Is there a code for the Floating P&L graph?Is this last graph "FloatingPL" the same graph like in the PowerX software to check if a stock would make money with the strategy? I am still searching for a backtesting option in TOS.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Archives: RSM Indicator for ThinkorSwim

- Thread starter cos251

- Start date

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Is there a code for the Floating P&L graph?

No, that code is licensed, therefore the code is hidden... I'm fairly certain it is tied into AddOrder() and most likely other functions; perhaps even some we don't have access to... What is your reason for asking...??? I actually debated creating my own version of AddOrder/FloatingPL a while back but have been too busy to act on the idea... Maybe it will be a winter project...

Using the RSM/PX strategy I think seeing the past p&l performance can help with decisions on what to get into when evaluating multiple options. It's a tool used on the PX program as well.No, that code is licensed, therefore the code is hidden... I'm fairly certain it is tied into AddOrder() and most likely other functions; perhaps even some we don't have access to... What is your reason for asking...??? I actually debated creating my own version of AddOrder/FloatingPL a while back but have been too busy to act on the idea... Maybe it will be a winter project...

ApeX Predator

Well-known member

Like @rad14733 said, Floating P/L is a TOS default indicator, to mimic Order execution and show P/L, the trick though comes from the strategy, nothing to do with Floating P/L Code.Using the RSM/PX strategy I think seeing the past p&l performance can help with decisions on what to get into when evaluating multiple options. It's a tool used on the PX program as well.

That said, you may want to write/modify existing strategy, to suite your trading style. Ex: existing strategy assumes, you would want to close all trades EOD and stay cash. But if that is not your style, you would want to change that in the strategy posted here.

-S

I have the PowerX code from the first page, but I would need to rewrite it, or add another strategy to the chart?Like @rad14733 said, Floating P/L is a TOS default indicator, to mimic Order execution and show P/L, the trick though comes from the strategy, nothing to do with Floating P/L Code.

That said, you may want to write/modify existing strategy, to suite your trading style. Ex: existing strategy assumes, you would want to close all trades EOD and stay cash. But if that is not your style, you would want to change that in the strategy posted here.

-S

ApeX Predator

Well-known member

There is a Strategy Section, Different Script than the Upper Indicator, posted by @cos251 in Comment #1, You need to add that as a strategy in TOS, and may have to modify that piece alone to match your trade style.I have the PowerX code from the first page, but I would need to rewrite it, or add another strategy to the chart?

Sorry I'm a newbie, but thanks for your help. I got it to work!There is a Strategy Section, Different Script than the Upper Indicator, posted by @cos251 in Comment #1, You need to add that as a strategy in TOS, and may have to modify that piece alone to match your trade style.

Would it be possible to add a divergence line to the RSi so you can see where the divergence is for a potential breakout @SuryaKiranC @cos251

Like this?Would it be possible to add a divergence line to the RSi so you can see where the divergence is for a potential breakout @SuryaKiranC @cos251

@bigshow3 - Code in post #1 for RSM_Lower Version 1.4 has been updated. Please see first post and updated screenshot. Credit to @BenTen for the code - it was borrowed from RSI Divergence Indicator.Yes exactly like that @cos251 @SuryaKiranC

https://usethinkscript.com/threads/rsm-indicator-for-thinkorswim.5407/

Enjoy!

Last edited:

Thanks a lot I really appreciate that!!!!@bigshow3 - Code in post #1 for RSM_Lower Version 1.4 has been updated. Please see first post and updated screenshot. Credit to @BenTen for the code - it was borrowed from RSI Divergence Indicator.

https://usethinkscript.com/threads/rsm-indicator-for-thinkorswim.5407/

Enjoy!

One more update: Version 1.5Thanks a lot I really appreciate that!!!!

@SuryaKiranC was kind enough to add the Stochastic Divergence code as well. We cleaned up the code a bit to reuse variables already instantiated within the code and modified the default OB/OS RSI settings to 70/30. You can change them if you'd like.

https://usethinkscript.com/threads/rsm-indicator-for-thinkorswim.5407/

Thanks a lot ill take a look at that one too!!!One more update: Version 1.5

@SuryaKiranC was kind enough to add the Stochastic Divergence code as well. We cleaned up the code a bit to reuse variables already instantiated within the code and modified the default OB/OS RSI settings to 70/30. You can change them if you'd like.

https://usethinkscript.com/threads/rsm-indicator-for-thinkorswim.5407/

@cos251 @SuryaKiranC : Looking at RSI for $SPY on 5 mins 07/22 chart and wanted to get your opinion on the divergence.

Notice the divergence line at the top.

Now notice the first red up arrow @ 14:10 PM EST mark and compare that to 2nd red up arrow. Shouldn't the line be drawn downwards from the first up arrow to the 2nd up arrow (closing price went up between the two)? Or am I missing something (settings perhaps) - could you please check from your end for this ticker/time frame and confirm?

Notice the divergence line at the top.

Now notice the first red up arrow @ 14:10 PM EST mark and compare that to 2nd red up arrow. Shouldn't the line be drawn downwards from the first up arrow to the 2nd up arrow (closing price went up between the two)? Or am I missing something (settings perhaps) - could you please check from your end for this ticker/time frame and confirm?

ApeX Predator

Well-known member

Good Catch, the problem was the parameters, I sent to @cos251, ported over from my Standard RSI Divergence Script, Adjust these to the previous values, you should be good to go.@cos251 @SuryaKiranC : Looking at RSI for $SPY on 5 mins 07/22 chart and wanted to get your opinion on the divergence.

Notice the divergence line at the top.

Now notice the first red up arrow @ 14:10 PM EST mark and compare that to 2nd red up arrow. Shouldn't the line be drawn downwards from the first up arrow to the 2nd up arrow (closing price went up between the two)? Or am I missing something (settings perhaps) - could you please check from your end for this ticker/time frame and confirm?

Ruby:

input over_BoughtRSI = 80;

input over_SoldRSI = 20;I will ask @cos251 to update this in the posted Original Script.

-Surya

Thank you for looking into this. I updated the values on my end but now am not seeing that divergence line at all (seeing one at an earlier time and one at a later time - from today - but that line is completely gone). Is that as expected?Good Catch, the problem was the parameters, I sent to @cos251, ported over from my Standard RSI Divergence Script, Adjust these to the previous values, you should be good to go.

Ruby:input over_BoughtRSI = 80; input over_SoldRSI = 20;

I will ask @cos251 to update this in the posted Original Script.

-Surya

A suggestion for future (if/when y'all have time/energy/motivation): Draw the corresponding divergence lines on the top study (price graph). And color code it for ease - bearish divergence = Red lines and bluish divergence = Green lines. Maybe alerts and watch list (color coded).. Maybe this sounds like a lot, so never mind. haha

Thanks for all your contribution guys!

UPDATE:

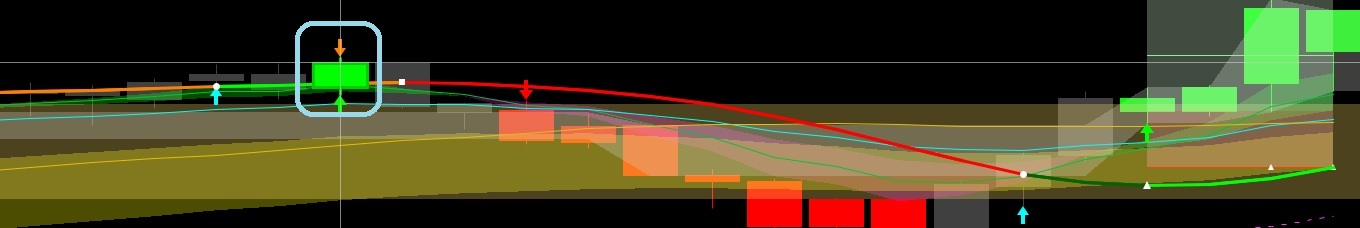

Noticed something else on the top study.

$MSFT - 5m chart 07/23 @14:35 EST

Notice the circled (or squared) candle and the two signal (one up and one down arrow). The up arrow is from RSM and the down arrow is from HULL MA by @mashume .

Notice the candles that follow (bearish). Is there a more optimal setting you suggest to get more precise signals (maybe it depends on the time interval)?

Last edited:

ApeX Predator

Well-known member

already working on something for noice reduction on lower frames. @cos251 might update once we have this finalized.UPDATE:

Noticed something else on the top study.

$MSFT - 5m chart 07/23 @14:35 EST

Notice the circled (or squared) candle and the two signal (one up and one down arrow). The up arrow is from RSM and the down arrow is from HULL MA by @mashume .

Notice the candles that follow (bearish). Is there a more optimal setting you suggest to get more precise signals (maybe it depends on the time interval)?

ApeX Predator

Well-known member

As of now the Divergence line are plotted, one each, Bull and Bear, not more than that, Intend to plot/retain the past once too, should come as update.Thank you for looking into this. I updated the values on my end but now am not seeing that divergence line at all (seeing one at an earlier time and one at a later time - from today - but that line is completely gone). Is that as expected?

A suggestion for future (if/when y'all have time/energy/motivation): Draw the corresponding divergence lines on the top study (price graph). And color code it for ease - bearish divergence = Red lines and bluish divergence = Green lines. Maybe alerts and watch list (color coded).. Maybe this sounds like a lot, so never mind. haha

Thanks for all your contribution guys!

Rest of the Suggestion, Tall order, however work in progress already on all R S M divergencies plot on top as well. Alerts and Update them to MTF, should be easy once the main code is completed, However will be resource intensive given the amount of calculations we have to do.

After all the goal is to make the system usable, not bloat it and consume all the resources. I like to keep them as simple as possible. Goal is if we get to use vZone for Scalping successfully, Use RSM for higher frames for a bit more longer game.

-S

Last edited:

bamafamily333

New member

This is simply outstanding work!!! thanks to all who made it happen...Great indicator package!!

- Status

- Not open for further replies.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| C | RSM Indicator for ThinkorSwim | Indicators | 99 | |

|

|

Repaints Cup and Handle Indicator for ThinkorSwim | Indicators | 25 | |

|

|

The Ultimate Buy and Sell Indicator for ThinkOrSwim | Indicators | 6 | |

| J | ATR Expected Move Indicator For ThinkOrSwim | Indicators | 17 | |

| J | Machine Learning kNN-based Indicator For ThinkOrSwim | Indicators | 8 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1432

Online

Similar threads

Similar threads

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.