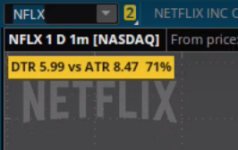

Hi Guys if anyone has DTR VS ATR indicator and can post a script for TOS would really appreciate it.

Code:

#

# Copyright 2014 Scott J. Johnson (https://scottjjohnson.com)

#

# Licensed under the Apache License, Version 2.0 (the "License");

# you may not use this file except in compliance with the License.

# You may obtain a copy of the License at

#

# http://www.apache.org/licenses/LICENSE-2.0

#

# Unless required by applicable law or agreed to in writing, software

# distributed under the License is distributed on an "AS-IS" BASIS,

# WITHOUT WARRANTIES OR CONDITIONS OF ANY KIND, either express or implied.

# See the License for the specific language governing permissions and

# limitations under the License.

#

#

# ATRLabel

#

# Displays Average True Range over the last 40 periods and the current period

#

input ATRLength = 40;

# historical ATR

def ATRValue = Average(TrueRange(high, close, low), ATRLength);

def ATRPercent = ATRValue / close * 100;

# current period range

def ATRLastBar = TrueRange(high, close, low);

AddLabel(yes, ATRLength + " Period ATR = $" + Round(ATRValue, 2) + " (" + Round(ATRPercent, 2) + "%), Current Period Range = $" + Round(ATRLastBar, 2) + " (" + Round(ATRLastBar / close * 100, 2) + "%)", CreateColor(153, 153, 0));