#+-------------------------------------------------------------+

# |Example: ATR Breakout |

# |Rleased to the public.... verifyed 12/19/2020 |

# |robert payne |

# |funwiththinkscript.com |

# |I added credit to the coder___12/19/2020 |

# +------------------------------------------------------------+

#

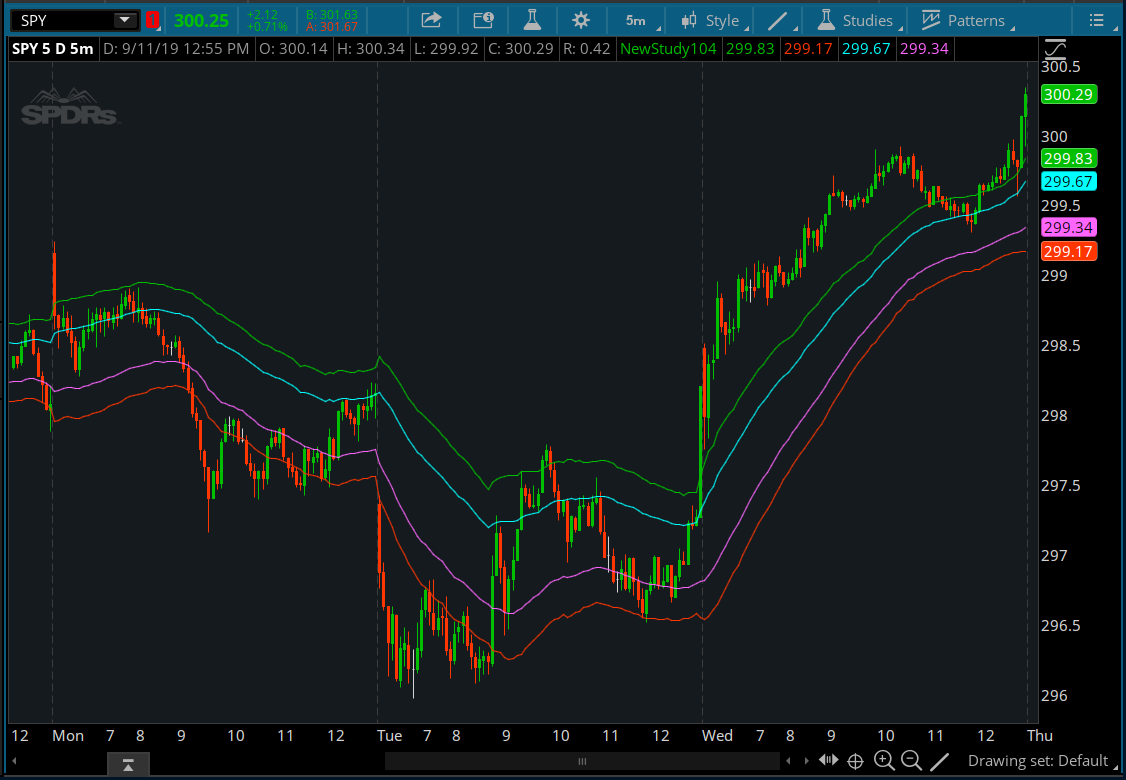

# white - entry point

# green - first profit target to scale out

# yellow - opening range

# orange - ATR breakout confirmation level

# ------------------------------------

# for extended hours

#script OpenRange {

# input ORtime = 5 ;

# def FirstBar = secondsfromtime(0930) >= 0 and secondsfromtime(0930) < 60;

# def RangeTime = SecondsFromTime(0930) >= 0 and SecondsFromTime(0930) < 60 * ORtime;

# def Rhigh = if FirstBar then high else if RangeTime and high > Rhigh[1] then high else Rhigh[1];

# def Rlow = if FirstBar then low else if RangeTime and low < Rlow[1] then low else Rlow[1];

# plot h = if RangeTime or secondstilltime(0930) > 0 then Double.NaN else Rhigh;

# plot l = if RangeTime or secondstilltime(0930) > 0then Double.NaN else Rlow; }

# ------------------------------------

# -------------------------------------

# marketForecast hours

script OpenRange {

input ORtime = 5;

def FirstBar = GetDay() != GetDay()[1];

def RangeTime = SecondsFromTime(0930) >= 0 and SecondsFromTime(0930) < 60 * ORtime;

def Rhigh = if FirstBar then high else if RangeTime and high > Rhigh[1] then high else Rhigh[1];

def Rlow = if FirstBar then low else if RangeTime and low < Rlow[1] then low else Rlow[1];

plot h = if RangeTime then Double.NaN else Rhigh;

plot l = if RangeTime then Double.NaN else Rlow;

