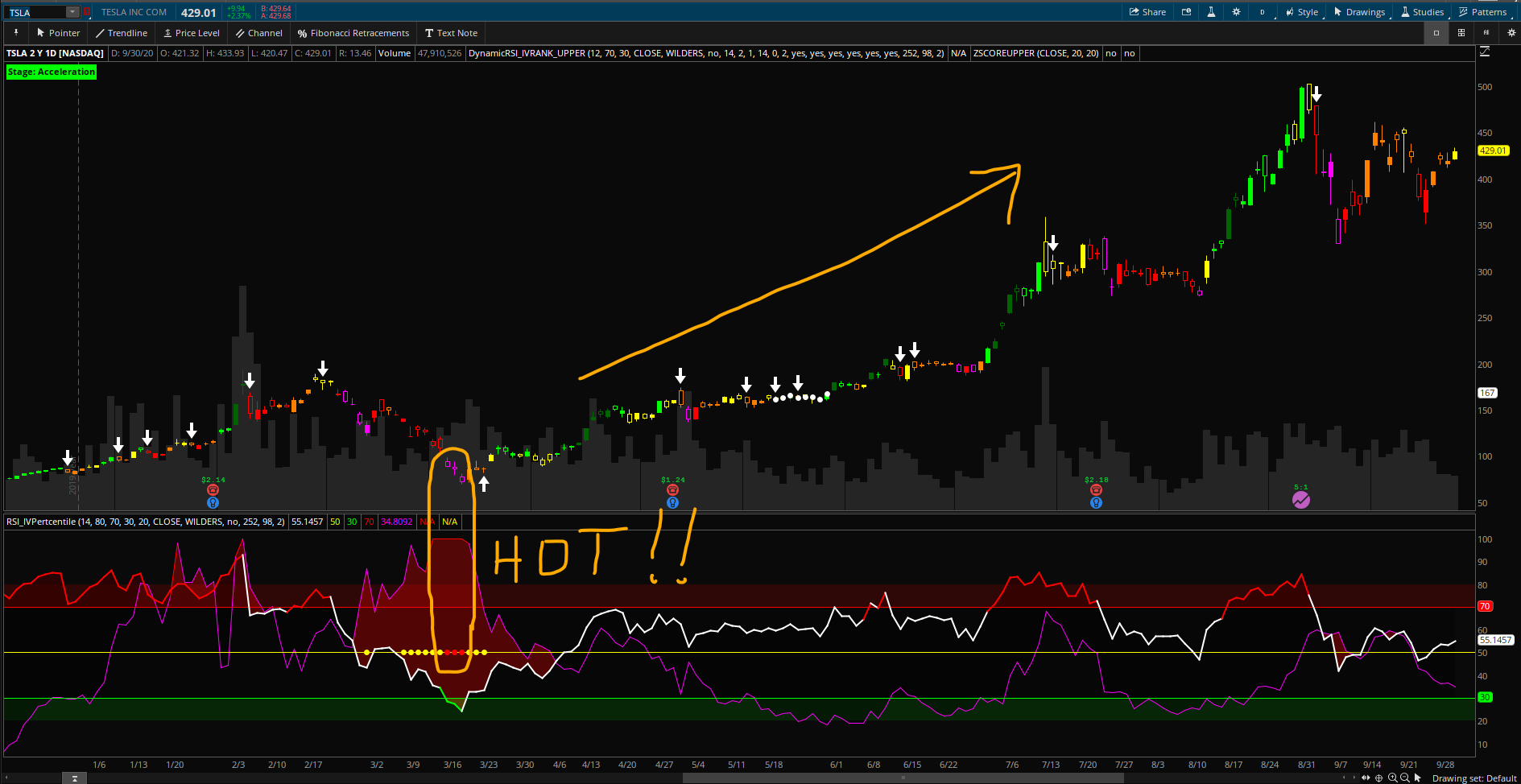

This is an example of TSLA. 3 days this year were HOT buys in the middle of March 2020.

There is another version of this indicator that @FateOwnzYou helped make. SHOUT OUT to you fellow scripter! You're awesome! This version is cleaner to the eye and basically subtracts the RSI from IV and makes one single line so the greater the distance between them the further down the Hot Zone goes. I added the yellow and red circles, but you may want to adjust these settings for your trading style. The only negative is you don't actually see the actual RSI indicator, and some people who already use RSI would probably prefer using the other version to keep the RSI. The clear advantage is it gives clear buy and sell areas. Under the green line is a buy area. Over the red line is a sell area shaded in green (collect your cash money!) . (Any area in red could be considered a buy area, but the closer to the green line, the better.)

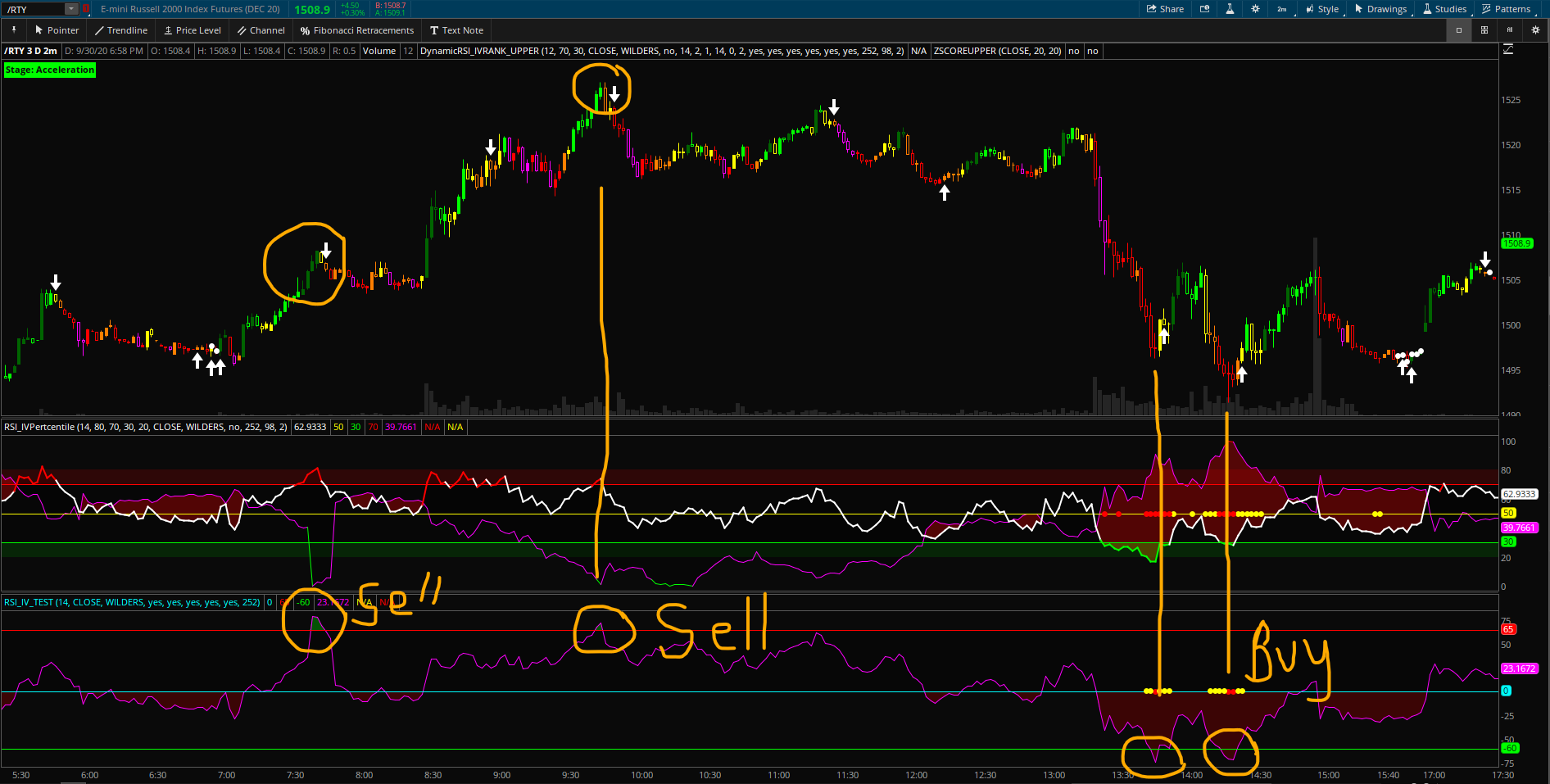

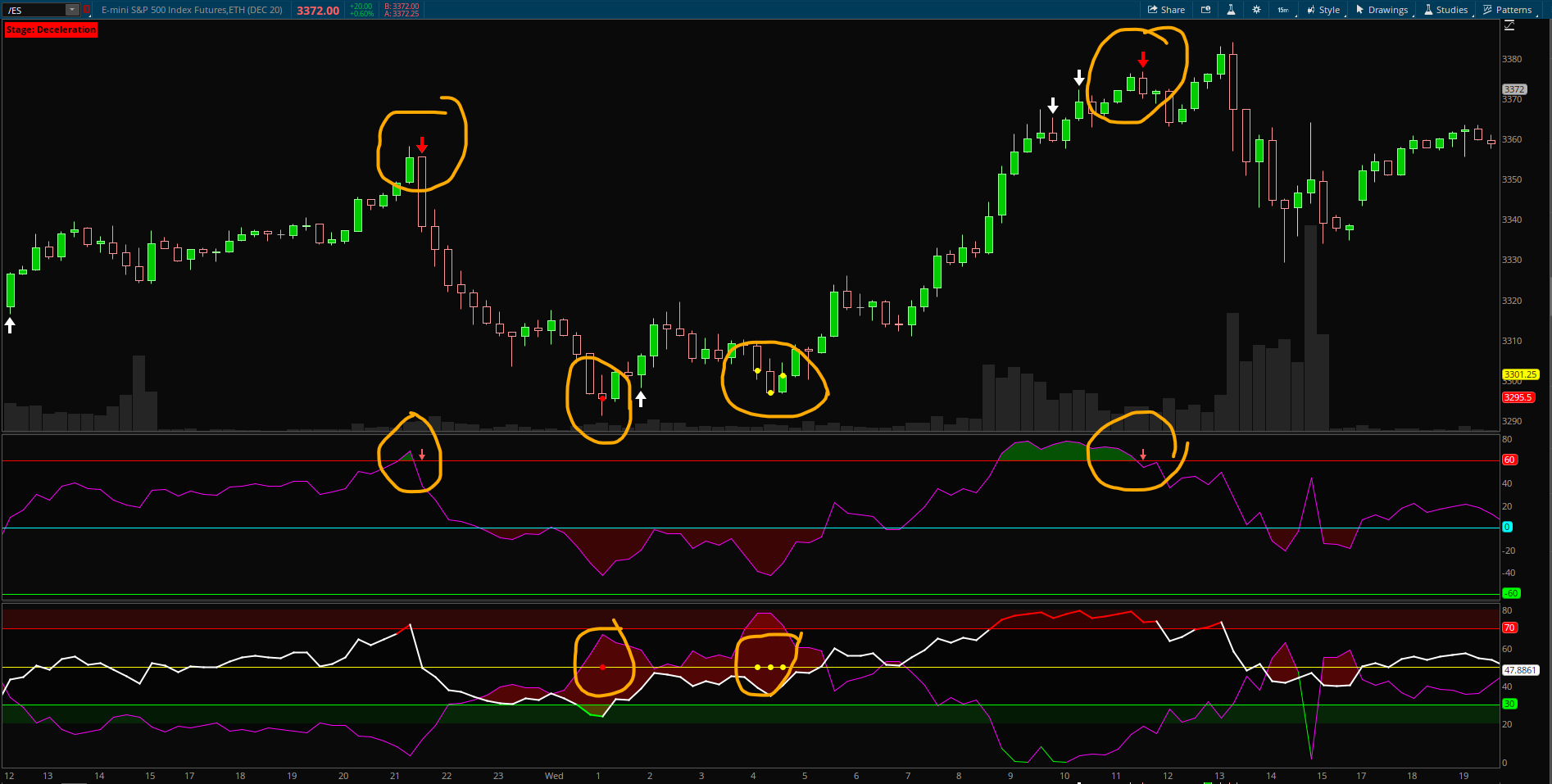

Lets look at a DAY TRADE in /RTY. Look at both of these Hot Zone indicators. Notice the one on the bottom. Circled areas for buys and sells.

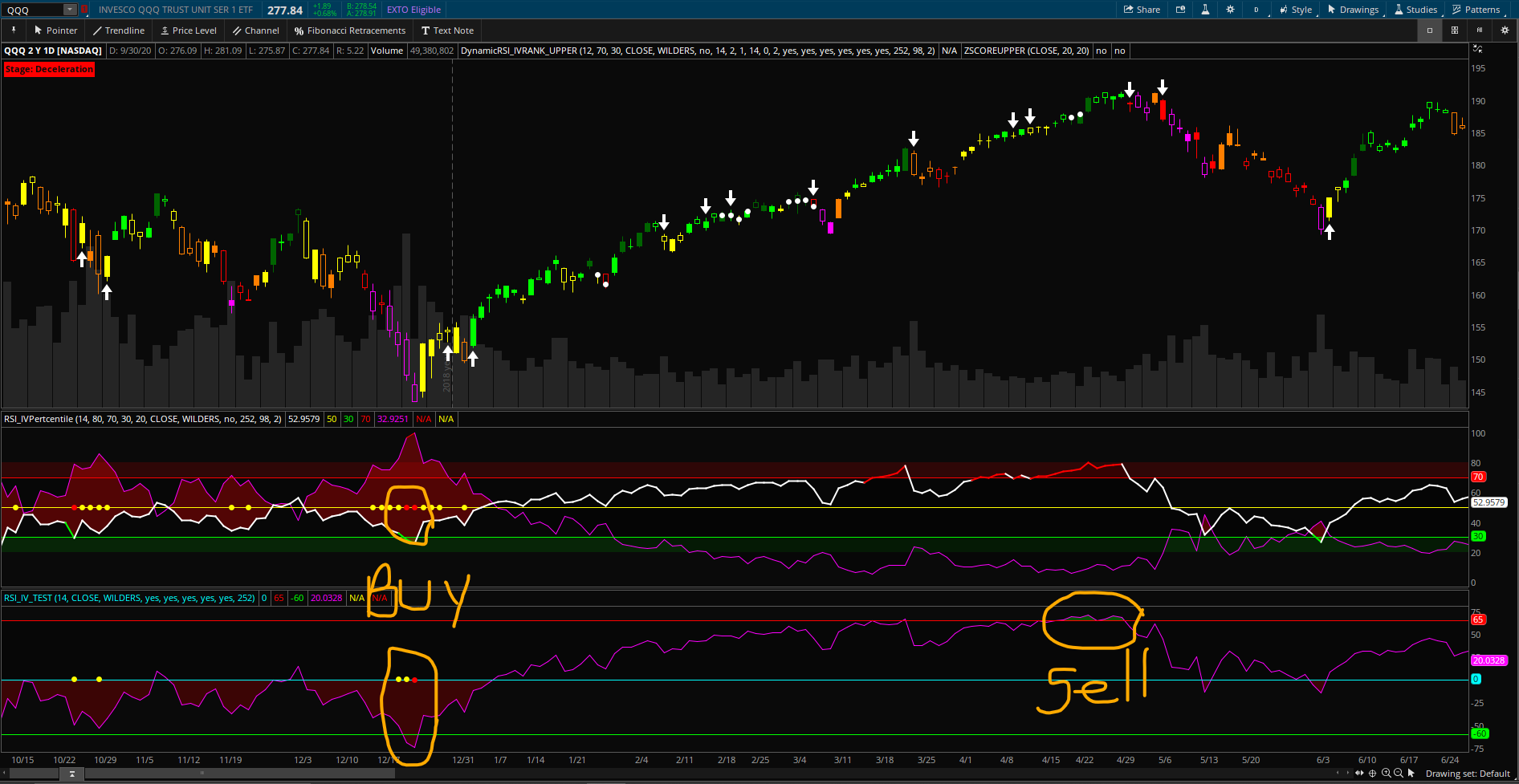

Here is an example of QQQ on a daily chart. Notice the HOT circles and buy area on lower indicator and the sell areas.

Added ARROWS to the indicator. See below.

Below is an example of day trading /RTY using a 2 min chart. Look at the sell signal arrow and the two red hot buy dots that are highlighted, both followed by green buy arrows.

Shareable link: http://tos.mx/9zhE6eE

Shareable link: http://tos.mx/ZaOhpnv

There are some traders who don't like to use lower indicators. Good news for YOU!!! I created an UPPER indicator that uses BOTH of these into one!!! You can turn on/off the arrows. You can turn on/off the hot and caution dots for the Hotzone and Hotzone line indicators. NOTE: IF you display dots for BOTH indicators, the Hotzone Line dots will plot over the Hotzone indicator dots. If you want to have the opposite, I believe you would just have to move their order within the code.

Below is an example of using the arrows from the HotZone Line indicator with the dots from the HotZone indicator on /ES 15 min chart.

Here is the link to the Hotzone UPPER indicator: http://tos.mx/6Co9B16

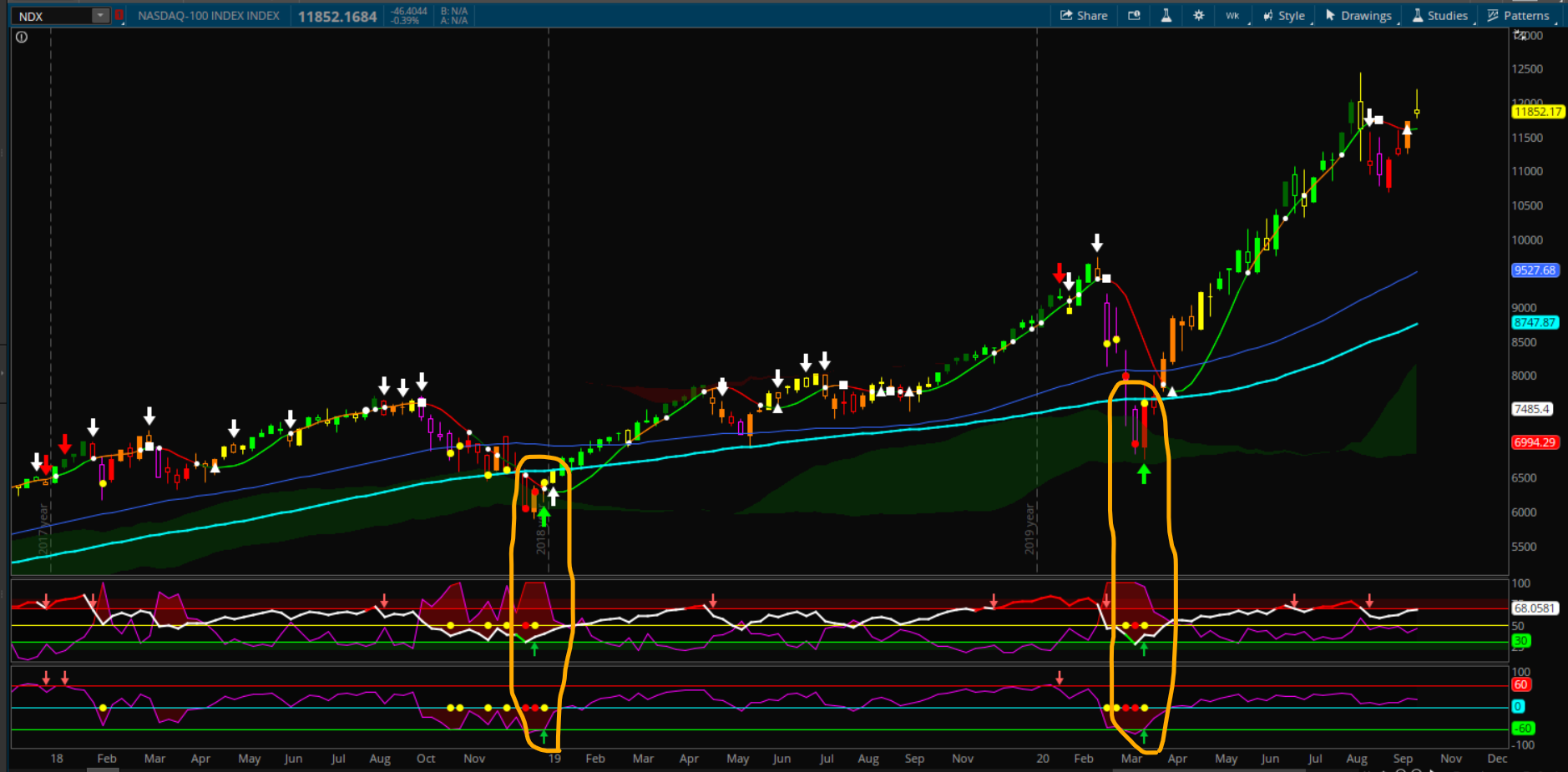

Do you want to make some serious long term cash?? Monitor the WEEKLY chart and set alerts in the scan for the weekly timeframe. Take a look at the below example of NDX. Hotzone will tell you when to get back into the market after a significant crash!

Looking for a watchlist column? Here you go!

HOTZONE RSI Watchlist: http://tos.mx/wjdMkBz

CODE:

#HOTZONE-RSI: WATCHLIST

#developed by Chewie76 9-30-2020

### Global Variables ###

input length = 14;

input over_Bought2 = 80;

input over_Bought = 70;

input over_Sold = 30;

input over_Sold2 = 20;

input price = close;

input averageType = AverageType.WILDERS;

input showBreakoutSignals = yes;

### RSI ###

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

DEF RSI = 50 * (ChgRatio + 1);

def MiddleLine = 50;

def OverSold = over_Sold;

def OverBought = over_Bought;

def UpSignal = if RSI crosses above OverSold then 1 else 0;

def DownSignal = if RSI crosses below OverBought then 2 else 0;

### IVPercentile ###

def vol = imp_volatility();

input TimePeriod = 252;

def data = if !isNaN(vol) then vol else vol[-1];

def hi = highest(data, TimePeriod);

def lo = lowest(data, TimePeriod);

def Percentile = (data - lo) / (hi - lo) * 100;

def lowend = Percentile < 25;

def highend = Percentile > 50;

input over_Bought1 = 98;

input over_Sold1 = 2;

### Squeeze Relationship (RSI and IV) ###

def RSIIV = if percentile - RSI >= 40 and RSI < 32 then 1 else 0;

def HOT = if RSIIV then 50 else Double.nan;

def RSIIV1 = if (percentile - RSI >= 30 and RSI > 32 and RSI < 40, 1, Double.NaN);

def CAUTION = if RSIIV1 then 50 else Double.nan;

AssignBackgroundColor(if DownSignal then color.RED else if Upsignal then color.GREEN else color.black);

AddLabel(yes, if Upsignal then "UP" else if Downsignal then "DOWN" else if RSIIV then “HOT” else if RSIIV1 then "CAUTION" else " ", if UPsignal then color.green else if Downsignal then color.red else if RSIIV then color.RED else if RSIIV1 then color.YELLOW else Color.black);

HOTZONE LINE Watchlist: http://tos.mx/lFkTO2b

CODE:

#HOTZONE LINE: WATCHLIST COLUMN

#developed by Chewie76 with help from FateOwnzYou 9-30-2020

### Global Variables ###

input length = 14;

input price = close;

input averageType = AverageType.WILDERS;

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = (50 * (ChgRatio + 1)) * -1;

def MiddleLine = 0;

def TakeProfit = 60;

def BUY = -60;

def vol = imp_volatility();

input TimePeriod = 252;

def data = if !IsNaN(vol) then vol else vol[-1];

def hi = Highest(data, TimePeriod);

def lo = Lowest(data, TimePeriod);

def Percentile = ((data - lo) / (hi - lo) * 100) * -1;

def lowend = Percentile < 25;

def highend = Percentile > 50;

plot HotZone = Percentile - RSI;

def H = HotZone < -60;

def C = HotZone < -45 and HotZone > -60;

def UpSignal = if HotZone crosses above BUY then 1 else 0;

def DownSignal = if HotZone crosses below TakeProfit then 2 else 0;

AddLabel(yes, if Upsignal then "UP" else if Downsignal then "DOWN" else if H then “HOT” else if C then "CAUTION" else " ", if Upsignal then color.green else if Downsignal then color.red else if H then color.RED else if C then color.YELLOW else Color.BLACK);

AssignBackgroundColor(if H then color.RED else if C then color.YELLOW else color.black);

Adjust the timeframe on it. It will look like the below. It will have a yellow CAUTION for the yellow dot and a red HOT for red dot. The reason there are two columns is because they are set to different timeframes.

Looking for a Scan? The below links alert for yellow and red dots along with arrows.

Here is a BUY scan. http://tos.mx/Qh32soR

Here is a SELL scan. http://tos.mx/87AySW1

Let me know what you think!!!!!

NOTE: there may be a string of red circles, so the first one that appears may not be the best entry because more could follow. You'll want to see the RSI and IV come back together for extra confirmation. Another confirmation is the ZSCORE upper indicator on this forum. Below are a few examples.

This indicator works great with the BTD indicator. Enjoy heating up your account with the Hot Zone!

This is an example of CWH on a daily chart.

This is an example of SPY on 12/24/2019. It showed the EXACT low! Then it ripped higher for the next 4 months.

This is an example of TSLA. 3 days this year were HOT buys in the middle of March 2020.

There is another version of this indicator that @FateOwnzYou helped make. SHOUT OUT to you fellow scripter! You're awesome! This version is cleaner to the eye and basically subtracts the RSI from IV and makes one single line so the greater the distance between them the further down the Hot Zone goes. I added the yellow and red circles, but you may want to adjust these settings for your trading style. The only negative is you don't actually see the actual RSI indicator, and some people who already use RSI would probably prefer using the other version to keep the RSI. The clear advantage is it gives clear buy and sell areas. Under the green line is a buy area. Over the red line is a sell area shaded in green (collect your cash money!) . (Any area in red could be considered a buy area, but the closer to the green line, the better.)

Lets look at a DAY TRADE in /RTY. Look at both of these Hot Zone indicators. Notice the one on the bottom. Circled areas for buys and sells.

Here is an example of QQQ on a daily chart. Notice the HOT circles and buy area on lower indicator and the sell areas.

Added ARROWS to the indicator. See below.

Below is an example of day trading /RTY using a 2 min chart. Look at the sell signal arrow and the two red hot buy dots that are highlighted, both followed by green buy arrows.

Hot Zone-RSI

Code:

#HOTZONE-RSI: RSI-IV_percentile indicator

#developed by Chewie76 9-30-2020

### Global Variables ###

declare lower;

input length = 14;

input over_Bought2 = 80;

input over_Bought = 70;

input over_Sold = 30;

input over_Sold2 = 20;

input price = close;

input averageType = AverageType.WILDERS;

input showBreakoutSignals = yes;

input alertsOn = yes;

input ChartBubblesOn = yes;

### RSI ###

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

plot RSI = 50 * (ChgRatio + 1);

plot MiddleLine = 50;

Middleline.SetDefaultColor(Color.YELLOW);

RSI.SetLineWeight(2);

plot OverSold = over_Sold;

plot OverBought = over_Bought;

plot UpSignal = if RSI crosses above OverSold then OverSold else Double.NaN;

plot DownSignal = if RSI crosses below OverBought then OverBought else Double.NaN;

AddCloud(Over_Bought2, OverBought, Color.dark_RED, Color.CURRENT);

AddCloud(OverSold, Over_Sold2, Color.dark_GREEN, Color.CURRENT);

UpSignal.SetHiding(!showBreakoutSignals);

DownSignal.SetHiding(!showBreakoutSignals);

RSI.DefineColor("OverBought", color.red);

RSI.DefineColor("Normal", GetColor(9));

RSI.DefineColor("OverSold", color.green);

RSI.AssignValueColor(if RSI > over_Bought then RSI.Color("OverBought") else if RSI < over_Sold then RSI.Color("OverSold") else RSI.Color("Normal"));

OverSold.SetDefaultColor(color.green);

OverBought.SetDefaultColor(color.red);

UpSignal.SetDefaultColor(Color.UPTICK);

UpSignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

DownSignal.SetDefaultColor(Color.DOWNTICK);

DownSignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

AddCloud(RSI, OverBought, Color.RED, Color.CURRENT);

AddCloud(OverSold, RSI, Color.GREEN, Color.CURRENT);

### IVPercentile ###

def vol = imp_volatility();

input TimePeriod = 252;

def data = if !isNaN(vol) then vol else vol[-1];

def hi = highest(data, TimePeriod);

def lo = lowest(data, TimePeriod);

plot Percentile = (data - lo) / (hi - lo) * 100;

def lowend = Percentile < 25;

def highend = Percentile > 50;

input over_Bought1 = 98;

input over_Sold1 = 2;

Percentile.DefineColor("OverBought", Color.red);

Percentile.DefineColor("Normal", color.magenta);

Percentile.DefineColor("OverSold", Color.GREEN);

Percentile.AssignValueColor(if Percentile > over_Bought1 then Percentile.color("OverBought") else if Percentile < over_Sold1 then Percentile.color("OverSold") else Percentile.color("Normal"));

AddCloud(percentile, rsi, Color.RED, Color.CURRENT);

### Squeeze Relationship (RSI and IV) ###

def RSIIV = if percentile - RSI >= 40 and RSI < 32 then 1 else 0;

plot HOT = if RSIIV then 50 else Double.nan;

HOT.SetPaintingStrategy(PaintingStrategy.POINTS);

HOT.SetLineWeight(4);

HOT.SetDefaultColor(Color.RED);

def RSIIV1 = if (percentile - RSI >= 30 and RSI > 32 and RSI < 40, 1, Double.NaN);

plot CAUTION = if RSIIV1 then 50 else Double.nan;

CAUTION.SetPaintingStrategy(PaintingStrategy.POINTS);

CAUTION.SetLineWeight(4);

CAUTION.SetDefaultColor(Color.YELLOW);

#Label

def bullish = if RSI > MiddleLine then 1 else 0;

def bearish = if RSI < MiddleLine then 1 else 0;

AddLabel(ChartBubblesOn, if bullish then "BULLISH" else if bearish then "BEARISH" else if RSI > 100 then "hi" else "low", if bullish then color.green else if bearish then color.red else color.black);

def condition1 = percentile - RSI >= 40 and RSI < 32;

def condition2 = percentile - RSI >= 30 and RSI > 32 and RSI < 40;

# Alert

Alert(alertsOn and condition1, "HOT", Alert.BAR, Sound.Chimes);

Alert(alertsOn and condition2, "CAUTION", Alert.BAR, Sound.bell);Shareable link: http://tos.mx/9zhE6eE

Hot Zone line

Code:

#HOTZONE LINE: RSI-IV_percentile indicator

#developed by Chewie76 with help from FateOwnzYou 9-30-2020

### Global Variables ###

declare lower;

input length = 14;

input price = close;

input averageType = AverageType.WILDERS;

input showBreakoutSignals = yes;

input alertsOn = yes;

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = (50 * (ChgRatio + 1))*-1;

plot MiddleLine = 0;

plot TakeProfit = 60;

plot BUY = -60;

TakeProfit.SetLineWeight(1);

TakeProfit.SetDefaultColor(Color.RED);

BUY.SetLineWeight(1);

BUY.SetDefaultColor(Color.GREEN);

def vol = imp_volatility();

input TimePeriod = 252;

def data = if !isNaN(vol) then vol else vol[-1];

def hi = highest(data, TimePeriod);

def lo = lowest(data, TimePeriod);

def Percentile = ((data - lo) / (hi - lo) * 100)*-1;

def lowend = Percentile < 25;

def highend = Percentile > 50;

plot HotZone = percentile - rsi;

HotZone.SetLineWeight(1);

HotZone.SetDefaultColor(Color.MAGENTA);

AddCloud(middleline, HotZone, Color.red, Color.CURRENT);

AddCloud(takeprofit,HotZone, Color.CURRENT, Color.GREEN);

### Caution Relationship (RSI and IV) ###

plot CAUTION = if(HotZone <-45 and HotZone > -60,1,double.nan);

#plot CAUTION = if RSIIV1 then 0 else Double.nan;

CAUTION.SetPaintingStrategy(PaintingStrategy.POINTS);

CAUTION.SetLineWeight(4);

CAUTION.SetDefaultColor(Color.YELLOW);

### HOT Relationship (RSI and IV) ###

def RSIIV2 = if HotZone <= -60 then 1 else 0;

plot HOT = if RSIIV2 then 0 else Double.nan;

HOT.SetPaintingStrategy(PaintingStrategy.POINTS);

HOT.SetLineWeight(4);

HOT.SetDefaultColor(Color.RED);

#Arrows#

plot UpSignal = if HotZone crosses above BUY then BUY else Double.NaN;

plot DownSignal = if HotZone crosses below TakeProfit then TakeProfit else Double.NaN;

UpSignal.SetHiding(!showBreakoutSignals);

DownSignal.SetHiding(!showBreakoutSignals);

UpSignal.SetDefaultColor(Color.GREEN);

DownSignal.SetDefaultColor(Color.RED);

UpSignal.SetDefaultColor(Color.UPTICK);

UpSignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

DownSignal.SetDefaultColor(Color.DOWNTICK);

DownSignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

def condition1 = HotZone <= -60;

def condition2 = HotZone < -45 and HotZone > -60;

# Alert

Alert(alertsOn and condition1, "HOT", Alert.BAR, Sound.Chimes);

Alert(alertsOn and condition2, "CAUTION", Alert.BAR, Sound.bell);Shareable link: http://tos.mx/ZaOhpnv

There are some traders who don't like to use lower indicators. Good news for YOU!!! I created an UPPER indicator that uses BOTH of these into one!!! You can turn on/off the arrows. You can turn on/off the hot and caution dots for the Hotzone and Hotzone line indicators. NOTE: IF you display dots for BOTH indicators, the Hotzone Line dots will plot over the Hotzone indicator dots. If you want to have the opposite, I believe you would just have to move their order within the code.

Below is an example of using the arrows from the HotZone Line indicator with the dots from the HotZone indicator on /ES 15 min chart.

Here is the link to the Hotzone UPPER indicator: http://tos.mx/6Co9B16

Do you want to make some serious long term cash?? Monitor the WEEKLY chart and set alerts in the scan for the weekly timeframe. Take a look at the below example of NDX. Hotzone will tell you when to get back into the market after a significant crash!

Looking for a watchlist column? Here you go!

HOTZONE RSI Watchlist: http://tos.mx/wjdMkBz

CODE:

#HOTZONE-RSI: WATCHLIST

#developed by Chewie76 9-30-2020

### Global Variables ###

input length = 14;

input over_Bought2 = 80;

input over_Bought = 70;

input over_Sold = 30;

input over_Sold2 = 20;

input price = close;

input averageType = AverageType.WILDERS;

input showBreakoutSignals = yes;

### RSI ###

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

DEF RSI = 50 * (ChgRatio + 1);

def MiddleLine = 50;

def OverSold = over_Sold;

def OverBought = over_Bought;

def UpSignal = if RSI crosses above OverSold then 1 else 0;

def DownSignal = if RSI crosses below OverBought then 2 else 0;

### IVPercentile ###

def vol = imp_volatility();

input TimePeriod = 252;

def data = if !isNaN(vol) then vol else vol[-1];

def hi = highest(data, TimePeriod);

def lo = lowest(data, TimePeriod);

def Percentile = (data - lo) / (hi - lo) * 100;

def lowend = Percentile < 25;

def highend = Percentile > 50;

input over_Bought1 = 98;

input over_Sold1 = 2;

### Squeeze Relationship (RSI and IV) ###

def RSIIV = if percentile - RSI >= 40 and RSI < 32 then 1 else 0;

def HOT = if RSIIV then 50 else Double.nan;

def RSIIV1 = if (percentile - RSI >= 30 and RSI > 32 and RSI < 40, 1, Double.NaN);

def CAUTION = if RSIIV1 then 50 else Double.nan;

AssignBackgroundColor(if DownSignal then color.RED else if Upsignal then color.GREEN else color.black);

AddLabel(yes, if Upsignal then "UP" else if Downsignal then "DOWN" else if RSIIV then “HOT” else if RSIIV1 then "CAUTION" else " ", if UPsignal then color.green else if Downsignal then color.red else if RSIIV then color.RED else if RSIIV1 then color.YELLOW else Color.black);

HOTZONE LINE Watchlist: http://tos.mx/lFkTO2b

CODE:

#HOTZONE LINE: WATCHLIST COLUMN

#developed by Chewie76 with help from FateOwnzYou 9-30-2020

### Global Variables ###

input length = 14;

input price = close;

input averageType = AverageType.WILDERS;

def NetChgAvg = MovingAverage(averageType, price - price[1], length);

def TotChgAvg = MovingAverage(averageType, AbsValue(price - price[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = (50 * (ChgRatio + 1)) * -1;

def MiddleLine = 0;

def TakeProfit = 60;

def BUY = -60;

def vol = imp_volatility();

input TimePeriod = 252;

def data = if !IsNaN(vol) then vol else vol[-1];

def hi = Highest(data, TimePeriod);

def lo = Lowest(data, TimePeriod);

def Percentile = ((data - lo) / (hi - lo) * 100) * -1;

def lowend = Percentile < 25;

def highend = Percentile > 50;

plot HotZone = Percentile - RSI;

def H = HotZone < -60;

def C = HotZone < -45 and HotZone > -60;

def UpSignal = if HotZone crosses above BUY then 1 else 0;

def DownSignal = if HotZone crosses below TakeProfit then 2 else 0;

AddLabel(yes, if Upsignal then "UP" else if Downsignal then "DOWN" else if H then “HOT” else if C then "CAUTION" else " ", if Upsignal then color.green else if Downsignal then color.red else if H then color.RED else if C then color.YELLOW else Color.BLACK);

AssignBackgroundColor(if H then color.RED else if C then color.YELLOW else color.black);

Adjust the timeframe on it. It will look like the below. It will have a yellow CAUTION for the yellow dot and a red HOT for red dot. The reason there are two columns is because they are set to different timeframes.

Looking for a Scan? The below links alert for yellow and red dots along with arrows.

Here is a BUY scan. http://tos.mx/Qh32soR

Here is a SELL scan. http://tos.mx/87AySW1

Let me know what you think!!!!!

Last edited: