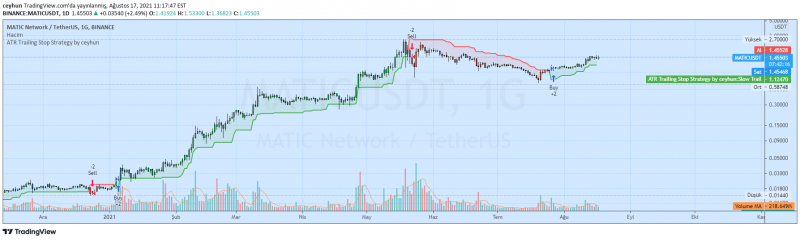

Hi everyone,

I am still pretty new to this. I tried searching the forums and wasn't able to find anything similar to this script from TradingView. I am trying to mimic an ATR Trail Stop Strategy script that was created by Ceyhun. Any help is greatly appreciated. Here is the link to his script. https://www.tradingview.com/script/cj3MJWNz/

I am still pretty new to this. I tried searching the forums and wasn't able to find anything similar to this script from TradingView. I am trying to mimic an ATR Trail Stop Strategy script that was created by Ceyhun. Any help is greatly appreciated. Here is the link to his script. https://www.tradingview.com/script/cj3MJWNz/

Ruby:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ceyhun

//@version=4

strategy("ATR Trailing Stop Strategy by ceyhun", overlay=true)

/////////notes////////////////////////////////////////

// This is based on the ATR trailing stop indicator //

// width addition of two levels of stops and //

// different interpretation. //

// This is a fast-reacting system and is better //

// suited for higher volatility markets //

//////////////////////////////////////////////////////

SC = input(close, "Source", input.source)

// Fast Trail //

AP1 = input(5, "Fast ATR period", input.integer) // ATR Period

AF1 = input(0.5, "Fast ATR multiplier", input.float) // ATR Factor

SL1 = AF1 * atr(AP1) // Stop Loss

Trail1 = 0.0

Trail1 := iff(SC > nz(Trail1[1], 0) and SC[1] > nz(Trail1[1], 0), max(nz(Trail1[1], 0), SC - SL1), iff(SC < nz(Trail1[1], 0) and SC[1] < nz(Trail1[1], 0), min(nz(Trail1[1], 0), SC + SL1), iff(SC > nz(Trail1[1], 0), SC - SL1, SC + SL1)))

// Slow Trail //

AP2 = input(10, "Slow ATR perod", input.integer) // ATR Period

AF2 = input(3, "Slow ATR multiplier", input.float) // ATR Factor

SL2 = AF2 * atr(AP2) // Stop Loss

Trail2 = 0.0

Trail2 := iff(SC > nz(Trail2[1], 0) and SC[1] > nz(Trail2[1], 0), max(nz(Trail2[1], 0), SC - SL2), iff(SC < nz(Trail2[1], 0) and SC[1] < nz(Trail2[1], 0), min(nz(Trail2[1], 0), SC + SL2), iff(SC > nz(Trail2[1], 0), SC - SL2, SC + SL2)))

// Bar color for trade signal //

Green = Trail1 > Trail2 and close > Trail2 and low > Trail2

Blue = Trail1 > Trail2 and close > Trail2 and low < Trail2

Red = Trail2 > Trail1 and close < Trail2 and high < Trail2

Yellow = Trail2 > Trail1 and close < Trail2 and high > Trail2

// Signals //

Bull = barssince(Green) < barssince(Red)

Bear = barssince(Red) < barssince(Green)

Buy = crossover(Trail1, Trail2)

Sell = crossunder(Trail1, Trail2)

TS1 = plot(Trail1, "Fast Trail", style=plot.style_line,color=Trail1 > Trail2 ? color.blue : color.yellow, linewidth=2, display=display.none)

TS2 = plot(Trail2, "Slow Trail", style=plot.style_line,color=Trail1 > Trail2 ? color.green : color.red, linewidth=2)

fill(TS1, TS2, Bull ? color.new(color.green,90) : color.new(color.red,90))

plotcolor = input(true, "Paint color on chart", input.bool)

bcl = iff(plotcolor == 1, Blue ? color.blue : Green ? color.lime : Yellow ? color.yellow : Red ? color.red : color.white, na)

barcolor(bcl)

if Buy

strategy.entry("Buy", strategy.long, comment="Buy")

if Sell

strategy.entry("Sell", strategy.short, comment="Sell")

Last edited by a moderator: