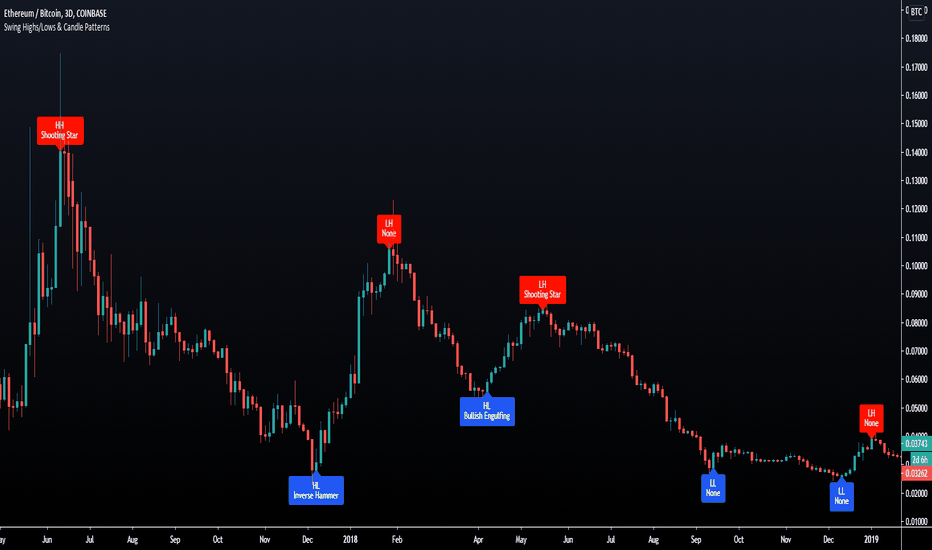

This looks like a very interesting indicator

https://www.tradingview.com/script/yxEJ4Dxw-Swing-Highs-Lows-Candle-Patterns-LUX/

that would work well with support resistance. Could someone please convert it to Thinkscript.

Thank you Cheeter

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0)

https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=4

study("Swing Highs/Lows & Candle Patterns",overlay=true)

length = input(21)

//------------------------------------------------------------------------------

o = open[length],h = high[length]

l = low[length],c = close[length]

//------------------------------------------------------------------------------

ph = pivothigh(close,length,length)

pl = pivotlow(open,length,length)

valH = valuewhen(ph,c,0)

valL = valuewhen(pl,c,0)

valpH = valuewhen(ph,c,1)

valpL = valuewhen(pl,c,1)

//------------------------------------------------------------------------------

d = abs(c - o)

hammer = pl and min(o,c) - l > d and h - max(c,o) < d

ihammer = pl and h - max(c,o) > d and min(c,o) - l < d

bulleng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

hanging = ph and min(c,o) - l > d and h - max(o,c) < d

shooting = ph and h - max(o,c) > d and min(c,o) - l < d

beareng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

//------------------------------------------------------------------------------

//Descriptions

//------------------------------------------------------------------------------

hammer_ = "The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend."

+ "\n" + "\n A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up."

ihammer_ = "The inverted hammer is a similar pattern than the hammer pattern. The only difference being that the upper wick is long, while the lower wick is short."

+ "\n" + "\n It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The inverse hammer suggests that buyers will soon have control of the market."

bulleng_ = "The bullish engulfing pattern is formed of two candlesticks. The first candle is a short red body that is completely engulfed by a larger green candle"

+ "\n" + "\n Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers"

hanging_ = "The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend."

+ "\n" + "It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. The large sell-off is often seen as an indication that the bulls are losing control of the market."

shotting_ = "The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick."

+ "\n" + "Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground."

beareng_ = "A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle."

+ "\n" + "It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The lower the second candle goes, the more significant the trend is likely to be."

//------------------------------------------------------------------------------

n = bar_index

label lbl = na

H = valH > valpH ? "HH" : valH < valpH ? "LH" : na

L = valL < valpL ? "LL" : valL > valpL ? "HL" : na

txt = hammer ? "Hammer" : ihammer ? "Inverse Hammer" :

bulleng ? "Bullish Engulfing" : hanging ? "Hanging Man" :

shooting ? "Shooting Star" : beareng ? "Bearish Engulfing" : "None"

des = hammer ? hammer_ : ihammer ? ihammer_ :

bulleng ? bulleng_ : hanging ? hanging_ :

shooting ? shotting_ : beareng ? beareng_ : ""

if ph

lbl := label.new(n[length],max(c,o),H + "\n" + txt,color=#ff1100,

style=label.style_label_down,textcolor=color.white,tooltip=des)

label.delete(lbl[1])

else if pl

lbl := label.new(n[length],min(c,o),L + "\n" + txt,color=#2157f3,

style=label.style_label_up,textcolor=color.white,tooltip=des)

label.delete(lbl[1])

//------------------------------------------------------------------------------