You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Beep Boop Indicator for ThinkorSwim

- Thread starter barbaros

- Start date

@andre.muhammad I'm glad this indicator is helpful to you.

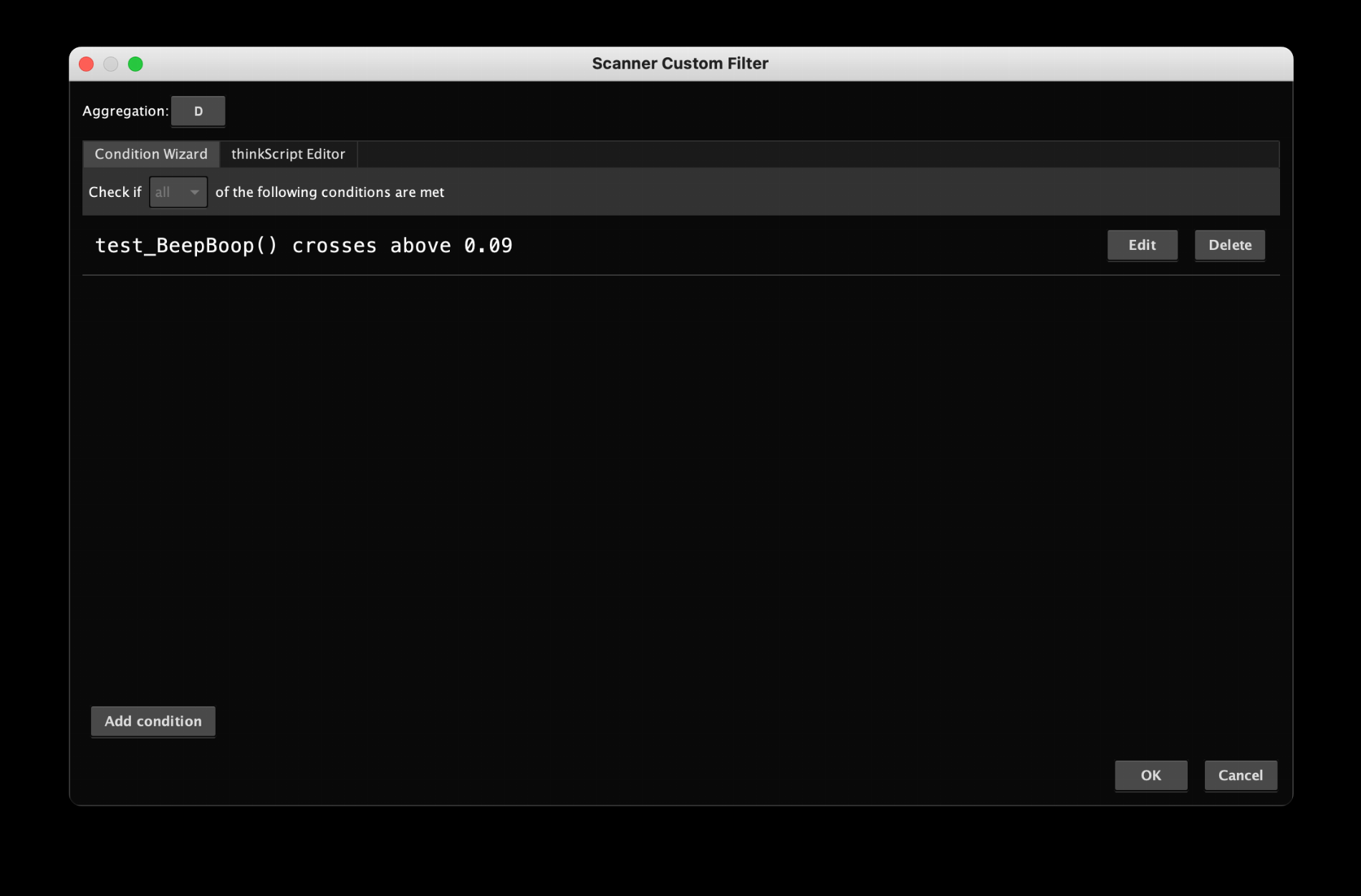

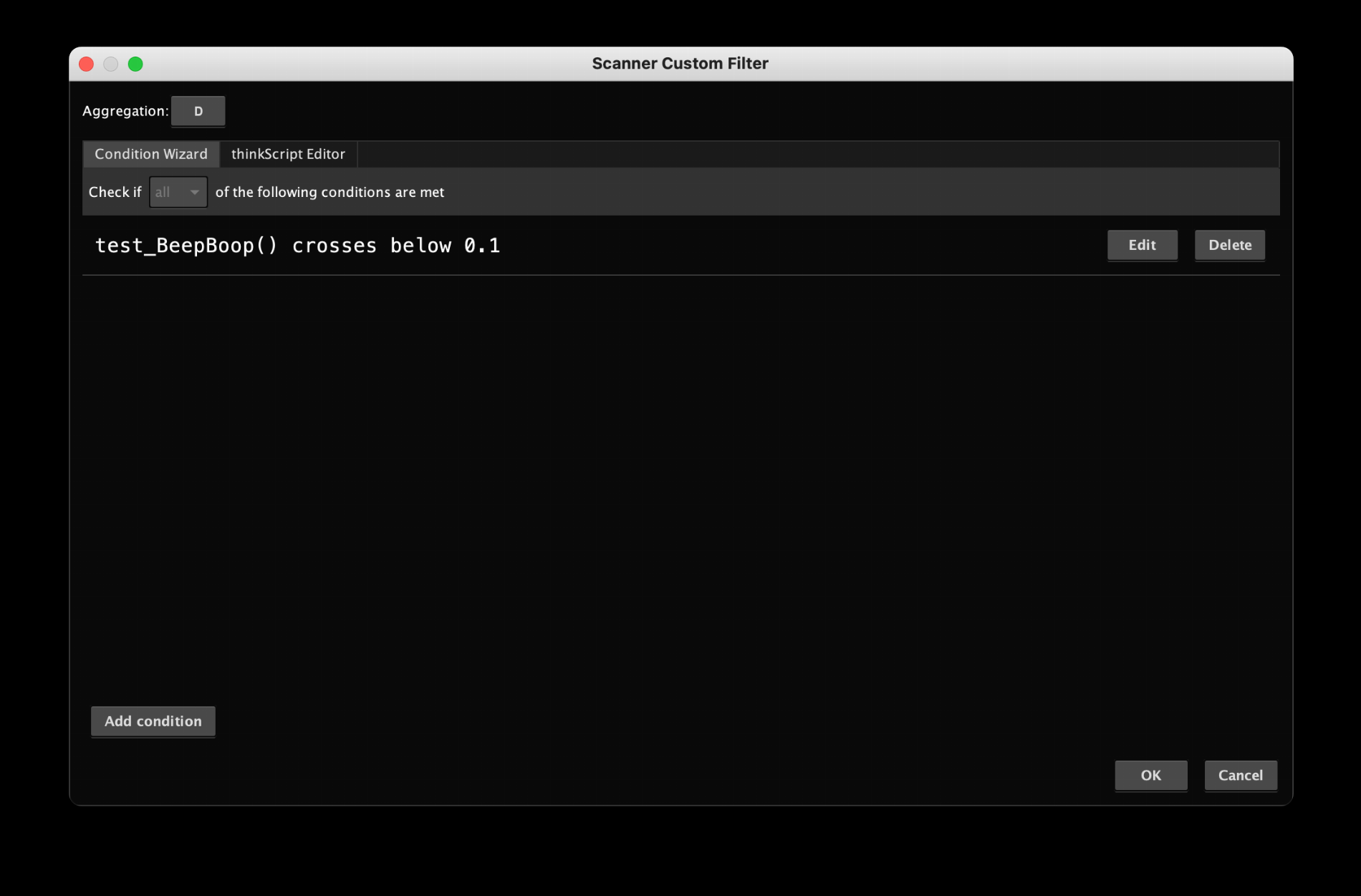

In order to scan for changes, you can create a custom filter and look for value changes for hist plot. Since the values are 0.1 and 0.09, you can look for value crossing below and above the valid values. I can also add value change indicators to make it a pretty much yes/no scan.

But, for now, you can do the following for bullish:

and for bearish:

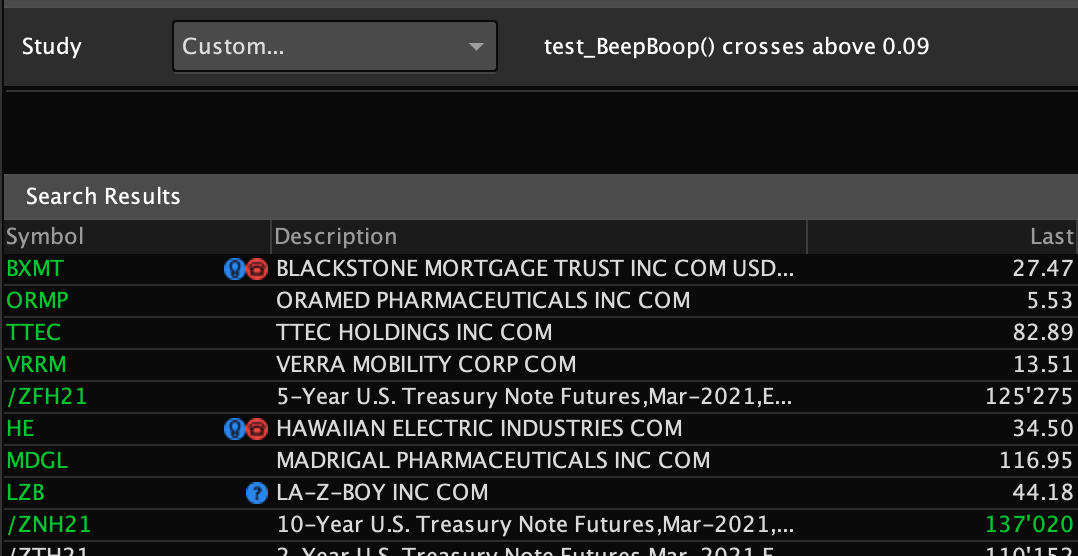

Results for bullish on daily:

In order to scan for changes, you can create a custom filter and look for value changes for hist plot. Since the values are 0.1 and 0.09, you can look for value crossing below and above the valid values. I can also add value change indicators to make it a pretty much yes/no scan.

But, for now, you can do the following for bullish:

and for bearish:

Results for bullish on daily:

@mashume What does it look like? Do you have a picture?I turned this one into a candle-colouring upper study. Seems an interesting approach.

@andre.muhammad how are you using this indicator? What type of assets? Timeframes?

@mashume What does it look like? Do you have a picture?

This is on a 5 day 30 min chart.

/ES on 1000 ticks. Seems much better here than the first example. Just goes to show there's no easy single-indicator that works everywhere all the time.

happy trading

-mashume

ITF Stochastic on the left y axis.Very interesting. What are the 2 lines @mashume?

Here is a version that paints the price bars, if anyone is interested. @mashume's chart looks good.

Code:

# Beep Boop

# Converted from TradingView

# v1 - 20210115 barbaros

# v2 - 20210117 barbaros - Added filter to show only in long term direction

# v3 - 20210122 barbaros - Added price bar painting

declare lower;

declare zerobase;

input FastLength = 12; # Fast Length

input SlowLength = 26; # Slow Length

input EMATrend = 50; # EMA Trend

input EMAFilter = no; # Only show in the direction of the trend

input EMAFilterPeriod = 200; # EMA Filter Trend Period

input Source = close; # Source

input SignalLength = 9; # Signal Smoothing, minval = 1, maxval = 50

input SMASource = no; # Simple MA(Oscillator)

input SMASignal = no; # Simple MA(Signal Line)

input ShowLabel = yes; # Show indicator label

input PaintBars = no; # Paints the price bars

def fast_ma = if SMASource then SimpleMovingAvg(Source, FastLength) else MovAvgExponential(Source, FastLength);

def slow_ma = if SMASource then SimpleMovingAvg(Source, SlowLength) else MovAvgExponential(Source, SlowLength);

def macd = fast_ma - slow_ma;

def signal = if SMASignal then SimpleMovingAvg(macd, SignalLength) else MovAvgExponential(macd, SignalLength);

def histVal = macd - signal;

def fastMA = MovAvgExponential(Source, EMATrend);

def longtermMA = MovAvgExponential(Source, EMAFilterPeriod);

plot hist = if histVal > 0 and (!EMAFilter or low > longtermMA) then 0.1

else if histVal < 0 and (!EMAFilter or high < longtermMA) then 0.09

else if EMAFilter then Double.NaN else histVal;

hist.defineColor("col_grow_above", CreateColor(38, 166, 154));

hist.defineColor("col_grow_below", CreateColor(255, 0, 0));

hist.defineColor("col_fall_above", CreateColor(255, 255, 255));

hist.defineColor("col_fall_below", CreateColor(255, 255, 255));

hist.defineColor("col_macd", CreateColor(0, 148, 255));

hist.defineColor("col_signal", CreateColor(255, 106, 0));

hist.setPaintingStrategy(PaintingStrategy.HISTOGRAM);

hist.assignValueColor(if hist == 0.1 then

if (hist == 0.1) and (close > fastMA) and (open > fastMA) and (low > fastMA) then

hist.Color("col_grow_above")

else

hist.Color("col_fall_above")

else

if (hist == 0.09) and (close < fastMA) and (open < fastMA) and (high < fastMA) then

hist.Color("col_grow_below")

else

hist.Color("col_fall_below"));

AssignPriceColor(

if PaintBars then

if hist == 0.1 then

if (hist == 0.1) and (close > fastMA) and (open > fastMA) and (low > fastMA) then

hist.Color("col_grow_above")

else

hist.Color("col_fall_above")

else

if (hist == 0.09) and (close < fastMA) and (open < fastMA) and (high < fastMA) then

hist.Color("col_grow_below")

else

hist.Color("col_fall_below")

else

Color.CURRENT

);

AddLabel(ShowLabel,

if hist == 0.1 then

if (hist == 0.1) and (close > fastMA) and (open > fastMA) and (low > fastMA) then

"Grow Above"

else

"Fall Above"

else

if (hist == 0.09) and (close < fastMA) and (open < fastMA) and (high < fastMA) then

"Grow Below"

else

"FallBelow",

if hist == 0.1 then

if (hist == 0.1) and (close > fastMA) and (open > fastMA) and (low > fastMA) then

hist.Color("col_grow_above")

else

hist.Color("col_fall_above")

else

if (hist == 0.09) and (close < fastMA) and (open < fastMA) and (high < fastMA) then

hist.Color("col_grow_below")

else

hist.Color("col_fall_below")

);I’m not familiar with it. Is it custom?ITF Stochastic on the left y axis.

I don't believe so. I've modded it a bit:I’m not familiar with it. Is it custom?

Code:

#

# TD Ameritrade IP Company, Inc. (c) 2012-2020

# Modded Mashume 2020

#

declare zerobase;

input price = close;

input threshold = 0.5;

input length = 30;

input slowingLength = 5;

input over_bought = 90;

input over_sold = 60;

def rainbow = reference RainbowAverage(price = price, averageType = AverageType.WEIGHTED);

plot Stochastic = sum(rainbow - Lowest(rainbow, length), slowingLength) / (sum(Highest(rainbow, length) - Lowest(rainbow, length), slowingLength) + 0.0001) * 100;

def normStochRainbow = 0.1 * (Stochastic - 50);

plot IFT = 100 / (1 + exp(-2 * normStochRainbow));

plot OverBought = over_bought;

plot OverSold = over_sold;

Stochastic.SetDefaultColor(GetColor(2));

IFT.SetDefaultColor(GetColor(1));

OverBought.setDefaultColor(GetColor(5));

OverSold.setDefaultColor(GetColor(5));

def smalldip = if

IFT > IFT[1]

and IFT[1] < IFT[2]

and IFT - IFT[1] >= threshold

and IFT[7] > IFT

and IFT[7] > 95

and IFT[1] <= 92.5

and IFT > over_sold

then IFT ELSE DOUBLE.NAN;

plot small_dip = smalldip;

small_dip.SetPaintingStrategy(paintingStrategy = PaintingStrategy.ARROW_UP);

small_dip.SetDefaultColor(getColor(3));EDIT:

I should explain the small_dip plot. The idea with this one is that, in a trending market (where the IFT is pegged near 100), a small dip in the IFT can indicate a place to 'get in on the momentum' if you will. Sometimes it fails and after a brief rebound, things fall flat -- Note the small blue arrow at the right of the LIFE chart above? That's the small dip being triggered... and then failing to maintain. Here's an example of it in action:

You can see the small blue arrow near the left, and the trend just continues going... The small dip showed a reasonable entry point.

happy trading

-mashume

Last edited:

Make sure you have the same parameters selected for both. It is the same code that paints the bars on both.@barbaros I ran the candle-coded version and I noticed a difference between the colored candles and the version I originally downloaded. I just wanted to let that be known.

@barbaros I did...I think I used the very first versionMake sure you have the same parameters selected for both. It is the same code that paints the bars on both.

It's a trend trade above or below the 50EMA. It resonates well with me on 5 minute.I've been trying to apply to Futures /NQ, /YM, /GC, /HG, etc.. Doesn't seem to work well, at least with my calibrations. Any suggestions? I guess for forex it seems fairly justified

look at MACD weighted with a MACD line of 3 and you'll see why BEEP-BOOP is IMO better on a 5 min than 1 min

ButtonDownBobby

New member

I"m using the "Beep Boop" as my entry into ThinkScript. I planned on adding the RSI as the height of the bars. I know the colors depend on the height but, if I can do it, then I'm learning. I added the counting part at the end.

I'd like to fix my lower studies range along the vertical axis to a range of 1 to 100. Currently it is taking on the value of the upper studies price...

I'd like to fix my lower studies range along the vertical axis to a range of 1 to 100. Currently it is taking on the value of the upper studies price...

Code:

# Beep Boop MTF

# Converted from TradingView

# v1 - 20210115 barbaros

# v2 - 20210117 barbaros - Added filter to show only in long term direction

# v3 - 20210121 barbaros - Added MTF, Removed Source

declare lower;

declare zerobase;

declare once_per_bar;

input FastLength = 12; # Fast Length

input SlowLength = 26; # Slow Length

input EMATrend = 50; # EMA Trend

input EMAFilter = no; # Only show in the direction of the trend

input EMAFilterPeriod = 200; # EMA Filter Trend Period

input Agg = AggregationPeriod.FIVE_MIN; # Aggregation Period

input SignalLength = 9; # Signal Smoothing, minval = 1, maxval = 50

input SMASource = no; # Simple MA(Oscillator)

input SMASignal = no; # Simple MA(Signal Line)

input ShowLabel = yes; # Show indicator label

def fast_ma = if SMASource then SimpleMovingAvg(close(period = Agg), FastLength) else MovAvgExponential(close(period = Agg), FastLength);

def slow_ma = if SMASource then SimpleMovingAvg(close(period = Agg), SlowLength) else MovAvgExponential(close(period = Agg), SlowLength);

def macd = fast_ma - slow_ma;

def signal = if SMASignal then SimpleMovingAvg(macd, SignalLength) else MovAvgExponential(macd, SignalLength);

def histVal = macd - signal;

def fastMA = MovAvgExponential(close(period = Agg), EMATrend);

def longtermMA = MovAvgExponential(close(period = Agg), EMAFilterPeriod);

#plot asdf = RSI(200);

def histResult = if histVal > 0 and (!EMAFilter or low > longtermMA) and (close > fastMA) and (open > fastMA) and (low > fastMA) then 10

else if histVal < 0 and (!EMAFilter or high < longtermMA)and (close < fastMA) and (open < fastMA) and (high < fastMA) then 9

# else if EMAFilter then Double.NaN else histVal;

else 8;

plot hist = histResult;

hist.defineColor("col_grow_above", CreateColor(38, 166, 154));

hist.defineColor("col_grow_below", CreateColor(255, 0, 0));

hist.defineColor("col_fall_above", CreateColor(255, 255, 255));

hist.defineColor("col_fall_below", CreateColor(255, 255, 255));

hist.defineColor("col_macd", CreateColor(0, 148, 255));

hist.defineColor("col_signal", CreateColor(255, 106, 0));

hist.setPaintingStrategy(PaintingStrategy.HISTOGRAM);

hist.assignValueColor(if hist == 10 then

hist.Color("col_grow_above")

else if (hist == 9) then

hist.Color("col_grow_below")

else

hist.Color("col_fall_below"));

AddLabel(ShowLabel,

if hist == 10 then

if (hist == 10) and (close > fastMA) and (open > fastMA) and (low > fastMA) then

"Grow Above"

else

"Fall Above"

else

if (hist == 9) and (close < fastMA) and (open < fastMA) and (high < fastMA) then

"Grow Below"

else

"FallBelow",

if hist == 10 then

if (hist == 10) and (close > fastMA) and (open > fastMA) and (low > fastMA) then

hist.Color("col_grow_above")

else

hist.Color("col_fall_above")

else

if (hist == 9) and (close < fastMA) and (open < fastMA) and (high < fastMA) then

hist.Color("col_grow_below")

else

hist.Color("col_fall_below")

);

def fall = 1;

plot pFall = fall;

pFall.SetDefaultColor(Color.WHITE);

def upLine = 1;

plot pUp = upLine;

pUp.SetDefaultColor(Color.GREEN);

def downLine = 1;

plot pDown = downLine;

pDown.SetDefaultColor(Color.RED);

def countUp = hist == 10; #color changed

def countDOWN = hist == 9; #color changed

def countFALL = hist == 8; #color changed

def barCount = CompoundValue(1,

if countFALL and hist[1] != 8 then barCount[1] - barCount[1] + 1 else if countFALL and hist[1] == 8 then barCount[1] + 1

else if CountDOWN and hist[1] != 9 then barCount[1] - barCount[1] + 1 else if countDOWN and hist[1] == 9 then barCount[1] + 1

else if CountUP and hist[1] != 10 then barCount[1] - barCount[1] + 1 else if countUP and hist[1] == 10 then barCount[1] + 1

else 0, 0);

plot pBarDownCount = barCount;

pBarDownCount.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

pBarDownCount.AssignValueColor(Color.YELLOW);Joseph Patrick 18

Active member

Hi @barbaros instead of using all of the lower real estate up is it feasible to set up a MTF label for this? Thanks in advance!Here you go.

Python:# Beep Boop MTF # Converted from TradingView # v1 - 20210115 barbaros # v2 - 20210117 barbaros - Added filter to show only in long term direction # v3 - 20210121 barbaros - Added MTF, Removed Source declare lower; declare zerobase; input FastLength = 12; # Fast Length input SlowLength = 26; # Slow Length input EMATrend = 50; # EMA Trend input EMAFilter = no; # Only show in the direction of the trend input EMAFilterPeriod = 200; # EMA Filter Trend Period input Agg = AggregationPeriod.FIVE_MIN; # Aggregation Period input SignalLength = 9; # Signal Smoothing, minval = 1, maxval = 50 input SMASource = no; # Simple MA(Oscillator) input SMASignal = no; # Simple MA(Signal Line) input ShowLabel = yes; # Show indicator label def fast_ma = if SMASource then SimpleMovingAvg(close(period = Agg), FastLength) else MovAvgExponential(close(period = Agg), FastLength); def slow_ma = if SMASource then SimpleMovingAvg(close(period = Agg), SlowLength) else MovAvgExponential(close(period = Agg), SlowLength); def macd = fast_ma - slow_ma; def signal = if SMASignal then SimpleMovingAvg(macd, SignalLength) else MovAvgExponential(macd, SignalLength); def histVal = macd - signal; def fastMA = MovAvgExponential(close(period = Agg), EMATrend); def longtermMA = MovAvgExponential(close(period = Agg), EMAFilterPeriod); plot hist = if histVal > 0 and (!EMAFilter or low > longtermMA) then 0.1 else if histVal < 0 and (!EMAFilter or high < longtermMA) then 0.09 else if EMAFilter then Double.NaN else histVal; hist.defineColor("col_grow_above", CreateColor(38, 166, 154)); hist.defineColor("col_grow_below", CreateColor(255, 0, 0)); hist.defineColor("col_fall_above", CreateColor(255, 255, 255)); hist.defineColor("col_fall_below", CreateColor(255, 255, 255)); hist.defineColor("col_macd", CreateColor(0, 148, 255)); hist.defineColor("col_signal", CreateColor(255, 106, 0)); hist.setPaintingStrategy(PaintingStrategy.HISTOGRAM); hist.assignValueColor(if hist == 0.1 then if (hist == 0.1) and (close > fastMA) and (open > fastMA) and (low > fastMA) then hist.Color("col_grow_above") else hist.Color("col_fall_above") else if (hist == 0.09) and (close < fastMA) and (open < fastMA) and (high < fastMA) then hist.Color("col_grow_below") else hist.Color("col_fall_below")); AddLabel(ShowLabel, if hist == 0.1 then if (hist == 0.1) and (close > fastMA) and (open > fastMA) and (low > fastMA) then "Grow Above" else "Fall Above" else if (hist == 0.09) and (close < fastMA) and (open < fastMA) and (high < fastMA) then "Grow Below" else "FallBelow", if hist == 0.1 then if (hist == 0.1) and (close > fastMA) and (open > fastMA) and (low > fastMA) then hist.Color("col_grow_above") else hist.Color("col_fall_above") else if (hist == 0.09) and (close < fastMA) and (open < fastMA) and (high < fastMA) then hist.Color("col_grow_below") else hist.Color("col_fall_below") );

Sure, you can drag it up to the upper chart and hide all the plot.Hi @barbaros instead of using all of the lower real estate up is it feasible to set up a MTF label for this? Thanks in advance!

Joseph Patrick 18

Active member

Hi @barbaros, Awesome worked like a charm thanks for taking the time appreciate it!Sure, you can drag it up to the upper chart and hide all the plot.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

804

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.