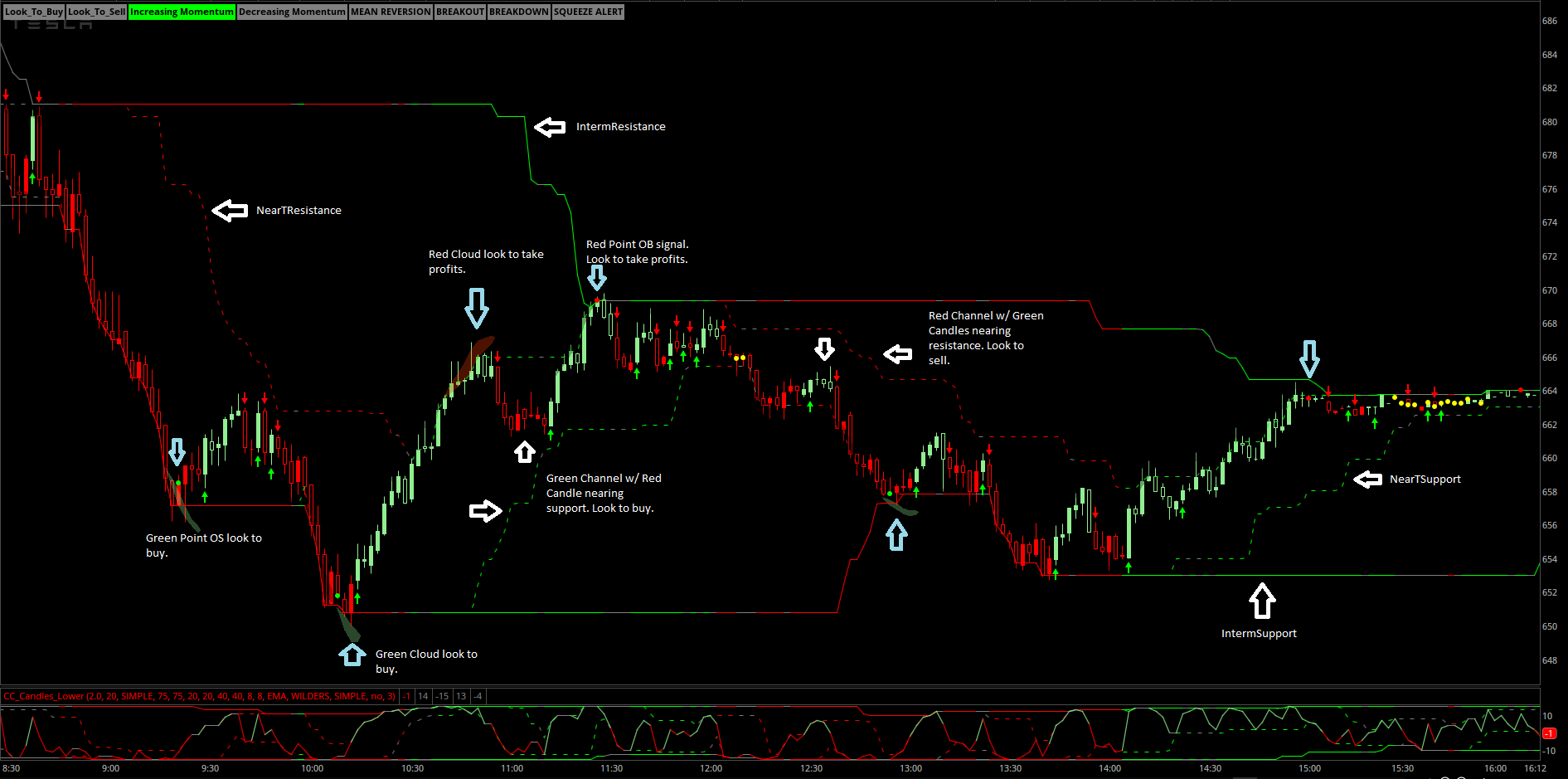

I am glad to hear the clouds are showing for you and that you are finding the indicator useful! I wanted you to know that this is not a repainting indicator though. Once the candle is closed, the painting will not change.The clouds are showing up now. Not sure what the issue was before. This works well thus far combined with my own strategy. The one thing is really helps me do is focus when the "look to buy" or "look to sell" label lights up. I also notice that if the "breakout" is lit up it seems to drive the train. I really do like the labels lighting up because it grabs your attention to what the price/volume action may be alerting you to. I still use my own stops, but I can get a pretty solid idea thus far from the various indicators, primarily the labels once I've entered a trade. While it does repaint, the labels can still tell you the story you may need. At least that's what I am seeing thus far during the trial with it. Have to see how it works over several weeks, particularly when the market gets really choppy. Thus far though it is looking really good. Biggest thing as always is finding your stops and exits. I think after using this a few weeks it could become the only indicator I use once I figure out some patterns in how it operates in different conditions. You should make a powerpoint type presentation explaining some of the details like the red/green dots which I think are sort of like warnings of which direction it might break next before an arrow occurs. I cleared pretty much everything else off my charts for this one. Thanks for the hard work on this!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DEEPWATER_THE ONE For ThinkOrSwim

- Thread starter Deepwater

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Trading view works in Pine Script.Hi!

Is there a tradingview version ?

poststreet

Member

we all see the peaks either up or down, in real time will you see part of the peaks,

the peaks seem to form in three hrs on a one hr chart, in real time will you see part of those peaks, one side of the peak,

will a scan fire when one half of the peak is achieved. or must the entire peak be formed for the peak to appear on a chart!

the peaks seem to form in three hrs on a one hr chart, in real time will you see part of those peaks, one side of the peak,

will a scan fire when one half of the peak is achieved. or must the entire peak be formed for the peak to appear on a chart!

I have seen peaks start to form but if by the end of the candle the condition is not met to trigger the Spike, the signal won't print or stick. It is rare for it not to print but i have seen one start to form as a bottom forms but then before the candle completes another wave of selling may remove a condition needed to set the buy spike. Hope that helps. But once the spike prints for good it will not erase or repaint.we all see the peaks either up or down, in real time will you see part of the peaks,

