In the previous article we learnt about the various types of spreads and delved deeper into bullish call spreads. Today, I want to take time to explain how the opposite position of the bullish call spread (aka) Bearish Put spreads work and also extend into Iron Condors. Of course, this article will accompany tutorials on ThinkOrSwim as well.

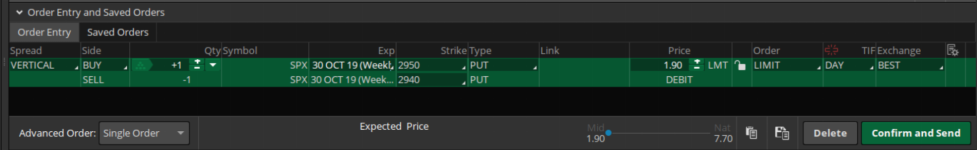

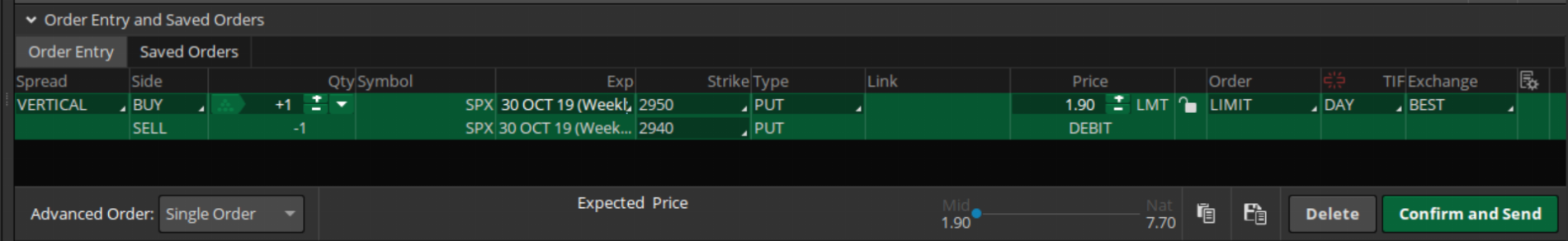

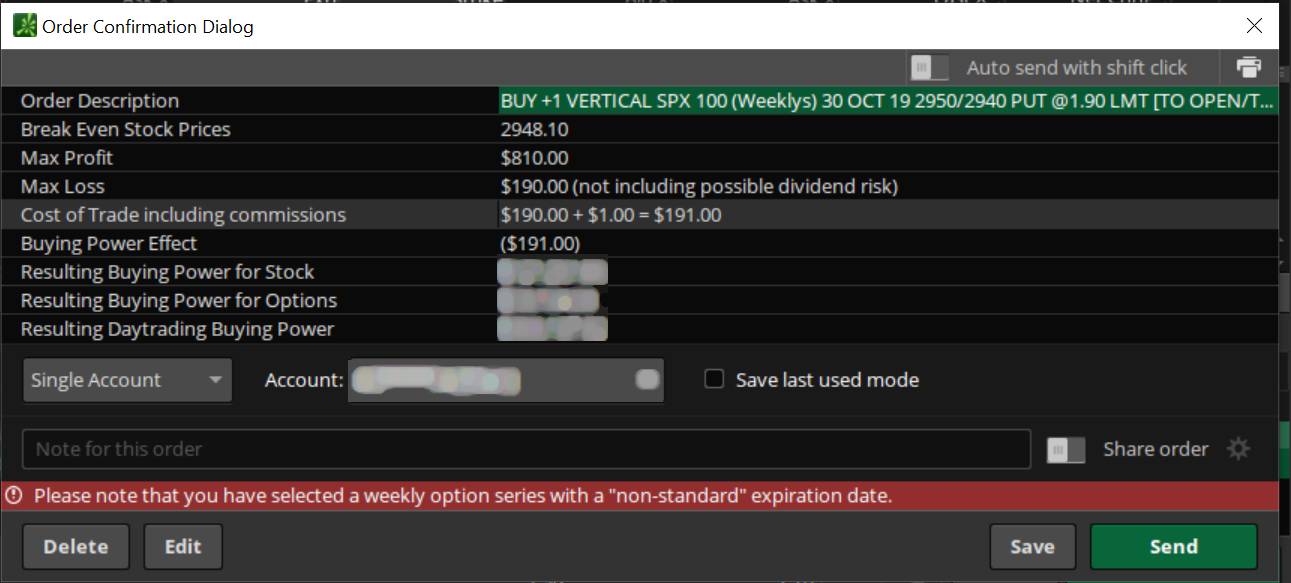

Let’s take an example of a bearish put spread.

The above trade can be broken down into the following constituents:

There are three cases that can happen at expiration:

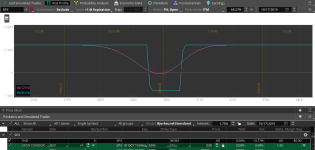

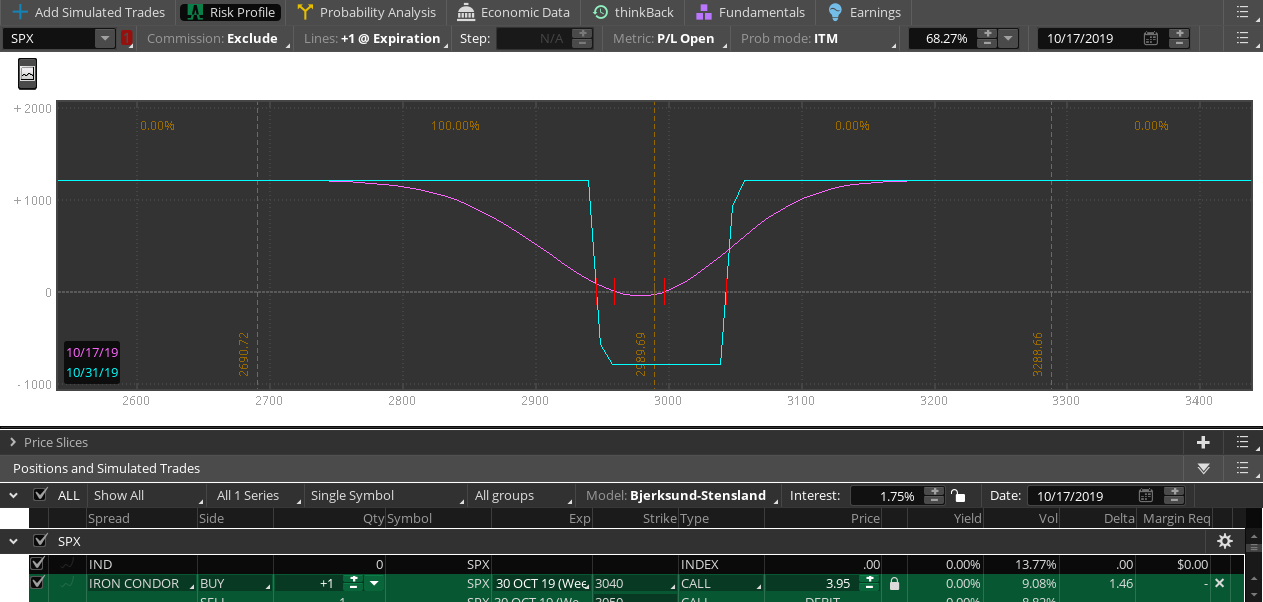

The “Analyze” tab looks mirrored to what we saw in the call spread.

An iron condor is a safer direction agnostic bet and builds on what we learnt previously. The iron condor combines a put spread and call spread in a risk defined manner.

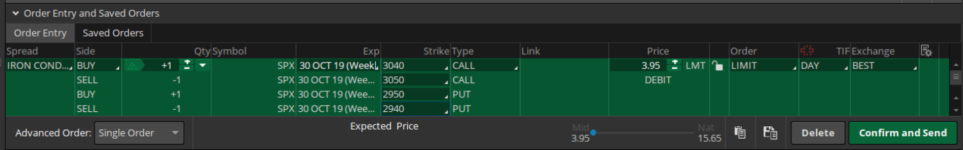

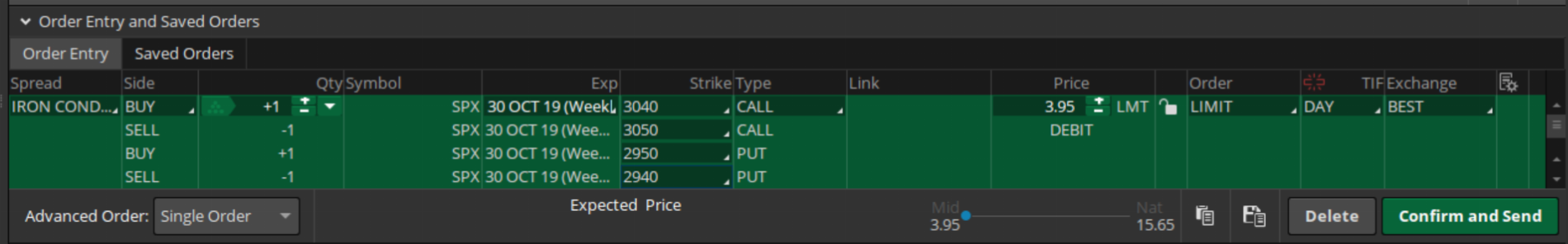

Let’s look at the following example in ThinkorSwim.

Breaking down the Iron Condor into the following:

Here’s how the Analyze tab looks for the above trade:

Next up: Tutorial on how to buy bearish put spreads and iron condors in ThinkorSwim.

Bearish Put Spreads

The bearish put spread allows us to take a bearish bet by basically placing bets that we would be buying the underlying at a lower price and selling it a higher price.Let’s take an example of a bearish put spread.

The above trade can be broken down into the following constituents:

- Long 2950 PUT – Buying the right to sell SPX at 2950

- Short 2940 PUT – Selling the obligation to buy SPX (back) at 2940

- Net debit of 190$ (excluding commissions)

There are three cases that can happen at expiration:

- SPX closes above 2948.10: We realize a loss anywhere to a maximum of premium paid (i.e.) 190$

- SPX closes below 2948.10: We realize a profit with a maximum of 1000$ – 190$ = 810$

- SPX closes at 2948.10: Break even

The “Analyze” tab looks mirrored to what we saw in the call spread.

Iron Condors

Often, as traders we are not comfortable taking directional positions as getting the direction wrong usually means loss. This is where Iron Condors come in.An iron condor is a safer direction agnostic bet and builds on what we learnt previously. The iron condor combines a put spread and call spread in a risk defined manner.

Let’s look at the following example in ThinkorSwim.

Breaking down the Iron Condor into the following:

- Bullish Call Spread at 3040/3050

- Bearish Put Spread at 2940/2950

- Net Debit: 3.95

Here’s how the Analyze tab looks for the above trade:

Next up: Tutorial on how to buy bearish put spreads and iron condors in ThinkorSwim.

Attachments

Last edited by a moderator: