Chris's Enhanced Volume For ThinkOrSwim

Buy / Sell Volume Pressure Percentages

Buyers and Sellers is not information available in the data feeds.

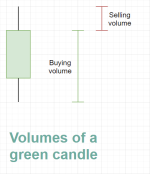

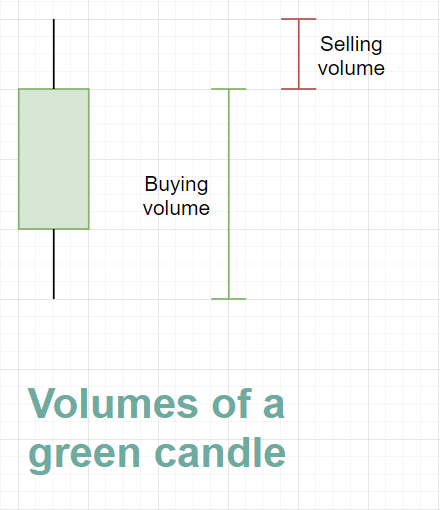

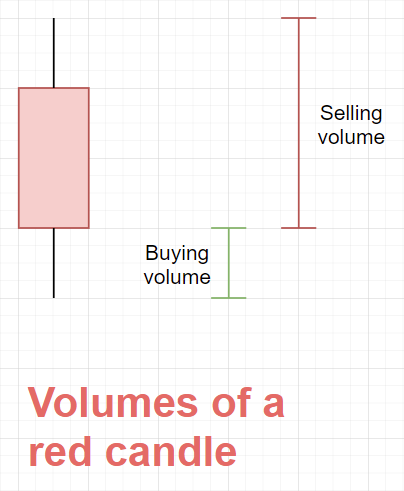

When we look at the movement of price in comparison to volume, it is called Volume Pressure.

The scripts discussed here are representative of the PRICE spread compared to the overall volume spread.

We create a percentage for buying and selling pressure by using the candlestick patterns weighted volume.

Volume Pressure identifies the price movement which when aggregated with volume it is used to define MOMENTUM not actual buyers and sellers.

You can't apply the momentum percentage to the volume number and declare that to be the number of buyers and sellers.

Buy / Sell Volume Pressure w/ volumes and percentages -- Upper Study Labels Only

Buy / Sell Volume Pressure Percentages

Buyers and Sellers is not information available in the data feeds.

When we look at the movement of price in comparison to volume, it is called Volume Pressure.

The scripts discussed here are representative of the PRICE spread compared to the overall volume spread.

We create a percentage for buying and selling pressure by using the candlestick patterns weighted volume.

Volume Pressure identifies the price movement which when aggregated with volume it is used to define MOMENTUM not actual buyers and sellers.

You can't apply the momentum percentage to the volume number and declare that to be the number of buyers and sellers.

Ruby:

#Chris' Enhanced Volume V.2 /w Uptick/Downtick

declare on_volume;

###############

#DPL CRITERIA #

###############

input Audible_Alert = yes;

def Deviation_Length = 60;

def Deviate = 2;

def volumestdev = RelativeVolumeStDev(length = Deviation_Length);

def abovedev = volumestdev >= Deviate;

def belowdev = volumestdev <= Deviate;

############

# DPL BARS #

############

def increase = volume > volume[1];

def devincrease = increase and abovedev;

def decrease = volume < volume[1];

def devdecrease = decrease and abovedev;

##############################

# UPTICK / DOWNTICK CRITERIA #

##############################

def O = open;

def H = high;

def C = close;

def L = low;

def V = volume;

def Buying = V * (C - L) / (H - L);

def Selling = V * (H - C) / (H - L);

##################

# Selling Volume #

##################

plot SV = Selling;

SV.DefineColor("Decrease", Color.rED);

SV.DefineColor("DevDecrease", Color.pink);

SV.AssignValueColor(if devdecrease then SV.Color("DevDecrease") else SV.Color("Decrease"));

SV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

SV.HideTitle();

SV.HideBubble();

SV.SetLineWeight(5);

#################

# Buying Volume #

#################

DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ;

plot BV = Buying;

BV.DefineColor("Increase", GlobalColor("LabelGreen"));

BV.DefineColor("DevIncrease", Color.light_GREEN);

BV.AssignValueColor(if devincrease then BV.Color("DevIncrease") else BV.Color("Increase"));

BV.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

BV.HideTitle();

BV.HideBubble();

BV.SetLineWeight(5);

#################

# Adding Volume Labels #

#################

input Show_Labels = yes;

AddLabel(Show_Labels, "Buy Vol = " + Round(Buying, 0),

if Buying > Selling then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Buy %: " + Round((Buying/(Buying+Selling))*100,2), If (Buying/(Buying+Selling))*100 > 60 then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Sell Vol = " + Round(Selling, 0),

if Selling > Buying then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Sell %: " + Round((Selling/(Selling+Buying))*100,2), If (Selling/(Selling+Buying))*100 > 60 then GlobalColor("LabelGreen") else color.RED);Buy / Sell Volume Pressure w/ volumes and percentages -- Upper Study Labels Only

Ruby:

#Chris' Enhanced Volume V.2 /w Uptick/Downtick LABELS ONLY

declare upper;

###############

#DPL CRITERIA #

###############

def Deviation_Length = 60;

def Deviate = 2;

def volumestdev = RelativeVolumeStDev(length = Deviation_Length);

def abovedev = volumestdev >= Deviate;

def belowdev = volumestdev <= Deviate;

############

# DPL BARS #

############

def increase = volume > volume[1];

def devincrease = increase and abovedev;

def decrease = volume < volume[1];

def devdecrease = decrease and abovedev;

##############################

# UPTICK / DOWNTICK CRITERIA #

##############################

def O = open;

def H = high;

def C = close;

def L = low;

def V = volume;

def Buying = V * (C - L) / (H - L);

def Selling = V * (H - C) / (H - L);

##################

# Selling Volume #

##################

def SV = Selling;

def BV = Buying;

#################

# Adding Volume Labels #

#################

DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ;

input Show_Labels = yes;

AddLabel(Show_Labels, "Buy Vol = " + Round(Buying, 0),

if Buying > Selling then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Buy %: " + Round((Buying/(Buying+Selling))*100,2), If (Buying/(Buying+Selling))*100 > 60 then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Sell Vol = " + Round(Selling, 0),

if Selling > Buying then GlobalColor("LabelGreen") else color.red);

AddLabel(Show_Labels, "Sell %: " + Round((Selling/(Selling+Buying))*100,2), If (Selling/(Selling+Buying))*100 > 60 then GlobalColor("LabelGreen") else color.RED);Attachments

Last edited: