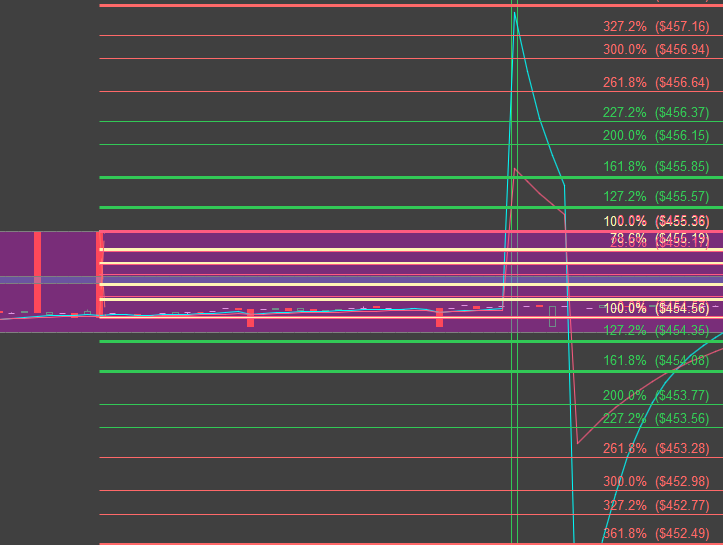

#AutoFib_Start_Time_Current_Day

#20250608 modified to include a range from Start_Time to End_Time

input start_time = 0640;

input end_time = 0930;

input label = yes;

AddLabel(label, "Fib Start_time: " + AsPrice(start_time), Color.WHITE);

AddLabel(label, "Fib End_time: " + AsPrice(end_time), Color.WHITE);

def start = if SecondsFromTime(start_time)[1] < 0 and SecondsFromTime(start_time) >= 0

then 1 else 0;

def rhi = if start == 1 then high else if rhi[1]>=1 and secondsFromTime(end_time)<=0 and high>rhi[1] then high else rhi[1];

def rlo = if start == 1 then low else if rlo[1]>=1 and secondsFromTime(end_time)<=0 and low<rlo[1] then low else rlo[1];

input H1 = .382;

input H2 = .786;

input H1272 = 1.272;

input H1618 = 1.618;

input H200 = 2.0;

input H2272 = 2.272;

input H2618 = 2.618;

input H300 = 3.0;

input H3272 = 3.272;

input H3618 = 3.618;

input L1 = .382;

input L2 = .786;

input L1272 = .272;

input L1618 = .618;

input L200 = 2.0;

input L2272 = 2.272;

input L2618 = 2.618;

input L300 = 3.0;

input L3272 = 3.272;

input L3618 = 3.618;

plot Mid = if secondsFromTime(end_time)>=0 then (rhi + rlo) / 2 else double.nan;

def range = if secondsFromTime(end_time)>=0 then rhi - Mid else double.nan;

plot P1 = Mid + (range * H1);

plot P2 = Mid + (range * H2);

plot P1272 = Mid + (range * H1272);

plot P1618 = Mid + (range * H1618);

plot P200 = Mid + (range * H200);

plot P2272 = Mid + (range * H2272);

plot P2618 = Mid + (range * H2618);

plot P300 = Mid + (range * H300);

plot P3272 = Mid + (range * H3272);

plot P3618 = Mid + (range * H3618);

plot N1 = Mid - (range * L1);

plot N2 = Mid - (range * L2);

plot N1272 = Mid - (range * H1272);

plot N1618 = Mid - (range * H1618);

plot N200 = Mid - (range * H200);

plot N2272 = Mid - (range * H2272);

plot N2618 = Mid - (range * H2618);

plot N300 = Mid - (range * H300);

plot N3272 = Mid - (range * H3272);

plot N3618 = Mid - (range * H3618);

plot ORH = if secondsFromTime(end_time)>=0 then rhi else double.nan;

plot ORL = if secondsFromTime(end_time)>=0 then rlo else double.nan;

ORH.SetDefaultColor(Color.MAGENTA);

ORH.SetPaintingStrategy(PaintingStrategy.DASHES);

ORH.SetLineWeight(4);

ORL.SetDefaultColor(Color.WHITE);

ORL.SetPaintingStrategy(PaintingStrategy.DASHES);

ORL.SetLineWeight(4);

Mid.SetDefaultColor(Color.MAGENTA);

Mid.SetPaintingStrategy(PaintingStrategy.DASHES);

Mid.SetLineWeight(2);

P1.SetDefaultColor(Color.WHITE);

P1.SetPaintingStrategy(PaintingStrategy.DASHES);

P1.SetLineWeight(4);

P2.SetDefaultColor(Color.WHITE);

P2.SetPaintingStrategy(PaintingStrategy.DASHES);

P2.SetLineWeight(4);

P1272.SetDefaultColor(Color.GREEN);

P1272.SetPaintingStrategy(PaintingStrategy.DASHES);

P1272.SetLineWeight(4);

P1618.SetDefaultColor(Color.GREEN);

P1618.SetPaintingStrategy(PaintingStrategy.DASHES);

P1618.SetLineWeight(4);

P200.SetDefaultColor(Color.GREEN);

P200.SetPaintingStrategy(PaintingStrategy.DASHES);

P200.SetLineWeight(2);

P2272.SetDefaultColor(Color.GREEN);

P2272.SetPaintingStrategy(PaintingStrategy.DASHES);

P2272.SetLineWeight(2);

P2618.SetDefaultColor(Color.MAGENTA);

P2618.SetPaintingStrategy(PaintingStrategy.DASHES);

P2618.SetLineWeight(2);

P300.SetDefaultColor(Color.MAGENTA);

P300.SetPaintingStrategy(PaintingStrategy.DASHES);

P300.SetLineWeight(2);

P3272.SetDefaultColor(Color.MAGENTA);

P3272.SetPaintingStrategy(PaintingStrategy.DASHES);

P3272.SetLineWeight(2);

P3618.SetDefaultColor(Color.MAGENTA);

P3618.SetPaintingStrategy(PaintingStrategy.DASHES);

P3618.SetLineWeight(2);

N1.SetDefaultColor(Color.WHITE);

N1.SetPaintingStrategy(PaintingStrategy.DASHES);

N1.SetLineWeight(4);

N2.SetDefaultColor(Color.WHITE);

N2.SetPaintingStrategy(PaintingStrategy.DASHES);

N2.SetLineWeight(4);

N1272.SetDefaultColor(Color.GREEN);

N1272.SetPaintingStrategy(PaintingStrategy.DASHES);

N1272.SetLineWeight(4);

N1618.SetDefaultColor(Color.GREEN);

N1618.SetPaintingStrategy(PaintingStrategy.DASHES);

N1618.SetLineWeight(4);

N200.SetDefaultColor(Color.GREEN);

N200.SetPaintingStrategy(PaintingStrategy.DASHES);

N200.SetLineWeight(2);

N2272.SetDefaultColor(Color.GREEN);

N2272.SetPaintingStrategy(PaintingStrategy.DASHES);

N2272.SetLineWeight(2);

N2618.SetDefaultColor(Color.MAGENTA);

N2618.SetPaintingStrategy(PaintingStrategy.DASHES);

N2618.SetLineWeight(2);

N300.SetDefaultColor(Color.MAGENTA);

N300.SetPaintingStrategy(PaintingStrategy.DASHES);

N300.SetLineWeight(2);

N3272.SetDefaultColor(Color.MAGENTA);

N3272.SetPaintingStrategy(PaintingStrategy.DASHES);

N3272.SetLineWeight(2);

N3618.SetDefaultColor(Color.MAGENTA);

N3618.SetPaintingStrategy(PaintingStrategy.DASHES);

N3618.SetLineWeight(2);

ORH.HideBubble();

ORL.HideBubble();

Mid.HideBubble();

P1.HideBubble();

P2.HideBubble();

P1272.HideBubble();

P1618.HideBubble();

P200.HideBubble();

P2272.HideBubble();

P2618.HideBubble();

P300.HideBubble();

P3272.HideBubble();

P3618.HideBubble();

N1.HideBubble();

N2.HideBubble();

N1272.HideBubble();

N1618.HideBubble();

N200.HideBubble();

N2272.HideBubble();

N2618.HideBubble();

N300.HideBubble();

N3272.HideBubble();

N3618.HideBubble();

input showbubbles = yes;

input bubblemover = 5;

def m = bubblemover;

def m1 = m + 1;

def mover = showbubbles and IsNaN(close[m]) and !IsNaN(close[m1]);

AddChartBubble(mover, Mid[m1], "0%" + AsText(Mid[m1]), Mid.TakeValueColor());

AddChartBubble(mover, ORH[m1], "100% " + AsText(ORH[m1]), ORH.TakeValueColor());

AddChartBubble(mover, P1[m1], H1 * 100 + "%" + AsText(P1[m1]), P1.TakeValueColor());

AddChartBubble(mover, P2[m1], H2 * 100 + "% " + AsText(P2[m1]), P2.TakeValueColor());

AddChartBubble(mover, P1272[m1], H1272 * 100 + "% " + AsText(P1272[m1]), P1272.TakeValueColor());

AddChartBubble(mover, P1618[m1], H1618 * 100 + "% " + AsText(P1618[m1]), P1618.TakeValueColor());

AddChartBubble(mover, P200[m1], H200 * 100 + "% " + AsText(P200[m1]), P200.TakeValueColor());

AddChartBubble(mover, P2272[m1], H2272 * 100 + "% " + AsText(P2272[m1]), P2272.TakeValueColor());

AddChartBubble(mover, P2618[m1], H2618 * 100 + "% " + AsText(P2618[m1]), P2618.TakeValueColor());

AddChartBubble(mover, P300[m1], H300 * 100 + "% " + AsText(P300[m1]), P300.TakeValueColor());

AddChartBubble(mover, P3272[m1], H3272 * 100 + "% " + AsText(P3272[m1]), P3272.TakeValueColor());

AddChartBubble(mover, P3618[m1], H3618 * 100 + "% " + AsText(P3618[m1]), P3618.TakeValueColor());

AddChartBubble(mover, ORL[m1], "100% " + AsText(ORL[m1]), ORL.TakeValueColor());

AddChartBubble(mover, N1[m1], L1 * 100 + "%" + AsText(N1[m1]), N1.TakeValueColor());

AddChartBubble(mover, N2[m1], L2 * 100 + "% " + AsText(N2[m1]), N2.TakeValueColor());

AddChartBubble(mover, N1272[m1], L1272 * 100 + "% " + AsText(N1272[m1]), N1272.TakeValueColor());

AddChartBubble(mover, N1618[m1], L1618 * 100 + "% " + AsText(N1618[m1]), N1618.TakeValueColor());

AddChartBubble(mover, N200[m1], L200 * 100 + "% " + AsText(N200[m1]), N200.TakeValueColor());

AddChartBubble(mover, N2272[m1], L2272 * 100 + "% " + AsText(N2272[m1]), N2272.TakeValueColor());

AddChartBubble(mover, N2618[m1], L2618 * 100 + "% " + AsText(N2618[m1]), N2618.TakeValueColor());

AddChartBubble(mover, N300[m1], L300 * 100 + "% " + AsText(N300[m1]), N300.TakeValueColor());

AddChartBubble(mover, N3272[m1], L3272 * 100 + "% " + AsText(N3272[m1]), N3272.TakeValueColor());

AddChartBubble(mover, N3618[m1], L3618 * 100 + "% " + AsText(N3618[m1]), N3618.TakeValueColor());

#