# mvp_01

# -----------------

# halcyonguy

# 21-08-25

# -----------------

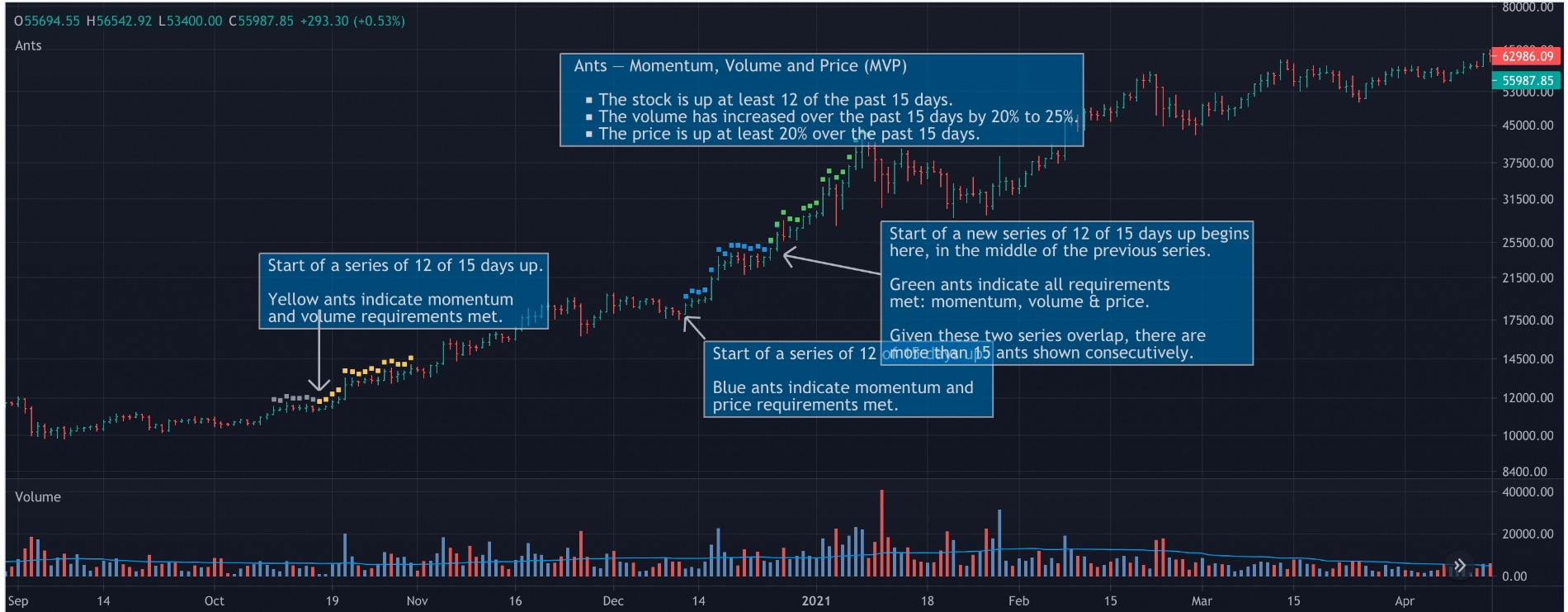

# Momentum, Volume and Price (MVP)

#https://usethinkscript.com/threads/ants-%E2%80%94-momentum-volume-and-price-mvp.7497/

#I saw this very interesting custom indicator on TradingView.

#https://www.tradingview.com/script/uEaFv7tm-Ants-Momentum-Volume-and-Price-MVP/

#The Ants indicator is based on the research of David Ryan, three-time winner of the U.S. Investing Championship. David came up with the idea for the indicator while managing the New USA Growth Fund at William O’Neil + Company. David was interested to understand what drove some stocks higher once they were extended from their most recent base, while others had only moderate moves up.

#What David found during his research was that stocks making the biggest moves often had consistent buying on volume over a period of 12 to 15 trading days. Stocks with these characteristics may be under institutional accumulation, where it may take days to weeks to fill a position.

# — Momentum, Volume And Price ( MVP ) —

# The Ants indicator looks for the following:

# 1... Momentum - The stock is up at least 12 of the past 15 days.

# 2... Volume - The volume has increased over the past 15 days by 20% to 25%.

# 3... Price - The price is up at least 20% over the past 15 days.

# colored squares, above the candles:

# Gray - Momen requirement met.

# Blue - Momen and price requirement met.

# Yellow - Momen and vol requirement met.

# Green - Momen and vol and price requirement met.

#/////////////////////////////////////

def na = Double.NaN;

def bn = barnumber();

# ======================================

input OOOOOO_Momentum_OOOOOOO = yes;

# MVP

# 1... Momentum - The stock is up at least 12 of the past 15 days.

# it tests if current bar close > previous close

input series_max = 15;

input series_min = 12;

def momen_max = series_max;

def momen_min = series_min;

#input momentum_qty = 15;

#input momentum_min = 12;

def chgup = close > close[1];

def squares_price_offset = 0.02;

def vert = squares_price_offset;

# min series , when there are 'min' quantity of bars or greater, within a 'qty' set of bars.

# ex. if there are 12 min bars, within 15 qty bars.

AddLabel(1, "MVP qtys " + momen_min + "/" + momen_max, Color.cyan);

# --------------------------------

# nested fold.

# test if x min bars, or more, are true , out of y qty bars

# loop1 , start at current bar, loops to future bars.

# loop2 , on each bar of loop1, it looks back at 'momentum_qty' quantity of bars and counts the times chgup is true.

# when done, if the count is > momentum_min, then a 1 is passed on to loop1.

# if momupx > 0, then at least 1 valid series was found, to go across the bar.

# add this to remove errors on last few bars, when bar is within (min-1) bars to the last bar,

# while !isnan( getvalue(close, -loop1) )

def momupx = fold loop1 = 0 to momen_max

with one

while !isnan( getvalue(close, -loop1) )

do one + if (fold loop2 = 0 to momen_max

with two

do two + if GetValue(chgup , (-loop1 + loop2) ) then 1 else 0) >= momen_min then 1 else 0;

# was there at least 1 min series found ?

def momup = if momupx > 0 then 1 else 0;

# line under bars

#def offset1 = 0.999;

def offset1 = 1.0;

def htper = 0.2;

def cldht = round( (htper/100) * close, 1 );

def cldtop = if !momup[1] and momup then (low * offset1) else if momup then cldtop[1] else na;

def cldbot = cldtop - cldht;

# addcloud(cldtop, cldbot, color.cyan, color.cyan);

input momen_series_horz_line = yes;

plot ddd = if momen_series_horz_line then cldtop else na;

ddd.setlineweight(2);

ddd.SetDefaultColor(Color.light_gray);

# ======================================

# ======================================

input OOOOOO_Volume_OOOOOOO = yes;

# 2... Volume - The volume has increased over the past 15 days by 20% to 25%.

# the 15 day average daily volume is 20% or greater than the 50 day average.

input volume_increase_percent = 20.0;

def vip = volume_increase_percent/100;

#input vol_qty = 15;

#input vol_min = 12;

#def vol_max = series_max;

#def vol_min = series_min;

input vol_avg_short_len = 15;

input vol_avg_long_len = 50;

def vol_avgshort = average(volume, vol_avg_short_len);

def vol_avglong = average(volume, vol_avg_long_len);

# compare vol15avg to (vol50avg * x%)

def volupx = if ( vol_avgshort > (vol_avglong * (1 + vip)) ) then 1 else 0;

def volup = volupx;

# ======================================

input OOOOOO_Price_OOOOOOO = yes;

# 3... Price - The price is up at least 20% over the past 15 days.

#input price_increase_percent = 20.0;

input price_increase_percent = 6.0;

def prp = price_increase_percent/100;

#input pr_max = 15;

#input pr_min = 12;

def pr_max = series_max;

def pr_min = series_min;

input price_avg_short_len = 15;

input price_avg_long_len = 50;

def pr_avgshort = average(close, price_avg_short_len);

def pr_avglong = average(close, price_avg_long_len);

def prupx = if ( pr_avgshort > (pr_avglong * (1 + prp)) ) then 1 else 0;

def prup = prupx;

# //////////////////////////////////////

# //////////////////////////////////////

# draw squares, above candles, when a cond is true

# -- when candle is part of a min momen series

# colored squares, above the candles:

# Gray - Momen requirement met.

# Blue - Momen and price requirement met.

# Yellow - Momen and vol requirement met.

# Green - Momen and vol and price requirement met.

def mom = (momup and !volup and !prup);

def mompr = (momup and !volup and prup);

def momvol = (momup and volup and !prup);

def momvolpr = (momup and volup and prup);

#def sqr = (momup or volup or prup);

def sqr = (mom or mompr or momvol or momvolpr);

# //////////////////////////////////////

# plot a square above candles

plot t = if sqr then (high * (1 + (1*vert))) else na;

t.DefineColor("cmom", color.light_gray);

t.DefineColor("cmompr", color.blue);

t.DefineColor("cmomvol", color.yellow);

t.DefineColor("cmomvolpr", color.green);

t.DefineColor("cnon", color.current);

t.AssignValueColor(

if momvolpr then t.color("cmomvolpr")

else if momvol then t.color("cmomvol")

else if mompr then t.color("cmompr")

else if mom then t.color("cmom")

else t.color("cnon"));

t.SetPaintingStrategy(PaintingStrategy.SQUARES);

t.SetLineWeight(4);

# -------------------------------------

# legend

input show_color_legend = yes;

input legend_bar_offset = 4;

input legend_vert_percent = 97;

def v = (legend_vert_percent/100) * (close[legend_bar_offset]);

def k = !isnan(close[legend_bar_offset]) and isnan(close[(legend_bar_offset-1)]);

addchartbubble(show_color_legend and k, v, "Gray - Momen", color.light_gray, yes);

addchartbubble(show_color_legend and k, v, "Blue - Momen, price", color.blue, yes);

addchartbubble(show_color_legend and k, v, "Yellow - Momen, vol", color.yellow, yes);

addchartbubble(show_color_legend and k, v, "Green - Momen, vol, price", color.green, yes);

# test data , show test squares below the candles

input test_momen_series_quantities = no;

# show counts of momen min series

plot mx = if test_momen_series_quantities then momupx else na;

mx.SetPaintingStrategy(PaintingStrategy.VALUES_below);

mx.SetDefaultColor(Color.WHITE);

input test_momen_up_lower_gray = no;

plot my = if (test_momen_up_lower_gray and momup) then (low * (1 - (1*vert))) else na;

my.SetDefaultColor(Color.light_gray);

my.SetPaintingStrategy(PaintingStrategy.SQUARES);

my.SetLineWeight(4);

input test_volume_up_lower_purple = no;

plot vy = if (test_volume_up_lower_purple and volup) then (low * (1 - (2*vert))) else na;

vy.SetDefaultColor(Color.magenta);

vy.SetPaintingStrategy(PaintingStrategy.SQUARES);

vy.SetLineWeight(4);

input test_price_up_lower_blue = no;

plot py = if (test_price_up_lower_blue and prup) then (low * (1 - (3*vert))) else na;

py.SetDefaultColor(Color.blue);

py.SetPaintingStrategy(PaintingStrategy.SQUARES);

py.SetLineWeight(4);

input test_all_up = no;

plot all = if (test_all_up and momvolpr) then (low * (1 - (4*vert))) else na;

all.SetDefaultColor(Color.green);

all.SetPaintingStrategy(PaintingStrategy.SQUARES);

all.SetLineWeight(4);

input test_price_average_lines = no;

plot prs = if test_price_average_lines then pr_avgshort else na;

plot prl = if test_price_average_lines then pr_avglong else na;

prs.SetDefaultColor(Color.green);

prl.SetDefaultColor(Color.magenta);

#