}

# ------------------------------------

def first30 = SecondsFromTime(0930) >= 0 and SecondsTillTime(1000) >= 0;

def today = GetLastDay() == GetDay();

def ATR = Average(TrueRange(high, close, low), 10);

plot yHigh = if !today then Double.NaN else high(period = "day" )[1];

yHigh.SetDefaultColor(Color.CYAN);

plot yLow = if !today then Double.NaN else low(period = "day" )[1];

yLow.SetDefaultColor(Color.PINK);

plot h5 = if !today then Double.NaN else if !first30 then Double.NaN else OpenRange(5).h;

h5.SetDefaultColor(Color.YELLOW);

plot l5 = if !today then Double.NaN else if !first30 then Double.NaN else OpenRange(5).l;

l5.SetDefaultColor(Color.YELLOW);

plot h30 = if !today then Double.NaN else OpenRange(30).h;

h30.SetDefaultColor(Color.YELLOW);

plot l30 = if !today then Double.NaN else OpenRange(30).l;

l30.SetDefaultColor(Color.YELLOW);

def lowConf = if first30 then Min(yLow, l5) - ATR else Min(yLow, l30) - ATR;

def highConf = if first30 then Max(yHigh, h5) + ATR else Max(yHigh, h30) + ATR;

plot lc1 = if first30 then lowConf else Double.NaN;

lc1.SetDefaultColor(Color.ORANGE);

plot lc2 = if !first30 then lowConf else Double.NaN;

lc2.SetDefaultColor(Color.ORANGE);

plot hc1 = if first30 then highConf else Double.NaN;

hc1.SetDefaultColor(Color.ORANGE);

plot hc2 = if !first30 then highConf else Double.NaN;

hc2.SetDefaultColor(Color.ORANGE);

def decisionL = if close > lowConf then Double.NaN else if close crosses below lowConf then low else decisionL[1];

def decisionH = if close < highConf then Double.NaN else if close crosses above highConf then high else decisionH[1];

plot dL = if !today then Double.NaN else decisionL;

dL.SetDefaultColor(Color.WHITE);

plot dH = if !today then Double.NaN else decisionH;

dH.SetDefaultColor(Color.WHITE);

def TL = CompoundValue(1, if IsNaN(dL) then Double.NaN else if !IsNaN(TL[1]) then TL[1] else if close crosses below dL then dL - 2 * ATR else Double.NaN, Double.NaN);

def SL = CompoundValue(1, if IsNaN(dL) then Double.NaN else if !IsNaN(SL[1]) then SL[1] else if close crosses below dL then dL + 2 * ATR else Double.NaN, Double.NaN);

plot Target1Low = if !today then Double.NaN else TL;

Target1Low.SetDefaultColor(Color.GREEN);

Target1Low.SetStyle(Curve.SHORT_DASH);

plot Stop1Low = if !today then Double.NaN else SL;

Stop1Low.SetDefaultColor(Color.RED);

Stop1Low.SetLineWeight(2);

AddChartBubble(IsNaN(TL[1]) and !IsNaN(TL), TL, "Target 1\n" + Round(TL, 2), Color.GREEN, no);

AddChartBubble(IsNaN(SL[1]) and !IsNaN(SL), SL, "Stop\n" + Round(SL, 2), Color.RED);

def alertup = close[1] crosses above hc1 or close[1] crosses above hc2;

def alertdn = close[1] crosses below lc1 or close[1] crosses below lc2;

alert(alertup, getsymbol() + " UP", alert.bar, sound.bell);

alert(alertdn, getsymbol() + " DOWN", alert.bar, sound.bell);