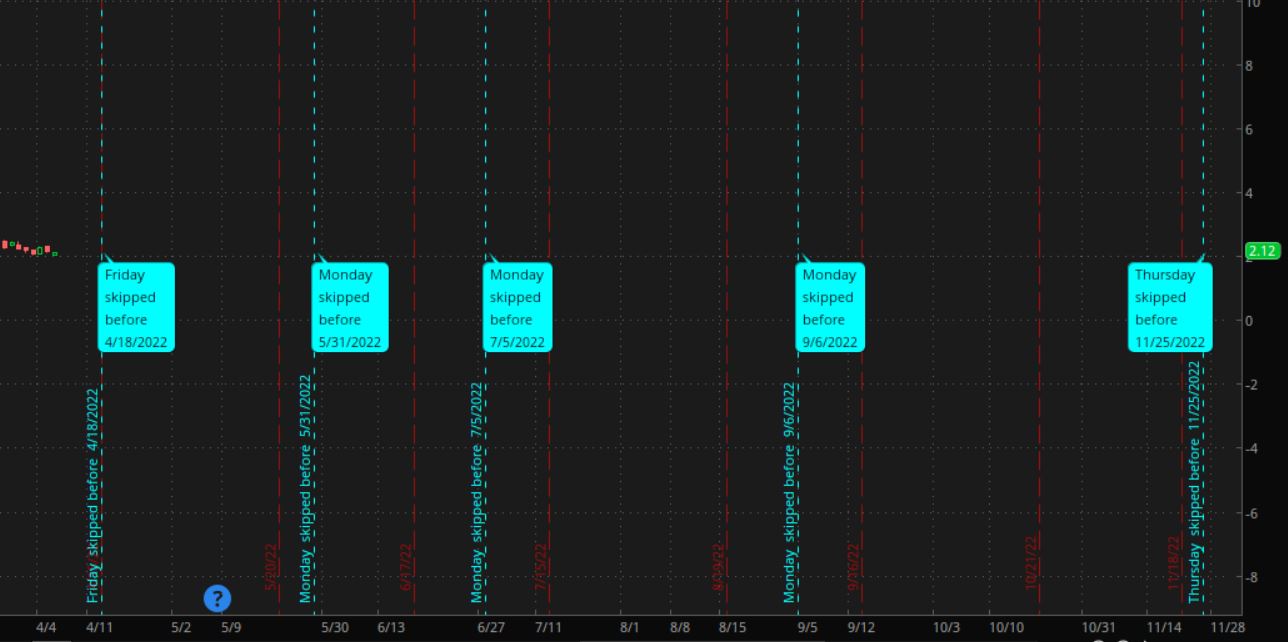

find holidays, missing trading days, on a chart.

..draw a vertical line and/or a bubble

..the text includes the name of the missing day and the date after it.

..works on any timeframe. on smaller times, will need the expansion area set to a big number.

sometimes i forget about a holiday and end up holding a trade over it.

i wanted somthing on the chart, to remind me about future holidays.

i have been working on and off on some ideas for awhile. but they involve typing in dates, which gets messy and long, with all of the comparisons.

then today i was using dayofweek for something and i came up with this.

if references the first bar of the day.

now that it is done, i see i could have referenced the dayend variable and compared to a future value [-1] , and probably come up with the date of the missing day... but it's late and this will work for me.

WMT day chart expansion area = 300

hal_hol

..draw a vertical line and/or a bubble

..the text includes the name of the missing day and the date after it.

..works on any timeframe. on smaller times, will need the expansion area set to a big number.

sometimes i forget about a holiday and end up holding a trade over it.

i wanted somthing on the chart, to remind me about future holidays.

i have been working on and off on some ideas for awhile. but they involve typing in dates, which gets messy and long, with all of the comparisons.

then today i was using dayofweek for something and i came up with this.

if references the first bar of the day.

now that it is done, i see i could have referenced the dayend variable and compared to a future value [-1] , and probably come up with the date of the missing day... but it's late and this will work for me.

Ruby:

# dow_holidays_01

# halcyonguy

# 22-04-06

# check if a trading day is skipped, holidays

# compare 2 day of week #'s to see if a date was skipped

# dow 1 = monday , 5 = friday

# mobius

def data = getYYYYMMDD();

def year = Round(data/10000, 0);

def month = Round((data % 10000) / 100, 0);

def day = (data % 100);

#addLabel(1, "date: " + month + "/" + day + "/" + AsPrice(year), color.white);

def bn = barnumber();

def lastbar = !isnan(close[0]) and isnan(close[-1]);

def lastcls = if !isnan(close) and !lastbar then close else if lastbar then close else lastcls[1];

def DOW = GetDayOfWeek(GetYYYYMMDD());

def daystart = if GetDay() != GetDay()[1] then 1 else 0;

#def dayend = if GetDay() != GetDay()[-1] then 1 else 0;

# if no skip = 99

def dayskipped;

if bn == 1 then {

dayskipped = 99;

} else if (daystart and dow == 2 and dow[1] != 1) then {

dayskipped = 1;

} else if (daystart and dow == 3 and dow[1] != 2) then {

dayskipped = 2;

} else if (daystart and dow == 4 and dow[1] != 3) then {

dayskipped = 3;

} else if (daystart and dow == 5 and dow[1] != 4) then {

dayskipped = 4;

} else if (daystart and dow == 1 and dow[1] != 5) then {

dayskipped = 5;

} else {

dayskipped = 99;

}

input show_bubble = yes;

addchartbubble(show_bubble and dayskipped != 99, lastcls,

(if dayskipped == 1 then "Monday"

else if dayskipped == 2 then "Tuesday"

else if dayskipped == 3 then "Wednesday"

else if dayskipped == 4 then "Thursday"

else if dayskipped == 5 then "Friday"

else "") + "\n" +

"skipped\n" +

"before\n" +

( month + "/" + day + "/" + AsPrice(year) )

, color.cyan, no);

input show_vertical_line = yes;

addverticalline(show_vertical_line and dayskipped != 99,

(if dayskipped == 1 then "Monday"

else if dayskipped == 2 then "Tuesday"

else if dayskipped == 3 then "Wednesday"

else if dayskipped == 4 then "Thursday"

else if dayskipped == 5 then "Friday"

else "") + " skipped before " + ( month + "/" + day + "/" + AsPrice(year)) , color.cyan);

# ---------------------------------------------------------

input test1_dow = no;

AddChartBubble( test1_dow, lastcls, dow , color.yellow, no);

#WMT day chart expansion area = 300

hal_hol