Hi Matt,Thank you for replying, i am sorry i am not sure what to check in 2000t or BB stop line, could you please share the screenshot ?

could you please share your grid?

Hi Matt,Thank you for replying, i am sorry i am not sure what to check in 2000t or BB stop line, could you please share the screenshot ?

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Madhu - It sounds like you may not have read all the posts in this chain, which is highly recommended. The 2000t confirmation signals and Bollinger bands stops are discussed at length. I am using a grid shared in this chain. If I just share my grid you still won't know what to look for without reading the posts. I know 40+ pages is a lot but it was well worth my time.Hi Matt,

could you please share your grid?

Thank you Matt, i will go through this.Madhu - It sounds like you may not have read all the posts in this chain, which is highly recommended. The 2000t confirmation signals and Bollinger bands stops are discussed at length. I am using a grid shared in this chain. If I just share my grid you still won't know what to look for without reading the posts. I know 40+ pages is a lot but it was well worth my time.

- Matt.

can you repost the grid, the link isn't working?I'm sure at some point or another this has been done but thought I would try to give something back to this great community. I believe both these indicators are from users on this site but I could be mistaken. One the RSIL and the other some form of RSI I believe, cant remember the exact name. I really like the FE indicator on the RSIL but dont care too much for the rest of it. So I basically just did a fractal energy overlay on top of whatever study this is called. Its no holy grail because there is no such thing, but paired with multiple time frames and known support/resistance it has proved to be an absolutely lethal tool (for me anyways). Usually run a 512, 1000, and 1600 tick chart all with this same setup (minus the slim ribbon on the 1600). Any input is well appreciated.

Original version with indicators (grid chart) https://tos.mx/4gmXmj2

Hi Blakecmathis,@twoduds Not exactly. Wait for confirmation from the CCI/ATR on the 2000t. You'll notice hows theres a double tap shelf @ 3331.50 right before the low was made. I went long for a fill @ 3331.75

@Madhu, what are the pink and yellow lines in your chart and how do you use them?@blakecmathis, Thanks for sharing this strategy. Sorry to ask you some basic questions:

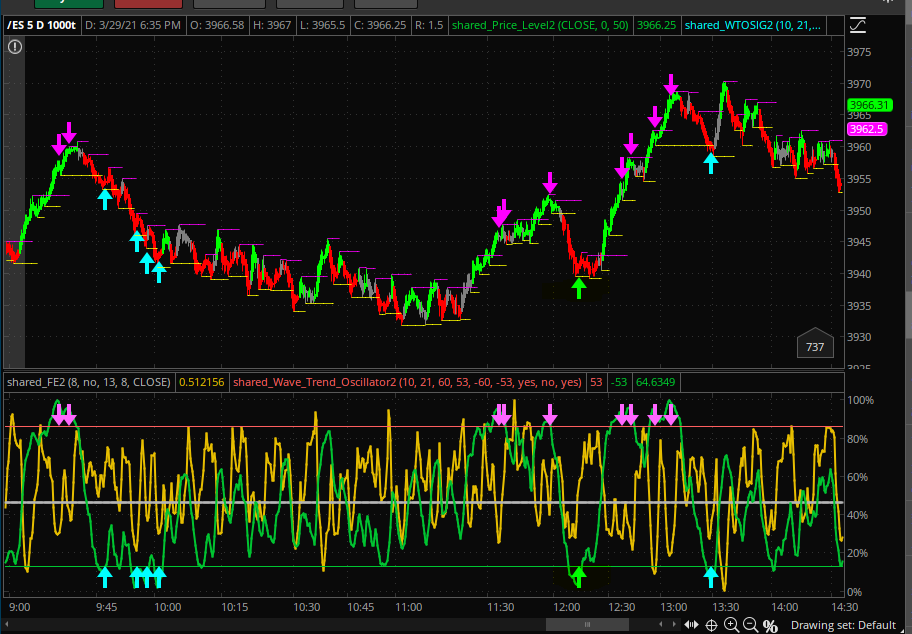

1.Today (03-29-21)I have seen up arrow signals at 9:55,9:57 and 10 AM , and FE line is below middle line, If I take position any of these 3 times there was no much moment .

2.But 12:12 PM there was a up arrow signal and FE is line is at around 14% and the from there it had a good move.

MY question is 9:55 ;9:57 and 10 AM, Is it good time to enter If not what is the criteria I can avoid this and enter the Trade at 12:12 PM?

@TIGER202020 - Those pink and yellow lines are fundamental to this strategy. If you are interested in learning how to use this strategy I strongly suggest you read the entire thread.@Madhu, what are the pink and yellow lines in your chart and how do you use them?

Nice clean Grid setup for this strategy. Could you share your grid?Nice trade on /RTY this morning. One the 1000 tick top chart, gamma being below 50 and then a green bar signal primes the trigger. 1600 tick bottom chart going pink to blue confirms the signal and entry is taken. Bollinger stops go from red to green on top chart acts as additional confirmation. Exited trade when Demark 9 arrow shows up. Traded this one with options for a 20% gain.

I agree with @Earthian. This is a pretty nice setup. Do you mind sharing the grid?I've been playing around with this strategy using the 1000 and 1600 tick charts. I have found that using the Demark 9 counter is doing a good job as indicating a place to get out once you have an objective entry. It does not get you every nickel on the move but it does keep you out of trouble. See screenshot from yesterday. On ToS the Demark 9 is study is called "Sequence Counter". Best - Matt

Here is one for /NQ today @12.05Sure - here you go. I use this grid to watch for a buy/sell bar on the major index futures, and when I get one I switch to a single full screen grid to watch for confirmation. For some reason, the pivot study stops the autozoom from working correctly so you have to manually adjust when you open the grid. I continue to play around with this so if you load this grid in the future it may not look exactly the same

http://tos.mx/G3SfOr8

@megastar I don't like labeling it as the "right" entry, but that is basically the trade I took today. I entered at 13954.75 when the 1600 tick turned blue. I exited at 13968 at the DeMark 9 label.

@kmeade Thank you but I cannot claim this to be my set-up. Everything you see is standing on the shoulders of the 40+ pages before this one@_Merch_Man_ I have used your set up a couple of times with all winning trades so far. Thank you for sharing this.

Perfect.. Thanks@megastar I don't like labeling it as the "right" entry, but that is basically the trade I took today. I entered at 13954.75 when the 1600 tick turned blue. I exited at 13968 at the DeMark 9 label.

@_Merch_Man_ i think you have got it work completely for you can you please explain exactly how you are using it, it will be extremely helpful?@kmeade Thank you but I cannot claim this to be my set-up. Everything you see is standing on the shoulders of the 40+ pages before this one

Do you have a specific question about what I (and others) have already posted?@_Merch_Man_ i think you have got it work completely for you can you please explain exactly how you are using it, it will be extremely helpful?

Thanks!

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.