There are many profitable gap trading strategies out there. You often hear people mention a stock when it's gapping up or gapping down. This is an indicator based on the Buyable Gap-Up Strategy written here.

Before using the script below, I highly recommend this article as it lay out the process of trading gaps.

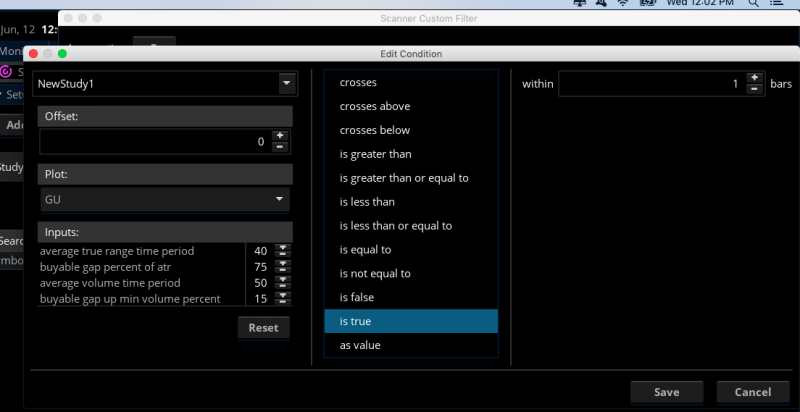

Switch over to the Scan tab, add a Study filter, enter your indicator's name then scan for GU within X bars.

Credit:

Before using the script below, I highly recommend this article as it lay out the process of trading gaps.

thinkScript Code

Rich (BB code):

#

# Copyright 2014 Scott J. Johnson (http://scottjjohnson.com)

#

# Licensed under the Apache License, Version 2.0 (the "License");

# you may not use this file except in compliance with the License.

# You may obtain a copy of the License at

#

# http://www.apache.org/licenses/LICENSE-2.0

#

# Unless required by applicable law or agreed to in writing, software

# distributed under the License is distributed on an "AS-IS" BASIS,

# WITHOUT WARRANTIES OR CONDITIONS OF ANY KIND, either express or implied.

# See the License for the specific language governing permissions and

# limitations under the License.

#

#

# BuyableGapUpIndicator

#

# Based on Gil Morales and Chris Kacher's rules for buyable gaps up.

# http://www.traderplanet.com/articles/view/164232-gain-your-stock-edge-buyable-gap-up-strategy/

#

# This study doesn't work intraday because the volume used is the actual volume

# and not the projected end-of-day volume. Instead, this study is useful

# in post-analysis to quickly find buyable gaps up.

#

# TODO: Add logic to handle the current period gaps up by projecting the full day volume

# based on the current time and volume so far.

#

input AverageTrueRangeTimePeriod = 40;

input BuyableGapPercentOfATR = 75; # percent of average true range to qualify for as a gap

input AverageVolumeTimePeriod = 50; # calculate 50 day MA volume

input BuyableGapUpMinVolumePercent = 150; # 150% of 50 day MA volume

def AverageTrueRange = reference ATR(AverageTrueRangeTimePeriod, averageType = AverageType.SIMPLE);

def OpeningPriceGap = open - high[1];

def AverageVolume = MovingAverage(AverageType.SIMPLE, volume, AverageVolumeTimePeriod );

def GapUp = (OpeningPriceGap >= AverageTrueRange * BuyableGapPercentOfATR / 100) and (volume > AverageVolume * BuyableGapUpMinVolumePercent / 100);

AddChartBubble(GapUp > 0, low, “GU", Color.GREEN, no);Shareable Link

https://tos.mx/Blt9EBGap Up Scanner

If you want to scan for buyable gap ups at market open, add the following code to your indicator.

Rich (BB code):

plot GU = GapUp;

GU.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

GU.SetDefaultColor(GetColor(8));

GU.SetLineWeight(2);Switch over to the Scan tab, add a Study filter, enter your indicator's name then scan for GU within X bars.

Credit:

Attachments

Last edited: