Fitzman

New member

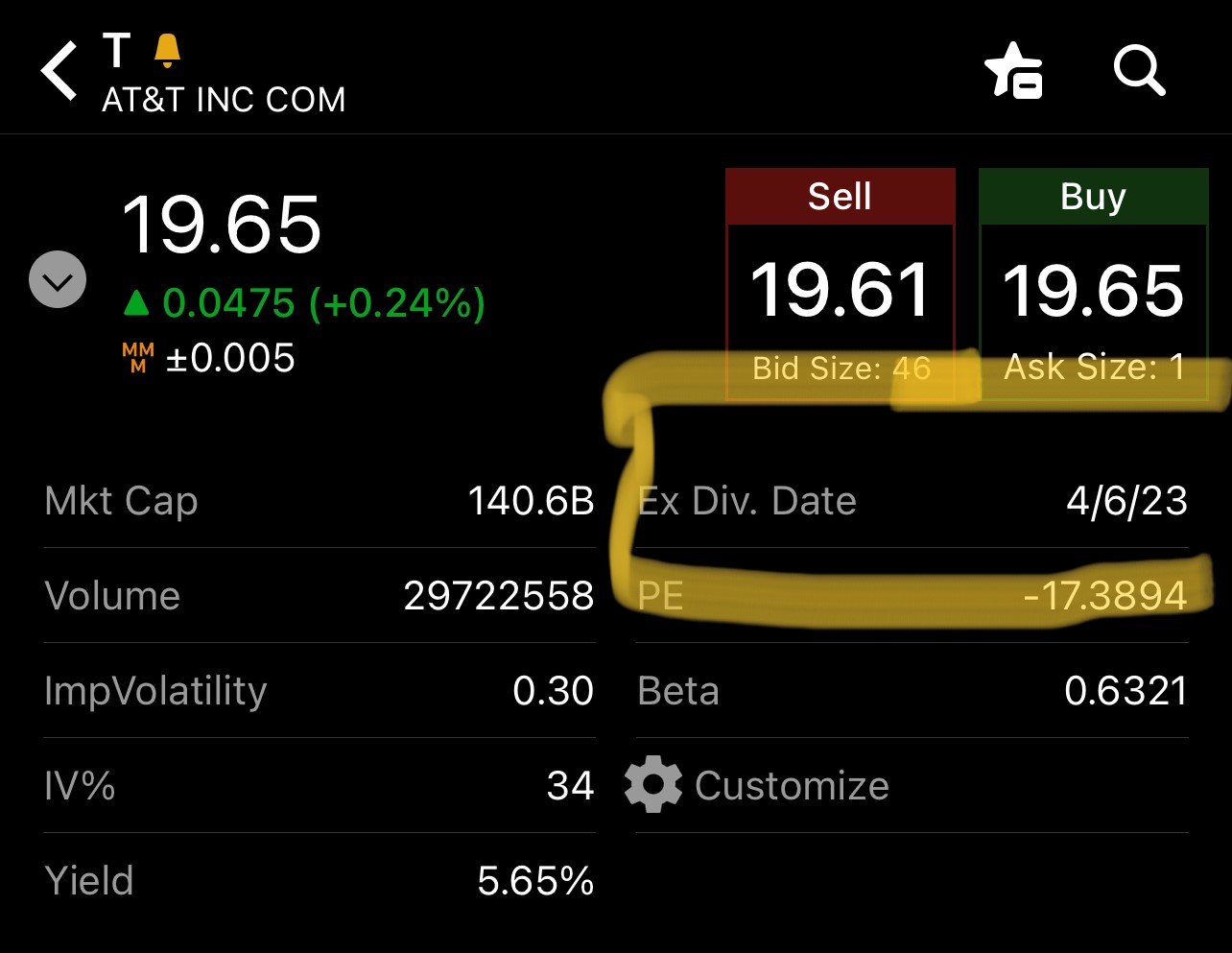

“Dividend capture strategy” returns are the trading technique of buying a stock just before the dividend is paid, holding it just long enough to collect the dividend, then selling it. If you can sell it for as much as you paid, you have “captured” the dividend at no cost.

To be eligible to receive dividends, you have to own the stock at least one trading day before the dividend payment date.

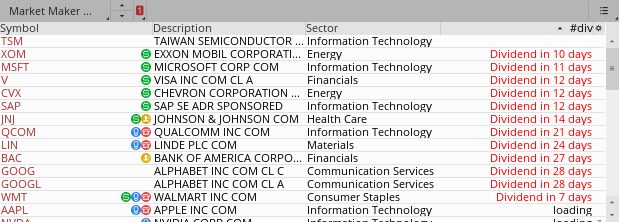

Therefore, is it possible to create a watchlist column displaying the ex div date - either date displayed and/or the number of days until ex div date?

I know the actual dividend date is displayed as an event in the chart, and the ex div date can be selected as a visible point in the TOS app, but I cannot seem to find it as a watchlist item.

Thank you,

Fitz

To be eligible to receive dividends, you have to own the stock at least one trading day before the dividend payment date.

Therefore, is it possible to create a watchlist column displaying the ex div date - either date displayed and/or the number of days until ex div date?

I know the actual dividend date is displayed as an event in the chart, and the ex div date can be selected as a visible point in the TOS app, but I cannot seem to find it as a watchlist item.

Thank you,

Fitz

Last edited by a moderator: