Bingy

Member

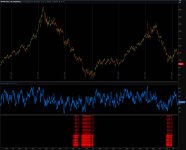

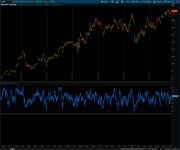

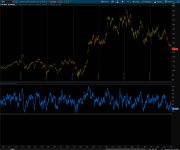

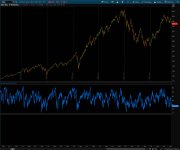

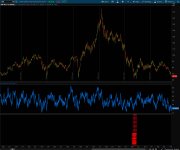

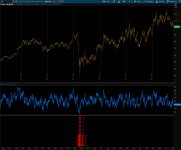

The following Indicator pairs well with a standard RSI indicator to pinpoint short and long entries on the Daily Time Frame for stocks. It's a freebie to give back to the community here. The Threshold's in relation to "DLength" can be tuned to work on lower Time Frames as well. Enjoy...

Code:

declare lower;

#DISCOUNT INDICATOR

# Define input parameters

input Dprice = close;

input Dlength = 2000;

input premiumThreshold = 2.315; # Premium threshold

input discountThreshold = 0.6861; # Discount threshold

# Calculate the moving average

def smaValue = SimpleMovingAvg(Dprice, Dlength);

# Calculate the premium and discount levels

def isPremium = Dprice > smaValue * premiumThreshold;

def isDiscount = Dprice < smaValue * discountThreshold;

# Manually draw lines

AddVerticalLine(isPremium, "Search for Short", Color.GREEN);

AddVerticalLine(isDiscount, "Search for Long", Color.RED);