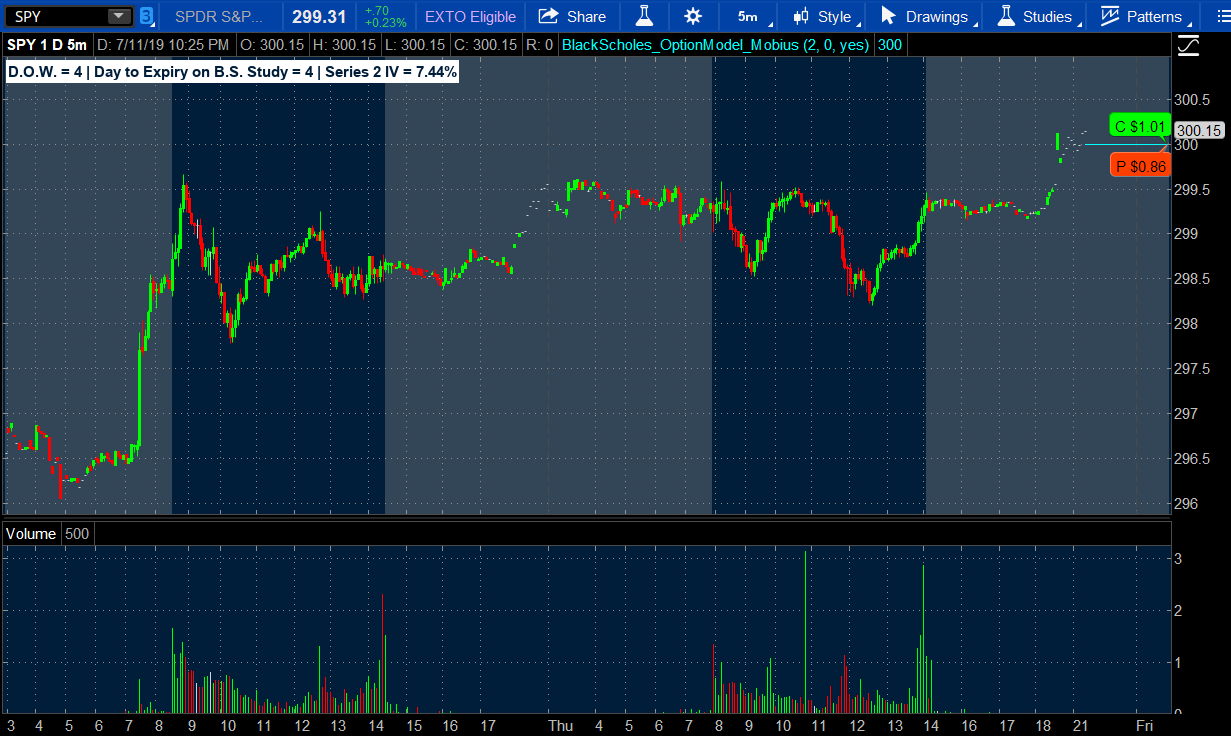

This study calculates the ATM Call and Put using the Black Scholes Options Model and then plots them on the intraday chart of the underlying Symbol.

https://www-tx.mytrade.com/profile/Mobius/statuses/11231658

thinkScript Code

Code:

# Black Scholes Option Plot Series 2 Weekly

# ATM Strike Call and Put

# Mobius at MyTrade

input series = 2; #hint series: 2 is weekly. Anything else and change DaysToExpiration to match.

input DaysToExpiration = 0; #hint DaysToExpiration: 0 = Weekly. For all others change Series to match.

input showLabel = yes;

addLabel(DaysToExpiration != 0, "Change series to match Days To Expiration", color.pink);

def RTHopen = getTime() crosses above RegularTradingStart(getYYYYMMDD());

def c = close;

def DOW = getDayOfWeek(getYYYYMMDD());

def DTE = if DaysToExpiration == 0

then (if DOW == 5

then 3

else if DOW == 4

then 4

else if DOW == 3

then 3

else if DOW == 2

then 3

else if DOW == 1

then 3

else 1)

else DaysToExpiration;

def Strike = if c < 300 and Average(volume(period = AggregationPeriod.DAY), 10) > 20000000

then RoundDown(c / .5, 0) * .5

else if c < 300 and Average(volume(period = AggregationPeriod.DAY)[1], 10) < 20000000

then Floor(c)

else if Between(Floor(c), 300, 500)

then Round(Floor(c) / 5, 0) * 5

else if Between(Floor(c), 500, 1000)

then Round(Floor(c) / 5, 0) * 5

else if c > 1000

then Round(Floor(c) / 10, 0) * 10

else Floor(c);

def strike_ = if isNaN(strike)

then strike_[1]

else strike;

def t = DTE / 365;

def seriesIV = if IsNaN(SeriesVolatility(series = series))

then seriesIV[1]

else SeriesVolatility(series = series);

def rate = ((GetInterestRate() / 365) * DTE);

def CurrDivi = if IsNaN(GetDividend())

then CurrDivi[1]

else GetDividend();

def LastDividend = if CurrDivi != CurrDivi[1]

then CurrDivi[1]

else LastDividend[1];

def YearlyDiv = if LastDividend == 0

then CurrDivi * 4

else if LastDividend < CurrDivi

then (LastDividend * 3) + CurrDivi

else YearlyDiv[1];

def DivYeild = YearlyDiv / c;

def LogR = Log(c / Strike);

def Denominator = LogR + (rate - DivYeild + Power(seriesIV, 2) / 2) * t;

def Divisor = seriesIV * Sqrt(t);

def D1 = Denominator / Divisor;

def D2 = D1 - seriesIV * Sqrt(t);

# Abramowiz Stegun Approximation for Cumulative Normal Distribution

script cnd

{

input data = 1;

def a = AbsValue(data);

def b1 = .31938153;

def b2 = -.356563782;

def b3 = 1.781477937;

def b4 = -1.821255978;

def b5 = 1.330274429;

def b6 = .2316419;

def e = 1 / (1 + b6 * a);

def i = 1 - 1 / Sqrt(2 * Double.Pi) * Exp(-Power(a, 2) / 2) *

(b1 * e + b2 * e * e + b3 * Power(e, 3) + b4 * Power(e, 4) + b5 * Power(e, 5));

plot CND = if data < 0

then 1 - i

else i;

}

def Call = (c * cnd(D1) - Strike * Exp(-rate * t) * cnd(D2));

def call_ = if isNaN(call)

then call_[1]

else call;

def put = (Strike * Exp(-rate * t) * cnd(-D2) - c * cnd(-D1));

def put_ = if isNaN(put)

then put_[1]

else put;

def tBar = if isNaN(close[-1]) and !isNaN(close)

then barNumber()

else tBar[1];

plot StrikeLine = if barNumber() >= highestAll(tBar)

then highestAll(if isNaN(close[-1])

then Strike_

else double.nan)

else double.nan;

addChartBubble(barNumber() == HighestAll(barNumber()),

StrikeLine,

"C " + AsDollars(Call_),

color.green,

yes);

addChartBubble(barNumber() == HighestAll(barNumber()),

StrikeLine,

"P " + AsDollars(Put_),

color.red,

no);

addLabel(showLabel, "D.O.W. = " + DOW +

" | Day to Expiry on B.S. Study = " + DTE +

" | Series " + series + " IV = " + AsPercent(seriesIV), color.white);

# End CodeShareable Link

https://tos.mx/edQQcYhttps://www-tx.mytrade.com/profile/Mobius/statuses/11231658

Attachments

Last edited by a moderator: