#H/L_2$_Candles_indicator_v1

input use_count_plot_limit = yes;

input count = 2;

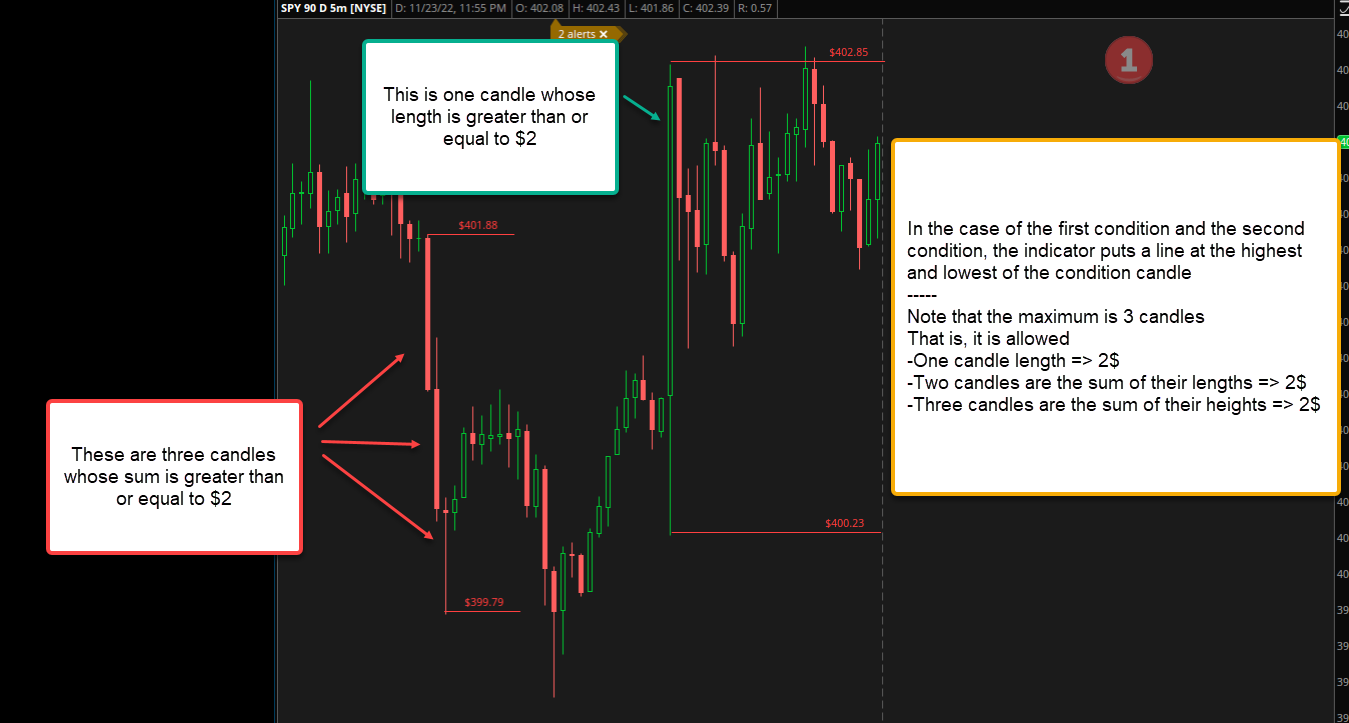

input diff = 2.0;

input show_bubbles = yes;

input bubblemover_updown = 3;

def day = if GetDay() != GetDay()[1] then 1 else day[1] + 1;

def up = if GetDay() != GetDay()[1]

then if close > open then 1

else 0

else if GetDay() == GetDay()[1]

then if close > open

then 1

else 0

else up[1];

def bull;

def bear;

# Bull Groups ##################################

bull = if day[1] != 78 and day >= 1 and #No bars from prior day allowed

#1 bar only: red, green, red

up[1] == 0 and up == 1 and up[-1] == 0 and

(high - low) > diff and

#Next bar must be within highest/lowest

high[-1] < highest(high, 1) and low[-1] > lowest(low, 1)

then 1

else if day[1] != 78 and day >= 1 and #No bars from prior day allowed

#2 bars only: red, green, green, red

up[2] == 0 and up[1] == 1 and up == 1 and up[-1] == 0 and

(Highest(high, 2) - Lowest(low, 2)) > diff and

#Next bar must be within highest/lowest

high[-1] < Highest(high, 2) and low[-1] > Lowest(low, 2)

then 1

else if day[3] != 78 and day >= 3 and

#3 bars: green, green, green

up[2] == 1 and up[1] == 1 and up == 1 and

(Highest(high, 3) - Lowest(low, 3)) > diff and

#Next bar must be within highest/lowest

high[-1] < Highest(high, 3) and low[-1] > Lowest(low, 3)

then 1

else 0;

def bull_hl = if day[1] != 78 and day >= 1 and #No bars from prior day allowed

#1 bar only: red, green, red

up[1] == 0 and up == 1 and up[-1] == 0 and

(high - low) > diff and

#Next bar must be within highest/lowest

high[-1] < highest(high, 1) and low[-1] > lowest(low, 1)

