# Clayburgs Directional Day Filter

# Written by KumoBob Dec 31 2009

# I removed the Price Bulbs and added Arrows

# Thanks to ThinkScriptor and aPPLE_PI for helping me with the secondsfromtime() function by showing me the code writen by Prospectus in his Opening Range study.

# Directional Day Filter Line - After the first five minutes calculate the average range for this 5-minute bar. Draw a horizontal line at this level.

# Time Line - Draw a vertical line at 60-minute bar (Low to High of the day so far).

# (slower value for faster moving charts like currency and S&P – Faster value for slower moving charts) (45 minutes to 90 minutes)

# Determine the amount of activity above and below the Directional Day Filter Line prior to the Time Line.

# (A rectangle can be drawn with Blue shading above and Red below the Directional Day Filter Line)

# If the majority of the activity is above the Directional Day Filter Line the trend bias for the day will be higher.

# If the majority of the activity is below the Directional Day Filter Line the trend bias for the day will be lower.

# If it's even the day will most likely be flat.

# If the closing bar on the Time Line is within 1/3 the distance from the Directional Day Filter Line then added bias can be anticipated.

#hint: Best used in a 1 to 5 minute chart period

def na = double.nan;

Directional Day Filter Line

input ORBegin = 0930;

input OREnd = 0935;

# Show Today only? (Default Yes)

input ShowTodayOnly = { default "No", "Yes"};

def s = ShowTodayOnly;

# Create logic for OR definition: 1 if between fist 5 minutes

Def ORActive = if secondsTillTime(OREnd) > 0 AND secondsFromTime(ORBegin) >= 0 then 1 else 0;

# Create logic to paint only current day post-open:

def today = if s == 0 OR getDay() == getLastDay() AND secondsFromTime(ORBegin) >= 0 then 1 else 0;

# Track OR High:

Rec ORHigh = if ORHigh[1] == 0 or ORActive[1] == 0 AND ORActive == 1 then high else if ORActive AND high > ORHigh[1] then high else ORHigh[1];

# Track OR Low:

Rec ORLow = if ORLow[1] == 0 or ORActive[1] == 0 AND ORActive == 1 then low else if ORActive AND low < ORLow[1] then low else ORLow[1];

# Calculate OR width:

Def ORWidth = ORHigh - ORLow;

# Define all the plots:

Def ORHA = if ORActive OR today < 1 then na else ORHigh;

Def ORLA = if ORActive OR today < 1 then na else ORLow;

Def O = ORHA - (ORHA - ORLA) / 2;

Plot ORL = if (o == 0 , na, o);

ORL.SetDefaultColor(color.Yellow);

ORL.SetStyle(curve.Long_DASH);

ORL.SetLineWeight(3);

Time Line

input ORBegin2 = 0930;

# Define time that OR is finished (in hhmm format,

# 10:00 is the default):

input OREnd2 = 1030;

# Show Today only? (Default Yes)

#input ShowTodayOnly={"No", default "Yes"};

#def s=ShowTodayOnly;

# Create logic for OR definition:

Def ORActive2 = if secondsTillTime(OREnd2) > 0 AND secondsFromTime(ORBegin2) >= 0 then 1 else 0;

# Create logic to paint only current day post-open:

def today=if s==0 OR getday()==getlastday() AND secondsfromtime(ORBegin2)>=0 then 1 else 0;

# Track OR High:

Rec ORHigh2 = if ORHigh2[1] == 0 or ORActive2[1] == 0 AND ORActive2 == 1 then high else if ORActive2 AND high > ORHigh2[1] then high else ORHigh2[1];

# Track OR Low:

Rec ORLow2 = if ORLow2[1] == 0 or ORActive2[1] == 0 AND ORActive2 == 1 then low else if ORActive2 AND low < ORLow2[1] then low else ORLow2[1];

# Calculate OR width:

Def ORWidth2 = ORHigh2 - ORLow2;

# Define all the plots:

Plot ORH2 = if ORActive2 OR today < 1 then na else ORHigh2;

Plot ORL2 = if ORActive2 OR today < 1 then na else ORLow2;

# Formatting:

ORH2.SetDefaultColor(color.green);

ORH2.SetStyle(curve.Long_DASH);

ORH2.SetLineWeight(3);

ORL2.SetDefaultColor(color.red);

ORL2.SetStyle(curve.Long_DASH);

ORL2.SetLineWeight(3);

Def TimeLine = if secondsTillTime(OREnd2) == 0 then 1 else 0;

Def pos = (ORH2 - ORL2) / 10;

plot d1 = if (TimeLine , ORH2, na);

plot d2 = if (TimeLine , ORH2 - ( pos * 2), na);

plot d3 = if (TimeLine , ORH2 - ( pos * 3), na);

plot d4 = if (TimeLine , ORH2 - ( pos * 4), na);

plot d5 = if (TimeLine , ORH2 - ( pos * 5), na);

plot d6 = if (TimeLine , ORH2 - ( pos * 6), na);

plot d7 = if (TimeLine , ORH2 - ( pos * 7), na);

plot d8 = if (TimeLine , ORH2 - ( pos * 8), na);

plot d9 = if (TimeLine , ORH2 - ( pos * 9), na);

plot d10 = if (TimeLine , (ORL2), na);

d1.SetPaintingStrategy(PaintingStrategy.arrow_down);

d10.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

d2.HideBubble();

d3.HideBubble();

d4.HideBubble();

d5.HideBubble();

d6.HideBubble();

d7.HideBubble();

d8.HideBubble();

d9.HideBubble();

DEF Span = (O - ORL2) / (ORH2 - ORL2);

rec colorState = if Span > 0.66 then -1

else if Span < 0.33 then 1 else 0;

d1.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d2.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d3.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d4.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d5.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d6.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d7.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d8.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d9.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.GREEN else

Color.Yellow

);

d10.AssignValueColor(

if colorState < 0 then Color.RED else

if colorState > 0 then Color.red else

Color.Yellow

);

d1.SetLineWeight(5);

d2.SetLineWeight(5);

d3.SetLineWeight(5);

d4.SetLineWeight(5);

d5.SetLineWeight(5);

d6.SetLineWeight(5);

d7.SetLineWeight(5);

d8.SetLineWeight(5);

d9.SetLineWeight(5);

d10.SetLineWeight(5);

Def TimeLineb = if secondsTillTime(OREND) == 0 then 1 else 0;

Def posbd = (ORHA - ORLA) / 10;

plot bd1 = if (TimeLineb , ORHA, na);

plot bd2 = if (TimeLineb , ORHA - ( posbd * 2), na);

plot bd3 = if (TimeLineb , ORHA - ( posbd * 3), na);

plot bd4 = if (TimeLineb , ORHA - ( posbd * 4), na);

plot bd5 = if (TimeLineb , ORHA - ( posbd * 5), na);

plot bd6 = if (TimeLineb , ORHA - ( posbd * 6), na);

plot bd7 = if (TimeLineb , ORHA - ( posbd * 7), na);

plot bd8 = if (TimeLineb , ORHA - ( posbd * 8), na);

plot bd9 = if (TimeLineb , ORHA - ( posbd * 9), na);

plot bd10 = if (TimeLineb , (ORL2), na);

bd1.SetDefaultColor(Color.YELLOW);

bd2.SetDefaultColor(Color.YELLOW);

bd3.SetDefaultColor(Color.YELLOW);

bd4.SetDefaultColor(Color.YELLOW);

bd5.SetDefaultColor(Color.YELLOW);

bd6.SetDefaultColor(Color.YELLOW);

bd7.SetDefaultColor(Color.YELLOW);

bd8.SetDefaultColor(Color.YELLOW);

bd9.SetDefaultColor(Color.YELLOW);

bd10.SetDefaultColor(Color.YELLOW);

bd1.HideBubble();

bd2.HideBubble();

bd3.HideBubble();

bd4.HideBubble();

bd5.HideBubble();

bd6.HideBubble();

bd7.HideBubble();

bd8.HideBubble();

bd9.HideBubble();

bd10.HideBubble();

#def aggregation = if getAggregationPeriod() == (AggregationPeriod.MIN * 5) or (AggregationPeriod.MIN * 10) or (AggregationPeriod.MIN * 15) then 1 else 0 ;

def aggregation = 1;

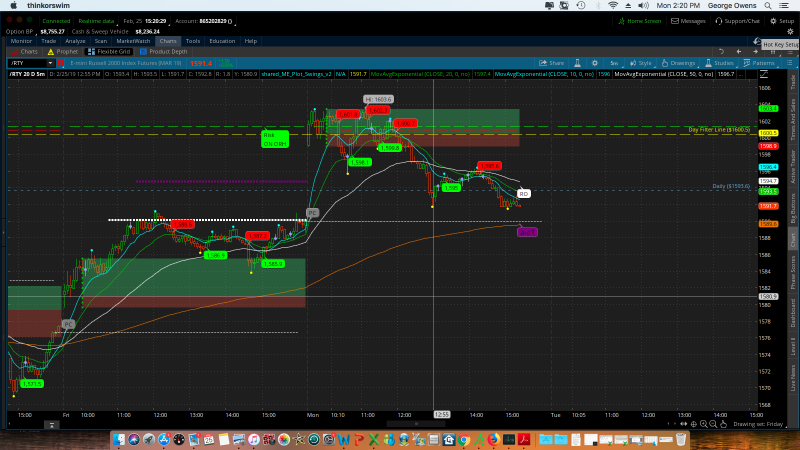

I am looking to use this set up to trade emini futures on the Russell 2000. Also, I see that this blog is primarily about trading options. On this blog do you have some other information about that. I am familiar with options but only longer term not scalping. Any help would be appreciated.

I am looking to use this set up to trade emini futures on the Russell 2000. Also, I see that this blog is primarily about trading options. On this blog do you have some other information about that. I am familiar with options but only longer term not scalping. Any help would be appreciated.