Hi there, I came up with the idea for a Fibonacci Weighted Moving Average, but I need help figuring out the math since I'll have to make it from scratch. Basically, it would work like a weighted moving average but with Fibonacci numbers instead of how the original weighted moving average works. For example, a 6 period weighted moving average would multiply the furthest period by 1, the second furthest by 2, the third furthest by 3 etc. until you get to the most recent period which is multiplied by 6. Then you'd divide the sum of those numbers by the sum of the weights which is 21 (1 + 2 + 3 + 4 + 5 + 6 = 21). I need a formula that would do the same thing but with Fibonacci numbers using only an input of the number of periods you'd like to use. So the furthest period would be multiplied by 1, the second furthest by 2, the third furthest by 3, the fourth furthest by 5, the fifth furthest by 8, etc. based on the number of periods you input. Any help from someone good with math who can come up with a thinkscript formula would be very helpful. Thanks in advance!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

i made a study that calculates the nth term, in the Fibonacci sequence.

i think this could be put in a fold loop and do what you are looking for.

it might be a day or 2 till i get back to it, so posting what i made, in case someone else wants to work on it.

https://usethinkscript.com/threads/find-the-nth-term-in-the-fibonacci-sequence.9276/

i think this could be put in a fold loop and do what you are looking for.

it might be a day or 2 till i get back to it, so posting what i made, in case someone else wants to work on it.

https://usethinkscript.com/threads/find-the-nth-term-in-the-fibonacci-sequence.9276/

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

i made a study that calculates the nth term, in the Fibonacci sequence.

i think this could be put in a fold loop and do what you are looking for.

it might be a day or 2 till i get back to it, so posting what i made, in case someone else wants to work on it.

https://usethinkscript.com/threads/find-the-nth-term-in-the-fibonacci-sequence.9276/

Thanks for posting! I think this would work with what I'm looking for but I'm not sure how to implement it. I'll leave you to it if/when you have time. And I'll be sure to give credit where credit is due if I repost the result.

its already made here somewhere.

If you could point me in a direction that would be of great help because I can't find it in the search.

germanburrito

Active member

https://usethinkscript.com/threads/fibonacci-moving-average.8099/#post-79894 IT WAS THERE. DID YOU EVEN TRY? LMAOIf you could point me in a direction that would be of great help because I can't find it in the search.

https://usethinkscript.com/threads/fibonacci-moving-average.8099/#post-79894 IT WAS THERE. DID YOU EVEN TRY? LMAO

Yeah I did and this isn't what I'm looking for. Lol. I'm pretty sure this combines Fibonacci length EMAs which I already have a similar indicator that does the same thing. Also that code I'm pretty sure is for TradingView not ToS. I'm looking for something where it weights based on Fibonacci numbers not a combination of Fibonacci length averages.

germanburrito

Active member

i think i saw something that might help https://tlc.thinkorswim.com/center/reference/thinkScript/Functions/Others/CompoundValueYeah I did and this isn't what I'm looking for. Lol. I'm pretty sure this combines Fibonacci length EMAs which I already have a similar indicator that does the same thing. Also that code I'm pretty sure is for TradingView not ToS. I'm looking for something where it weights based on Fibonacci numbers not a combination of Fibonacci length averages.

i think i saw something that might help https://tlc.thinkorswim.com/center/reference/thinkScript/Functions/Others/CompoundValue

Thank you, I think this may be just what I was looking for. I have to mess with it first, but I think it will simplify things immensely.

i think i saw something that might help https://tlc.thinkorswim.com/center/reference/thinkScript/Functions/Others/CompoundValue

So unfortunately I couldn't figure out a way to utilize that code the way I need. It returns values for every bar on the chart. But, I made an 18 period Fibonacci Weighted Average with this code:

Code:

def close1 = close[17];

def close2 = close[16] * 2;

def close3 = close[15] * 3;

def close4 = close[14] * 5;

def close5 = close[13] * 8;

def close6 = close[12] * 13;

def close7 = close[11] * 21;

def close8 = close[10] * 34;

def close9 = close[9] * 55;

def close10 = close[8] * 89;

def close11 = close[7] * 144;

def close12 = close[6] * 233;

def close13 = close[5] * 377;

def close14 = close[4] * 610;

def close15 = close[3] * 987;

def close16 = close[2] * 1597;

def close17 = close[1] * 2584;

def close18 = close * 4181;

def avg = (close1 + close2 + close3 + close4 + close5 + close6 + close7 + close8 + close9 + close10 + close11 + close12 + close13 + close14 + close15 + close16 + close17 + close18) / 10944;

plot FibonacciWeightedAvg = avg;This is essentially what I want it to do, but with this code the length isn't adjustable from the indicator settings. If I want to adjust the length I have to manually edit the code and add lines of code until I get the length I want. If there's a way, I'd like to develop a version that allows adjustable length so I can compare different lengths.

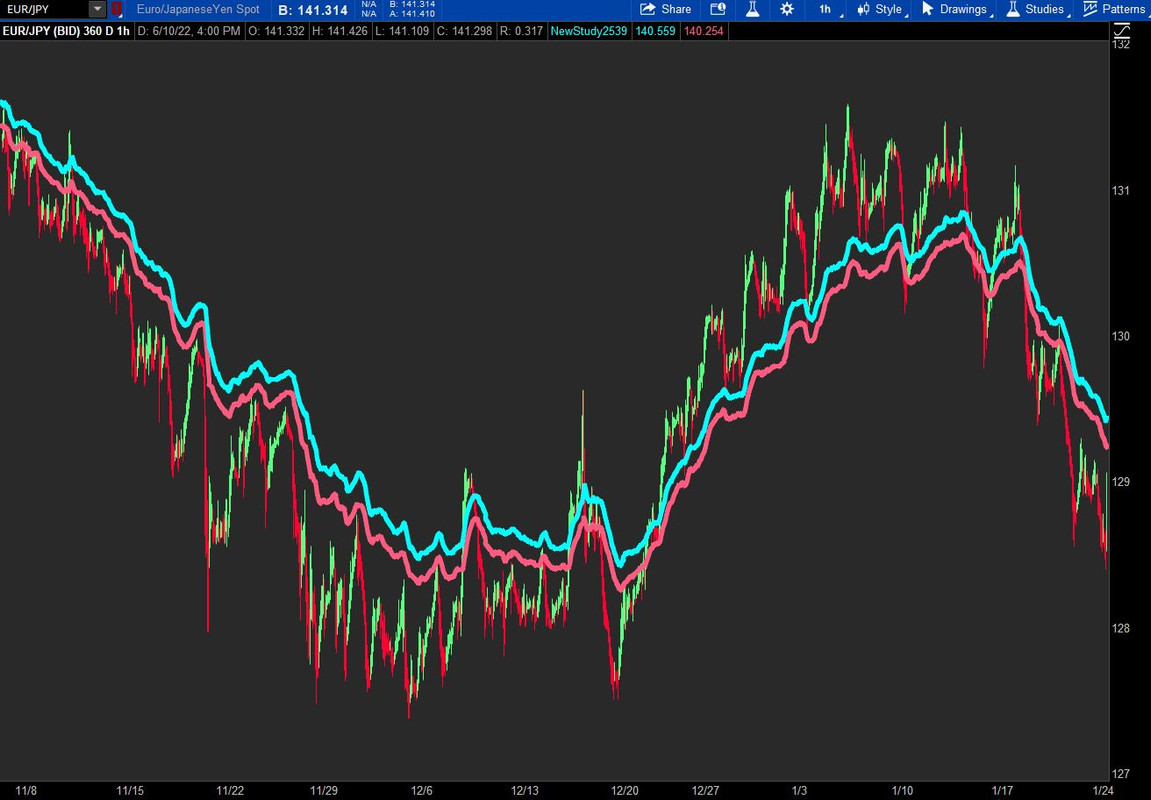

This is what the result looks like so far without any other indicators on:

Bidtheoffer

New member

this is from trading view i tried modifying but im lacking codes

//@version=4

study("Fibonacci Moving Average", overlay = true)hfib_ma_1 = ema(high, 5)

hfib_ma_2 = ema(high, 8)

hfib_ma_3 = ema(high, 13)

hfib_ma_4 = ema(high, 21)

hfib_ma_5 = ema(high, 34)

hfib_ma_6 = ema(high, 55)

hfib_ma_7 = ema(high, 89)

hfib_ma_8 = ema(high, 144)

hfib_ma_9 = ema(high, 233)

hfib_ma_10 = ema(high, 377)

hfib_ma_11 = ema(high, 610)

hfib_ma_12 = ema(high, 987)

hfib_ma_13 = ema(high, 1597)fib_high = (hfib_ma_13 + hfib_ma_12 + hfib_ma_11 + hfib_ma_10 + hfib_ma_9 + hfib_ma_8 + hfib_ma_7 + hfib_ma_6 + hfib_ma_5 + hfib_ma_4 + hfib_ma_3 + hfib_ma_2 + hfib_ma_1) / 13plot(fib_high, color = (fib_high < close) ? color.blue : color.orange)lfib_ma_1 = ema(low, 5)

lfib_ma_2 = ema(low, 8)

lfib_ma_3 = ema(low, 13)

lfib_ma_4 = ema(low, 21)

lfib_ma_5 = ema(low, 34)

lfib_ma_6 = ema(low, 55)

lfib_ma_7 = ema(low, 89)

lfib_ma_8 = ema(low, 144)

lfib_ma_9 = ema(low, 233)

lfib_ma_10 = ema(low, 377)

lfib_ma_11 = ema(low, 610)

lfib_ma_12 = ema(low, 987)

lfib_ma_13 = ema(low, 1597)fib_low = (lfib_ma_13 + lfib_ma_12 + lfib_ma_11 + lfib_ma_10 + lfib_ma_9 + lfib_ma_8 + lfib_ma_7 + lfib_ma_6 + lfib_ma_5 + lfib_ma_4 + lfib_ma_3 + lfib_ma_2 + lfib_ma_1) / 13plot(fib_low, color = (fib_low < close) ? color.blue : color.orange)

//@version=4

study("Fibonacci Moving Average", overlay = true)hfib_ma_1 = ema(high, 5)

hfib_ma_2 = ema(high, 8)

hfib_ma_3 = ema(high, 13)

hfib_ma_4 = ema(high, 21)

hfib_ma_5 = ema(high, 34)

hfib_ma_6 = ema(high, 55)

hfib_ma_7 = ema(high, 89)

hfib_ma_8 = ema(high, 144)

hfib_ma_9 = ema(high, 233)

hfib_ma_10 = ema(high, 377)

hfib_ma_11 = ema(high, 610)

hfib_ma_12 = ema(high, 987)

hfib_ma_13 = ema(high, 1597)fib_high = (hfib_ma_13 + hfib_ma_12 + hfib_ma_11 + hfib_ma_10 + hfib_ma_9 + hfib_ma_8 + hfib_ma_7 + hfib_ma_6 + hfib_ma_5 + hfib_ma_4 + hfib_ma_3 + hfib_ma_2 + hfib_ma_1) / 13plot(fib_high, color = (fib_high < close) ? color.blue : color.orange)lfib_ma_1 = ema(low, 5)

lfib_ma_2 = ema(low, 8)

lfib_ma_3 = ema(low, 13)

lfib_ma_4 = ema(low, 21)

lfib_ma_5 = ema(low, 34)

lfib_ma_6 = ema(low, 55)

lfib_ma_7 = ema(low, 89)

lfib_ma_8 = ema(low, 144)

lfib_ma_9 = ema(low, 233)

lfib_ma_10 = ema(low, 377)

lfib_ma_11 = ema(low, 610)

lfib_ma_12 = ema(low, 987)

lfib_ma_13 = ema(low, 1597)fib_low = (lfib_ma_13 + lfib_ma_12 + lfib_ma_11 + lfib_ma_10 + lfib_ma_9 + lfib_ma_8 + lfib_ma_7 + lfib_ma_6 + lfib_ma_5 + lfib_ma_4 + lfib_ma_3 + lfib_ma_2 + lfib_ma_1) / 13plot(fib_low, color = (fib_low < close) ? color.blue : color.orange)

@Bidtheoffer this is from trading view i tried modifying but im lacking codes

Here is a possible TOS conversion

The image is what was used by the Tradingview author

Ruby:

Ruby:#Fibonacci Moving Average #Sofien-Kaabar #Oct 21, 2021 #//@version=4 #The Fibonacci Moving Average is a powerful indicator that takes into account many underlying moving averages to give out an approximate short-term/long-term view of the markets. Its strength lies with dynamic support and resistance levels. I have created this indicator in order to improve trend-following entry positions. #study("Fibonacci Moving Average", overlay = true) #TOS conversion from TradingView script ema { input price = high; input length = 5; plot emaavg = expaverage(price, length); } def hfib_ma_1 = ema(high, 5); def hfib_ma_2 = ema(high, 8); def hfib_ma_3 = ema(high, 13); def hfib_ma_4 = ema(high, 21); def hfib_ma_5 = ema(high, 34); def hfib_ma_6 = ema(high, 55); def hfib_ma_7 = ema(high, 89); def hfib_ma_8 = ema(high, 144); def hfib_ma_9 = ema(high, 233); def hfib_ma_10 = ema(high, 377); def hfib_ma_11 = ema(high, 610); def hfib_ma_12 = ema(high, 987); def hfib_ma_13 = ema(high, 1597); plot fib_high = (hfib_ma_13 + hfib_ma_12 + hfib_ma_11 + hfib_ma_10 + hfib_ma_9 + hfib_ma_8 + hfib_ma_7 + hfib_ma_6 + hfib_ma_5 + hfib_ma_4 + hfib_ma_3 + hfib_ma_2 + hfib_ma_1) / 13; #, color = (fib_high < close) ? color.blue : color.orange) def lfib_ma_1 = ema(low, 5); def lfib_ma_2 = ema(low, 8); def lfib_ma_3 = ema(low, 13); def lfib_ma_4 = ema(low, 21); def lfib_ma_5 = ema(low, 34); def lfib_ma_6 = ema(low, 55); def lfib_ma_7 = ema(low, 89); def lfib_ma_8 = ema(low, 144); def lfib_ma_9 = ema(low, 233); def lfib_ma_10 = ema(low, 377); def lfib_ma_11 = ema(low, 610); def lfib_ma_12 = ema(low, 987); def lfib_ma_13 = ema(low, 1597); plot fib_low = (lfib_ma_13 + lfib_ma_12 + lfib_ma_11 + lfib_ma_10 + lfib_ma_9 + lfib_ma_8 + lfib_ma_7 + lfib_ma_6 + lfib_ma_5 + lfib_ma_4 + lfib_ma_3 + lfib_ma_2 + lfib_ma_1) / 13; #color = (fib_low < close) ? color.blue : color.orange)

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| A | Candle Pattern Coding Formulas | Questions | 2 | |

| W | Removing price bubbles in Fibonacci code | Questions | 1 | |

|

|

Auto Fibonacci Sequence - Determined by Entering Time of Candle. | Questions | 2 | |

|

|

Fibonacci retracement on 30 minute bar | Questions | 1 | |

| K | Multiple Fibonacci Retracement Question | Questions | 1 |

Similar threads

-

-

-

Auto Fibonacci Sequence - Determined by Entering Time of Candle.

- Started by Stockitect

- Replies: 2

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

238

Online

Similar threads

-

-

-

Auto Fibonacci Sequence - Determined by Entering Time of Candle.

- Started by Stockitect

- Replies: 2

-

-

Similar threads

-

-

-

Auto Fibonacci Sequence - Determined by Entering Time of Candle.

- Started by Stockitect

- Replies: 2

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.