mbarcala

Active member

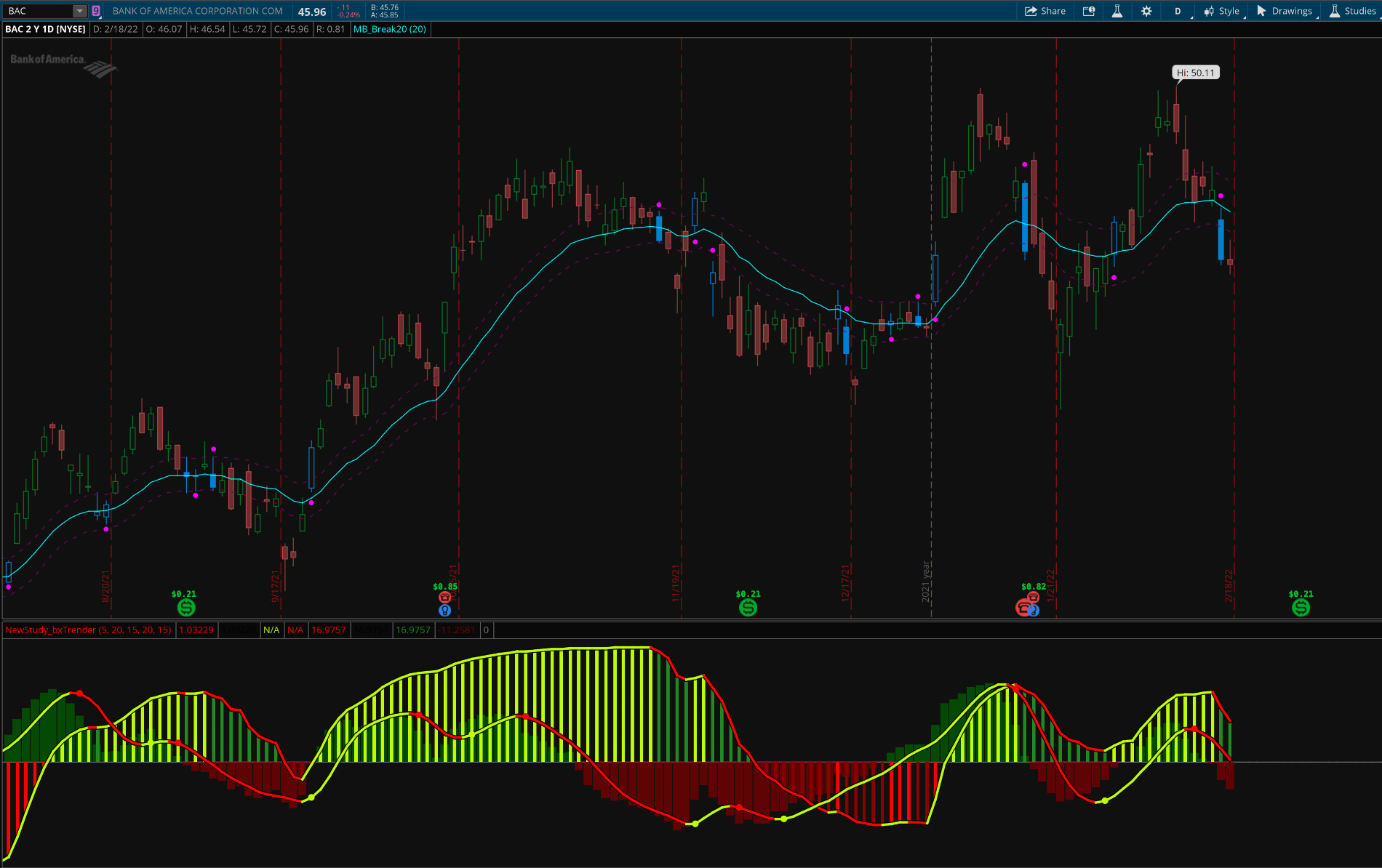

Trend Detection: This indicator uses both short- and long-term oscillators to spot market trends.

Momentum Measurement: The B-Xtrender oscillator shows momentum as a histogram—green bars mean bullish, red bars mean bearish, and changes within the greens and reds reflect weakening/strengthening momentum.

It works best on bigger timeframes and pairs well with other tools like support/resistance, volume, or other indicators for better accuracy.

read more:

https://usethinkscript.com/threads/good-strategy-basics-in-thinkorswim.8058/

Photo

']

Link: https://www.tradingview.com/script/YHZimEz8-B-Xtrender-Puppytherapy/

Script

Momentum Measurement: The B-Xtrender oscillator shows momentum as a histogram—green bars mean bullish, red bars mean bearish, and changes within the greens and reds reflect weakening/strengthening momentum.

It works best on bigger timeframes and pairs well with other tools like support/resistance, volume, or other indicators for better accuracy.

read more:

https://usethinkscript.com/threads/good-strategy-basics-in-thinkorswim.8058/

Photo

']

Link: https://www.tradingview.com/script/YHZimEz8-B-Xtrender-Puppytherapy/

Script

Code:

# BXtrender converted to TOS mbarcala and IgorF

#Link: https://www.tradingview.com/script/YHZimEz8-B-Xtrender-Puppytherapy/

declare lower;

input short_l1 = 5;

input short_l2 = 20;

input short_l3 = 15;

input long_l1 = 20;

input long_l2 = 15;

def shortTermXtrender = RSI(price = ExpAverage(close, short_l1) - ExpAverage(close, short_l2), length = short_l3) - 50;

def longTermXtrender = RSI(price = ExpAverage(close, long_l1), length = long_l2) - 50;

script t3 {

input src = close;

input len = 10;

def xe1_1 = ExpAverage(src, len);

def xe2_1 = ExpAverage(xe1_1, len);

def xe3_1 = ExpAverage(xe2_1, len);

def xe4_1 = ExpAverage(xe3_1, len);

def xe5_1 = ExpAverage(xe4_1, len);

def xe6_1 = ExpAverage(xe5_1, len);

def b_1 = 0.7;

def c1_1 = -b_1 * b_1 * b_1;

def c2_1 = 3 * b_1 * b_1 + 3 * b_1 * b_1 * b_1;

def c3_1 = -6 * b_1 * b_1 - 3 * b_1 - 3 * b_1 * b_1 * b_1;

def c4_1 = 1 + 3 * b_1 + b_1 * b_1 * b_1 + 3 * b_1 * b_1;

plot t3 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1;

}

def maShortTermXtrender = t3( shortTermXtrender, 5);

plot BXtrenderColor = maShortTermXtrender;

BXtrenderColor.AssignValueColor(if maShortTermXtrender > maShortTermXtrender[1] then Color.Lime else color.red);

BXtrenderColor.SetLineWeight(3);

BXtrenderColor.HideBubble();

plot BXtrenderShadow = maShortTermXtrender;

BXtrenderShadow.SetDefaultColor(color.black);

BXtrenderShadow.SetLineWeight(5);

BXtrenderShadow.HideBubble();

plot shape1 = if maShortTermXtrender > maShortTermXtrender[1] and maShortTermXtrender[1] < maShortTermXtrender[2] then maShortTermXtrender else double.nan;

shape1.SetPaintingStrategy(PaintingStrategy.POINTS);

shape1.SetLineWeight(5);

shape1.SetDefaultColor(color.lime);

shape1.HideBubble();

plot shape2 = if maShortTermXtrender < maShortTermXtrender[1] and maShortTermXtrender[1] > maShortTermXtrender[2] then maShortTermXtrender else double.nan;

shape2.SetPaintingStrategy(PaintingStrategy.POINTS);

shape2.SetLineWeight(5);

shape2.SetDefaultColor(color.red);

shape2.HideBubble();

plot BXtrenderTrendLine = longTermXtrender;

BXtrenderTrendLine.SetDefaultColor(color.black);

BXtrenderTrendLine.SetLineWeight(3);

BXtrenderTrendLine.AssignValueColor(if longTermXtrender > longTermXtrender[1] then color.lime else color.red);

BXtrenderTrendLine.HideBubble();

plot BXtrenderTrendLineShadow = longTermXtrender;

BXtrenderTrendLineShadow.SetDefaultColor(color.black);

BXtrenderTrendLineShadow.SetLineWeight(5);

BXtrenderTrendLineShadow.HideBubble();

plot BXtrenderTrendHistogram = longTermXtrender;

BXtrenderTrendHistogram.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

BXtrenderTrendHistogram.SetLineWeight(1);

BXtrenderTrendHistogram.AssignValueColor(if longTermXtrender > 0 then (if longTermXtrender > longTermXtrender[1] then color.lime else CreateColor(34, 139, 34)) else if longTermXtrender > longTermXtrender[1] then color.red else CreateColor(139, 0, 0));

BXtrenderTrendHistogram.HideBubble();

plot BXtrenderHistogram = shortTermXtrender;

#BXtrenderHistogram.AssignValueColor(if shortTermXtrender > 0 then (if shortTermXtrender > shortTermXtrender[1] then color.lime else createColor(34, 139, 34)) else if shortTermXtrender > shortTermXtrender[1] then color.red else createColor(139, 0, 0));

BXtrenderHistogram.AssignValueColor(if shortTermXtrender > 0 then Color.DARK_GREEN else Color.DARK_RED);

BXtrenderHistogram.SetPaintingStrategy(PaintingStrategy.SQUARED_HISTOGRAM);

BXtrenderHistogram.HideBubble();

plot cline = 0;

cline.SetDefaultColor(Color.GRAY);

Last edited by a moderator: