@lazeelink Thank you for the information and yes it was helpful, I was also considering the Mini ES to start. I will be contacting TD directly but unfortunately the customer support was already closed in my area. Thanks again for your response.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

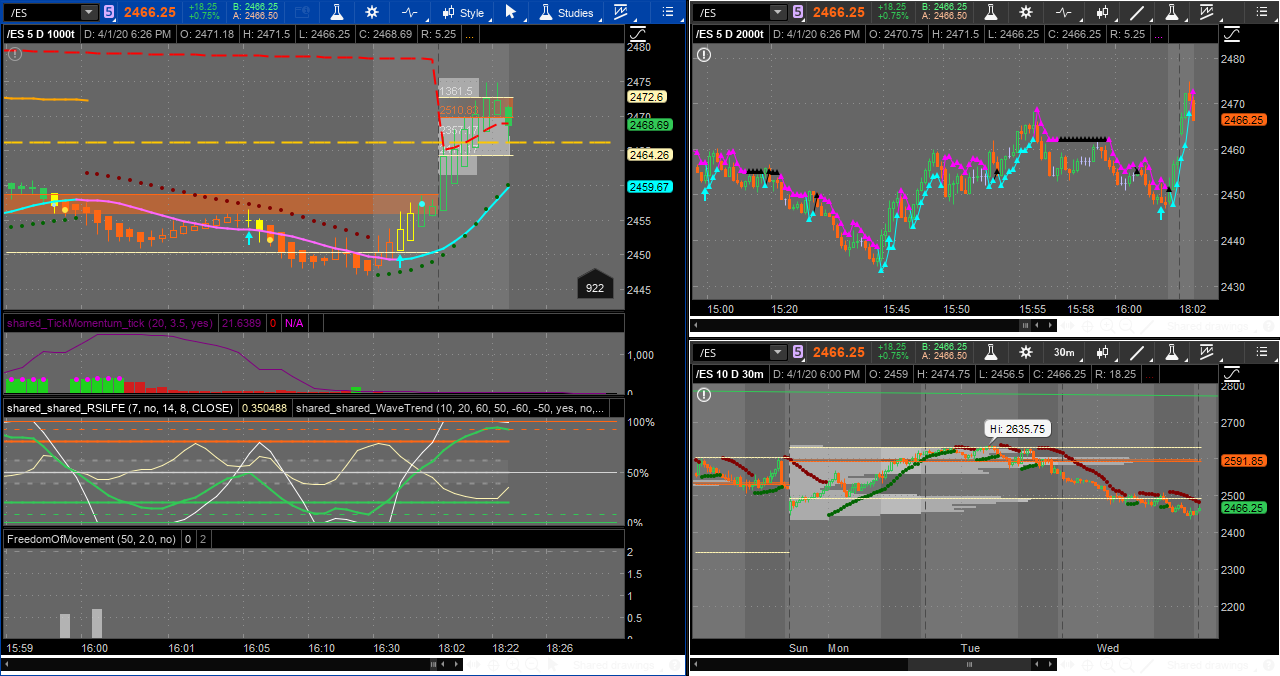

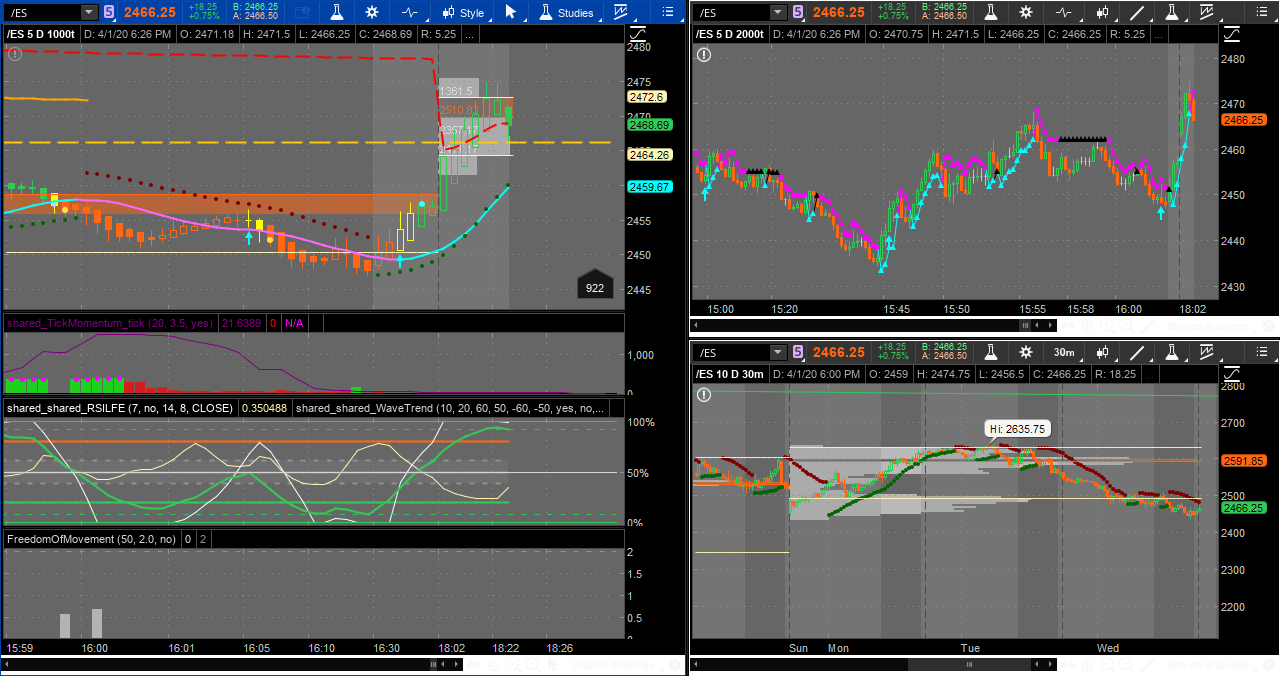

/ES Futures Trading Strategy on ThinkorSwim

- Thread starter blakecmathis

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

blakecmathis

Well-known member

I haven't noticed a difference in the accuracy of the signals. What I have noticed is that identifying specific entries/exits is more difficult. Times like this are when a good stop loss is crucial to your setup. The best part about the current market is that a lot more buy/sell signals are being generated due to extremely high volatility. Trust the setup. Trust the signals. Obey the stop loss. Hope everyone is turning a profit in this market

blakecmathis

Well-known member

How's everybody been doing??

Thanks for that info. I know stop loss settings are a matter of personal tolerance, but how much of a SL is your standard? I trade MIco Minis as opposed to Mini ES but normally have a $50 (10 points in Micro) in mind but rarely use it. I either panic out before its hit or let it run and THEN panic out! As you say, trust the signals.I haven't noticed a difference in the accuracy of the signals. What I have noticed is that identifying specific entries/exits is more difficult. Times like this are when a good stop loss is crucial to your setup. The best part about the current market is that a lot more buy/sell signals are being generated due to extremely high volatility. Trust the setup. Trust the signals. Obey the stop loss. Hope everyone is turning a profit in this market

Doing great on my paper account but staying about even on my hard $ account using similar signals on both. Trying to refine the do's and don'ts and control my fear and greed. As a rule, do you trade only when the 1000 tick and 2000 tick charts agree, using CCI or Hull as added confirmation?How's everybody been doing??

blakecmathis

Well-known member

@lazeelink I use the Bollinger Band stop loss so it always varies on the distance from the current market price. Sometimes it could easily be 10 points away but I never let it go that far against me. When I get that upside down on a trade it's fairly easy to recognize that I've made a bad trade based on price action and I need to accept my losses and close out my position.

Excellent idea. Standard (20,-2.0, 2.0) or modified settings on the Bollinger Bands?@lazeelink I use the Bollinger Band stop loss so it always varies on the distance from the current market price. Sometimes it could easily be 10 points away but I never let it go that far against me. When I get that upside down on a trade it's fairly easy to recognize that I've made a bad trade based on price action and I need to accept my losses and close out my position.

blakecmathis

Well-known member

I roll with (20, -1.0, 1.0)

And one final question. As a rule, do you trade only when the 1000 tick and 2000 tick charts agree, using CCI or Hull as added confirmation? Sorry for being a pest.I roll with (20, -1.0, 1.0)

blakecmathis

Well-known member

Youre good man no worries. 2000t is basically just used for CCI confirmation. However, If they do agree as far as the WTO signals go, thats just icing on the cake. Tried to get in long on that last run up @ 2458.75 (looking for 2458.25) but no fill. Touched it three times on that single candle.

