Wiinii

Member

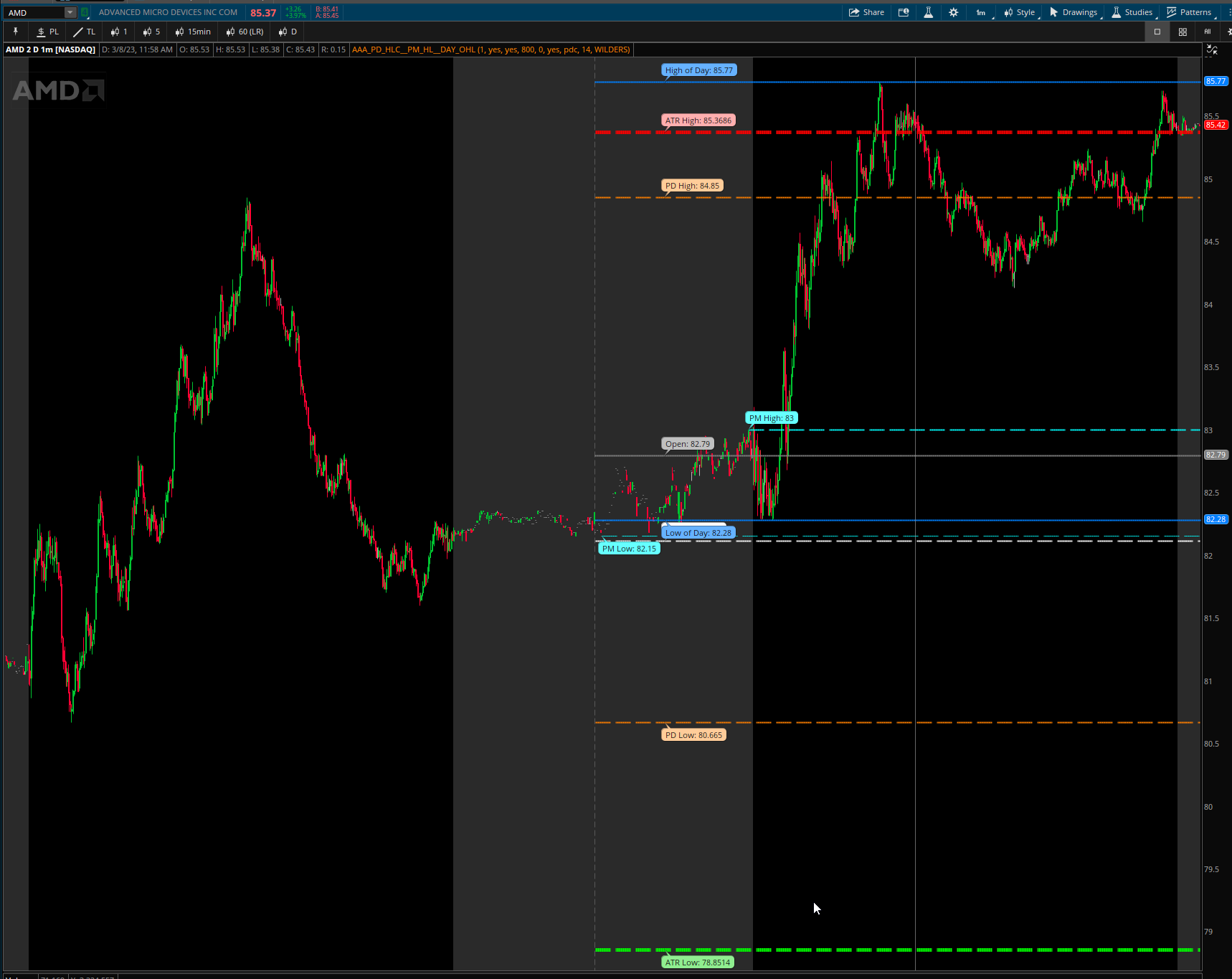

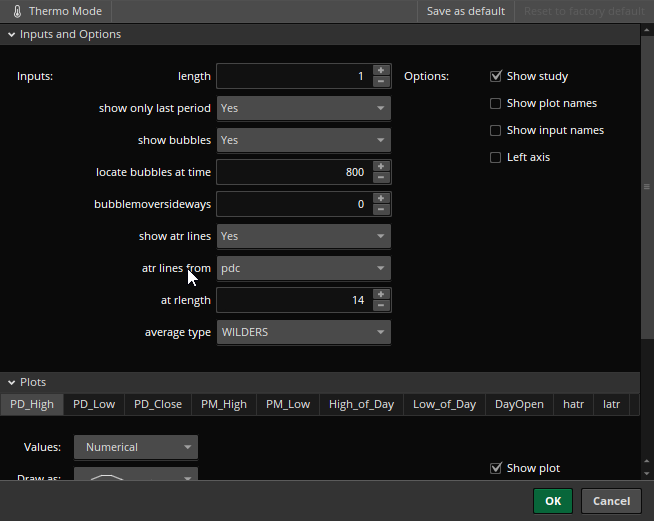

I looked around for a script with all the things and didn't see one, so I made one. You can change the colors and transparency of the bubbles under Globals as seen in 2nd pic, adjust the bubbles position to a specific time, and there is an option to turn off the bubbles altogether. By default the previous day's stuff is dashes, today's stuff is solid (but you can of course customize it all). You can also turn on the option to see previous days' stuff too. Enjoy!

UPDATES (1.6 - 4/7/23):

UPDATES (1.6 - 4/7/23):

- Now includes ATR projected move lines! Option for from open or previous day close.

- You can now choose to have the bubbles show at a time or in the expansion area! To see it in the expansion area, click on the gear above the chart > go to Time Axis and change the Expansion area to a number that keeps them off your charts (this will vary depending on timeframe and zoom level).

Code:

# Previous Day High/Low/Close + Premarket High/Low + High/Low/Open of Day + ATR Lines

# Created by Wiinii

# V1.6

# Some code based on code by Mobius (premarket) and TraderKevin (ATR lines

# https://usethinkscript.com/threads/previous-day-high-low-close-premarket-high-low-high-low-open-of-day-for-thinkorswim.13139/

declare hide_on_daily;

input length = 1;

input showOnlyLastPeriod = yes;

input ShowBubbles = yes;

input locate_bubbles_at = {default Expansion, Time};

input locate_bubbles_at_time = 800;

input BarsFromExpansion = 1;

input ShowPricesInBubbles = yes;

def bn = BarNumber();

def na = Double.NaN;

def h = high;

def l = low;

def o = open;

def c = close;

def v = volume;

def aggregationPeriod = AggregationPeriod.DAY;

def displace = -1;

def timeopen = SecondsFromTime(locate_bubbles_at_time) == 0;

def isExpansion = locate_bubbles_at == locate_bubbles_at.Expansion and IsNaN(close);

def firstExpansionBar = if !IsNaN(close[-1]) and isExpansion then 1 else if isExpansion then firstExpansionBar[1] + 1 else 0;

def BubbleLocation = if locate_bubbles_at == locate_bubbles_at.Time then timeopen else isExpansion and firstExpansionBar == BarsFromExpansion;

#----- Previous Day High/Low/Close -----#

plot PD_High;

plot PD_Low;

plot PD_Close;

if showOnlyLastPeriod and !IsNaN(close(period = aggregationPeriod)[-1]) {

PD_High = na;

PD_Low = na;

PD_Close = na;

} else {

PD_High = Highest(high(period = aggregationPeriod)[-displace], length);

PD_Low = Lowest(low(period = aggregationPeriod)[-displace], length);

PD_Close = close(period = aggregationPeriod)[-displace];

}

PD_High.SetDefaultColor(Color.DARK_ORANGE);

PD_High.SetStyle(Curve.LONG_DASH);

PD_High.SetLineWeight(2);

PD_High.HideTitle();

PD_Low.SetDefaultColor(Color.DARK_ORANGE);

PD_Low.SetStyle(Curve.LONG_DASH);

PD_Low.SetLineWeight(2);

PD_Low.HideTitle();

PD_Close.SetDefaultColor(Color.WHITE);

PD_Close.SetStyle(Curve.LONG_DASH);

PD_Close.SetLineWeight(2);

PD_Close.HideTitle();

DefineGlobalColor("PD_High", CreateColor(255, 204, 153));

AddChartBubble(ShowBubbles and BubbleLocation, PD_High, "PDH: " + (if ShowPricesInBubbles then AsText(PD_High) else ""), GlobalColor("PD_High"));

DefineGlobalColor("PD_Low", CreateColor(255, 204, 153));

AddChartBubble(ShowBubbles and BubbleLocation, PD_Low, "PDL: " + (if ShowPricesInBubbles then AsText(PD_Low) else ""), GlobalColor("PD_Low"), no);

DefineGlobalColor("PD_Close", Color.WHITE);

AddChartBubble(ShowBubbles and BubbleLocation, PD_Close, "PDC: " + (if ShowPricesInBubbles then AsText(PD_Close) else ""), GlobalColor("PD_Close"));

PD_High.HideBubble();

PD_Low.HideBubble();

PD_Close.HideBubble();

#----- Premarket High/Low -----# Thanks to Mobius

def GlobeX = GetTime() < RegularTradingStart(GetYYYYMMDD());

def vol = if GlobeX and !GlobeX[1]

then v

else if GlobeX

then vol[1] + v

else na;

def GlobeX_Volume = vol;

def ONhigh = if GlobeX and !GlobeX[1]

then h

else if GlobeX and

h > ONhigh[1]

then h

else ONhigh[1];

def ONhighBar = if GlobeX and h == ONhigh

then bn

else na;

def ONlow = if GlobeX and !GlobeX[1]

then l

else if GlobeX and

l < ONlow[1]

then l

else ONlow[1];

def ONlowBar = if GlobeX and l == ONlow

then bn

else na;

def OverNightHigh = if BarNumber() == HighestAll(ONhighBar)

then ONhigh

else OverNightHigh[1];

def OverNightLow = if BarNumber() == HighestAll(ONlowBar)

then ONlow

else OverNightLow[1];

plot PM_High;

plot PM_Low;

if showOnlyLastPeriod and !IsNaN(close(period = aggregationPeriod)[-1]) {

PM_High = na;

PM_Low = na;

} else {

PM_High = if OverNightHigh > 0 then OverNightHigh else na;

PM_Low = if OverNightLow > 0 then OverNightLow else na;

}

#PM_High.SetHiding(!PlotOverNightExtremes);

PM_High.SetLineWeight(2);

PM_High.SetDefaultColor(Color.CYAN);

PM_High.SetStyle(Curve.LONG_DASH);

PM_High.HideBubble();

PM_High.HideTitle();

#PM_Low.SetHiding(!PlotOverNightExtremes);

PM_Low.SetStyle(Curve.LONG_DASH);

PM_Low.SetDefaultColor(Color.CYAN);

PM_Low.HideBubble();

PM_Low.HideTitle();

DefineGlobalColor("PM_High", CreateColor(102, 255, 255));

AddChartBubble(ShowBubbles and if locate_bubbles_at == locate_bubbles_at.Time then bn == ONhighBar else isExpansion and firstExpansionBar == BarsFromExpansion, PM_High, "PMH: " + (if ShowPricesInBubbles then AsText(PM_High) else ""), GlobalColor("PM_High"));

DefineGlobalColor("PM_Low", CreateColor(102, 255, 255));

AddChartBubble(ShowBubbles and if locate_bubbles_at == locate_bubbles_at.Time then bn == ONlowBar else isExpansion and firstExpansionBar == BarsFromExpansion, PM_Low, "PML: " + (if ShowPricesInBubbles then AsText(PM_Low) else ""), GlobalColor("PM_Low"), no);

#----- Today Open/High/Low -----#

plot High_of_Day;

plot Low_of_Day;

plot DayOpen;

if showOnlyLastPeriod and !IsNaN(close(period = aggregationPeriod)[-1]) {

DayOpen = na;

High_of_Day = na;

Low_of_Day = na;

} else {

DayOpen = open(period = aggregationPeriod)[0];

High_of_Day = Highest(high(period = aggregationPeriod), length);

Low_of_Day = Lowest(low(period = aggregationPeriod), length);

}

DayOpen.SetDefaultColor (Color.GRAY);

DayOpen.SetPaintingStrategy(PaintingStrategy.DASHES);

DayOpen.SetLineWeight(2);

DayOpen.HideTitle();

High_of_Day.SetDefaultColor(CreateColor(0, 128, 255));

High_of_Day.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

High_of_Day.SetLineWeight(2);

High_of_Day.HideTitle();

Low_of_Day.SetDefaultColor(CreateColor(0, 128, 255));

Low_of_Day.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Low_of_Day.SetLineWeight(2);

Low_of_Day.HideTitle();

DefineGlobalColor("Open", Color.LIGHT_GRAY);

AddChartBubble(ShowBubbles and BubbleLocation, DayOpen, "Open: " + (if ShowPricesInBubbles then AsText(DayOpen) else ""), GlobalColor("Open"));

DefineGlobalColor("High_of_Day", CreateColor(102, 178, 255));

AddChartBubble(ShowBubbles and BubbleLocation, High_of_Day, "HOD: " + (if ShowPricesInBubbles then AsText(High_of_Day) else ""), GlobalColor("High_of_Day"));

DefineGlobalColor("Low_of_Day", CreateColor(102, 178, 255));

AddChartBubble(ShowBubbles and BubbleLocation, Low_of_Day, "LOD: " + (if ShowPricesInBubbles then AsText(Low_of_Day) else ""), GlobalColor("Low_of_Day"), no);

#----- ATR Lines -----# Thaanks to TraderKevin

input showAtrLines = Yes;

input atrLinesFrom = {default pdc, dayOpen};

input ATRlength = 14;

input averageType = AverageType.WILDERS;

def ATR = MovingAverage(averageType, TrueRange(high(period = ”DAY”)[1], close(period = ”DAY”)[1], low(period = ”DAY”)[1]), ATRlength);

plot hatr = if atrLinesFrom == atrLinesFrom .dayOpen then DayOpen + ATR else PD_Close + ATR;

plot latr = if atrLinesFrom == atrLinesFrom .dayOpen then DayOpen - ATR else PD_Close - ATR;

hatr.SetLineWeight(5);

hatr.SetDefaultColor(Color.RED);

hatr.SetStyle(Curve.LONG_DASH);

hatr.HideBubble();

hatr.HideTitle();

hatr.SetHiding(showAtrLines == no);

latr.SetLineWeight(5);

latr.SetStyle(Curve.LONG_DASH);

latr.SetDefaultColor(Color.GREEN);

latr.HideBubble();

latr.HideTitle();

latr.SetHiding(showAtrLines == no);

DefineGlobalColor("hatr", Color.PINK);

AddChartBubble(ShowBubbles and showAtrLines and BubbleLocation, hatr, "ATRH: " + (if ShowPricesInBubbles then AsText(hatr) else ""), GlobalColor("hatr"));

DefineGlobalColor("latr", Color.LIGHT_GREEN);

AddChartBubble(ShowBubbles and showAtrLines and BubbleLocation, latr, "ATRL: " + (if ShowPricesInBubbles then AsText(latr) else ""), GlobalColor("latr"), no);

Last edited: