blakecmathis

Well-known member

Yeah I'm thinking between 35-37

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Thanks for continuing to post -- honestly, the only thread I actively track.Chop update

@blakecmathis Hi.. new to trading and new on this site. excellent site for learning. read thru this thread and have quick question please... can /ES strategy be used for trading UGAZ/DGAZ (/NZ) UWT/DWT (/CL) and stocks? please suggest

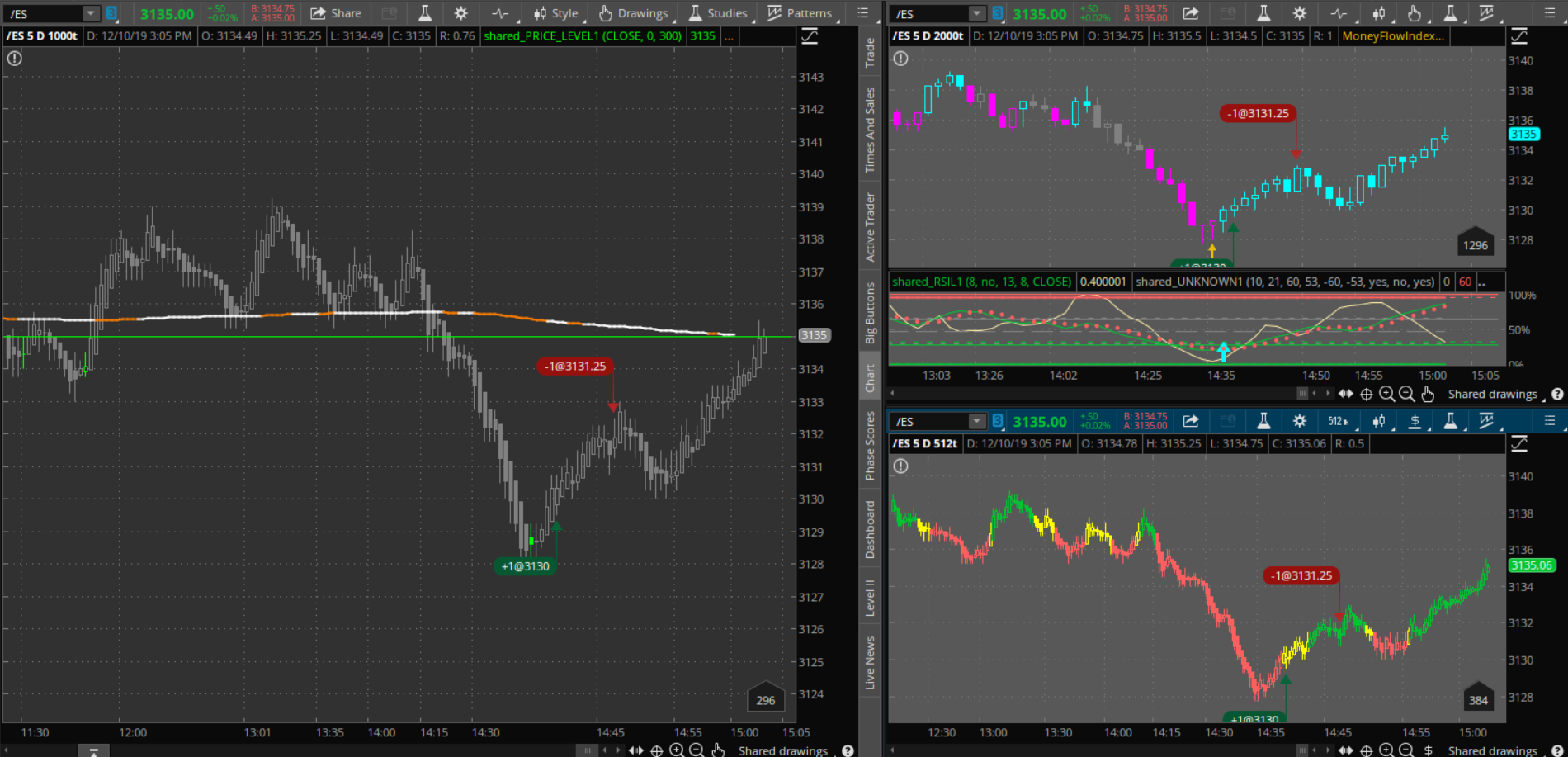

Money in the pocket is better than no money at all. What you did was a good trade. I was out at 3 ticks on that move. It was to close to the end of the day to risk it for me.I'm a newbie to shorter term trades and definitely to futures trades. However, I've placed two trades using the tools shared in this group and I felt comfortable with the indicators. Both were profitable, but I sold early (and I'm okay with that). Thanks to the group for your patience and willingness to share. You're making a difference.

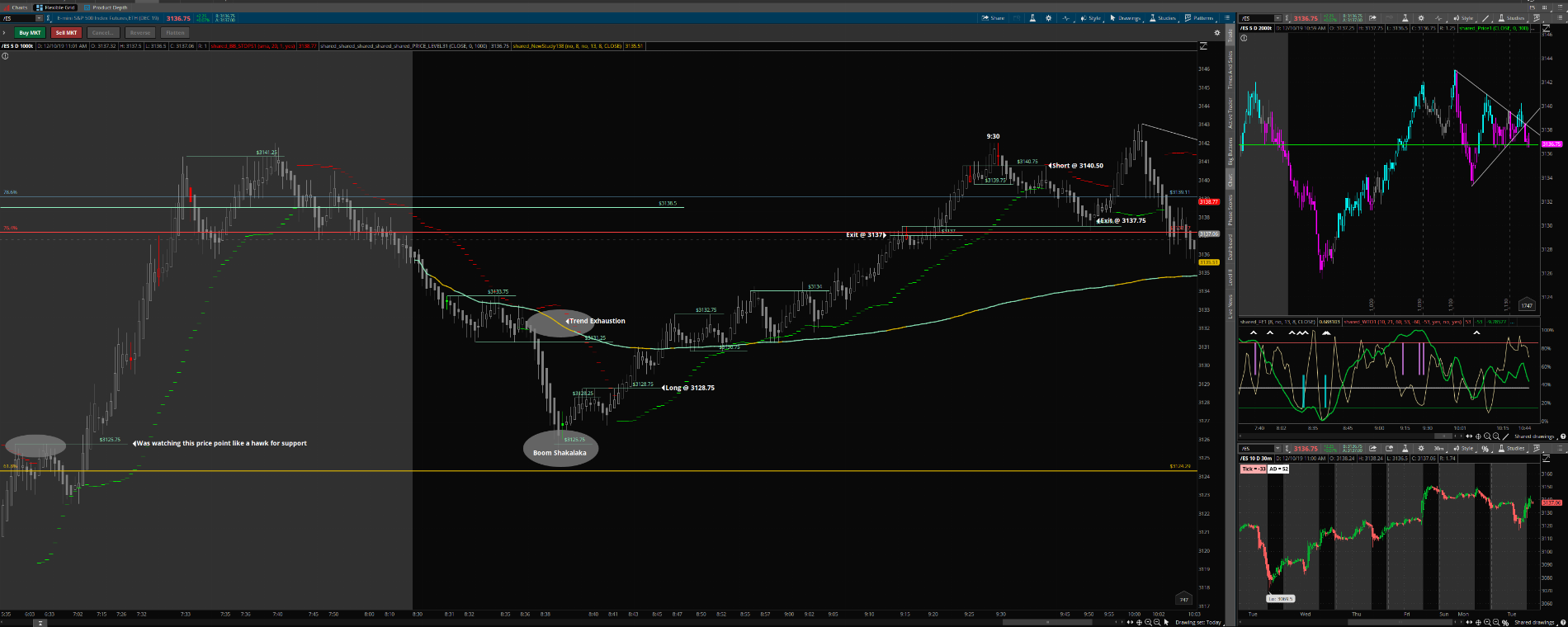

Here's the most recent trade. Feedback is welcomed.

It's exactly why I sold it so quickly. I didn't want the day to end. Thanks for the encouragement!Money in the pocket is better than no money at all. What you did was a good trade. I was out at 3 ticks on that move. It was to close to the end of the day to risk it for me.

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.