Author Message:

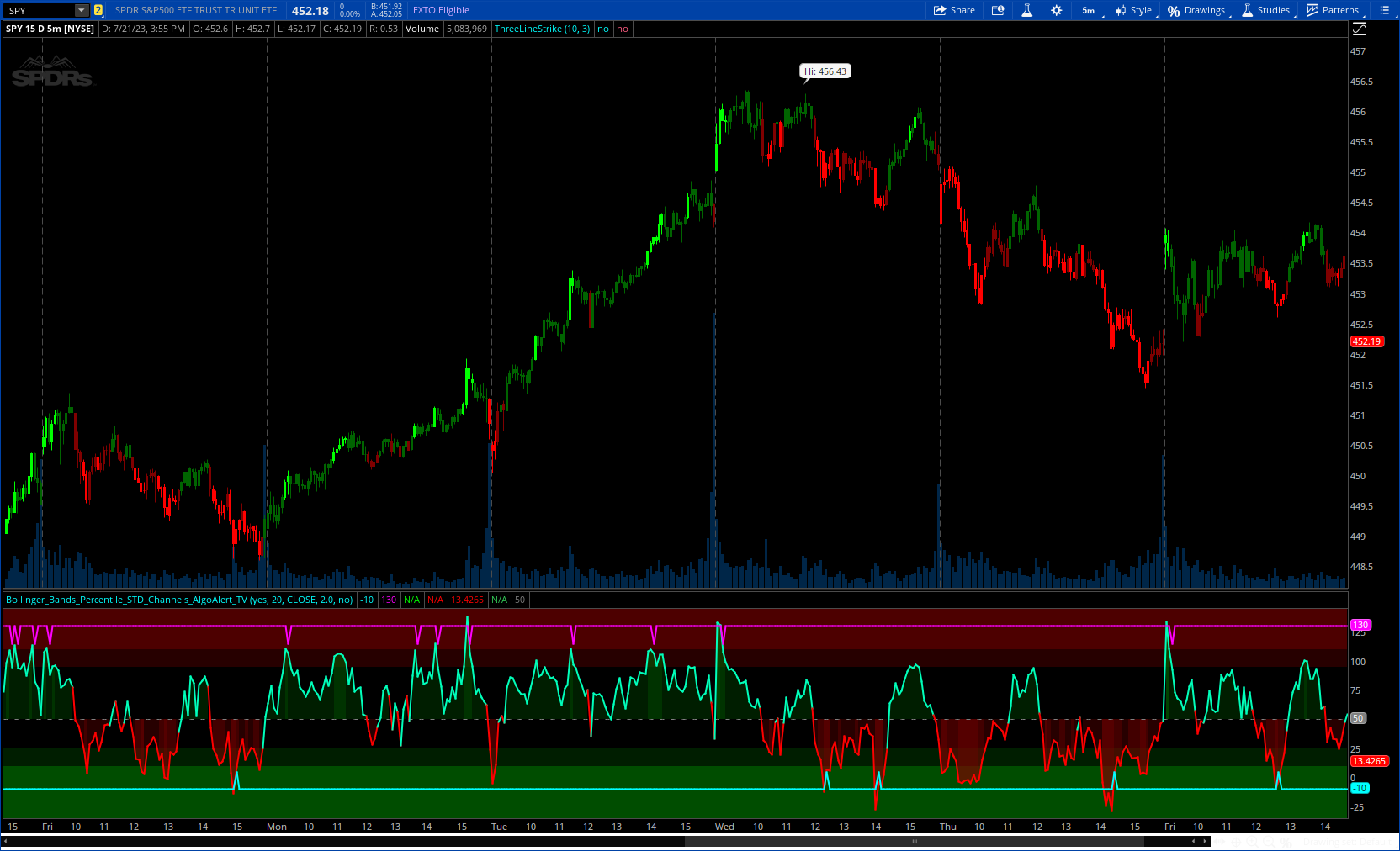

The "Bollinger Bands Percentile (BBPct) + STD Channels" mean reversion indicator, developed by Algo_Alert, is a technical analysis tool designed to analyze price positions using Bollinger Bands and Standard Deviation Channels (STDC). The combination of these two indicators reinforces a stronger reversal signal. BBPct calculates the percentile rank of the price's standard deviation relative to a specified lookback period. Standard deviation channels operate by utilizing a moving average as the central line, with upper and lower lines equidistant from the average based on the market's volatility, helping to identify potential price boundaries and deviations.

More details : https://www.tradingview.com/v/Txv4QC95/

CODE:

CSS:

#https://www.tradingview.com/v/Txv4QC95/

#/ This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © Algo_Alert

#Bollinger Bands Percentile (BBPct) + STD Channels [Algo Alert]

#indicator(shorttitle="? BBPCT% [Algo Alert]", title="? Bollinger Bands Percent", overlay=false)

# Converted by Sam4Cok@Samer800 - 07/2023

declare lower;

#//Symmetrical Standard Deviation Channels

#//BBPCT

input colorBars = yes;

input BollingerBandLength = 20; # 'Bollinger Band'

input Source = close; # "Source"

input bbMultiplier = 2.0; # "Multiplier"

input showBbStdevHistogram = no; # 'Show Bollinger Band Stdev %'

def na = Double.NaN;

def last = isNaN(close);

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

DefineGlobalColor("up", CreateColor(0,255,187));

DefineGlobalColor("dn", CreateColor(255,0,0));

DefineGlobalColor("histup", CreateColor(38,166,154));

DefineGlobalColor("histdn", CreateColor(178,223,219));

def upper1 = close + 0.05 * close;

def lower1 = close - 0.05 * close;

def stdL = close > lower1;

def stdS = close < upper1;

def basis = Average(Source, BollingerBandLength);

def dev = bbMultiplier * StDev(Source, BollingerBandLength);

def upper = basis + dev;

def lower = basis - dev;

def positionBetweenBands = 100 * (Source - lower) / (upper - lower);

def hist = 100 * dev/close;

def crossUp = (positionBetweenBands Crosses above -8) and stdL;

def crossDn = (positionBetweenBands Crosses Below 108) and stdS;

def upCol = positionBetweenBands > 50;

def upCol1 = positionBetweenBands> 95;

def upCol2 = positionBetweenBands> 110;

def dnCol = positionBetweenBands <= 50;

def dnCol1 = positionBetweenBands<= 25;

def dnCol2 = positionBetweenBands<= 10;

def obupper = if last then na else pos;#if showBbStdev then 1 else pos;

def oblower = if last then na else if showBbStdevHistogram then 0.65 else 110;

def obmid = if last then na else if showBbStdevHistogram then 0.4 else 95;

def osupper = if last then na else if showBbStdevHistogram then 0.1 else 10;

def oslower = if last then na else neg;#then 0 else neg;

def osmid = if last then na else if showBbStdevHistogram then 0.25 else 25;

plot SigUp = if showBbStdevHistogram then na else if crossUp then 5 else -10;

plot SigDn = if showBbStdevHistogram then na else if crossDn then 115 else 130;

SigUp.SetLineWeight(2);

SigDn.SetLineWeight(2);

SigUp.SetDefaultColor(Color.CYAN);

SigDn.SetDefaultColor(Color.MAGENTA);

plot SqUp = if showBbStdevHistogram then if crossUp then hist+0.05 else na else na;

plot SqDn = if showBbStdevHistogram then if crossDn then hist+0.05 else na else na;

SqUp.SetLineWeight(2);

SqDn.SetLineWeight(2);

SqUp.SetPaintingStrategy(PaintingStrategy.SQUARES);

SqDn.SetPaintingStrategy(PaintingStrategy.SQUARES);

SqUp.SetDefaultColor(Color.GREEN);

SqDn.SetDefaultColor(Color.RED);

plot z = if showBbStdevHistogram then na else positionBetweenBands;

z.AssignValueColor(if upCol then GlobalColor("up") else GlobalColor("dn"));

z.SetLineWeight(2);

plot Histo = if showBbStdevHistogram then hist else na;

Histo.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

Histo.AssignValueColor( if hist>hist[1] then GlobalColor("histup") else GlobalColor("histdn"));

plot mid = if last or showBbStdevHistogram then na else 50;

mid.SetDefaultColor(Color.GRAY);

mid.SetStyle(Curve.SHORT_DASH);

AssignPriceColor(if !colorBars then Color.CURRENT else if upCol then

if upCol1 then Color.GREEN else Color.DARK_GREEN else

if dnCol1 then Color.RED else Color.DARK_RED);

AddCloud(obupper, oblower, Color.RED);#

AddCloud(oblower, obmid, Color.DARK_RED);

AddCloud(osupper, oslower, Color.GREEN, Color.GREEN, showBbStdevHistogram);

AddCloud(osmid, osupper, Color.DARK_GREEN);

AddCloud(if upCol then z else na, mid, Color.DARK_GREEN);

AddCloud(if upCol1 then z else na, mid, Color.DARK_GREEN);

AddCloud(if upCol2 then z else na, mid, Color.DARK_GREEN);

AddCloud(if dnCol then mid else na, z, Color.DARK_RED);

AddCloud(if dnCol1 then mid else na, z, Color.DARK_RED);

AddCloud(if dnCol2 then mid else na, z, Color.DARK_RED);

#-- END of CODE