I modified the script little to avoid repainting - pls check

Author Message -

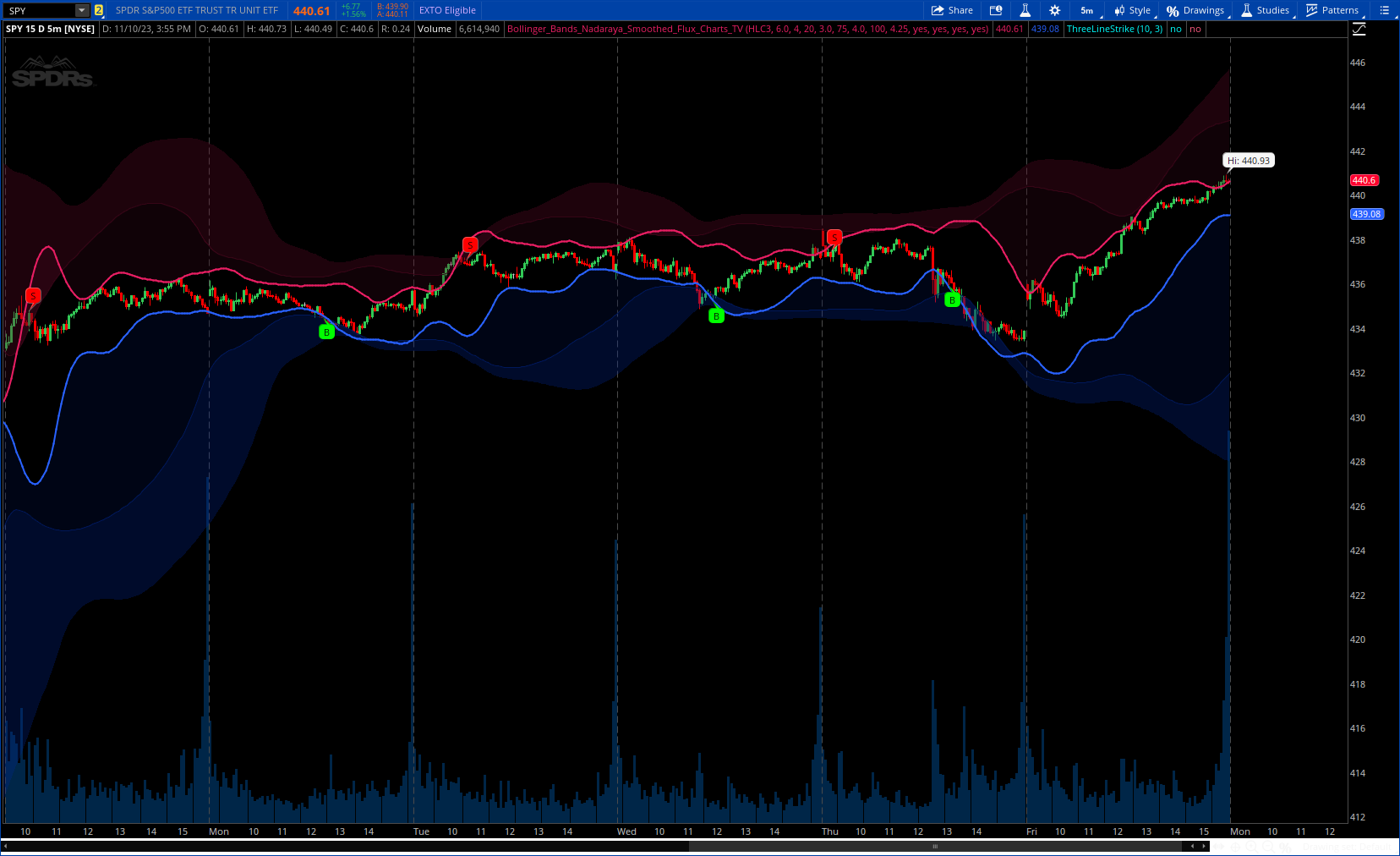

This script is an upgrade to the classic Bollinger Bands. The idea behind Bollinger bands is the detection of price movements outside of a stock's typical fluctuations. Bollinger Bands use a moving average over period n plus/minus the standard deviation over period n times a multiplier. When price closes above or below either band this can be considered an abnormal movement. This script allows for the classic Bollinger Band interpretation while de-noising or "smoothing" the bands.

CODE:

CSS:

# https://www.tradingview.com/v/LUoxSDKw/

#// This source code is subject to the terms of the Mozilla Public License 2.0

#// © fluxchart

#indicator("Bollinger Bands (Nadaraya Smoothed) | Flux Charts", overlay =

# Converted and mod by Sam4Cok@Samer800 - 11/2023

input src = hlc3;

input SmoothingFactor = 6.0; # "Smoothing Factor"

input BollingerMovAvgType = AverageType.SIMPLE;

input short_period = 20; # "Period"

input short_stdev = 3.0; # "Deviation"

input med_period = 75; # "Period"

input med_stdev = 4.0; # "Deviation"

input long_period = 100; # " Period"

input long_stdev = 4.25; # "Deviation"

input showSignals = yes; # "Labels"

input signalLookback = 3;

input plotsLines = yes; # "Plot Lines"

input showBand1 = yes; # "Level 1 Bands"

input showBand2 = yes; # "Level 2 Bands"

def na = Double.NaN;

def n_first = short_period;

def n_second = med_period;

def n_third = long_period;

DefineGlobalColor("up", CreateColor(41, 98, 255));

DefineGlobalColor("dn", CreateColor(233, 30, 99));

DefineGlobalColor("up1", CreateColor(0, 18, 68));

DefineGlobalColor("dn1", CreateColor(54, 5, 22));

DefineGlobalColor("up2", CreateColor(0, 38, 144));

DefineGlobalColor("dn2", CreateColor(100, 10, 41));

#bollingers(n, factor = 3) =>

script bollingers {

input src = hlc3;

input len = 20;

input factor = 3;

input MovAvg = AverageType.SIMPLE;

def Avg = MovingAverage(MovAvg, src, len);

def dev = factor * StDev(src, len);

def bolu = Avg + dev;

def bold = Avg - dev;

plot up = bolu;

plot dn = bold;

}

script nadaraya {

input src = hlc3;

input h = 6;

input n = 500;

def bar = AbsValue(BarNumber());

def den = 2 * Sqr(h);

def gk_sum = if Bar == 0 then

fold i = 0 to n with p do

p + Exp(- Sqr(i) / den) else gk_sum[1];

def smoothed = fold j = 0 to n with q do

q + src[j] * Exp(- Sqr(j) / den) / gk_sum;

plot out = smoothed;

}

def BOLU_FIRST = bollingers(src, n_first, short_stdev, BollingerMovAvgType).up;

def BOLD_FIRST = bollingers(src, n_first, short_stdev, BollingerMovAvgType).dn;

def BOLU_SECOND = bollingers(src, n_second, short_stdev, BollingerMovAvgType).up;

def BOLD_SECOND = bollingers(src, n_second, short_stdev, BollingerMovAvgType).dn;

def BOLU_THIRD = bollingers(src, n_third, med_stdev, BollingerMovAvgType).up;

def BOLD_THIRD = bollingers(src, n_third, med_stdev, BollingerMovAvgType).dn;

def BOLU_FOURTH = bollingers(src, n_third, long_stdev, BollingerMovAvgType).up;

def BOLD_FOURTH = bollingers(src, n_third, long_stdev, BollingerMovAvgType).dn;

def pivot_high = high < Highest(src, signalLookback);

def pivot_low = low > Lowest (src, signalLookback);

def n = 500;

def smoothed_bolu_1 = nadaraya(BOLU_FIRST, SmoothingFactor, n);

def smoothed_bold_1 = nadaraya(BOLD_FIRST, SmoothingFactor, n);

def smoothed_bolu_2 = nadaraya(BOLU_SECOND, SmoothingFactor, n);

def smoothed_bold_2 = nadaraya(BOLD_SECOND, SmoothingFactor, n);

def smoothed_bolu_3 = nadaraya(BOLU_THIRD, SmoothingFactor, n);

def smoothed_bold_3 = nadaraya(BOLD_THIRD, SmoothingFactor, n);

def smoothed_bolu_4 = nadaraya(BOLU_FOURTH, SmoothingFactor, n);

def smoothed_bold_4 = nadaraya(BOLD_FOURTH, SmoothingFactor, n);

def BOLU_FIRST_PLOT = smoothed_bolu_1;

def BOLD_FIRST_PLOT = smoothed_bold_1;

def BOLU_SECOND_PLOT = smoothed_bolu_2;

def BOLD_SECOND_PLOT = smoothed_bold_2;

def BOLU_THIRD_PLOT = smoothed_bolu_3;

def BOLD_THIRD_PLOT = smoothed_bold_3;

def BOLU_FOURTH_PLOT = smoothed_bolu_4;

def BOLD_FOURTH_PLOT = smoothed_bold_4;

plot bearLine = if plotsLines then BOLU_FIRST_PLOT else na;

plot bullLine = if plotsLines then BOLD_FIRST_PLOT else na;

bearLine.SetLineWeight(2);

bullLine.SetLineWeight(2);

bearLine.SetDefaultColor(GlobalColor("dn"));

bullLine.SetDefaultColor(GlobalColor("up"));

AddCloud(if showBand1 then BOLU_FIRST_PLOT else na, BOLU_SECOND_PLOT, GlobalColor("dn1"), GlobalColor("dn1"), yes);

AddCloud(if showBand1 then BOLD_FIRST_PLOT else na, BOLD_SECOND_PLOT, GlobalColor("up1"), GlobalColor("up1"), yes);

AddCloud(if showBand2 then BOLU_SECOND_PLOT else na, BOLU_THIRD_PLOT, GlobalColor("dn2"), GlobalColor("dn2"));

AddCloud(if showBand2 then BOLD_SECOND_PLOT else na, BOLD_THIRD_PLOT, GlobalColor("up2"), GlobalColor("up2"));

def upper_band_test = pivot_high and src crosses BOLU_FIRST_PLOT;

def lower_band_test = pivot_low and src crosses BOLD_FIRST_PLOT;

def cntUp = if upper_band_test then 0 else cntUp[1] + 1;

def cntDn = if lower_band_test then 0 else cntDn[1] + 1;

AddChartBubble(showSignals and cntUp == 2, high, "S", Color.RED);

AddChartBubble(showSignals and cntDn == 2, low, "B", Color.GREEN, no);

#-- END of CODE