the peaks seem to form in three hrs on a one hr chart, in real time will you see part of those peaks, one side of the peak,

will a scan fire when one half of the peak is achieved. or must the entire peak be formed for the peak to appear on a chart!

I'll have to keep an eye on it as far as repainting goes. I thought I saw it repaint a few times, but that might have been during an active candle. I'm also watching the red/yellow dots that form on the candles. Some are on the top and some are on the bottom of the candle. I also saw the "squeeze alert" trigger in yellow. Is that a cautionary signal or does an actual squeeze turn green or red depending on direction? Yes, I am finding it useful, mostly in confirming my own trading strategy, but it also keeps me more focused when I see the indicators doing something after I enter a trade. I'd like to find something that shows the percentage over the daily volume average so you know if the volume is over 100% and by how much. It's obvious that if it breaks above the daily volume average it is above 100%, but I like to know if it is at least 130% during that candle. I'm using your CC indicator which is more like the Mass Action Indicator because it gives a LOT of input and can really help confirm or deny if something is setting up for your strategy. I'll get a bunch of red/green arrows after I've entered a trade, but I keep an eye on the labels more than anything else along with the price/volume action (which is what I did before along with the stock's behavior in previous situations). You've definitely put a LOT of effort into this coding and I think people can definitely benefit from it if they study it, even more so if they tie it to a strategy that has had some modest success because this could be something that could turn a modest success into a significant success. For me it gives me 'warnings' of potential entries so I stay focused watching for the actual entry. Same for potential exits. When the labels start showing me weakness, I pay closer attention. It can definitely help you when you start getting bored with watching a chart. With this I can put the monitor next to my laptop and play Plants Vs. Zombies and see the labels out of the corner of my eye. Once I see the change I'm interested in, I get back into focus. I'll keep you posted on its performance and if you want I'll throw some ideas at you if I see any potentially useful ones. There's definitely a lot of great stuff in it already so not sure if there would be anything useful to add. I definitely appreciate you sharing your hard work with all of us on here. People should most definitely check it out and see how they can incorporate it with their own trading strategies.I am glad to hear the clouds are showing for you and that you are finding the indicator useful! I wanted you to know that this is not a repainting indicator though. Once the candle is closed, the painting will not change.Here is an image explaining some details about the indicator's signals. Thank you for the feedback! Happy trading!

Hi FreefallJM03!,I'll have to keep an eye on it as far as repainting goes. I thought I saw it repaint a few times, but that might have been during an active candle. I'm also watching the red/yellow dots that form on the candles. Some are on the top and some are on the bottom of the candle. I also saw the "squeeze alert" trigger in yellow. Is that a cautionary signal or does an actual squeeze turn green or red depending on direction? Yes, I am finding it useful, mostly in confirming my own trading strategy, but it also keeps me more focused when I see the indicators doing something after I enter a trade. I'd like to find something that shows the percentage over the daily volume average so you know if the volume is over 100% and by how much. It's obvious that if it breaks above the daily volume average it is above 100%, but I like to know if it is at least 130% during that candle. I'm using your CC indicator which is more like the Mass Action Indicator because it gives a LOT of input and can really help confirm or deny if something is setting up for your strategy. I'll get a bunch of red/green arrows after I've entered a trade, but I keep an eye on the labels more than anything else along with the price/volume action (which is what I did before along with the stock's behavior in previous situations). You've definitely put a LOT of effort into this coding and I think people can definitely benefit from it if they study it, even more so if they tie it to a strategy that has had some modest success because this could be something that could turn a modest success into a significant success. For me it gives me 'warnings' of potential entries so I stay focused watching for the actual entry. Same for potential exits. When the labels start showing me weakness, I pay closer attention. It can definitely help you when you start getting bored with watching a chart. With this I can put the monitor next to my laptop and play Plants Vs. Zombies and see the labels out of the corner of my eye. Once I see the change I'm interested in, I get back into focus. I'll keep you posted on its performance and if you want I'll throw some ideas at you if I see any potentially useful ones. There's definitely a lot of great stuff in it already so not sure if there would be anything useful to add. I definitely appreciate you sharing your hard work with all of us on here. People should most definitely check it out and see how they can incorporate it with their own trading strategies.

I want to reiterate that this indicator does not repaint. Once a candle is closed, it is what it is. No repainting. The position of the points (dots) on the candles isn't of much relevance. They will be positioned on the close price of the candle. The squeeze alert (yellow dots) remain yellow. When they appear, it is telling the trader that a price squeeze in play. When a squeeze develops, it usually results in a release of volatility and larger price movements. When they appear, its important to use the trend indicated by the candle color and the trend environment indicated by the near term and intermediate support and resistance lines to assess the most likely direction for the squeeze to play out. So in essence the goal of the squeeze alert is to make sure the trader is on the right side of the price movement. Thank you for sharing your feedback! I am glad you are finding it complementary to your trading strategy/style.

G

greenalert20

Guest

When did this entire thread turn into a discussion about Confirmation Candles indicator?

I am really liking the Deepwater indicator. I am using the original Deepwater and also the lower time. The best confirmations are when both indicators give a strong buy signal.

I am really liking the Deepwater indicator. I am using the original Deepwater and also the lower time. The best confirmations are when both indicators give a strong buy signal.

Christopher has good indicators too LOL. I tried to make mine easy enough for a 10 year old or a 80 year old to figure out how to use it pretty fast and be pretty accurate to make money trading. When a stock moves it lets you know it. I tell people, run it for a week, and if something is moving see what the Chart does. My indicator likes Volatility and gets very active. I like an indicator that starts getting excited when things get exciting.When did this entire thread turn into a discussion about Confirmation Candles indicator?

I am really liking the Deepwater indicator. I am using the original Deepwater and also the lower time. The best confirmations are when both indicators give a strong buy signal.

Last edited:

Sorry for hijacking the thread (definitely wasn't my intention). I was just trying to help FreefallJM03 with their question regarding DeepWater's indicator giving entries and not giving exit signals in downtrends. (see pg.4 of this thread)When did this entire thread turn into a discussion about Confirmation Candles indicator?

I am really liking the Deepwater indicator. I am using the original Deepwater and also the lower time. The best confirmations are when both indicators give a strong buy signal.

G

greenalert20

Guest

its all good @Christopher84. We appreciate your efforts as well and I actually installed your confirmation candles indicator as well a few days ago and have a few questions myself that I will articulate and pose on the thread.

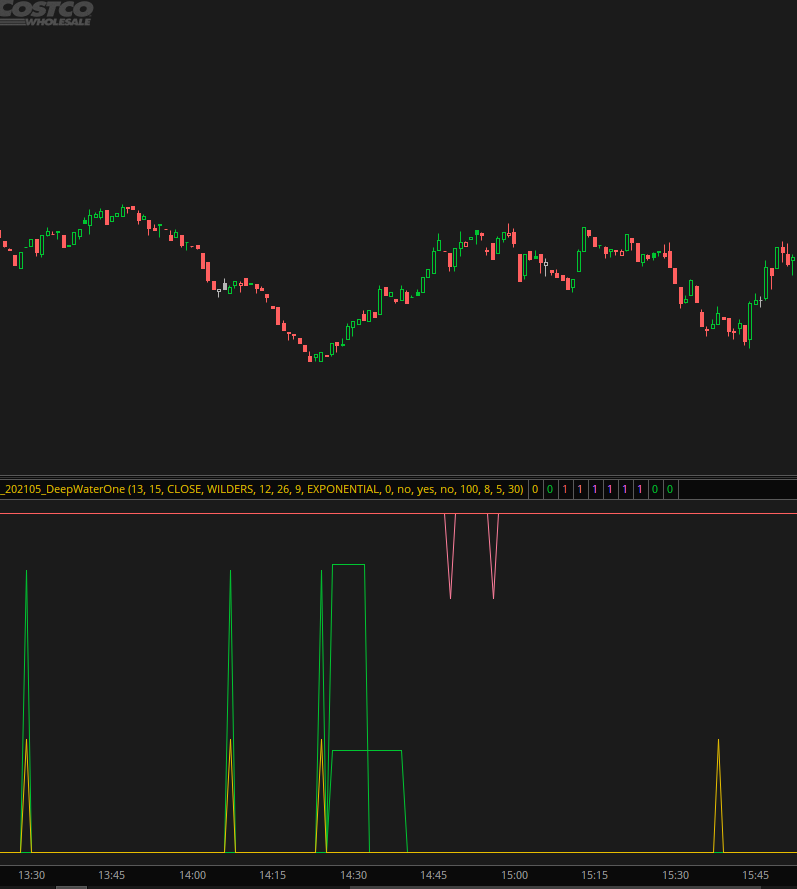

Just trying to test the great thread. But it's a little difficult for me to trade on 1m chart. could you guide me with the following chart of COSTCO during 14:00-15:00. tksIf you put up 7 - 14 charts, different stocks, and add DEEPWATER_THE ONE and sit back and watch it work, it will alert you to many different things. Load it and watch it work. If you get a yellow/green Spike up it commonly marks the bottom and a second one close to the first is confirmation and an even stronger buy signal. 10% is knowing when to buy. 90% is knowing when to sell LOL. I made the RSI Cumulative to give me a second sell signal and it gives purple SPIKES DOWN. You get PURPLE SPIKES DOWN You better start selling some or part. or all. Good luck trading. It's just a tool but I have found it to be Synergetic in that all the parts make it very very useful.

PS: If there is no second spike then NO trading due to no confirmation?! If THREE(as shown in the figure) then a solid confirmation?!Just trying to test the great thread. But it's a little difficult for me to trade on 1m chart. could you guide me with the following chart of COSTCO during 14:00-15:00. tks

PS: how to avoid the false signals like the second figure to the right (divergence)?

Last edited:

A Yellow Spike is an Oversold Signal (I call it a minor buy signal) if you get a Green /Yellow taller Spike it is a stronger buy signal. If you get a Yellow/Green signal the stock could still roll over and DIP some more and shortly give you another Yellow/Green Spike to buy (a Second buy signal considered stronger) If you get the Yellow/Green taller spike and also a wider Green RSI Compounding oversold signal I consider it strong mark of a bottom and would buy it myself if it is confirmed by my knowledge of the stock (You see one of these in your first chart you posted). Now where you sell it depends on your risk threshold but the first red top down small spike is an overbought signal and can be sold or if you want a chance of bigger gains you can hold for the Larger RED Spikes and the even massive RSI Compound overbought Red signal bundle that can come on some charts.PS: If there is no second spike then NO trading due to no confirmation?! If THREE(as shown in the figure) then a solid confirmation?!

PS: how to avoid the false signals like the second figure to the right (divergence)?

Also if you buy on a buy signal and the stock keeps falling then maybe a stop loss my be appropriate. I don't give financial advice but this is a tool that you can use to help you take emotion out of trades and have the machine look for high probability entry and exits and alert you clearly. It should be used with other TA tools.

G

greenalert20

Guest

I updated the indicator with this update. However, I noticed that I lost very strong Buy signals towards morning open on Tesla and other stocks i trade on 1 min and 2 min chart. The previous code has been working really well for me for lower timeframes especially during when the market opens. I also use it with the slight Deepwater variant for lower-timeframe based on a contribution by another user on this thread. Do you mind re-sharing the previous build dated 05/07 as I did an overwrite on that version with the version you just updated. Thank you!

@greenalert20

take out RSIAvg3 < 40 from line TrendReversal1 it should be back to what you had before

take out RSIAvg3 < 40 from line TrendReversal1 it should be back to what you had before

Deepwater just want to say thank you again this has been a big help for for meThe code gives plenty of great buy signals. It's figuring out when to sell and not sell too early. So I trade with a yellow + green spikes as buys and wait for an RSI cumulative Purple sell

Some people were complaining they got false buy signals so in trying to tighten it up it may have dropped a few strong buys that were borderline.I updated the indicator with this update. However, I noticed that I lost very strong Buy signals towards morning open on Tesla and other stocks i trade on 1 min and 2 min chart. The previous code has been working really well for me for lower timeframes especially during when the market opens. I also use it with the slight Deepwater variant for lower-timeframe based on a contribution by another user on this thread. Do you mind re-sharing the previous build dated 05/07 as I did an overwrite on that version with the version you just updated. Thank you!

Actually looking at TSLA 1D 1Min the opening Strong buy was marginal today and you got the yellow buy with the new code, just not the strong buy signal.

I will run the code both ways on two different lines. the 5/7/2021 code had those plot if you want to go back to original for now. replace this line.

plot TrendReversal1 = (twoBarPivotMACD and Highest(overSoldRSIHeavy, 6) > 0) / 1.2; #Original5/7/2021

Last edited:

Deepwater, thanks for sharing it with the community. I have seen many Buy signals than Sell Signals missing out on shorts. On the sell signal, what is the difference between Pink and Purple color signals?Small code update today. Added 'and RSIAvg3 < 40' to try and get fewer spurious Yellow/Green Buy Spikes

Modified this line: plot TrendReversal1 = (twoBarPivotMACD and RSIAvg3 < 40 and Highest(overSoldRSIHeavy, 6) > 0) / 1.2;

Similar threads

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

-

-

-

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 13

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

845

Online

Similar threads

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

-

-

-

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 13

Similar threads

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

-

-

-

-

Repaints AGAIG Sell Calls & Puts For ThinkOrSwim

- Started by csricksdds

- Replies: 13

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.