Hello,

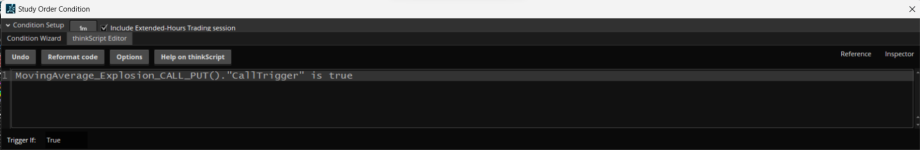

My question is about setting up a conditional order for a 1 minute candle relative to a study. I would like to buy a stock only once the stock price is ABOVE the 1m VWAP from the previous 1minute candle. I know how to set up the conditional order (or the alert) relative to the price crossing above the 1m VWAP but do not know how to relate that to the actual buy if only the stock is presently above the past 1 minute VWAP. Thank you for your help.

My question is about setting up a conditional order for a 1 minute candle relative to a study. I would like to buy a stock only once the stock price is ABOVE the 1m VWAP from the previous 1minute candle. I know how to set up the conditional order (or the alert) relative to the price crossing above the 1m VWAP but do not know how to relate that to the actual buy if only the stock is presently above the past 1 minute VWAP. Thank you for your help.