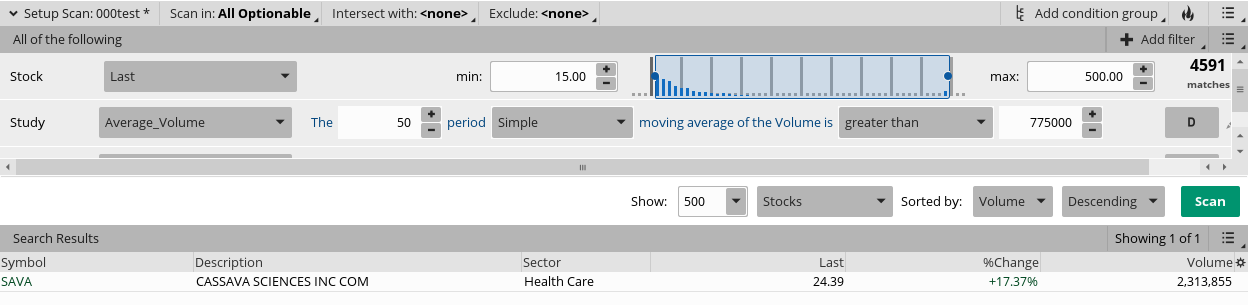

Can any of you look at my scanner and let me know what type of changes you would make to get some more quality tickers to evaluate. I will go several days or even a week without a single stock to populate. I am trying to scan for stocks in the ttm squeeze that have just made the turn from red to yellow bars with bullish momentum. I do not want to go through too many, but would like a viable handful or dozen each day. I am part time and a novice. I am only able to check the scanner after hours or very early in the a.m. (0300 est). Thanks!

I am a Schwab user, shared links are not active yet.

Here is an explanation of my scan:

I use a min to max last price of $1 to $500

market cap > 500 M

Volume > 300000

with script below:

TTM_Squeeze()."Histogram" is greater than TTM_Squeeze()."Histogram" from 1 bars ago

TTM_Squeeze()."Histogram" from 2 bars ago is greater than TTM_Squeeze()."Histogram" from 1 bars ago

TTM_Squeeze()."SqueezeAlert" is not equal to 0

MovAvgExponential("length" = 21)."AvgExp" is greater than MovAvgExponential("length" = 34)."AvgExp" and MovAvgExponential("length" = 8)."AvgExp" is greater than MovAvgExponential("length" = 21)."AvgExp"

TTM_Squeeze()."Histogram" is less than 0

ADX() is greater than 20

Hope that works. Never tried that before.

I am a Schwab user, shared links are not active yet.

Here is an explanation of my scan:

I use a min to max last price of $1 to $500

market cap > 500 M

Volume > 300000

with script below:

TTM_Squeeze()."Histogram" is greater than TTM_Squeeze()."Histogram" from 1 bars ago

TTM_Squeeze()."Histogram" from 2 bars ago is greater than TTM_Squeeze()."Histogram" from 1 bars ago

TTM_Squeeze()."SqueezeAlert" is not equal to 0

MovAvgExponential("length" = 21)."AvgExp" is greater than MovAvgExponential("length" = 34)."AvgExp" and MovAvgExponential("length" = 8)."AvgExp" is greater than MovAvgExponential("length" = 21)."AvgExp"

TTM_Squeeze()."Histogram" is less than 0

ADX() is greater than 20

Hope that works. Never tried that before.

Last edited by a moderator: