Author Message:

OVERVIEW

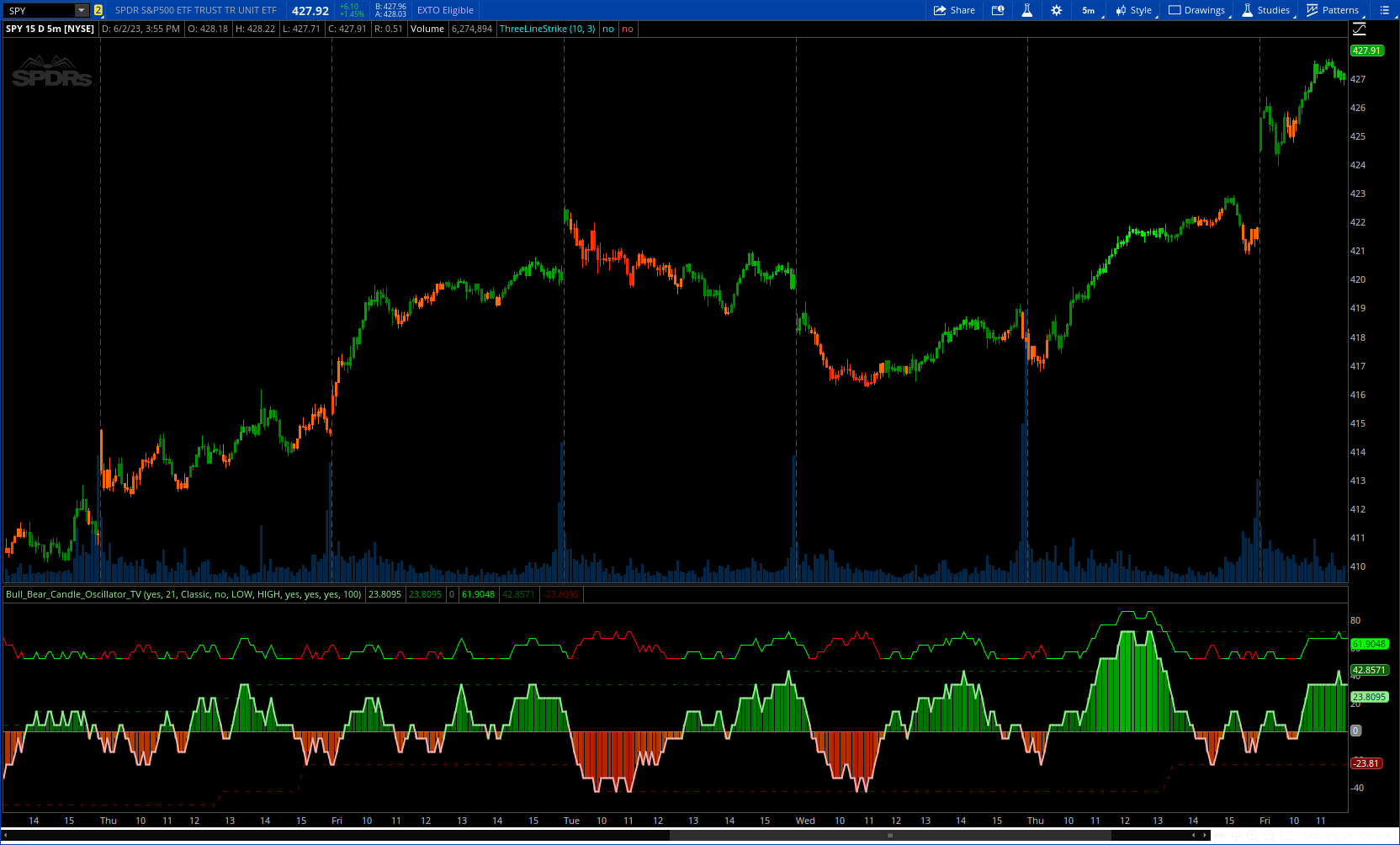

This script determines the proportion of bullish and bearish candles in a given sample size. It will produce an oscillator that fluctuates between 100 and -100, where values > 0 indicate more bullish candles in the sample and values < 0 indicate more bearish candles in the sample. Data produced by this oscillator is normalized around the 50% value, meaning that an even 50/50 split between bullish and bearish candles makes this oscillator produce 0; this oscillator indirectly represents the percent proportion of bullish and bearish candles in the sample.

https://www.tradingview.com/v/Ag7NKgTE/

CODE:

CSS:

#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

# https://www.tradingview.com/v/Ag7NKgTE/

#// © SolCollector

#// BS Computer Science

#// Spencer G.

#indicator("Bull/Bear Candle % Oscillator", overlay = false, max_bars_back = 300)

# converted by Sam4Cok@Samer800 - 06/2023

declare lower;

#// CONSTANT VALUES

input ColorBars = yes;

input SampleLength = 21; # "Sample Length"

input CalculationType = { default "Classic", "Range"}; # "Calculation Type"

input VolumeWeighted = no; # "Volume Weighted"

input UpperWickSource = low; # "Limiting Value: Upper Wicks"

input LowerWickSource = high; # "Lower Wicks"

input DisplayMinMaxGuide = no; # "Display Min/Max Guide"

input ShowConvertedNormalVal = no;

input RestrictMinMaxData = yes;

input MinMaxRestrictVal = 100;

def na = Double.NaN;

def last = isNaN(close);

def classic = CalculationType == CalculationType."Classic";

##-- Color

DefineGlobalColor("up" , CreateColor(76,175,80));

DefineGlobalColor("norm", Color.WHITE);

DefineGlobalColor("dn" , CreateColor(255,82,82));

#// volsum - (float) The volume determined to be in the requested wick at

#// the current chart resolution's candle.

#normalize(series float src, float min, float max) =>

script normalize {

input src = close;

input min = 0;

input max = 100;

def _historicMin1 = 10000000;

def _historicMax1 = 0.00000001;

def _historicMin = Min(src, Min(_historicMin[1], _historicMin1));

def _historicMax = Max(src, Max(_historicMax[1], _historicMax1));

def normalize = min + (max - min) * (src - _historicMin) / Max(_historicMax - _historicMin, _historicMax1);

plot out = normalize;

}

#f_GetWickVol(_lowerTFValArr, _volArr, string _type) =>

script f_GetWickVol {

input _lowerTFValArr = close;

input _volArr = volume;

input _type = 1;

def dir = _type > 0;

def volsum;# = 0

def arrSize = if (!IsNaN(_lowerTFValArr) and _lowerTFValArr > 0) then arrSize[1] + 1 else arrSize[1];

def count;

def value;

def vol;

#// Iterate through the lower resolution candles.

if count[1] < arrSize{

value = GetValue(_lowerTFValArr,arrSize - count[1]);

vol = GetValue(_volArr,arrSize - count[1]);

volsum = if dir then if value > close then volsum[1] + vol else volsum[1] else

if value < close then volsum[1] + vol else volsum[1];

count = count[1] + 1;

} else {

value = value[1];

vol = vol[1];

volsum = volsum[1];

count = count[1];

}

plot return = volsum;

}

#f_ConvertNormalizedValue(_val) =>

script f_ConvertNormalizedValue {

input _val = close;

def norm = 50 + ((AbsValue(_val) / 100) * 50);

plot out = norm;

}

#-- CalculationType

def UPPERWICKSOURCELOWTF = UpperWickSource;

def LOWERWICKSOURCELOWTF = LowerWickSource;

def VOLUMELOWTF = volume;

#/ Ignore introductory data

def body;

def cRange;

def vol;

def bar_index = AbsValue(CompoundValue(1, BarNumber(), 0));

if (bar_index + SampleLength+1)> SampleLength {

body = close - open;

cRange = high - low;

vol = volume;

} else {

body = 0;

cRange = 0;

vol = 0;

}

def bullOrBear = body >= 0;

def upperWick = if bullOrBear then high - close else high - open;

def lowerWick = if bullOrBear then open - low else close - low;

def bullRange = cRange - upperWick;

def bearRange = cRange - lowerWick;

#// If classic, wick volumes are not considered, determine wick volume by

#// lower resolution candles otherwise

def upperWickVol = if classic then 0 else f_GetWickVol(UPPERWICKSOURCELOWTF, VOLUMELOWTF, 1);

def lowerWickVol = if classic then 0 else f_GetWickVol(LOWERWICKSOURCELOWTF, VOLUMELOWTF,-1);

#// Value of candle:

# // classic - 1

# // range - if bullish candle: bullRange, bearRange otherwise

def value = if classic then 1 else if bullOrBear then bullRange else bearRange;

# // Find total volume during the sample length

def sampleVolSum = Sum(vol, SampleLength);

# // For standard volumetric weight, divide current candle's volume by the

# // sample volume, if not weighted return 1

def standardVolWeight = if VolumeWeighted then vol / sampleVolSum else 1;

def classicValues = value * standardVolWeight;

def adjustedBullVol = if VolumeWeighted then (vol - upperWickVol) / sampleVolSum else 1;

def adjustedBearVol = if VolumeWeighted then (vol - lowerWickVol) / sampleVolSum else 1;

# // Determine the proportion of the wick volumes

def bullWickVolWeight = if VolumeWeighted then lowerWickVol / sampleVolSum else 1;

def bearWickVolWeight = if VolumeWeighted then upperWickVol / sampleVolSum else 1;

def complexValue = if bullOrBear then value * adjustedBullVol else value * adjustedBearVol;

def counterValue = if bullOrBear then upperWick * bearWickVolWeight else lowerWick * bullWickVolWeight;

def ternaryValA = if classic then classicValues else complexValue;

def ternaryValB = if classic then 0 else counterValue;

def bullSum = Sum(if bullOrBear then ternaryValA else ternaryValB, SampleLength);

def bearSum = Sum(if !bullOrBear then ternaryValA else ternaryValB, SampleLength);

# // SIGNALPERCENT Calculation

def totalSum = bullSum + bearSum;

def bullPercent = (bullSum / totalSum) * 100;

def bearPercent = (bearSum / totalSum) * 100;

def SIGNALPERCENT = bullPercent - bearPercent;

def sigSize = if !isNaN(SIGNALPERCENT) then sigSize[1] + 1 else sigSize[1];

#// Treat MODARR like a queue

#// Determine the change in HIGHER/LOWERMOD based on SIGNALPERCENT

def HIGHERMOD = if RestrictMinMaxData then highest(SIGNALPERCENT, MinMaxRestrictVal+1) else

if SIGNALPERCENT > HIGHERMOD[1] then SIGNALPERCENT else HIGHERMOD[1];

def LOWERMOD = if RestrictMinMaxData then lowest(SIGNALPERCENT, MinMaxRestrictVal+1) else

if SIGNALPERCENT < LOWERMOD[1] then SIGNALPERCENT else LOWERMOD[1];

def NORMALCONVERT = if ShowConvertedNormalVal then f_ConvertNormalizedValue(SIGNALPERCENT) else na;

def SIGNALCOLOR = SIGNALPERCENT > 0;

def MODARR = if SIGNALPERCENT > MinMaxRestrictVal then MinMaxRestrictVal else

if SIGNALPERCENT < -MinMaxRestrictVal then -MinMaxRestrictVal else SIGNALPERCENT;

def colup = normalize((MODARR), 0, 100);

def col = if AbsValue(colup) > 100 then 100 else if AbsValue(colup) < 0 then 0 else AbsValue(colup);

plot sigLine = SIGNALPERCENT;

sigLine.SetLineWeight(2);

sigLine.AssignValueColor(if SIGNALCOLOR then Color.LIGHT_GREEN else Color.PINK);

plot SIGNALPLOT = SIGNALPERCENT; # "Bull/Bear ±% Line"

SIGNALPLOT.AssignValueColor(if SIGNALCOLOR then CreateColor(0, col * 2.55 , 0) else

CreateColor(255, col * 2.55 , 0));

SIGNALPLOT.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

plot ZEROPLOT = if last then na else 0; # "Zero Line"

ZEROPLOT.SetDefaultColor(Color.GRAY);

plot NormValue = NORMALCONVERT;#, title = "Converted Normalized Value Line",

NormValue.AssignValueColor(if SIGNALCOLOR then Color.GREEN else Color.RED);

plot highMod = if DisplayMinMaxGuide then HIGHERMOD else na; # "Higher Mod Value"

plot LowMod = if DisplayMinMaxGuide then LOWERMOD else na; # "Lower Mod Value"

highMod.SetStyle(Curve.SHORT_DASH);

LowMod.SetStyle(Curve.SHORT_DASH);

highMod.SetDefaultColor(Color.DARK_GREEN);#GlobalColor("up"));

LowMod.SetDefaultColor(Color.DARK_RED);#GlobalColor("dn"));

AssignPriceColor(if !ColorBars then Color.CURRENT else

if SIGNALCOLOR then CreateColor(0, col * 2.55 , 0) else

CreateColor(255, col * 2.55 , 0));

#-- END of CODE