I am wondering if there is someone out there that can help me do a scan for any study that uses Boolean arrows. I have a few studies that will indicate Boolean arrows that I would like to run scans to see if the arrows are present. I am looking for the generic think script code that I can use. Any help is much appreciated.

The code below has "BOOLEAN_ARROW_UP" and "BOOLEAN_ARROW_DOWN"

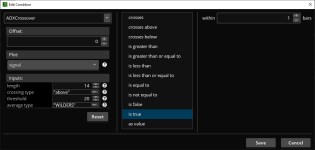

How do I put that into a scanner?

The code below has "BOOLEAN_ARROW_UP" and "BOOLEAN_ARROW_DOWN"

Code:

input length = 14;

input crossingType = {default above, below};

input threshold = 20;

input averageType = AverageType.WILDERS;

plot signal = crosses(DMI(length, averageType).ADX, threshold, crossingType == CrossingType.above);

signal.DefineColor("Above", GetColor(0));

signal.DefineColor("Below", GetColor(1));

signal.AssignValueColor(if crossingType == CrossingType.above then signal.color("Above") else signal.color("Below"));

signal.SetPaintingStrategy(if crossingType == CrossingType.above

then PaintingStrategy.BOOLEAN_ARROW_UP

else PaintingStrategy.BOOLEAN_ARROW_DOWN);How do I put that into a scanner?