Thanks! I got in long @ 2457.50 (paper) and hanging in there. I have a sell @ 50% FIB from the 11:09 AM high but not sure it will make it.Youre good man no worries. 2000t is basically just used for CCI confirmation. However, If they do agree as far as the WTO signals go, thats just icing on the cake. Tried to get in long on that last run up @ 2458.75 (looking for 2458.25) but no fill. Touched it three times on that single candle.

blakecmathis

Well-known member

@lazeelink Hell yeah man!!

@blakecmathis I'm hoping that you can help me out. I have been trying to find the link for the grid that I posted below and cannot find it, if you might know what post # it is from it would be greatly appreciated. Thank you for your selflessness.

Here is the list I have for the different grids that have been posted in this forum. Hopefully the one you are looking for is among them.@blakecmathis I'm hoping that you can help me out. I have been trying to find the link for the grid that I posted below and cannot find it, if you might know what post # it is from it would be greatly appreciated. Thank you for your selflessness.

https://tos.mx/4gmXmj2https://tos.mx/O4giY9V

https://tos.mx/4gmXmj2

https://tos.mx/O4giY9V

https://tos.mx/WX94HLh

https://tos.mx/4gmXmj2

https://tos.mx/mWfhOCS

https://tos.mx/zaztFEe

https://tos.mx/z4iTUQL

https://tos.mx/1bDLCyNhttps://tos.mx/bDgZoOH

Thank you so much for your reply but unfortunately it was not among the links that you sent. I have no idea were how I got this particular version, I have been through all the links that I could find in this thread. The issue that I'm having is that I have that grid in live training but I would like to use it as well in Paper trading to get a feel for it, I just can't figure out how to copy it over.

I'll keep checking out YouTube vids. lol

I'll keep checking out YouTube vids. lol

Hi, share it. Then use the link to open it in the paper trading setup. Add it to here as well so everyone knows what you are referring to.Thank you so much for your reply but unfortunately it was not among the links that you sent. I have no idea were how I got this particular version, I have been through all the links that I could find in this thread. The issue that I'm having is that I have that grid in live training but I would like to use it as well in Paper trading to get a feel for it, I just can't figure out how to copy it over.

I'll keep checking out YouTube vids. lol

@Robster021 I have been searching endlessly on how to share the grid and cannot figure it out. I don't know if its the fact that I am in Canada but I seem to have different options then all the vids I have been watching. I posted the grid that I am referencing is #577.

blakecmathis

Well-known member

@kmeade I think that is one of @skynetgen grids. If I had it saved I would definitely send it your way but unfortunately I dont think he ever shared the actual grid that you showed in that screenshot.

@blakecmathis that's what I was thinking. I have tried every grid that was shared but can't find it, I'm not sure how I got it to begin with.

@lazeelink I am in the same boat. I have been doing very well with this setup in paper account but haven't built up the courage to live with it yet.

@lazeelink I am in the same boat. I have been doing very well with this setup in paper account but haven't built up the courage to live with it yet.

- Status

- Not open for further replies.

Ben's Swing Trading Strategy + Indicator

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Similar threads

-

/ES Futures, /GC, and even FX Trading strategy For ThinkOrSwim

- Started by tradebyday

- Replies: 38

-

-

Futures strategy: Wide Ranging Days In ThinkOrSwim

- Started by danB

- Replies: 33

-

-

Verniman strategy for /ES Futures Entry signals For ThinkOrSwim

- Started by STB

- Replies: 41

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1507

Online

Similar threads

-

/ES Futures, /GC, and even FX Trading strategy For ThinkOrSwim

- Started by tradebyday

- Replies: 38

-

-

Futures strategy: Wide Ranging Days In ThinkOrSwim

- Started by danB

- Replies: 33

-

-

Verniman strategy for /ES Futures Entry signals For ThinkOrSwim

- Started by STB

- Replies: 41

Similar threads

-

/ES Futures, /GC, and even FX Trading strategy For ThinkOrSwim

- Started by tradebyday

- Replies: 38

-

-

Futures strategy: Wide Ranging Days In ThinkOrSwim

- Started by danB

- Replies: 33

-

-

Verniman strategy for /ES Futures Entry signals For ThinkOrSwim

- Started by STB

- Replies: 41

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.