then 1

else if day[1] != 78 and day >= 1 and

#2 bars only: red, green, green, red

up[2] == 0 and up[1] == 1 and up == 1 and up[-1] == 0 and

(Highest(high, 2) - Lowest(low, 2)) > diff and

#Next bar must be within highest/lowest

high[-1] < Highest(high, 2) and low[-1] > Lowest(low, 2)

then 2

else if day[3] != 78 and day >= 3 and

#3 bars: green, green, green

up[2] == 1 and up[1] == 1 and up == 1 and

(Highest(high, 3) - Lowest(low, 3)) > diff and

#Next bar must be within highest/lowest

high[-1] < Highest(high, 3) and low[-1] > Lowest(low, 3)

then 3

else 0;

def hbull_ = if bull

then if bull_hl == 1 then Highest(high, 1) else

if bull_hl == 2 then Highest(high, 2)

else Highest(high, 3)

else hbull_[1];

def lbull_ = if bull

then if bull_hl == 1 then Lowest(low, 1) else

if bull_hl == 2 then Lowest(low, 2)

else Lowest(low, 3)

else lbull_[1];

def hbull = if bull

then if bull_hl == 1 then Highest(high, 1) else

if bull_hl == 2 then Highest(high, 2)

else Highest(high, 3)

else if high < hbull_[1] and low > lbull_[1]

then hbull[1] else Double.NaN;

def lbull = if bull

then if bull_hl == 1 then Lowest(low, 1) else

if bull_hl == 2 then Lowest(low, 2)

else Lowest(low, 3)

else if high < hbull_[1] and low > lbull_[1]

then lbull[1] else Double.NaN;

def hbullbar = if bull

then 1 else 0;

def lbullbar = if bull

then 1 else 0;

def dataCounthbull = CompoundValue(1, if hbullbar[1] == 0 and hbullbar then dataCounthbull[1] + 1 else dataCounthbull[1], 0);

def dataCountlbull = CompoundValue(1, if lbullbar[1] == 0 and lbullbar then dataCountlbull[1] + 1 else dataCountlbull[1], 0);

plot hhbull = if use_count_plot_limit and HighestAll(dataCounthbull) - dataCounthbull <= count - 1 or !use_count_plot_limit then hbull else Double.NaN;

hhbull.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

hhbull.SetDefaultColor(Color.CYAN);

plot llbull = if use_count_plot_limit and HighestAll(dataCountlbull) - dataCountlbull <= count - 1 or !use_count_plot_limit then lbull else Double.NaN;

llbull.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

llbull.SetDefaultColor(Color.CYAN);

AddChartBubble(show_bubbles and hbullbar[1] == 0 and hbullbar, hhbull + TickSize() * bubblemover_updown, hhbull, Color.GREEN);

AddChartBubble(show_bubbles and lbullbar[1] == 0 and lbullbar, llbull - TickSize() * bubblemover_updown, llbull, Color.GREEN, no);

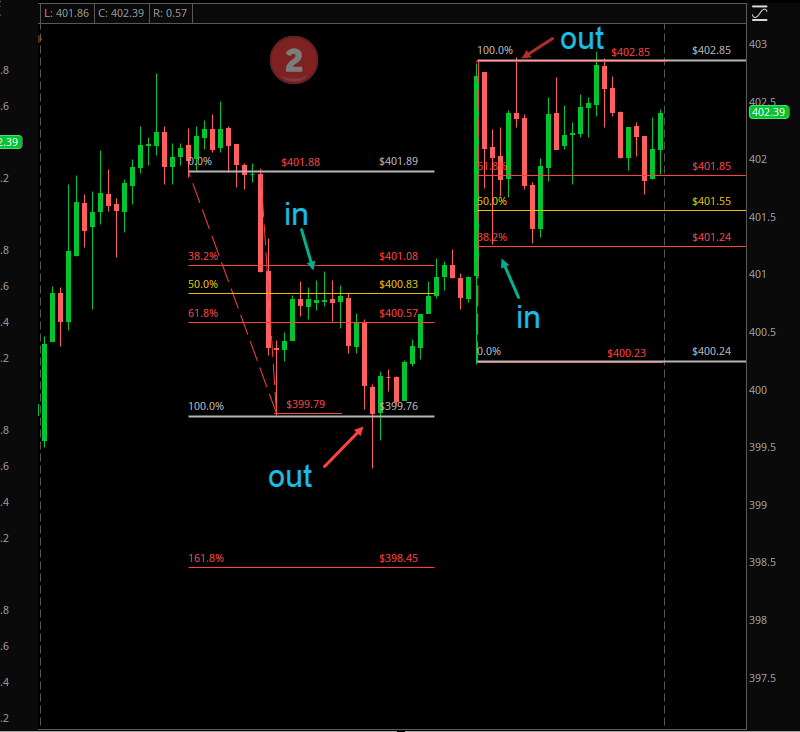

plot fib1bull = llbull + (hhbull - llbull) * .618;

plot fib2bull = llbull + (hhbull - llbull) * .500;

plot fib3bull = llbull + (hhbull - llbull) * .382;

fib1bull.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

fib2bull.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

fib3bull.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

fib1bull.SetDefaultColor(Color.WHITE);

fib2bull.SetDefaultColor(Color.YELLOW);

fib3bull.SetDefaultColor(Color.RED);

# Bear Groups ##################################

bear = if day[1] != 78 and day >= 1 and #No bars from prior day allowed

#1 bar only: green, red, green

up[1] == 1 and up == 0 and up[-1] == 1 and

(high - low) > diff and

#Next bar must be within highest/lowest

high[-1] < highest(high, 1) and low[-1] > lowest(low, 1)

then 1

else if day[1] != 78 and day >= 1 and

#2 bars: green, red, red, green

up[2] == 1 and up[1] == 0 and up == 0 and up[-1] == 1 and

(Highest(high, 2) - Lowest(low, 2)) > diff and

high[-1] < Highest(high, 2) and low[-1] > Lowest(low, 2)

then 1

else if day[3] != 78 and day >= 3 and

#3 bars: red, red, red

up[2] == 0 and up[1] == 0 and up == 0 and

(Highest(high, 3) - Lowest(low, 3)) > diff and

high[-1] < Highest(high, 3) and low[-1] > Lowest(low, 3)

then 1

else 0;

def bear_hl = if day[1] != 78 and day >= 1 and #No bars from prior day allowed

#1 bar only: green, red, green

up[1] == 1 and up == 0 and up[-1] == 1 and

(high - low) > diff and

#Next bar must be within highest/lowest

high[-1] < Highest(high, 2) and low[-1] > Lowest(low, 2)

then 1

else if day[1] != 78 and day >= 1 and

#2 bars: green, red, red, green

up[2] == 1 and up[1] == 0 and up == 0 and up[-1] == 1 and

(Highest(high, 2) - Lowest(low, 2)) > diff and

high[-1] < Highest(high, 2) and low[-1] > Lowest(low, 2)

then 2

else if day[3] != 78 and day >= 3 and

#3 bars: red, red, red

up[2] == 0 and up[1] == 0 and up == 0 and

(Highest(high, 3) - Lowest(low, 3)) > diff and

high[-1] < Highest(high, 3) and low[-1] > Lowest(low, 3)

then 3

else 0;

def hbear_ = if bear

then if bear_hl == 1 then Highest(high, 1) else

if bear_hl == 2 then Highest(high, 2)

else Highest(high, 3)

else hbear_[1];

def lbear_ = if bear

then if bear_hl == 1 then Lowest(low, 1) else

if bear_hl == 2 then Lowest(low, 2)

else Lowest(low, 3)

else lbear_[1];

def hbear = if bear

then if bear_hl == 1 then Highest(high, 1) else

if bear_hl == 2 then Highest(high, 2)

else Highest(high, 3)

else if high < hbear_[1] and low > lbear_[1]

then hbear[1] else Double.NaN;

def lbear = if bear

then if bear_hl == 1 then Lowest(low, 1) else

if bear_hl == 2 then Lowest(low, 2)

else Lowest(low, 3)

else if high < hbear_[1] and low > lbear_[1]

then lbear[1] else Double.NaN;

def hbearbar = if bear

then 1 else 0;

def lbearbar = if bear

then 1 else 0;

def dataCounthbear = CompoundValue(1, if hbearbar[1] == 0 and hbearbar then dataCounthbear[1] + 1 else dataCounthbear[1], 0);

def dataCountlbear = CompoundValue(1, if lbearbar[1] == 0 and lbearbar then dataCountlbear[1] + 1 else dataCountlbear[1], 0);

plot hhbear = if use_count_plot_limit and HighestAll(dataCounthbear) - dataCounthbear <= count - 1 or !use_count_plot_limit then hbear else Double.NaN;

hhbear.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

hhbear.SetDefaultColor(Color.CYAN);

plot llbear = if use_count_plot_limit and HighestAll(dataCountlbear) - dataCountlbear <= count - 1 or !use_count_plot_limit then lbear else Double.NaN;

llbear.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

llbear.SetDefaultColor(Color.CYAN);

AddChartBubble(show_bubbles and hbearbar[1] == 0 and hbearbar, hhbear + TickSize() * bubblemover_updown, hhbear, Color.RED);

AddChartBubble(show_bubbles and lbearbar[1] == 0 and lbearbar, llbear - TickSize() * bubblemover_updown, llbear, Color.RED, no);

plot fib1bear = llbear + (hhbear - llbear) * .382;

plot fib2bear = llbear + (hhbear - llbear) * .500;

plot fib3bear = llbear + (hhbear - llbear) * .618;

fib1bear.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

fib2bear.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

fib3bear.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

fib1bear.SetDefaultColor(Color.WHITE);

fib2bear.SetDefaultColor(Color.YELLOW);

fib3bear.SetDefaultColor(Color.RED);