Everything you wanted to know about REPAINTING and were afraid to ask

ZigZags, Swings, Waves, Reversals, Pivots, Order Books, Fair Value Gaps and all Higher Highs-Lower Lows are all repainting indicators.

Repainting indicators paint on a signal or condition, then go back and erase it, then repaint it sometime later, so on and so on...

Forward-looking scripts using future bars also repaint.

Future bars wait for a signal or a condition. Then go back, many bars ago and paint the perfect-looking signal on a long-ago candle. Making it appear that it was there the whole time.

No, repainting indicators can not be rewritten to not repaint. Repainting is part of their DNA.

The Positive: Repainters are the fastest tool for identifying trends making them an integral part of a trader's toolbox.

The biggest and costliest mistake that new retail traders make is using repainters for trade entry.

Repainters can not be relied upon for entry or exit signals.

Repainters serve as a visual aid to spot trends, but other indicators and analysis need to be used to determine entry and exit points.

Use repainters in correlation with price action, candlestick patterns, a disciplined stop-loss plan.

The Negative: Repainting is problematic especially for newer traders using them for entry signals. Repainting arrows are ONLY signaling that a stock has moved lower. NOT THAT IT HAS REVERSED!

But n00bs tend to read those arrows as entry signals. Thinking that the stock has hit a low (or high) and that it is indicating NOW NOW NOW is the time to make entry,

That is NOT what repainters tell us, it is just saying that the stock is lower. As the stock continues to plummet, it erases the signal, continues to drop like a rock, and crushes previous profits. Just the potential of that possibility causes traders to lack confidence, to leave trades early at the smallest sign of trouble, creating a feedback loop of ever-smaller profits and ever-larger losses.

Positive Side of these Indicators:

They are written specifically to repaint.

Repainter's proper use, by most traders, is not for entry but for analyzing trendlines and support & resistance on a higher timeframe.

They purposely repaint when trends change and when support or resistance are broken through thus providing up-to-date data as to the state of our trend.

When using repainting studies:

Never use a repainting arrows for entry!

Both up and down signals will repaint.

You will see more low arrow repainting when the instrument has a strong bearish trend. As it makes new lows, the previous low signals will be erased.

You will see more high arrow repainting when the instrument has a bullish trend. As it makes new highs the previous high signals will be erased.

How do you know if an indicator is a repainting indicator?

If you look at a script and if there is a fold operation using highest and/or lowest that is the indication that it repaints.

Fold is a recursive operation that keeps redefining the highest and lowest and redrawing them.

Generally, if you have an indicator that shows low and high signals on your chart and every single signal works out perfectly, such as: Trend Reversals, Zigzags, Swing High, Swing Low, COG, Hurst indicators, some Pivot Points. all Waves, etc... then most likely that indicator repaints. Looks great for backtesting because all the intermediate signals are erased.

It's important to note that repainted signals are not recommended for entry, which is why the Forum adds the prefix "repaints" to those indicators.

Be careful with your coding, folks!

Another type of repainting occurs when you trade on the current bar, a common mistake of n00b traders.

When you write triggers on the current bar, obviously repainting will occur since the current bar doesn't know what the final close, high, and low is going to be until it's finished forming. Therefore, by definition, you are asking it to repaint with new information on every tick.

To avoid repainting, ToS recommends using the open of the next bar open[-1] for entry in strategies,

and use of the previous bar [1] for studies. Thereby, never experiencing repainting again!

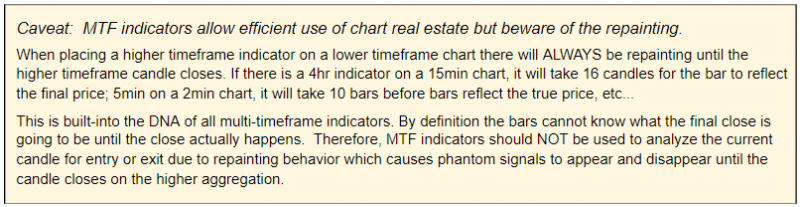

Multi-Timeframe REPAINTING-type Behavior

This information was compiled from the various posts written about repainting. A search of this forum will provide the detail from which these statements were derived.

HTH

ZigZags, Swings, Waves, Reversals, Pivots, Order Books, Fair Value Gaps and all Higher Highs-Lower Lows are all repainting indicators.

Repainting indicators paint on a signal or condition, then go back and erase it, then repaint it sometime later, so on and so on...

Forward-looking scripts using future bars also repaint.

Future bars wait for a signal or a condition. Then go back, many bars ago and paint the perfect-looking signal on a long-ago candle. Making it appear that it was there the whole time.

No, repainting indicators can not be rewritten to not repaint. Repainting is part of their DNA.

The Positive: Repainters are the fastest tool for identifying trends making them an integral part of a trader's toolbox.

The biggest and costliest mistake that new retail traders make is using repainters for trade entry.

Repainters can not be relied upon for entry or exit signals.

Repainters serve as a visual aid to spot trends, but other indicators and analysis need to be used to determine entry and exit points.

Use repainters in correlation with price action, candlestick patterns, a disciplined stop-loss plan.

The Negative: Repainting is problematic especially for newer traders using them for entry signals. Repainting arrows are ONLY signaling that a stock has moved lower. NOT THAT IT HAS REVERSED!

But n00bs tend to read those arrows as entry signals. Thinking that the stock has hit a low (or high) and that it is indicating NOW NOW NOW is the time to make entry,

That is NOT what repainters tell us, it is just saying that the stock is lower. As the stock continues to plummet, it erases the signal, continues to drop like a rock, and crushes previous profits. Just the potential of that possibility causes traders to lack confidence, to leave trades early at the smallest sign of trouble, creating a feedback loop of ever-smaller profits and ever-larger losses.

Positive Side of these Indicators:

They are written specifically to repaint.

Repainter's proper use, by most traders, is not for entry but for analyzing trendlines and support & resistance on a higher timeframe.

They purposely repaint when trends change and when support or resistance are broken through thus providing up-to-date data as to the state of our trend.

When using repainting studies:

Never use a repainting arrows for entry!

Both up and down signals will repaint.

You will see more low arrow repainting when the instrument has a strong bearish trend. As it makes new lows, the previous low signals will be erased.

You will see more high arrow repainting when the instrument has a bullish trend. As it makes new highs the previous high signals will be erased.

How do you know if an indicator is a repainting indicator?

If you look at a script and if there is a fold operation using highest and/or lowest that is the indication that it repaints.

Fold is a recursive operation that keeps redefining the highest and lowest and redrawing them.

Generally, if you have an indicator that shows low and high signals on your chart and every single signal works out perfectly, such as: Trend Reversals, Zigzags, Swing High, Swing Low, COG, Hurst indicators, some Pivot Points. all Waves, etc... then most likely that indicator repaints. Looks great for backtesting because all the intermediate signals are erased.

It's important to note that repainted signals are not recommended for entry, which is why the Forum adds the prefix "repaints" to those indicators.

Be careful with your coding, folks!

Another type of repainting occurs when you trade on the current bar, a common mistake of n00b traders.

When you write triggers on the current bar, obviously repainting will occur since the current bar doesn't know what the final close, high, and low is going to be until it's finished forming. Therefore, by definition, you are asking it to repaint with new information on every tick.

To avoid repainting, ToS recommends using the open of the next bar open[-1] for entry in strategies,

and use of the previous bar [1] for studies. Thereby, never experiencing repainting again!

Multi-Timeframe REPAINTING-type Behavior

This information was compiled from the various posts written about repainting. A search of this forum will provide the detail from which these statements were derived.

HTH

Last edited: