There was not much information written about this indicator. Take it as is.

thinkScript Code

Code:

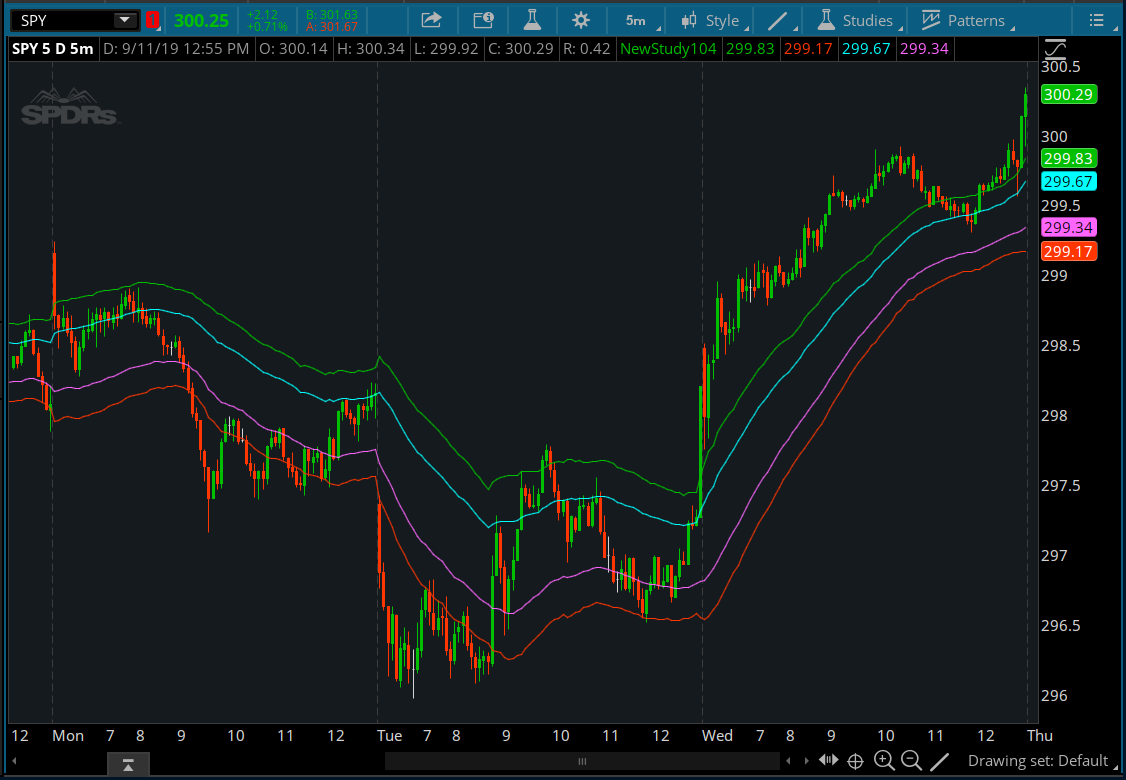

# ATR Breakouts

# Assembled by BenTen at useThinkScript.com

# Converted from https://www.tradingview.com/script/RqEk3iZu/

def long_entry = (expAverage(close, 50)) + (2 * atr(20));

def short_entry = (expAverage(close, 50)) - (2 * atr(20));

def short_stop_loss = (expAverage(close, 50)) + (atr(20));

def long_stop_loss = (expAverage(close, 50)) - (atr(20));

plot b_entry = long_entry;

plot s_entry = short_entry;

plot s_stop = short_stop_loss;

plot l_stop = long_stop_loss;

b_entry.SetDefaultColor(GetColor(6));

s_entry.SetDefaultColor(GetColor(5));

s_stop.SetDefaultColor(GetColor(1));

l_stop.SetDefaultColor(GetColor(0));Attachments

Last edited: