So this candle pattern was recently introduced to me via a weblog called A Teen Trader.

@Korinek_Trades, the trader behind ateentrader.com describe it perfectly.

I followed that concept and some of the illustrations on his blog and made a similar indicator for ThinkorSwim.

Before you start trading with the FTR indicator, be sure to read through this blog post so you understand clearly and know where to put your stop loss and profit target.

@Korinek_Trades, the trader behind ateentrader.com describe it perfectly.

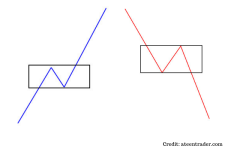

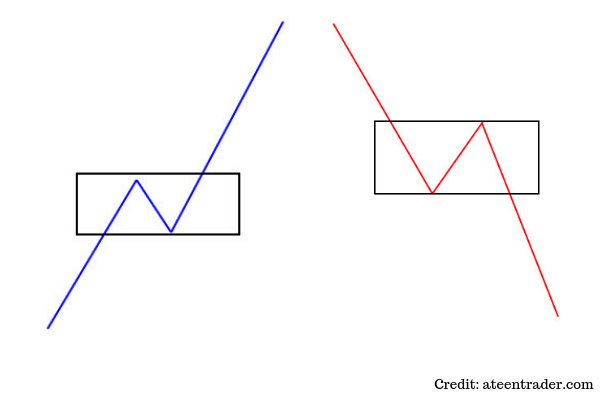

An FTR or Failed To Return, is a candle pattern in trading. What this pattern shows is that as price is in an up/down trend, price will push back and collect orders (causing a candle close of the opposite direction) before continuing the current trend.

I followed that concept and some of the illustrations on his blog and made a similar indicator for ThinkorSwim.

Before you start trading with the FTR indicator, be sure to read through this blog post so you understand clearly and know where to put your stop loss and profit target.

thinkScript Code

Code:

# Failed to Return Candles

# Inspired by Forex Trading Pattern as Described at https://ateentrader.com/ftr/

# Candles built from the ThinkorSwim's Candlestick Pattern Editor

# Assembled by BenTen at useThinkScript.com

# You are free to use this code for personal use, and make derivative works from it.

# You are NOT GRANTED permission to use this code (or derivative works) for commercial

# purposes which includes and is not limited to selling, reselling, or packaging with

# other commercial indicators. Headers and attribution in this code should remain as provided,

# and any derivative works should extend the existing headers.

# Define Bullish FTR Candle

def IsUp = close > open;

def IsDown = close < open;

plot Bullish_FTR =

IsUp[4] and

IsUp[3] and

IsUp[2] and

IsDown[1] and

IsUp[0] and

high[2] > high[1] and

close[3] < close[2] and

open[1] < close[0] and

low[2] < low[1] and

open[4] < open[3] and

close[4] < high[3] and

open[3] < open[2];

Bullish_FTR.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

Bullish_FTR.SetDefaultColor(GetColor(0));

# Define Bearish FTR Candle

plot Bearish_FTR =

IsDown[4] and

IsDown[3] and

IsDown[2] and

IsUp[1] and

IsDown[0] and

close[4] > close[3] and

open[1] > close[0] and

close[1] > open[0] and

open[2] > close[1] and

open[4] > open[3] and

open[3] > open[2] and

close[3] > close[2] and

close[2] < open[1];

Bearish_FTR.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

Bearish_FTR.SetDefaultColor(GetColor(0));

# Alerts

Alert(Bullish_FTR, " ", Alert.Bar, Sound.Chimes);

Alert(Bearish_FTR, " ", Alert.Bar, Sound.Bell);Shareable Link

https://tos.mx/Gl5L5aAttachments

Last edited: