Hi All

@halcyonguy you really helped me tremendously here with this code.

https://usethinkscript.com/threads/...cant-be-used-in-thinkorswim.13822/post-134848

I've made some tweaks to it to get close to the output I was expecting. I've made no impactful structural changes to the code, but I've noticed that the code doesn't work with extended hours turned off. Presumably it should pickup the first X bars from RTH sessions, I don't see where in the logic it requires extended hours turned on?

Really could use your help, or anyone, on how to get the code to work the same with either extended hours turned on or off.

Best,

H

Here is the latest code..

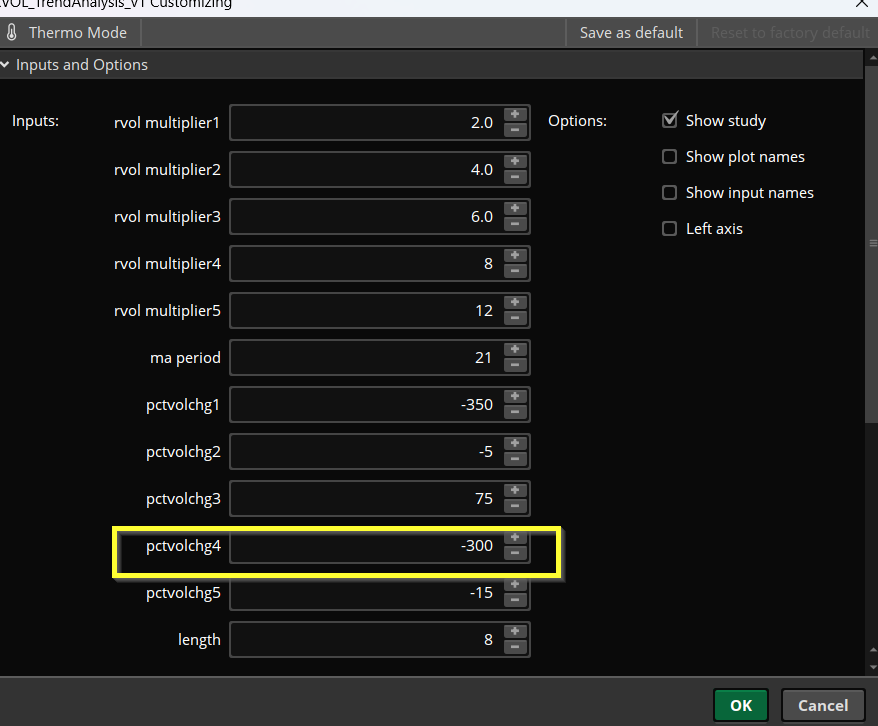

These are the inputs I'm using to provide results that are ok. I hit a wall with the spikepoints but I'm close enough at the moment. Really want to figure out how to get this to work with extended hours turned off.

@halcyonguy you really helped me tremendously here with this code.

https://usethinkscript.com/threads/...cant-be-used-in-thinkorswim.13822/post-134848

I've made some tweaks to it to get close to the output I was expecting. I've made no impactful structural changes to the code, but I've noticed that the code doesn't work with extended hours turned off. Presumably it should pickup the first X bars from RTH sessions, I don't see where in the logic it requires extended hours turned on?

Really could use your help, or anyone, on how to get the code to work the same with either extended hours turned on or off.

Best,

H

Here is the latest code..

Code:

# --------------------------------------------------------------

# Relative Volume Code with Price Exhaustion Logic

# hboogie

# Credit to Halcyonguy for logic correction and overhaul

# https://usethinkscript.com/threads/dynamic-zero-line-and-rvol-contraction.17238/

# edits by hboogie on 1-24-2024

# --------------------------------------------------------------

def na = double.nan;

def bn = barnumber();

def gd = getday();

def lastday = getlastday();

def currentday = gd == lastday;

def lastbar = (!isnan(close) and isnan(close[-1]));

# Define Rvol Thresholds

declare lower;

input rvolMultiplier1 = .2;

input rvolMultiplier2 = .5;

input rvolMultiplier3 = .8;

input rvolMultiplier4 = 1;

input rvolMultiplier5 = 3;

input maPeriod = 21;

input pctvolchg1 = 20; # Percentage volume change

input pctvolchg2 = 10; # Percentage volume change

input pctvolchg3 = 2; # Percentage volume change

input pctvolchg4 = 5; # Percentage volume change

input pctvolchg5 = 2; # Percentage volume change

def period_bars = 10;

# find barnumber at day open, each day

#def startBar = secondsFromTime(0930) / secondsFromTime(1); # 9:30 AM EST

def startBar = if secondsFromTime(0930) == 0 then bn else startbar[1];

def barcnt = if bn == 1 then 1 else if secondsFromTime(0930) == 0 then 1 else barcnt[1] + 1;

def endBar = startBar + period_bars - 1; # First 10 bars

#def sessionVolume = TotalSum(if BarNumber() >= startBar and BarNumber() <= endBar then volume else 0);

def bars_en = (BarNumber() >= startBar and BarNumber() <= endBar);

# Calculate the total sum of volume from the first 10 bars, of each day ( except current bar

#def sessionVolume = TotalSum(if bars_en and !lastbar then volume else 0);

def sessionVolume = if bars_en and !lastbar then sessionVolume[1] + volume else sessionVolume[1];

#if bn == 1 then 0 else

# get qty of bars, exclude last bar

def bar_qty = if bars_en and !lastbar then bar_qty[1] + 1 else bar_qty[1];

# rvol average

def rvol_avg = sessionVolume / bar_qty;

# session v needs to be divided by qty to get avg

#sessionVolume should be divided by a quantity of bars, to get an average, to be used in this,

#and sessionVolume should not include the volume from current bar

#addchartbubble(1, 0, startBar , color.yellow

# Calculate the relative volume change

#def rvolChange = ((volume - sessionVolume) / sessionVolume) * 100;

#def rvolChange = ((sessionVolume - volume) / sessionVolume) * 100;

def rvolChange = ((rvol_avg - volume) / rvol_avg) * 100;

#def rvolChange = ((rvol_avg - volume) / sessionVolume) * 100;

#def n_bars = 500;

# Calculate the oscillator value

#def oscillatorValue = Min(Max(rvolChange, -n_bars), n_bars);

def oscillatorValue = close - ExpAverage(close, maPeriod);

# Choose the Moving Average type (Exponential)

def maValue = ExpAverage(oscillatorValue, maPeriod);

# Determine spike thresholds based on a % increase

def spikeThreshold1 = rvolChange < pctvolchg1;

def spikeThreshold2 = rvolChange > pctvolchg2;

def spikeThreshold3 = rvolChange > pctvolchg3;

def spikeThreshold4 = rvolChange < pctvolchg4;

def spikeThreshold5 = rvolChange > pctvolchg5;

# add a factor to make threshold numbers smaller, close to the vol change

#def f = 1/10000;

# Define Rvol Thresholds

def rvolThreshold1 = rvolMultiplier1 * rvol_avg;

def rvolThreshold2 = rvolMultiplier2 * rvol_avg;

def rvolThreshold3 = rvolMultiplier3 * rvol_avg;

def rvolThreshold4 = rvolMultiplier4 * rvol_avg;

def rvolThreshold5 = rvolMultiplier5 * rvol_avg;

#def rvolThreshold1 = rvolMultiplier1 * rvol_avg * f;

#def rvolThreshold2 = rvolMultiplier2 * rvol_avg * f;

#def rvolThreshold3 = rvolMultiplier3 * rvol_avg * f;

#def rvolThreshold4 = rvolMultiplier4 * rvol_avg * f;

#def rvolThreshold5 = rvolMultiplier5 * rvol_avg * f;

# Define logic for volume contraction

def volumeContraction = rvolChange < (0.4 * AbsValue(rvolChange[1]));

# Plot the zero line

plot ZeroLine = 0;

ZeroLine.SetPaintingStrategy(PaintingStrategy.LINE);

ZeroLine.SetDefaultColor(Color.GRAY);

# Plot colored points for the spike thresholds

plot SpikePoints1 = if spikeThreshold1 then 0 else double.nan;

SpikePoints1.SetPaintingStrategy(PaintingStrategy.POINTS);

SpikePoints1.AssignValueColor(Color.GREEN);

SpikePoints1.setlineweight(3);

#SpikePoints1.hidebubble();

# Plot points

plot SpikePoints2 = if spikeThreshold2 and volumeContraction then 0 else double.nan;

SpikePoints2.SetPaintingStrategy(PaintingStrategy.POINTS);

SpikePoints2.AssignValueColor(Color.MAGENTA);

SpikePoints2.setlineweight(3);

SpikePoints2.hidebubble();

# Plot colored points for the spike thresholds

plot SpikePoints3 = if spikeThreshold3 and volumeContraction then 0 else double.nan;

SpikePoints3.SetPaintingStrategy(PaintingStrategy.POINTS);

SpikePoints3.AssignValueColor(Color.RED);

SpikePoints3.setlineweight(3);

SpikePoints3.hidebubble();

# Plot colored points for the spike thresholds

plot SpikePoints4 = if spikeThreshold4 then 0 else double.nan;

SpikePoints4.SetPaintingStrategy(PaintingStrategy.POINTS);

SpikePoints4.AssignValueColor(Color.YELLOW);

SpikePoints4.setlineweight(3);

SpikePoints4.hidebubble();

# Plot colored points for the spike thresholds

plot SpikePoints5 = if spikeThreshold5 and volumeContraction then 0 else double.nan;

SpikePoints5.SetPaintingStrategy(PaintingStrategy.POINTS);

SpikePoints5.AssignValueColor(Color.CYAN);

SpikePoints5.setlineweight(3);

SpikePoints5.hidebubble();

def absrvol = absvalue(rvolChange);

# Plot the oscillator in the lower pane (Exponential MA)

plot rel_vol_osc = maValue;

rel_vol_osc.AssignValueColor(

if absrvol >= rvolThreshold5 then Color.RED

else if absrvol >= rvolThreshold4 then Color.LIGHT_ORANGE

else if absrvol >= rvolThreshold3 then Color.CYAN

else if absrvol >= rvolThreshold2 then Color.VIOLET

else if absrvol >= rvolThreshold1 then Color.GREEN

else Color.WHITE

);

rel_vol_osc.SetLineWeight(1);

rel_vol_osc.HideTitle();

###################

## Elder Impulse Logic

###################

input length = 13;

def EMA = MovAvgExponential(length=length)."AvgExp";

def impulseSignal = if (EMA < EMA[1])

then 0

else if (EMA > EMA[1])

then 1

else -1;

assignpriceColor(if impulseSignal == 1 then Color.White else if impulseSignal == 0 then Color.MAGENTA else Color.Yellow);These are the inputs I'm using to provide results that are ok. I hit a wall with the spikepoints but I'm close enough at the moment. Really want to figure out how to get this to work with extended hours turned off.

Last edited by a moderator: