RobertPayne

Member

You will need to use a

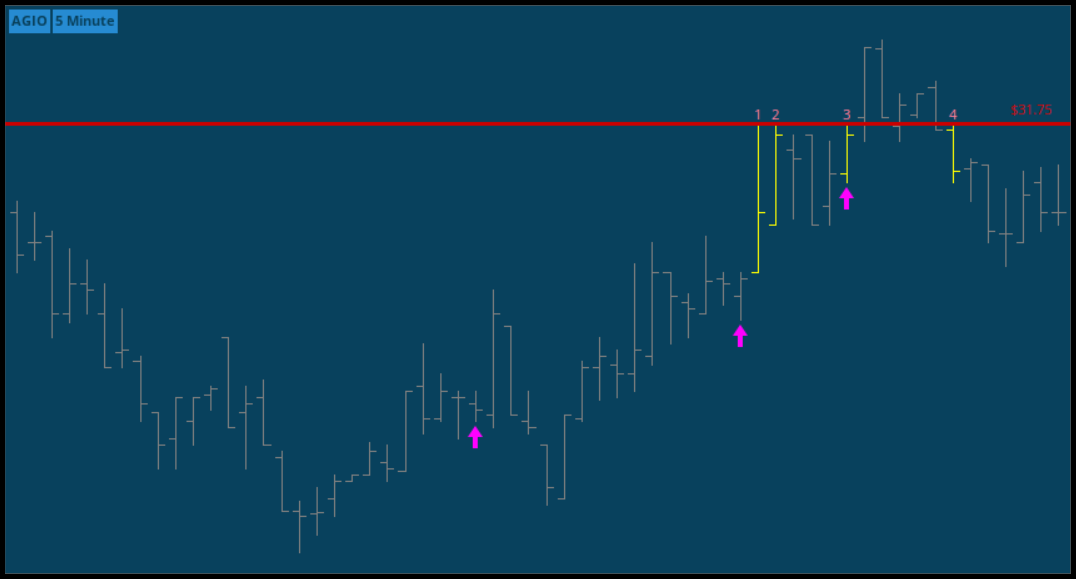

Here's an example.

fold loop in thinkScript. More information on this function is available here: https://tlc.thinkorswim.com/center/reference/thinkScript/Reserved-Words/fold.htmlHere's an example.

Ruby:

input length = 60;

def countHighTouches = fold i = 0 to length with internalSum = 0 do if GetValue(high, i) == high then internalSum + 1 else internalSum;

plot arrowUp = counthightouches == 3;

arrowup.setpaintingStrategy(paintingStrategy.BOOLEAN_ARROW_UP);

arrowup.setdefaultColor(color.magenta);

arrowup.setlineWeight(3);